Feverpitched

To get an concept of the place the economic system goes, let’s take a look at just a few main financial indicators. There are usually 5 excellent main financial indicators – yield curve, sturdy items orders, inventory market, manufacturing jobs, and constructing allow purposes/approvals. Once you have a look at these indicators, the outlook isn’t shiny.

Yield Curve

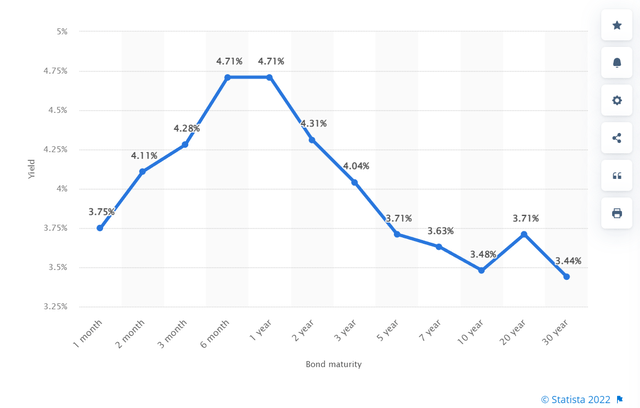

Usually, a yield curve begins out low and rises over time. It is enterprise as regular when a yield curve begins low and goes up with the length of bond maturity. When it’s the other or inverted, that has traditionally been handled as a foul signal. Is it at the moment inverted? Sure, it’s. As of Dec 8, that is what the USA yield curve appears like.

Yield Curve (Statista)

Traditionally, the yield curve has been a very good predictor of the final 8 recessions as it’s properly illustrated on this article, which mentions the recession in 1970, ’73, ’80, ’90, ’01, and ’08 have been all proceeded by an inverted yield curve. The yield curve did additionally invert in 1966, nevertheless it was not adopted by a recession. On common, the yield curve is an effective predictor of a recession. A great way to have a look at rates of interest is as a trade-off for taking the danger of lending funds to a 3rd celebration. If the state of affairs turns into riskier – firm is simply too leveraged, or economic system is about to crash – the consequence is identical; lenders require a larger reward for the danger they take. As you’ll be able to see from the curve illustrated within the graph above, lenders see a lot larger danger within the brief time period vs the long run.

Sturdy Items Orders

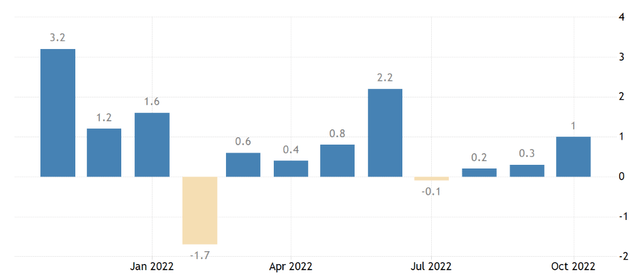

Regardless of inflation, sturdy items orders have been capable of rise 1% in October 2022. As you’ll be able to see from the graph beneath, they’ve been usually optimistic in 2022. Sturdy items are these big-ticket objects that require numerous labor to provide. They embody objects like vehicles, dwelling home equipment, furnishings, heavy tools, and so forth.

Buying and selling Economics

Rising demand for sturdy items is an effective indicator of enterprise confidence. The extra sturdy items which might be bought, the extra enterprise labor wanted to provide these merchandise. This main indicator is optimistic, however will not be sufficient to offset the opposite main indicators.

Inventory Market

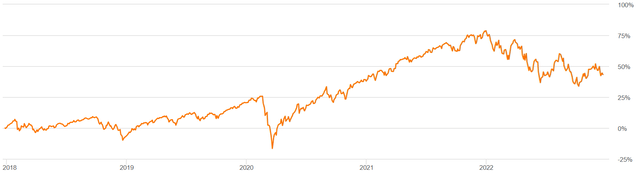

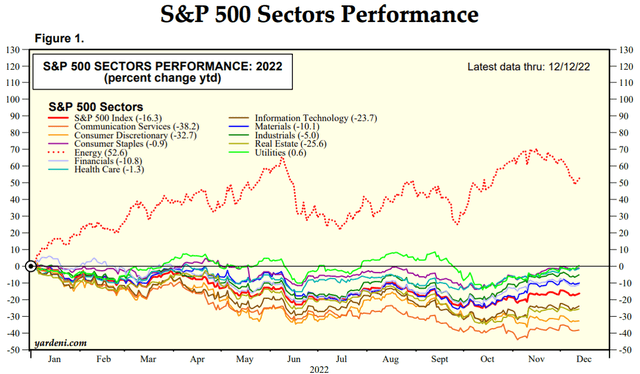

The S&P 500 has not had a very good 2022. It went down from 4766 on the finish of 2021 to 4019 as of Dec 13, 2022. YTD, the S&P 500 is down 15%. You may see from the graph that it was not a clean experience down. The inventory market tried to recuperate 3 occasions however simply couldn’t maintain. It isn’t shocking that now we have had a roller-coaster of a yr. Each week, new materials info hits the market – inflation, jobs numbers, cuts to gasoline manufacturing, and frequent warfare information from Ukraine.

S&P 500 (In search of Alpha)

Bear in mind what the inventory market is. It’s a grouping of firms and their valuations. These valuations are derived from buyers, portfolio managers, and hedge fund managers that spend all day researching firms to foretell future earnings and development charges. A decline within the inventory market logically means buyers are seeing purple flags on the horizon. This main indicator is destructive.

Manufacturing Jobs

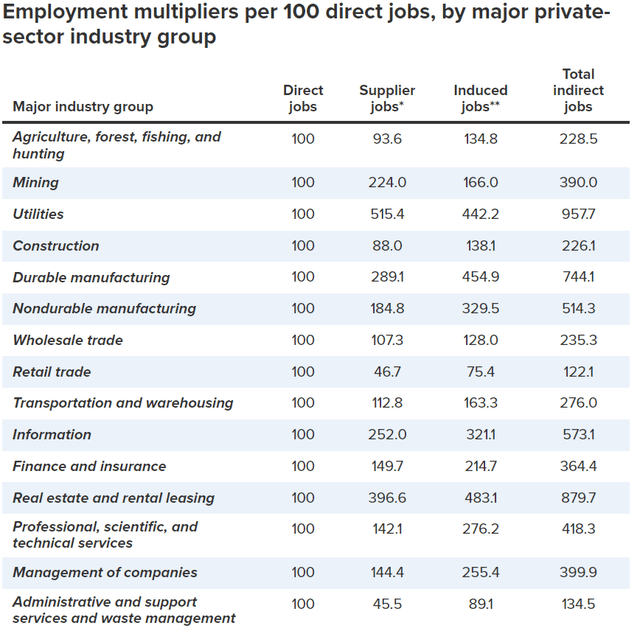

An essential part of employment is the manufacturing jobs. You may see from the desk beneath that the multiplier impact from manufacturing jobs is giant. Mainly, the multiplier is what number of spin-off jobs one explicit job helps. Sturdy and non-durable items manufacturing is kind of excessive at 7x and 5x, respectively.

Financial Coverage institute

We’ve got been getting extra alerts from the Federal Reserve that charges are going up and won’t be coming down quickly. The ADP November jobs report revealed this Nov 30 experiences that total, 127,000 jobs have been added in November. These additional jobs have been additionally accompanied with wage development. So, we’re in a state of affairs the place we hold including jobs and better wages in a single space, however on the identical time, manufacturing jobs are reducing. This strong jobs report solely strengthens the case that rates of interest will go up and hold pushing us nearer to a recession.

The ADP jobs report states 127,000 jobs have been added to the USA economic system in November. Of these jobs, goods-producing industries accounted for 16,000 in pure useful resource and mining, -2000 in development, and sadly, -100,000 in producer.

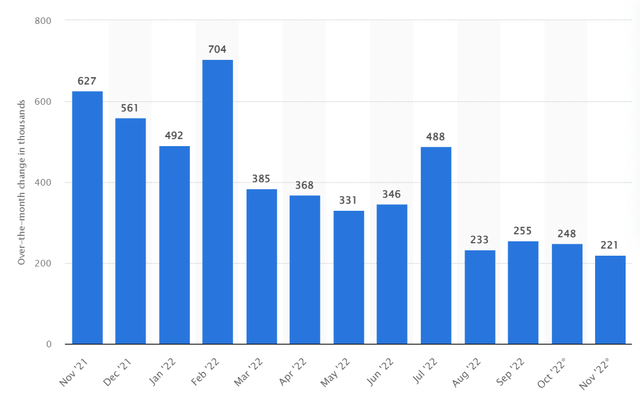

The graph beneath exhibits the declining pattern in new jobs stuffed over the past yr.

Non-farm payroll development (Statista)

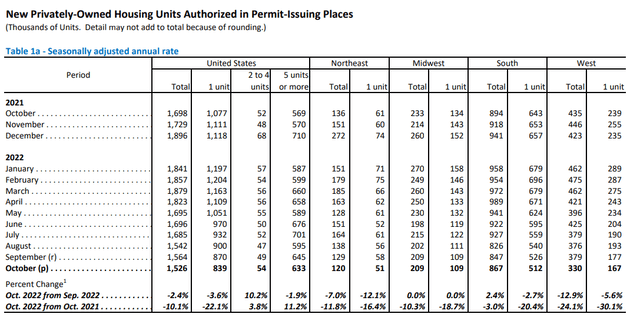

Constructing Permits

The actual property market is a vital sign of enterprise and shopper confidence. When shoppers, companies, or buyers really feel assured within the path of the economic system, they really feel safe sufficient to make or finance large-scale investments. The extra investments which might be made not solely have an effect on the development trade however banking as properly. Constructing permits issued are an effective way to gauge the demand for development labor 6 to 9 months forward. Falling demand for brand spanking new properties additionally signifies a weak spot within the resale market, affecting commissions and income of many actual property corporations and salespeople. We will see from the chart beneath that the true property market remains to be heading down. The variety of permits nonetheless continues to fall.

Housing permits issued (United States Census Bureau)

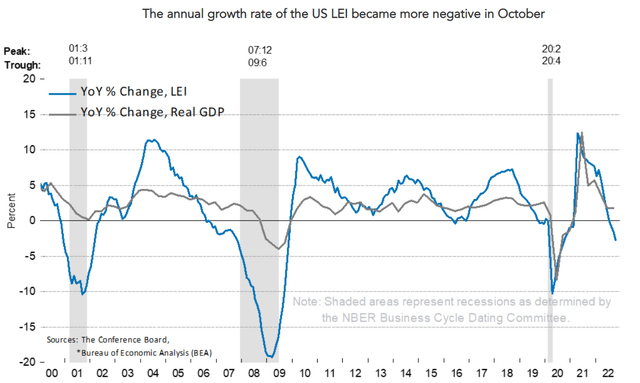

The Convention Board Main Financial Index

There are lots of good main financial indicators. Until you need to observe every one among them your self, the convention Board has three nice indexes that observe main, coincidence, and lagging indicators. All of those can be utilized, however I choose to have a look at the main indicator. This can be a highly effective indicator of the place the economic system will probably go. Historical past has proven that the Main Financial Index predicts corrections within the enterprise cycle by roughly 7 months.

The index consists of assorted main indicators:

Common weekly preliminary claims for unemployment insurance coverage. Producers’ new orders for shopper items and supplies. ISM Index of New Orders. Producers’ new orders for nondefense capital items excluding plane orders. Constructing permits for brand spanking new non-public housing items. S&P 500 Index of Inventory Costs; Main Credit score Index. Rate of interest unfold (10-year Treasury bonds much less federal funds fee). Common shopper expectations for enterprise situations.

Convention Board

At the moment, the index is down 3.2 % over the past 6 months. “The US LEI fell for an eighth consecutive month, suggesting the economic system is presumably in a recession,” mentioned Ataman Ozyildirim, Senior Director, Economics, at The Convention Board. As you’ll be able to see from the graph above, the index has been profitable at predicting upcoming recessions. As of not too long ago, now we have crossed into recession territory.

The place to Make investments?

So, the place can we put money into these tough occasions. There are conventional ideas on investing throughout recessions to investment-defensive shares. Shares which have a small Beta. A inventory with a beta of 1 strikes precisely with the market. So, if the market goes down 2% so does the inventory with a beta of 1. If a inventory has a beta of 0.5 and the market goes down 2%, then the inventory with a beta of 0.5 solely goes down by 1%. This works in the wrong way as properly.

So, if we predict that the market goes down, do we actually need to put money into a inventory that we all know is not going to go down as a lot because the market, however will nonetheless go down? You may see from the graph beneath that every one sectors aside from vitality have gone down over the past yr’s downturn. Though I just like the efficiency of the vitality sector not too long ago, I attempt to keep away since globally governments have made conventional vitality firms public enemy primary. Globally, conventional vitality firms have been focused with stricter rules, denied permits to drill or stopped from increasing pipelines. Now with wholesome income in vitality, progressive representatives discuss “extra revenue” taxes. In my eyes, conventional vitality firms can’t win in the long term.

Yardeni

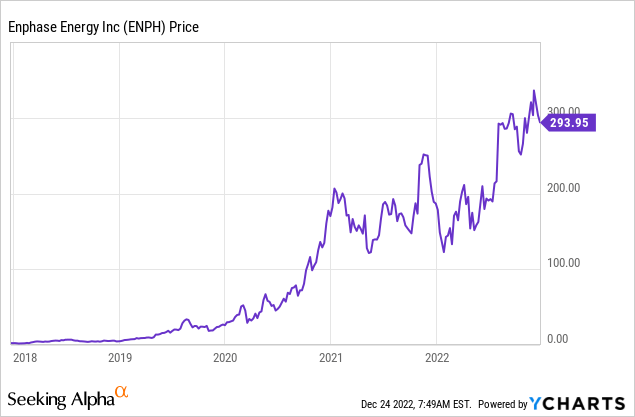

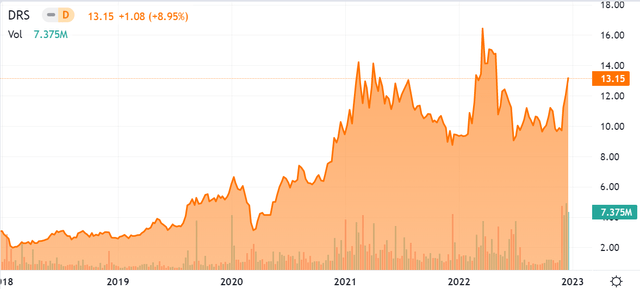

I’ve seemed for firms which have grown their income and earnings persistently over the previous couple of years. If these constant growers did take successful to their income or earnings throughout Covid, I’d need to see a fast turnaround and continued development up up to now. I additionally need to search for small firms which will have been ignored by the vast majority of buyers. Whereas numerous shares have been falling within the final yr, these shares are nonetheless growing in worth. The next 2 shares have been capable of climate the Covid recession, making me assured in investing in them for the upcoming recession. I’d additionally like shares that aren’t comparable to one another, I seemed for shares in very totally different industries and sectors.

So the place are the alternatives?

Enphase Power (ENPH)

Zacks.com

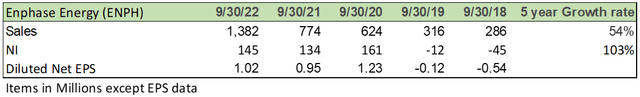

Established in 2006, Enphase Power is a expertise firm headquartered in California that develops and manufactures photo voltaic battery storage, micro-inverters, and EV charging stations. They’re the primary firm to efficiently commercialize the photo voltaic micro-inverter. Micro-inverters convert direct present energy generated by a photo voltaic panel into grid-ready alternating present.

Enphase’s largest market is the USA. Over the previous couple of years, income from the American market composed 70% to 80% of the corporate’s whole gross sales. Additionally they promote into Canada, Mexico, Europe, Australia, Central America, India, and different Asian markets. So far, the corporate has shipped greater than 42 million microinverters globally.

I just like the strategic highway map they’ve outlined of their annual report.

They want to be best-in-class in buyer expertise. They appear to design merchandise which might be “dependable, sensible, easy and protected”(2021 10K); I really feel that is one thing that the majority shoppers would gravitate to. They’re making an attempt to tell apart themselves from their opponents by being a system-based supplier. The 10K additional states their merchandise “handle vitality era, vitality storage and management and communications on one clever platform”. They’re closely concerned in R&D making an attempt to extend energy conversion effectivity and output energy. Their “engineering staff is concentrated on growing the vitality density of our battery capability, lowering set up time and lowering price per kWh to make solar-plus-storage resilient, sustainable and reasonably priced for the lots”. This firm is an ideal place to take a position right now due to the massive deal with renewable vitality and photo voltaic that governments world wide are pushing.

Leonardo DRS (DRS)

Zacks.com Leonardo DRS inventory worth (In search of Alpha)

Protection has big potential within the subsequent few years. Not solely was a rustic in Europe invaded just like WW2 not too long ago, which is at the moment consuming numerous sources that the west is offering, but in addition many nations world wide want to enhance their army spending. The present Ukraine state of affairs can also be exhibiting the constraints the world has in controlling a nuclear energy state. The west has put many sanctions on Russia however there appears to be no de-escalation within the state of affairs.

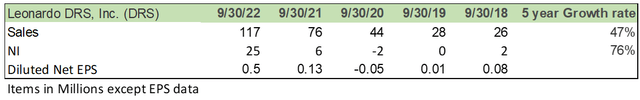

I’ve come throughout Leonardo DRS, Inc. It develops and makes protection merchandise for the USA and allies. Their product combine contains superior sensing, community computing, and electrical energy and propulsion. They function in land, air, sea, house, cyber, and safety.

Even not too long ago, as a part of its Nationwide Safety Technique, Japan has dedicated to buying long-range weapons and growing its protection finances, citing regional threats as a key issue. The growth of army capabilities by Japan would have been unprecedented just some years again, however that is the worldwide actuality we discover ourselves in proper now. Nearer to dwelling, The New York Instances has reported “The prospect of rising army threats from each China and Russia is driving bipartisan help for a surge in Pentagon spending”

The elevated spending and the necessity to replenish ammunition utilized in Ukraine are all nice indicators for the protection trade.

Conclusion

With all the worldwide tensions and recession alerts flashing purple, I believe now’s one of the best time to get into some area of interest firms which have confirmed their potential to develop in tough occasions.