byakkaya/iStock by way of Getty Pictures

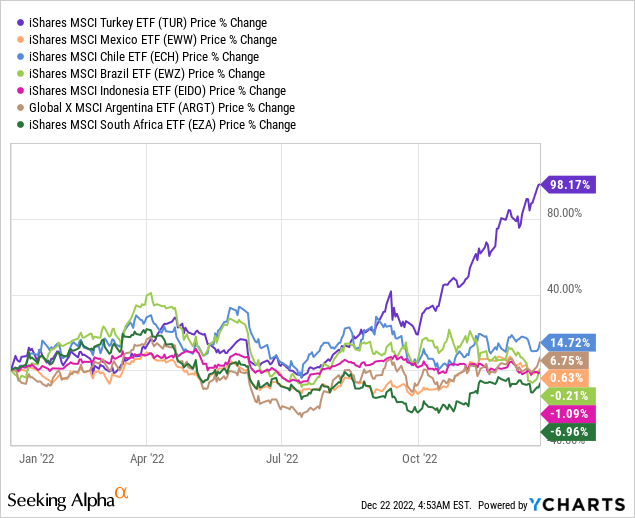

In April 2021, I revealed an article about iShares MSCI Turkey ETF (TUR) that took a bearish stance because of fleeing overseas traders, and my bear case held nicely till the summer season of 2022. Regardless of the Turkish financial system severely deteriorating in 2022 with record-breaking, triple-digit inflation figures not seen for over 20 years, the Turkish inventory market had a stellar yr. The TUR ETF considerably outperformed all different nation ETFs by a considerable margin, nearly doubling in worth.

On this article, I’ll clarify Turkey’s present financial and political points and Erdogan’s unorthodox answer to financial headwinds to determine if this outstanding bull rally can proceed.

TUR started its rally in the summertime of 2022 alongside different developed and rising market international locations. Nonetheless, as these different markets flattened, the Turkish inventory market skyrocketed. Whereas there is no such thing as a elementary rationalization for the optimistic divergence of Turkish equities from their friends, Erdogan’s unorthodox financial insurance policies created an enormous demand that propelled the Turkish inventory market. TUR has lastly damaged its 10-year adverse development and is at present the top-performing nation ETF yr up to now.

Erdogan’s Unorthodox Resolution

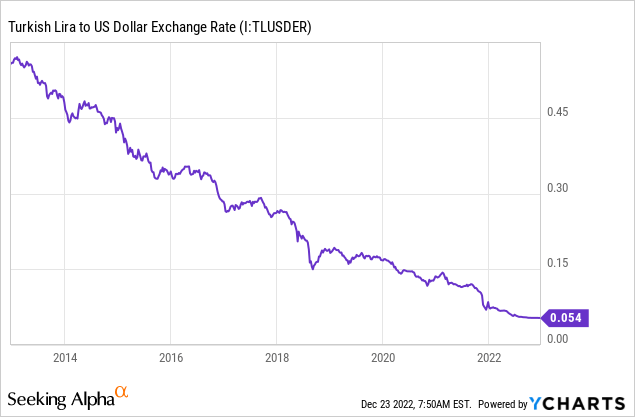

For the previous decade, Turkey has been grappling with a persistent subject of foreign money depreciation. Previously, the central financial institution has tried to stabilize the foreign money by engaging overseas traders with high-interest charges. Nonetheless, Erdogan has lengthy been at odds with these excessive charges, believing that they’re the basis explanation for inflation and are pushed by the so-called “Curiosity Foyer”. Erdogan’s unorthodox financial coverage takes a contrarian strategy, arguing that international locations ought to really decrease rates of interest to fight rising inflation. This concept means that decrease charges can create a optimistic suggestions loop that helps to curb inflation. Whereas this concept goes towards established financial rules, Erdogan has absolutely applied these unconventional insurance policies in recent times. Sadly, these unorthodox financial insurance policies do not mesh nicely with open market insurance policies, and overseas capital tends to flee such regimes.

Because of this, overseas capital has been fleeing Turkey, resulting in excessive depreciation of the Lira in 2021 and early 2022. The weakening lira has led to the dollarization of the Turkish financial system, as each companies and people have held onto overseas money reserves. The elevated demand for foreign exchange has created a vicious cycle for the Lira.

The federal government needed to cease dollarization and stabilize the native foreign money, nevertheless it required dry powder, and Erdogan launched an answer to gasoline his “Lirarization” plan. He secured new credit score strains from Qatar, Russia, and Erdogan’s former adversaries, the UAE and the Saudi Kingdom, to supply the monetary assets for this new technique. These credit score strains would assist to kickstart and gasoline this unconventional financial strategy.

However, the federal government needed to restrict the affect of the offshore market on the Lira to maximise its management. The extreme depreciation of the Lira and lowered rates of interest did a lot of the work, however the authorities additionally took varied official and unofficial monetary measures and laws. These included rising cross-currency rates of interest, proscribing locals’ entry to supranational bonds, and limiting Turkish banks’ issuance and positions of by-product positions to brief the Lira. The banking laws establishment, BDDK, performed a task on this effort, as did unofficial pressures from the central financial institution to restrict high-volume transactions after 4 pm. These measures made it tougher for offshore markets and overseas gamers, however for anybody generally, to take speculative positions towards the Lira or brief it for extended durations.

To restrict home demand for foreign exchange, Erdogan launched varied new laws. Essentially the most important measure was the introduction of KKM “FX Linked Deposits”. KKM was the primary distinguished step within the “Lirarization” marketing campaign, which aimed to extend demand for the Lira by incentivizing lira deposits however at a dire value to the Treasury. Mainly, it’s a saving deposit with a free possibility granted to the investor to purchase FX on the train date on the foreign money trade fee of the initiation date. The Central Financial institution bears the danger of the choice, nevertheless it has the potential to show right into a vicious cycle if the Lira considerably depreciates. The Central Financial institution would owe more cash, which might create extra Lira provide to pay its debt, and that results in greater foreign money depreciation because of extra provide which results in greater payouts once more.

However, Turkish firms had been “incentivized” (or, in some circumstances, compelled) to trade their overseas deposits for “FX Linked Deposits”, additional advancing the “Lirarization” motion. Lastly, new banking laws required Turkish banks to carry greater lira deposits, additional strengthening demand for the foreign money. Whereas doing all the opposite interventions, the Central Financial institution used the money they obtained from the international locations by way of credit score to gasoline all these operations and maintain the foreign money secure by way of direct market interventions. Total, the “Lirarization” marketing campaign has been profitable for now, because the Lira remained secure within the second half of 2022.

Shares – The Solely Possibility For Peculiar Turks

Regardless of the soundness of the Lira with the “Lirarization” marketing campaign, inflation soared to excessive ranges because of the severely depreciated foreign money and international inflation up to now yr. Based on official figures, YoY inflation was 84.4% in November, however respected sources akin to ENAG estimate that it was a lot greater, at over 185%. Beforehand, peculiar Turks had used overseas deposits to maintain up with rising inflation. Nonetheless, because the foreign money stabilized, folks started on the lookout for various methods to struggle excessive inflation.

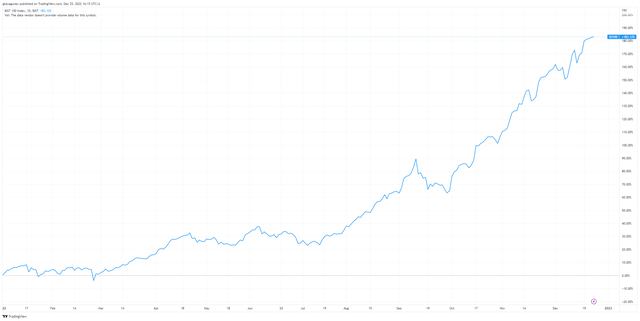

The excessive inflation led to record-breaking revenues and earnings for firms, and the Turkish inventory market (BIST) soared as quickly as monetary outcomes had been introduced. The center class, searching for alternate options to holding overseas deposits with minimal curiosity, rushed into the inventory market. In 2022, greater than 1.2 million individuals who had by no means invested within the inventory market joined. It is a rise of over 50% within the variety of particular person traders, which now stands at 3.6 million. Because of this demand, the BIST 100 index, which incorporates the highest 100 firms listed on the Istanbul Inventory Alternate, rose by over 180% in Turkish Lira and over 100% in US {dollars}.

BIST 100 (Tradingview)

Supply: Tradingview

It Will Work Till It Does Not

The Turkish inventory market has seen a major inflow of home traders because of the lack of other funding choices and low cost rates of interest on the Lira. Many peculiar Turks have taken out client loans to leverage their positions within the inventory market, and the widespread use of this tactic has led authorities officers to subject warnings about its dangers. Moreover, the center class has taken benefit of money advances on their bank cards with reasonably priced loans, additional rising their leverage. These accustomed to historical past can acknowledge the unsustainable nature of this development, which is more likely to result in a market bubble and an inevitable crash.

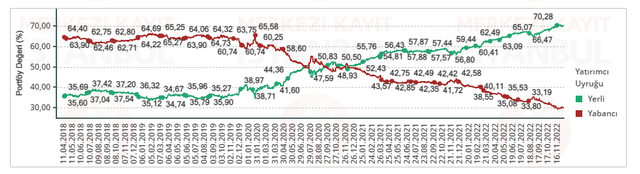

Presently, peculiar Turks make up the vast majority of the inventory market, with overseas funding representing a lowering portion. Previously, the overseas funding made up round 60-65% of the market, whereas home funding accounted for 40-35%. Nonetheless, home funding now makes up over 70% of the market, and the hole continues to widen. As a consequence of inadequate overseas traders to regulate costs and restricted instruments to take positions towards the market, the bullish development is more likely to proceed.

Market Break up (VAP)

Supply: VAP

The Bull Case Argument

Lately, the minimal wage was elevated for the second time this yr by 55% to 8500 Lira, which is round $445. This huge improve in working-class wages will inevitably push inflation greater in early 2023, even when the Lira stays secure. As the center class is the principle driving drive behind the market, folks will seemingly reinvest their additional revenue into the inventory market, additional fueling the rally. Nonetheless, this additionally creates a possible danger for traders as it could contribute to a market bubble.

Elections Create Uncertainty

The inventory market continues to succeed in new highs every single day, however excessive inflation is the phrase on the streets. Elections are scheduled to happen on June 2023. The impression of inflation is already being mirrored in polls as Erdogan’s help is at traditionally low ranges. After twenty years in energy, many consider elections will probably be fierce, as Erdogan is not going to go down with out a struggle. We have now already seen Erdogan take anti-democratic measures to safe victory, akin to sentencing the mayor of Istanbul, Imamoglu, who defeated the AKP in earlier elections, to 2 years in jail. Though Imamoglu could not in the end go to jail, the sentence means a political ban from elections. Because the elections draw nearer, many consider that Erdogan could improve his use of anti-democratic measures in an try and win. Elections bear a excessive danger that’s tough to quantify, as Erdogan is more likely to do no matter it takes to emerge victorious in my view.

Conclusion

To conclude, Erdogan’s unorthodox financial coverage has efficiently decreased home demand for FX and in the end created a virtuous cycle for the inventory market. Nonetheless, the bull rally could have dire penalties for brand spanking new traders as it’s seemingly not backed by institutional traders however by inexperienced retail investor hype. Whereas I consider the present rally is poised to proceed within the brief time period because of elevated wages, traders ought to concentrate on the unparalleled danger posed by the upcoming elections. Moreover, inexperienced retail traders who’re the spine of the rally could flee the markets when confronted with the slightest headwinds. Traders ought to contemplate these components when making funding selections.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.