Jun/iStock through Getty Photos

Each from time to time, an organization that was just lately stagnant actually hits its stride. That’s definitely the case with e.l.f. Magnificence (NYSE:ELF) up to now 2 years. The corporate has been a strong participant within the low finish of the beauty house for a few years, however the current inflationary atmosphere has confirmed to be an enormous boon to ELF. The corporate is benefitting tremendously from girls buying and selling right down to decrease priced cosmetics for worth. At a worth level 1/4th of the most costly opponents on common, they’ve a big benefit amongst youthful much less rich shoppers. ELF can be actually leaning into digital advertising and pushing for progress among the many youngest demographics. This could result in outsized market share features and income progress for the long run.

DTC energy and Division enlargement

Elf reported a powerhouse fiscal second quarter with income progress up a sturdy 33% to $122.3m. This was a progress acceleration over Q2, a rarity within the shopper house with most firms struggling to develop towards laborious comparisons. Gross margins had been additionally sturdy, and enhancing with 65% gross margin up 190 foundation factors over the prior 12 months. These margin enhancements will proceed as the corporate scales its income and direct to shopper enterprise. Web earnings was $14.5m in a GAAP foundation or 27 cents per share. Market share was up 115 foundation factors over the prior quarter, a formidable little bit of momentum heading into the important vacation season. Not like many different shopper discretionary shares, ELF has an affordable stock degree with no danger of markdowns. The inventory solely had stock within the quarter of $81m, up simply $4.5m from the prior 12 months Q2. The corporate identified it really has a bit much less stock than it needs, because it tries to maintain well-liked SKU on cabinets exhibiting sturdy gross sales momentum. Sure merchandise go viral the place they promote excess of the corporate expects, such because the Halo glow liquid filter. The corporate retains promoting the product out and it sells at simply $14 in comparison with $46 for comparable status manufacturers. This type of worth is the rationale to be bullish the inventory as individuals look to chop their budgets the place they will. Digital gross sales had been up 75% y/y in Q2, as much as 15% of complete gross sales which is the businesses personal web site gross sales. The growing direct enterprise will assist obtain increased margins in the long run with over 70% achievable. The corporate continues to extend its share of house at main retailers with expansions in Walmart (WMT), Goal (TGT) and CVS (CVS) in early 2023. The reason being apparent – ELF brings in sturdy gross sales volumes. CEO Tarang Amin identified

“…on the skincare aspect, class is up 15%, e.l.f. pores and skin grew 44%. So the energy that we’re seeing is actually throughout the board. We’re getting commerce down from Status, however we’re additionally getting commerce from inside different mass manufacturers.”

This energy in skincare particularly exhibits that younger girls would slightly commerce down than quit spending in these areas. Outgrowing the class by 3x is extremely spectacular within the present atmosphere. Present estimates for Fiscal 2024 beginning in April 2023 appear very beatable with simply 11% estimated income progress at $542m for the 12 months. A progress fee of 15-20% is definitely attainable if the continued inflationary atmosphere pushes shoppers right down to the higher worth that ELF gives. The corporate ought to profit from weak point in the actual economic system and proceed to realize market share due to the sturdy social media presence.

Digital advertising – Key to Gen Z success

The corporate has continued to lean into promoting on TikTok with over 9 Billion views on the primary web page. They’ve elevated digital spend and advertising to 16% of gross sales which has tremendously elevated progress and model consciousness up to now 3 years. They referred to as out even increased advertising spend for the total 12 months of 19% as they’re seeing massive features from their digital technique and viral movies. Their ‘magnificence squad’ loyalty program is as much as 3.2 million members good for a strong 20% progress 12 months over 12 months in Q2. These prospects spend considerably greater than non-loyalty prospects. They supply 70% of all gross sales on elfbeauty.com and supply a trove of knowledge main in continued product innovation. ELF continues to resonate with shoppers with their environmentally pleasant strategy and enormous digital presence in comparison with competitors. The corporate is strongly cruelty free and vegan which is usually necessary for younger prospects.

Firms have confirmed that viral advertising on TikTok is crucial to success amongst Gen Z and Millennial girls. That is paying nice dividends now with income persevering with to extend at a quick tempo. The corporate is leaning into different well-liked platforms like Amazon’s (AMZN) Twitch and Snapchat (SNAP) ensuring to be seen wherever fashionable Gen Z shoppers are. Piper Sandler’s current teen survey confirmed the dominant thoughts share ELF has. For teenagers surveyed 16% stated ELF was their favourite model in cosmetics – an amazing signal for the approaching decade. This continued progress among the many most necessary demographic for the approaching years bodes very effectively for the inventory’s long run prospects. Viral merchandise proceed to dominate and are usually not attainable with no sturdy presence in all digital channels that attraction to younger of immediately.

Piper Sandler Teen Survey (ELF Q2 presentation)

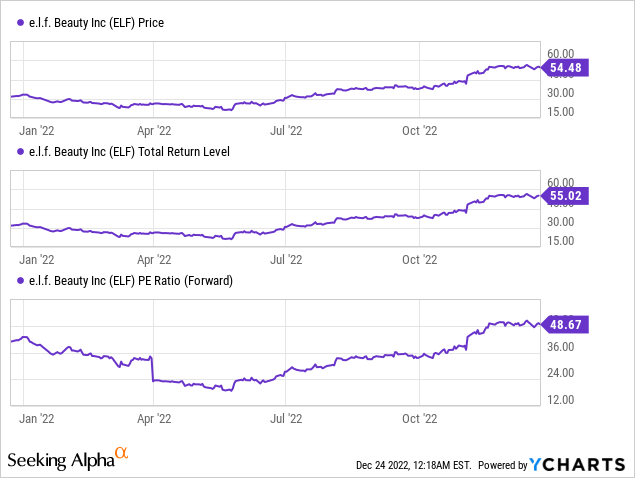

Dangers

The primary danger for ELF buyers proper now’s an general selloff out there, slightly than a recessionary atmosphere. A recession may very well show to assist market share for ELF, nevertheless a robust economic system and weak inventory market might result in revenue taking within the identify. The inventory is without doubt one of the few shares that’s up considerably up to now 6 months, with a achieve of 64% up to now 12 months giving the inventory a ‘full valuation’. Any sizzling inflation readings will probably be a danger to shares within the coming 12 months so be sure that to offset the identify with safer choices in any portfolio. The inventory trades at ahead worth earnings ratio of 48.67 which is dear in comparison with a repeatedly reducing market a number of. It’s also a big premium to its personal historic P/E. As you may see beneath the inventory spent a lot of the previous 12 months within the 25-35 ahead earnings vary. Within the occasion of a income or earnings miss the inventory is extra prone to a giant fall of 10% or greater than different shopper names which is necessary to remember. Nonetheless, the advantages far outweigh the dangers on this case with such momentum in shares and enhancing fundamentals.

Proper time to purchase?

ELF continues its spectacular 2022 with this most up-to-date quarter and firms within the house have continued to indicate the younger feminine shopper is resilient. Search for continued sturdy progress in 2023, though it’s much less clear how a lot extra upside ELF shares may have with the inventory buying and selling above 45x 2023 earnings. Accumulating shares on any pullback into the $40s could be best throughout one of many markets inevitable swoons in 2023. Any buyers in search of long-term progress ought to look intently at this recession resistant identify figuring out the dangers of an costly inventory in what has been a tricky market in 2022.

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)