Sittipol Sukuna/iStock by way of Getty Photographs

Article Objective

On December 16, 2022, the Index monitoring the iShares Core Dividend Progress ETF (NYSEARCA:DGRO) reconstituted, ensuing within the addition of high-growth shares like Exxon Mobil (XOM) and Chevron (CVX) and the deletion of potential yield traps like 3M (MMM) and Intel (INTC). After assessing the ETF pre- and post-reconstitution, I am happy with the modifications and see it higher monitoring the market subsequent yr whereas providing an estimated 2.43% dividend yield. Most significantly, DGRO ought to sustain its double-digit dividend progress fee, and I proceed to view it as a stable dividend ETF going ahead.

ETF Overview

Technique and Reconstitution Abstract

DGRO tracks the Morningstar US Dividend Progress Index, reconstituting yearly, efficient the third Friday of every December. The fundamental necessities are for corporations to have 5 years of consecutive dividend progress, payout ratios lower than 75%, and a constructive consensus earnings forecast. Notably, the Index avoids potential yield traps by excluding the highest 10% of corporations by dividend yield.

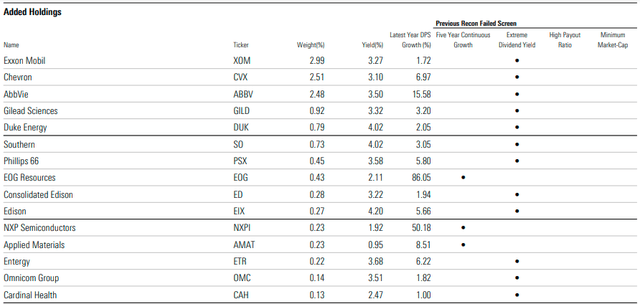

The next summarizes the Index’s high 15 additions and beforehand failed screens. 80% had been because of the “excessive dividend yield” display screen, with Exxon Mobil, Chevron, and AbbVie (ABBV) being probably the most vital. The Index added 52 corporations, however the 37 not proven have insignificant weights.

Morningstar

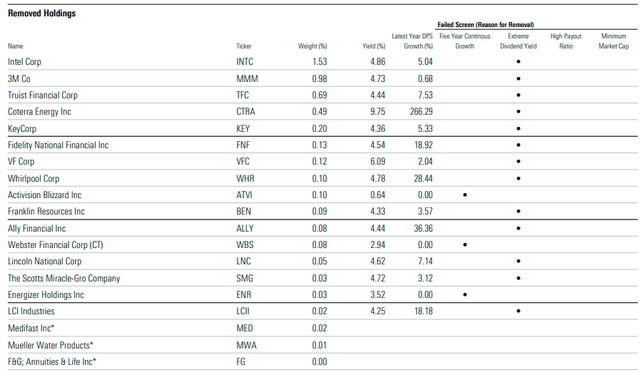

The Index eliminated 19 holdings primarily due to the intense dividend yield display screen. Intel and 3M at the moment have ahead dividend yields of 5.62% and 4.90% and poor Looking for Alpha EPS Revision Grades. Subsequently, these modifications look useful from a momentum perspective.

Morningstar

Sector Exposures and High Ten Holdings

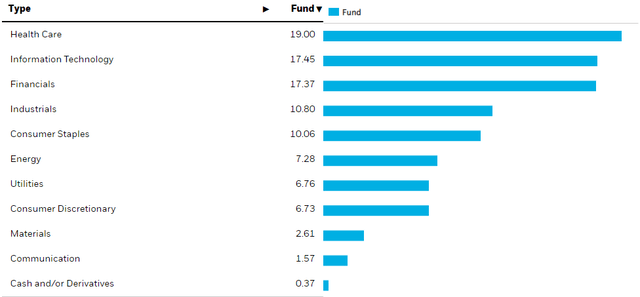

DGRO’s sector exposures are proven beneath, with no sector dominating greater than 20% of the portfolio. Well being Care (19.00%) and Know-how (17.45%) are outstanding. Financials declined by 3.55% from 20.92% to 17.37%, whereas Power elevated by 5.96%. Buyers treating DGRO as a core holding will respect this improved diversification.

iShares

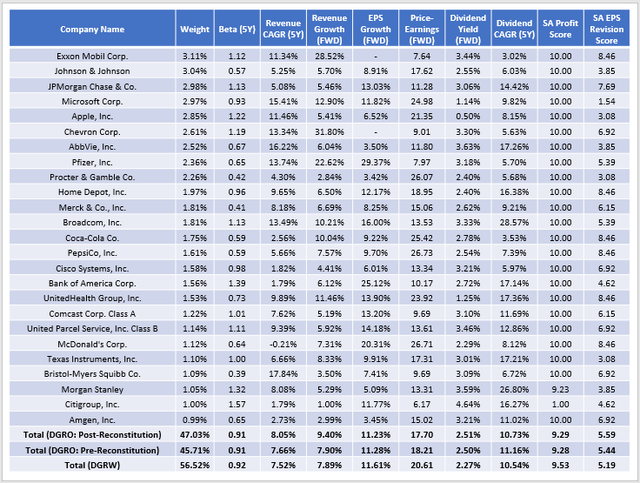

Exxon Mobil now leads the fund with a 3.10% weighting, adopted by Johnson & Johnson (JNJ) and JPMorgan Chase (JPM). These holdings whole 26.58% in comparison with 24.40% for the SPDR S&P 500 Belief ETF (SPY), indicating a bit much less diversification than the simple market strategy.

iShares

Efficiency and Dividends

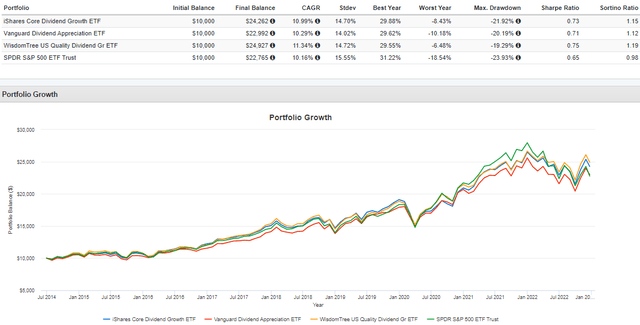

DGRO has gained an annualized 10.99% since its June 2014 inception date, besting the Vanguard Dividend Appreciation ETF (VIG) and SPY by 0.70% and 0.83% per yr with comparable volatility. The WisdomTree U.S. Dividend Progress ETF (DGRW) outperformed DGRO by 0.35% per yr and is thrashing by about 2% YTD. In a earlier article, I famous DGRW’s superior profitability and decrease volatility because the doubtless supply.

Portfolio Visualizer

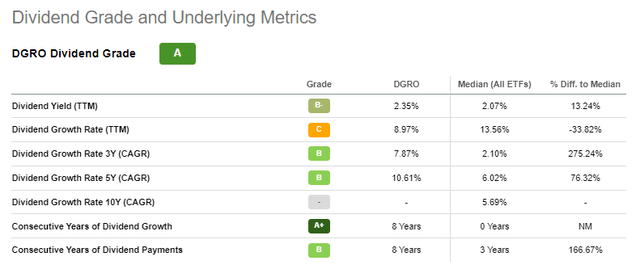

DGRO earns a powerful “A” Dividend Grade based mostly on Looking for Alpha Issue Grades. As anticipated in September, DGRO’s dividend progress resumed with the final two quarterly funds, and dividends have grown at an annualized 10.61% fee over the earlier 5 years. The draw back is a comparatively low beginning yield of two.35%. Nevertheless, if in case you have a considerably very long time horizon of 7-10 years, your yield on value will doubtless exceed what high-dividend ETFs at the moment provide. My desire is dividend progress over dividend yield.

Looking for Alpha

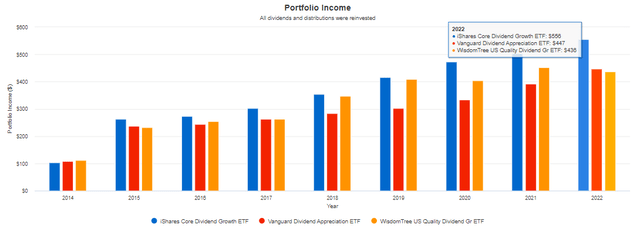

For instance, DGRO’s portfolio revenue on an preliminary $10,000 funding in July 2014 (with reinvested dividends) is now $556, or a $ 5.56% yield on value. VIG’s and DGRW’s yield on value is about 1% much less, even after accounting for the one remaining month-to-month distribution for DGRW.

Portfolio Visualizer

ETF Evaluation

One of many the explanation why DGRO is stable is that regardless of the sometimes-eventful reconstitutions, the portfolio’s options are constant year-to-year. For instance, traders will not get up one December morning to seek out DGRO’s estimated dividend yield or progress has plummeted. The next desk demonstrates that consistency by evaluating DGRO’s fundamentals pre- and post-reconstitution. I’ve additionally included DGRW’s fundamentals within the closing row.

The Sunday Investor

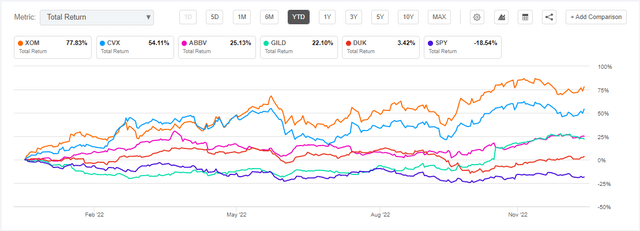

DGRO’s five-year beta stays at 0.91, about common for large-cap dividend ETFs, indicating that it might probably present some draw back safety in a market downturn. That, together with its comparatively low 17.70x ahead earnings valuation, is why DGRO and its friends outperformed in 2022. DGRO’s high holdings embody a number of that share these two options, together with AbbVie, up 25% YTD. DGRO’s high 5 additions beforehand failed the intense dividend yield display screen, and so they’re all performing properly this yr, thereby lowering their yields. This fashion, DGRO turns into higher from a momentum perspective at every reconstitution, although it is important to search for indicators of fashion drift all year long.

Looking for Alpha

In a prior overview, I famous how DGRO’s gross sales and earnings progress charges had been stronger than high-dividend friends like SCHD and CDC. These options meant DGRO was higher capable of help future dividend progress, too, and I am happy to see these metrics enhance much more: 9.40% vs. 7.90% pre-reconstitution. Importantly, this enchancment didn’t sacrifice profitability by including extra small- and mid-cap shares. DGRO’s weighted-average market capitalization elevated from $252 billion to $281 billion, and its high 25 holdings listing is stuffed with corporations with “A+” Looking for Alpha Profitability Grades.

In comparison with DGRW, DGRO now seems to be superior. Together with higher progress and valuation metrics, DGRO’s EPS Revision Rating of 5.59/10 suggests stronger sentiment on Wall Road. The one space the place DGRW seems to be extra engaging is its profitability rating (9.53/10 vs. 9.29/10). Nevertheless, each scores are sturdy, and it is pointless to be too strict with this criterion.

The portfolio’s gross dividend yield on dividends is 2.51% or 2.43% after charges. In different phrases, the trailing 2.35% dividend yield is correct, as is the ten.73% historic dividend progress fee listed within the earlier desk. Once more, I respect consistency, even when the reconstitution resulted in some notable modifications.

Funding Advice

The important thing takeaway from this yr’s reconstitution was the addition of Exxon Mobil and Chevron, two relatively-low danger Power corporations that pay stable dividends, have good estimated progress, and supply a crucial inflation hedge ought to that proceed to be problematic in 2023. My goal for the sector is 10%, and DGRO’s 7.28% is now within the acceptable vary and above what S&P 500 Index ETFs provide. AbbVie is one other glorious addition, and like most corporations, the Index added it due to latest value appreciation. In distinction, the Index eliminated struggling corporations like Intel and 3M. These are two examples of corporations with adverse earnings momentum, indicated by “D” and “C-“ EPS Revisions Grades. To purchase them now’s a contrarian play, and never solely is that too speculative, however it additionally goes towards DGRO’s dividend progress goals. If it is dividend consistency relatively than dividend progress you are searching for, I like to recommend readers take a look at NOBL as an alternative.

Whereas reconstitutions generally change the underlying fundamentals of an ETF, DGRO’s was constant, and that is one thing shareholders ought to welcome. The ETF trades at a lovely 17.70x ahead earnings, has double-digit earnings and dividend progress, and an estimated 2.43% dividend yield that can finally catch as much as most higher-yielding friends. Mission achieved, so far as I am involved, and I believe 2023 will probably be one other stable yr for this well-liked dividend progress ETF. Thanks for studying, and I hope you all have a Completely satisfied Holidays and take a well-deserved break!