FG Commerce

If there is a single lesson that life teaches us, it is that wishing would not make it so.― Lev Grossman

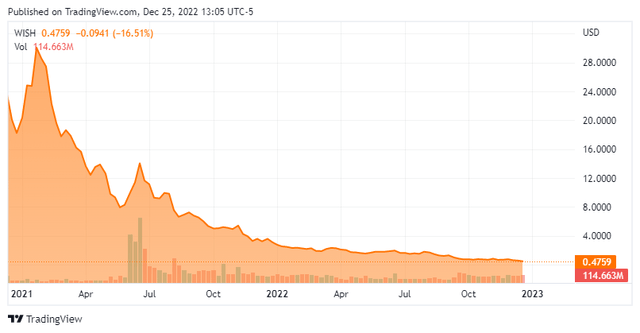

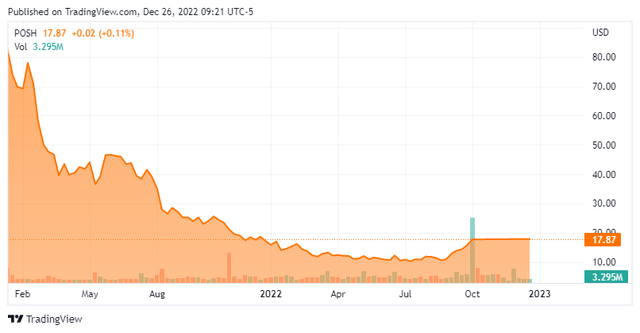

Immediately, we put ContextLogic, Inc. (NASDAQ:WISH) within the highlight for the primary time. This e-commerce play got here public in late 2020 throughout an enormous growth within the IPO house and was based by ex Yahoo and Google executives. As could be seen beneath, the inventory has been a catastrophe for shareholders since. Nevertheless, the shares now promote for a considerable low cost to the web money on its steadiness sheet. Worth Entice or shopping for alternative? An evaluation follows beneath.

Searching for Alpha

Firm Overview:

ContextLogic, Inc. is headquartered in San Francisco. The corporate operates Want, an ecommerce platform that connects customers to retailers and different offers market and logistics companies to shoppers. The inventory at present trades round fifty cents a share and sports activities an approximate market capitalization of $350 million.

The corporate sells novelty and distinctive objects to discount aware customers from retailers, primarily in China in addition to different rising markets. ContextLogic noticed gross sales surge throughout the pandemic, when many of the inhabitants within the western world was both locked down or working from house.

Third Quarter Outcomes:

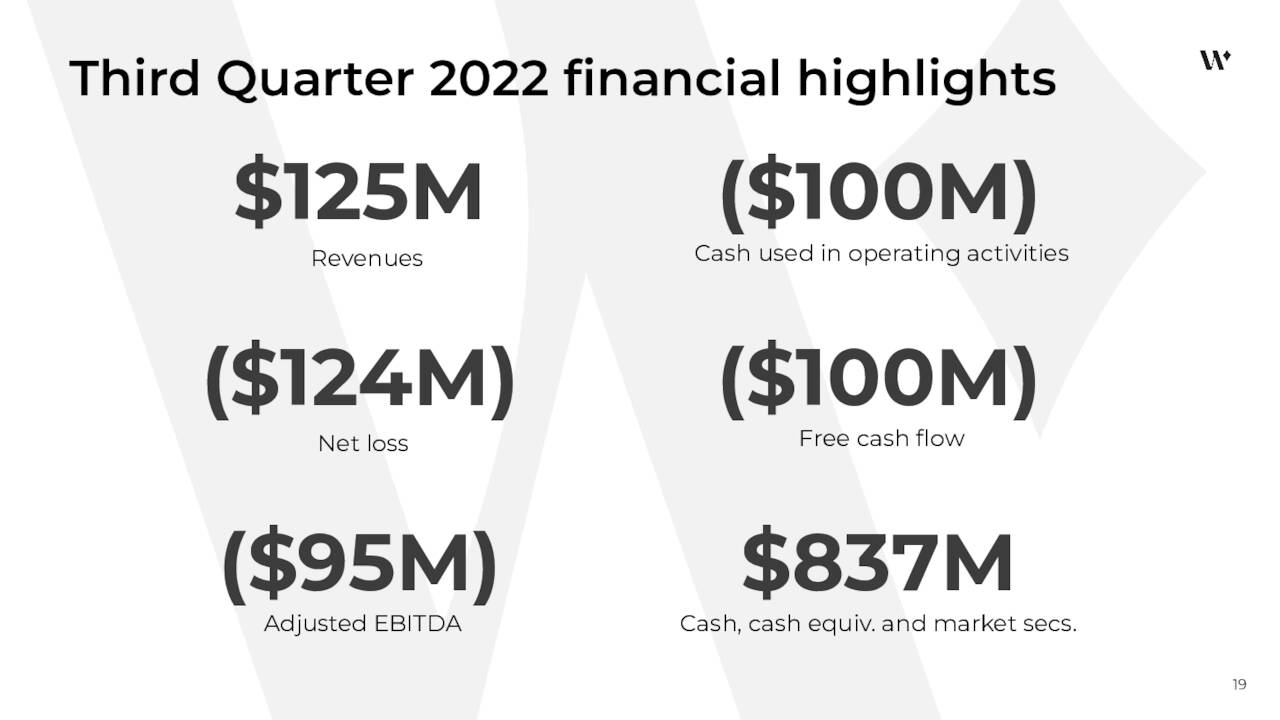

ContextLogic posted third quarter numbers on November ninth. They had been disappointing on the income facet. The corporate posted a GAAP lack of 18 cents a share, which was a couple of cents a share above the consensus. Nevertheless, revenues fell 66% on a year-over-year foundation to $125 million, roughly $30 million beneath the consensus. Core Market gross sales got here in at simply $40 million, down 78% from the identical interval a 12 months in the past. ProductBoost revenues had been $11 million, off 70% from 3Q2021.

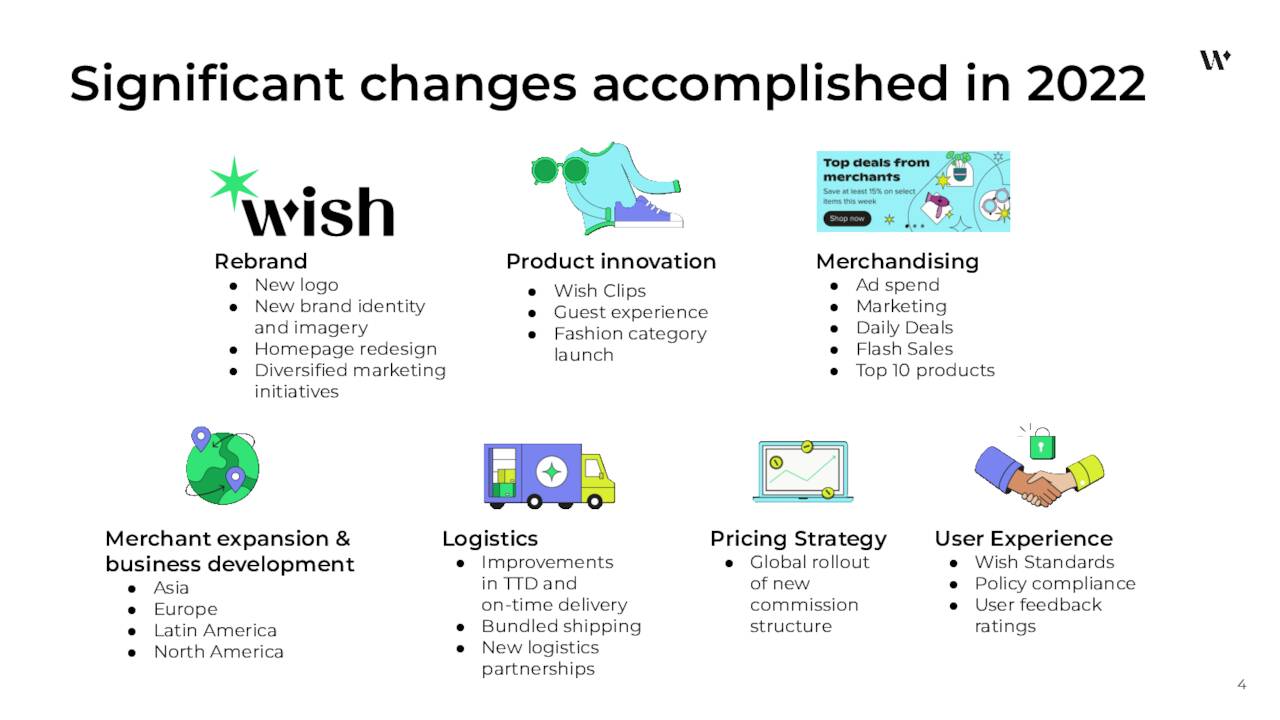

November Firm Presentation

Analyst Commentary & Stability Sheet:

Because the firm’s final earnings report, Credit score Suisse has decreased its worth goal to $5.70 a share from $7.20 whereas sustaining its Outperform ranking on the inventory. UBS lower their worth goal in half to only .80 a share whereas sustaining a Impartial ranking on the fairness, and Citigroup initiated the shares with a Promote ranking and a 50 cent a share worth goal.

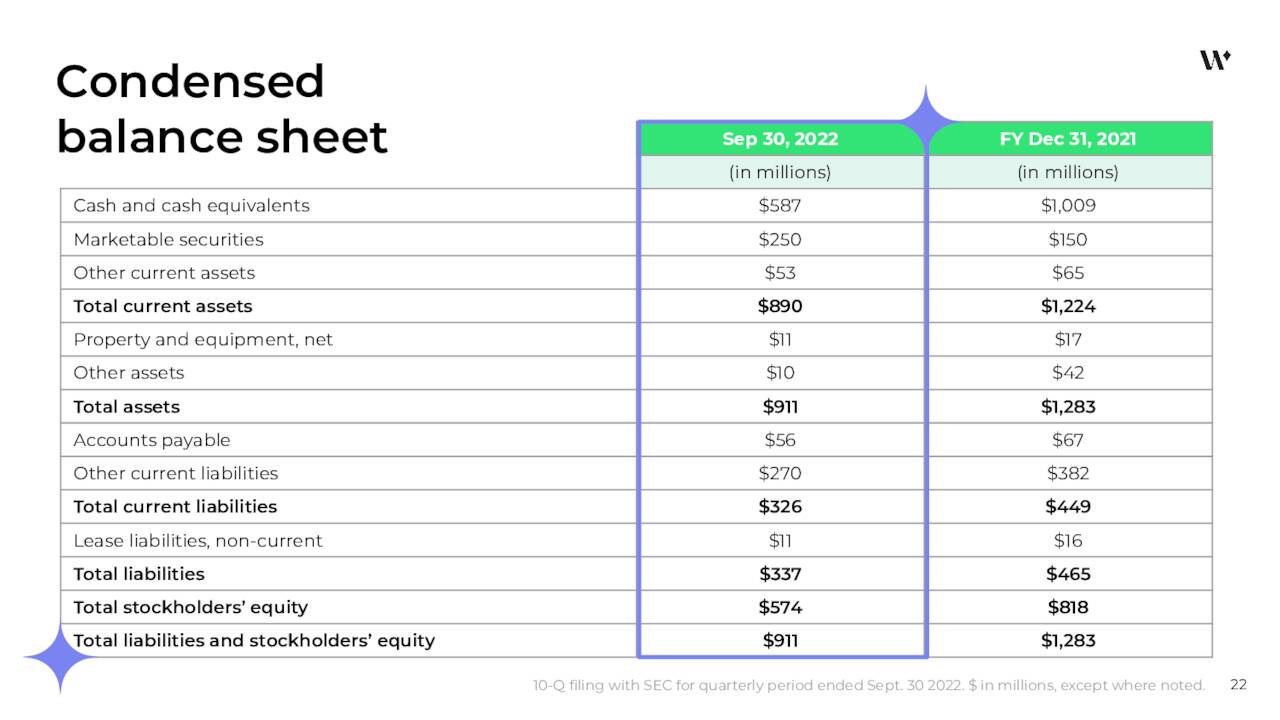

November Firm Presentation

Roughly seven % of the excellent float in WISH is at present held brief. Quite a few insiders have been frequent and constant sellers of the inventory since lock ups expired. Thus far, they’ve disposed of roughly $10 million price of inventory in combination right here within the fourth quarter up to now. After posting an enormous lack of $121 million for the third quarter, the corporate nonetheless had simply north of $835 million of money and marketable securities on its steadiness sheet. The corporate had unfavorable free money move of $100 million within the third quarter, which was really an enchancment from unfavorable free money move of $344 million it posted in 3Q2021.

Verdict:

The present evaluation agency consensus has the corporate dropping roughly 55 cents a share in FY2022 as gross sales shrink over 70% to only over $590 million. Gross sales development within the excessive single digits is projected in FY2023, however ContextLogic is anticipated to put up comparable losses for FY2023.

Searching for Alpha

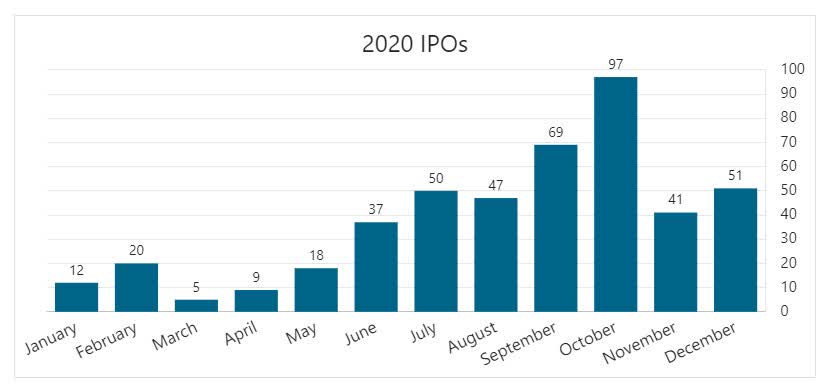

The corporate debuted available on the market in December 2020 when IPOs raked in $20 billion for December, an all-time document for the month. Because of low-cost cash from the Federal Reserve, IPO quantity would proceed to be sturdy by way of the summer season of 2021. WISH raised simply over $1 billion on the time of its IPO giving it a valuation of $17 billion at $24.00 per share. On the time, the corporate had 100 million month-to-month lively customers or MAUs worldwide, promoting roughly two million merchandise every day on its e-commerce platform. On the time each JP Morgan and Oppenheimer positioned Purchase scores on the inventory with an identical $30 worth targets.

Searching for Alpha

E-commerce retailer Poshmark (POSH) got here public quickly after ContextLogic, and in addition has been a catastrophe for its authentic shareholders. ContextLogic delivered income development (however lower than authentic projections) for its first two quarters available on the market, however by 2Q2021, revenues began to fall on a year-over-year foundation, badly lacking projections. Because the pandemic ebbed, worldwide installations of its app fell by 13% sequentially in 2Q2021 and the typical time spent on the Want platform dropped by 15% throughout the identical interval. WISH additionally ceased being a ‘meme’ inventory across the identical time.

Administration turnover additionally beginning to happen round that point, with the corporate dropping its CFO in July. The CEO, who had almost 60% of the voting shares when the corporate got here public, introduced he was stepping down a couple of months later however would stay on the board of administrators. The corporate introduced a brand new CEO in February of this 12 months, who was CEO of Foot Locker’s (FL) Europe, Center East & Africa companies. The corporate’s earlier CEO left the board this summer season. ContextLogic then put in place its third chief since going public this September, and he was introduced as an interim CEO.

November Firm Presentation

The corporate has been plagued with slumping demand for its low-cost merchandise, the shortcoming to persistently management prices, and a continued giant quarterly burn charge. As well as, the agency has been challenged by high quality points and provide chain issues by way of most of its historical past as a public firm. ContextLogic has made some enhancements since coming public, together with including service provider rewards, incorporating reside and video procuring, and redesigning its homepage. Administration has made some progress lowering the quantity of buyer refunds and order cancellations (above). The inventory additionally trades for considerably beneath the worth of its money holdings.

November Firm Presentation

That mentioned, it’s onerous to suggest even a small funding in ContextLogic presently till buyers see some extra progress lowering quarterly losses and a brand new CEO is in place. Subsequently, we’re passing on recommending even a small ‘watch merchandise’ place on this title, buying and selling at a big low cost to its money worth.

To grant all a person’s needs is to remove his goals and ambitions. Life is just price dwelling when you’ve got one thing to try for. To purpose at.”― P.B. Kerr

Editor’s Be aware: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.