ssucsy

Since mid of November the rally within the gold market has develop into increasingly more tenacious and whipsawing. And over the previous couple of weeks gold has been buying and selling sideways. Truly, we witnessed solely barely new highs and 4 sharp pullbacks. General, our assumption that gold would oscillate across the 200MA for some time has performed out. However for the way lengthy will this uneven and overlapping advance proceed?

Assessment

Ranging from the triple backside round 1,615 USD, gold (XAUUSD:CUR), the SPDR Gold Belief ETF (GLD), the iShares Gold Belief ETF (IAU) and the Sprott Bodily Gold Belief (PHYS) staged a powerful restoration over the past eight weeks. To this point, this “bounce” culminated in a 5-month excessive round 1,833 USD on December twenty seventh. Initially, this rally seemed like a pointy and “quick squeeze-like rally”. Since a primary interim excessive round 1,786 USD on November fifteenth, nevertheless, the continued rise has been more and more sluggish and erratic.

Finally, gold bulls and gold bears have been combating since December 1st in a wild back-and-forth across the nonetheless falling 200-day transferring common line (1,782 USD). This resulted in a sideways buying and selling vary, primarily between 1,770 USD and 1,820 USD for December. As costs are at the moment buying and selling round 1,805 USD, a transparent resolution has not but been made. Nevertheless, the renewed rally to nearly 1,833 yesterday (Tuesday) appears as if the bulls usually are not but prepared to make room for a wholesome pullback. But, the sharp reversal thereafter is a warning signal.

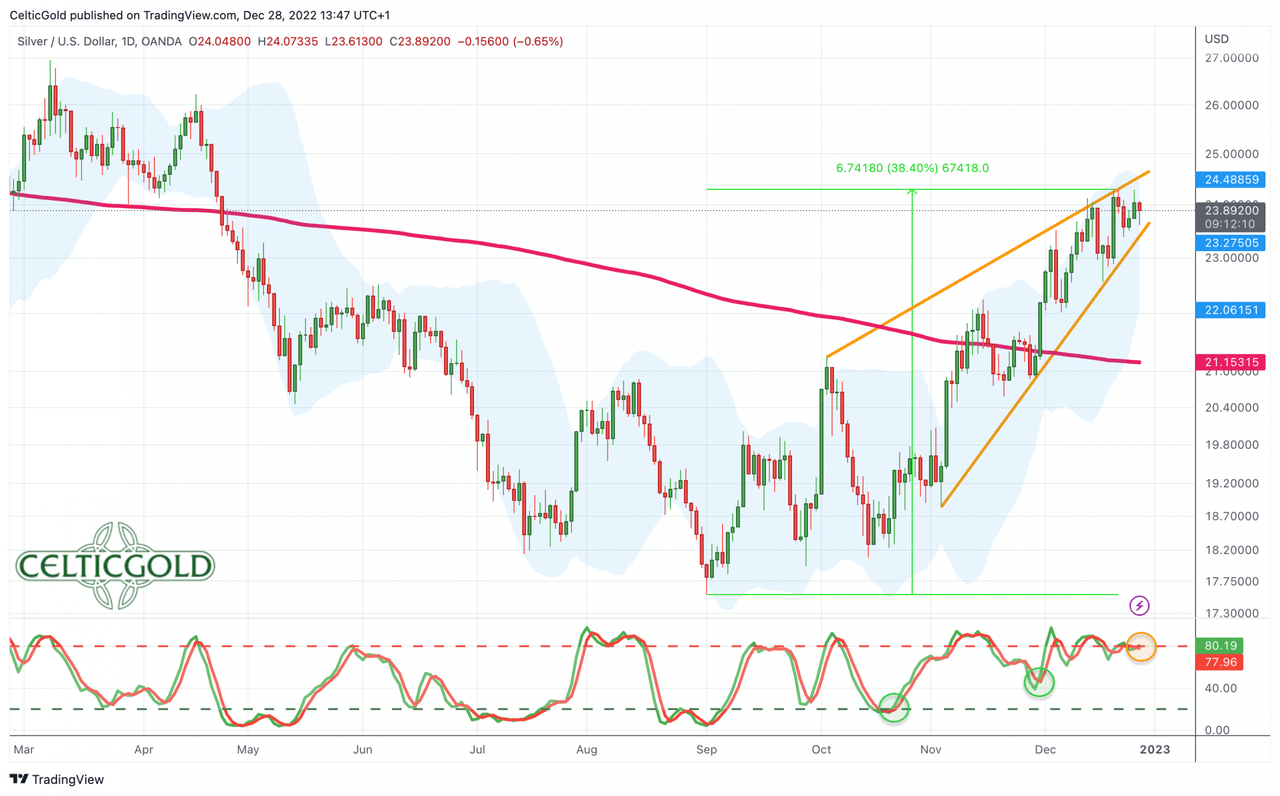

Since September 1st, Silver recovered by 38%!

Silver in US-Greenback, every day chart as of December twenty eighth, 2022. (TradingView)

In distinction, silver (XAGUSD:CUR) as effectively iShares Silver Belief ETF (SLV), and the Sprott Bodily Silver Belief (PSLV) introduced themselves extraordinarily robust over the identical interval. General, silver managed to recuperate by over 38% since its low at 17.56 USD on September 1st. With a present double prime round 24.30 USD, silver bulls have recaptured the 200-day transferring common line (USD 21.12) since 4 weeks already. Nevertheless, the warning alerts on the every day chart at the moment are growing and a pullback to the falling 200-day transferring common line should be anticipated quickly.

Your entire restoration within the valuable metals sector is carried by the correction within the US-Greenback. The US-Greenback had nearly continuous been rising from the start of the yr till the top of September. The euro, for instance, misplaced from over 16% down from 1.136 USD to 0.953 USD towards the dollar. Nevertheless, within the final three months, the strongly overbought state of affairs brought on an enormous restoration rally within the euro and a major correction within the US-Greenback.

Shortly earlier than the flip of the yr, the query stays whether or not the rallies in valuable metals and within the inventory markets merely characterize a countermovement or whether or not an essential and long-term turning level could have been reached in all market sectors throughout this fall.

Chart Evaluation Gold in US {Dollars}

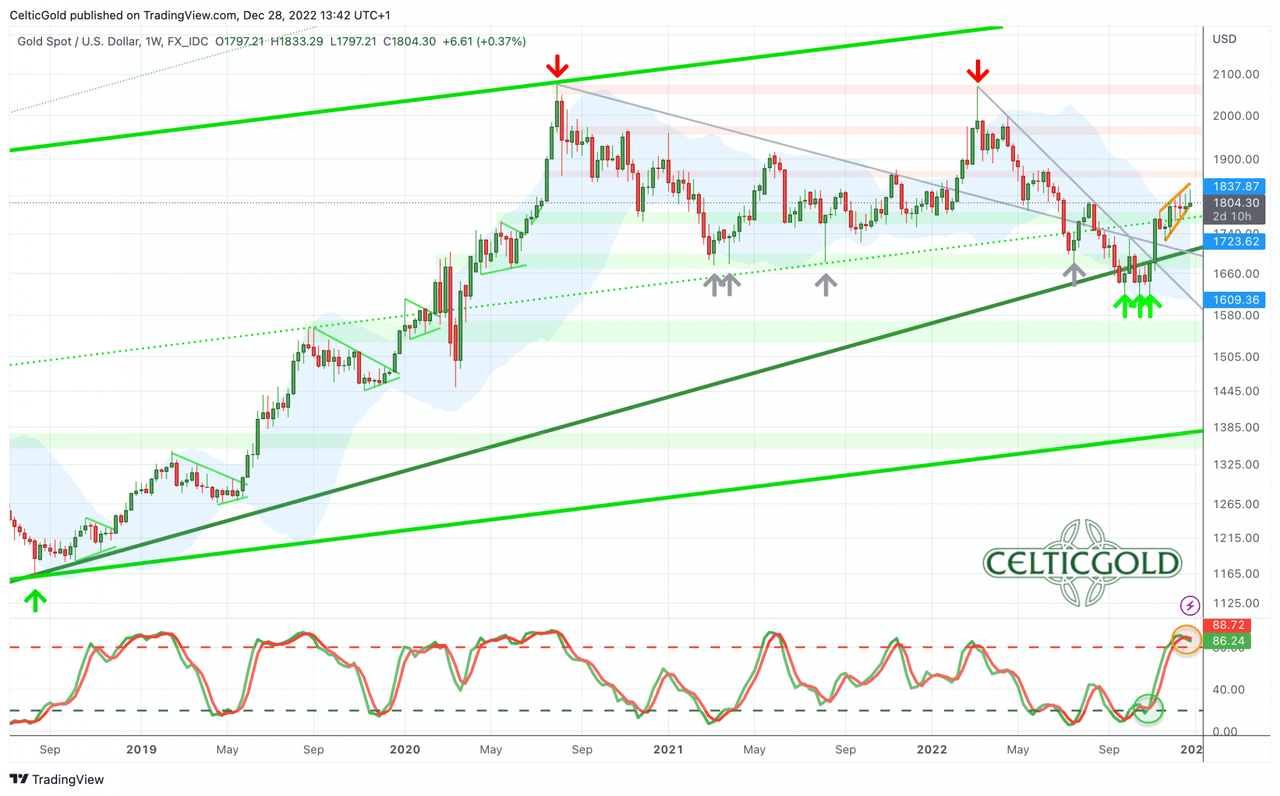

Weekly chart: Costs working right into a bearish wedge

Gold in US-Greenback, weekly chart as of December twenty eighth, 2022. (TradingView)

After the continued eight-week restoration rally within the gold market, the set-up on the weekly chart has improved, in fact. However, the correction that has been underway since August 2020 can not but be declared over. For this, a brand new all-time excessive with costs above 2,075 USD can be wanted as the final word affirmation. Till then, about 275 USD or round 15% are at the moment lacking.

In any case, the triple backside since early November offered a major restoration. Nevertheless, this rally has more and more stalled because the starting of December and is shedding its momentum. Therefore, we nonetheless have to assume that this rally might merely be a counter-trend motion. If, then again, the triple backside was certainly the top of the correction that has lasted for greater than two years, then gold ought to already be on its means in the direction of the two,000 USD mark.

The following pullback will carry extra readability

In seek for extra readability, the subsequent pullback within the gold market ought to present essential info. If gold can maintain round 1,730 to 1,750 USD or on the newest round 1,680 USD, the top of the two-year correction stays the popular state of affairs. If, then again, gold costs would fall under 1,680 USD once more, the correction will drag on and will even ship new lows round and under 1,600 USD within the medium time period.

Trying ahead in the direction of the subsequent few weeks, the overbought stochastic and the rising bearish wedge are warning alerts and advise warning. In precept, a pullback can be wholesome and even fascinating. Solely on this means gold might recharge and regain power for additional will increase. In probably the most optimistic case, gold might then moderately rapidly knock on the resistance round 2,000 USD by the spring. Extra life like, nevertheless, can be a deep pullback, which ought to occur quickly and would clearly postpone a rally in the direction of 2,000 USD.

General, the weekly chart continues to be bullish, however the warning alerts are growing. The moderately overheating state of affairs would solely ease with a pullback in the direction of round 1,750 USD.

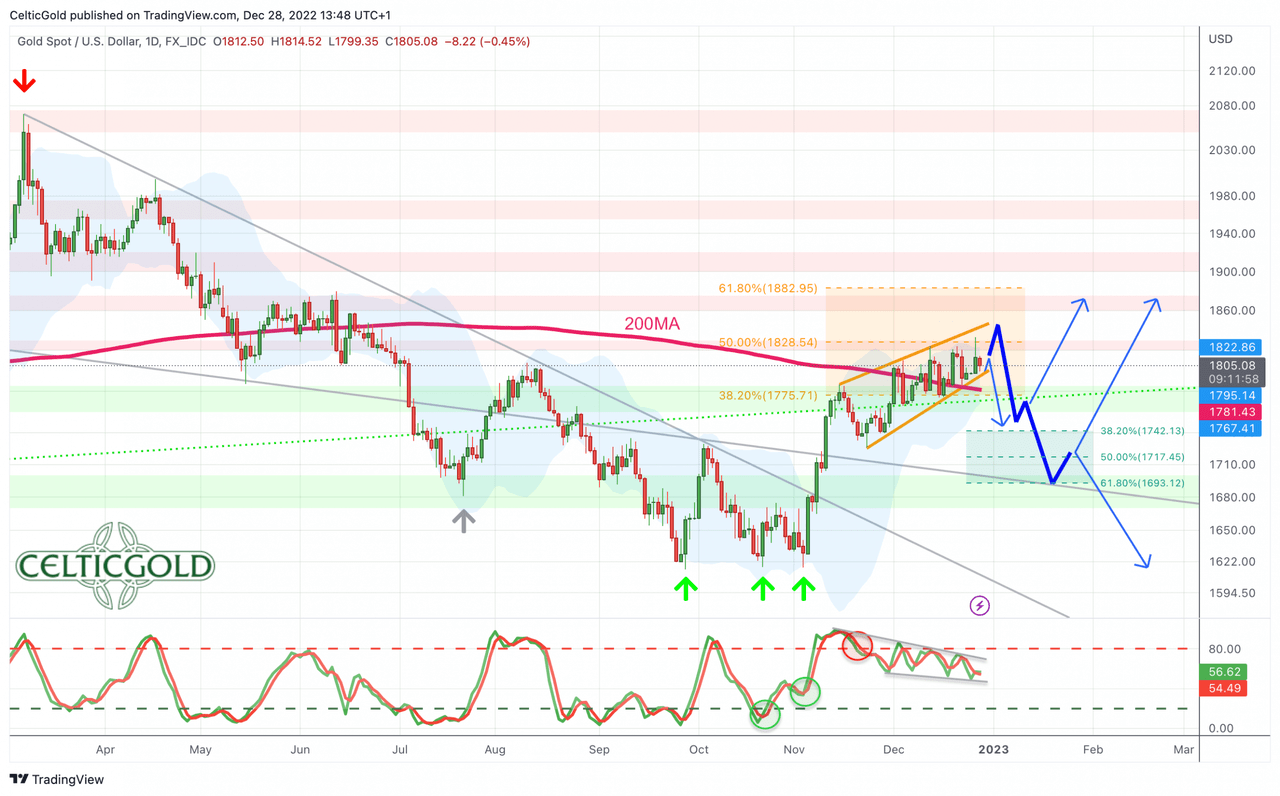

Day by day chart: Struggle across the 200-day transferring common not but determined

Gold in US-Greenback, every day chart as of December twenty eighth, 2022. (TradingView)

On its every day chart, gold has been oscillating round its falling 200-day transferring common (1,782 USD) because the starting of December. Though the bulls had been largely capable of maintain costs above this much-observed and traditional common, a choice has not but been made. On the similar time, the stochastic oscillator is whipsawing under its overbought zone, indicating that there isn’t a readability in momentum. Moreover, the higher Bollinger Band (1,824 USD) presents solely little room on the upside.

All in all, the chance/reward-ratio is now moderately unfavorable for the bulls. Based mostly on the growing tenacity of the restoration rally (low at 1,616 USD and excessive 1,833 USD), a wholesome correction ought to be anticipated quickly. A possible goal can be the 38.2% retracement at 1,747 USD at the very least. However solely under 1,680 USD would the bears be again in cost.

Commitments of Merchants for Gold – Impartial

Commitments of Merchants (COT) for Gold as of December twentieth, 2022. (Sentimentrader)

In line with the latest CoT report, the web quick place of economic market contributors on December thirteenth was 138,529 cumulated quick contracts. Thus, the state of affairs within the futures market has deteriorated barely. Solely under 100,000 quick contracts, one can communicate of a sustainable bullish CoT report.

In abstract, the CoT report is impartial.

Sentiment for Gold – Impartial

Sentiment Optix for Gold as of December twentieth, 2022. (Sentimentrader)

Because of the robust restoration over the past two months, the temper within the gold market has improved considerably. In a long-term comparability although, sentiment continues to be at moderately pessimistic ranges. But, a contrarian alternative is at the moment now not current. However, it is very important recall that gold was capable of rise by greater than 900 USD, or about 80%, inside two years from a equally bombed-out sentiment again in August 2018.

General, sentiment is impartial.

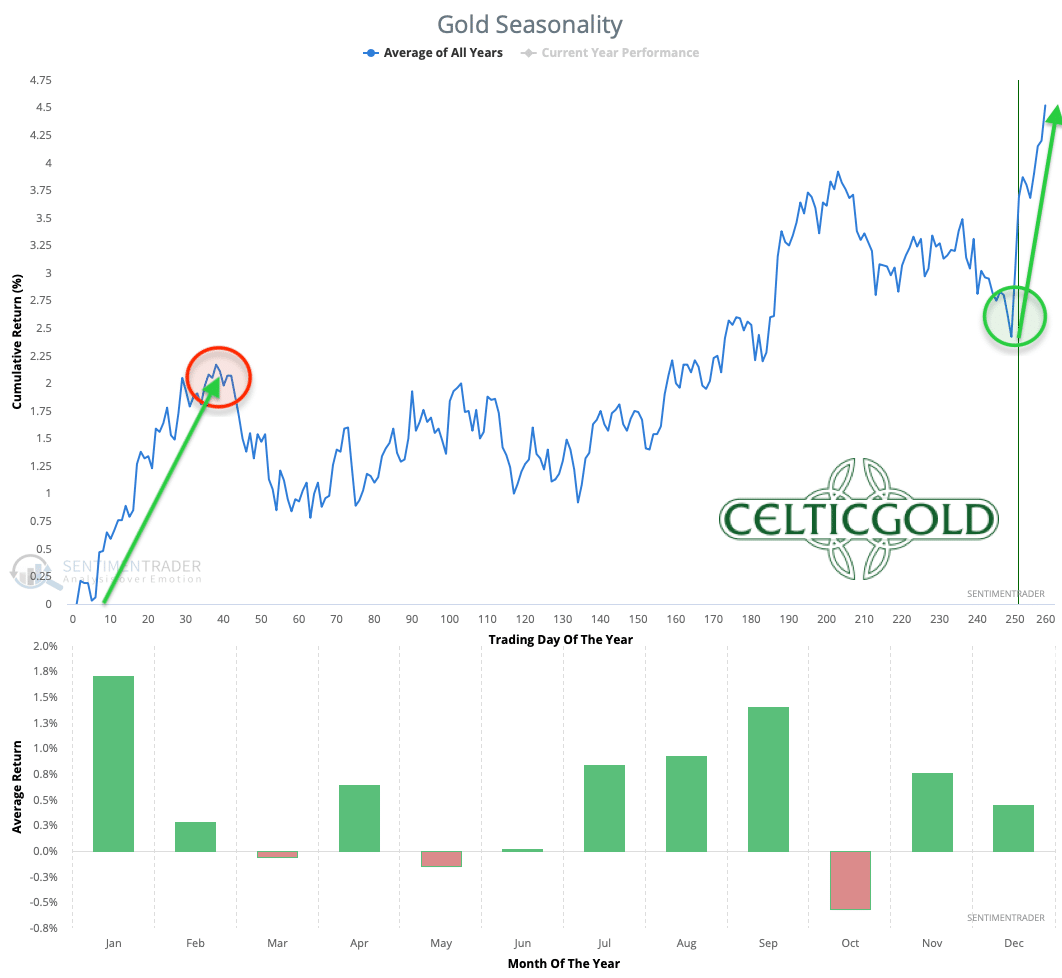

Seasonality for Gold – Bullish till the top of February

Seasonality for Gold over the past 54-years as of December twentieth, 2022. (Sentimentrader)

From the seasonal perspective, a particularly promising part for the gold worth started in mid-December. Prior to now, this era often delivered vital will increase into late February.

Seasonality for the gold and silver is subsequently clearly bullish till the top of February.

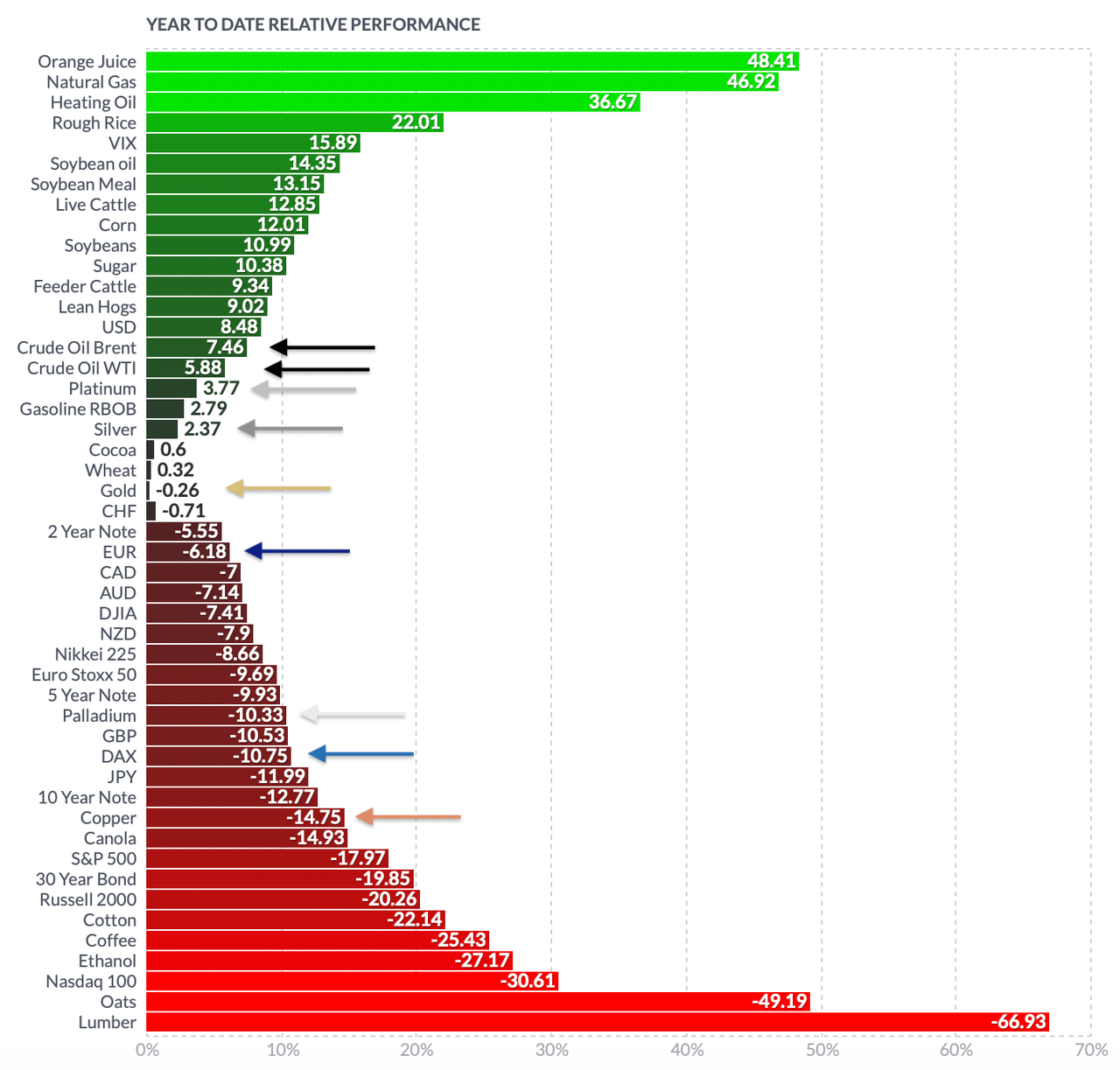

Macro replace – A particularly troublesome yr attracts to an in depth

Yr-to-date relative efficiency as of December twenty second, 2022. (finviz)

A particularly troublesome and difficult yr 2022 is drawing to an ending. The Russia-Ukraine conflict, excessive vitality costs and excessive inflation charges, the aftermath of the Corona disaster and the turmoil in China brought on lots of stress in monetary markets. The tip of the forty-year low rate of interest surroundings was felt above all within the bond markets, which noticed a brutal sell-off. Rates of interest for 10-year US authorities bonds shot up from 1.5% to 4.33% and are at the moment 3.82%, greater than doubling because the starting of the yr.

Inventory market returns had been additionally disastrous in some circumstances. Meta (Fb) misplaced -64% since January 1st, Amazon -48% and Apple -24%. Bitcoin is buying and selling -58% decrease. The true financial system, then again, is slowly however absolutely feeling the consequences of those poor developments with a major delay. There may be nonetheless loads to meet up with within the coming yr (e.g. “mass layoffs”). The recession is already right here, however the mainstream’s embellished figures are nonetheless masking the reality. There may be at the moment no signal of a sustained change within the restrictive financial coverage! Neither within the USA nor within the eurozone. Slightly, rates of interest at the moment are additionally rising in Japan, which implies that the general liquidity obtainable within the world monetary system will proceed to say no.

Valuable metals held up moderately effectively

However, valuable metallic costs have been capable of maintain up fairly effectively inside this troublesome surroundings. Though the course of the yr introduced a excessive at 2,070 USD and a low at 1,615 USD, finally gold costs are at the moment buying and selling near the beginning of the yr (1,828 USD). Silver and platinum are even forward, with a small plus. However, copper, which is delicate to the financial system, recorded a lack of 14.75% for the yr.

General, the low valuations in lots of sectors are definitely a chance within the medium to long run. However, we proceed to see main dangers in the interim within the coming months. A right away return to the booming years is utopian. As a substitute, scorching air continues to flee from the largest bubble of all time. How lengthy the U.S. Federal Reserve will be capable to proceed its aggressive financial coverage is anybody’s guess. We nonetheless suspect that there will likely be a pointy reversal in U.S. financial coverage in the midst of subsequent yr (2023), as they may then be pressured to restrict the harm to the collapsing financial system. Nevertheless, the robust restoration since mid-October has in all probability pushed again the pivot in financial coverage barely. Thus, our “risk-off” stance stays in precept.

Conclusion: Gold – Struggle across the 200-day transferring common not but determined

To sum up, the latest restoration in all markets has introduced the yr to a midway conciliatory shut. But, the underlying issues haven’t been solved. Given the often skinny buying and selling quantity throughout the holidays, not a lot is more likely to occur between now and the primary few days of the brand new yr 2023. Nevertheless, the trendsetting first two weeks of the brand new yr ought to be thrilling and essential once more.

We suspect that the air is getting thinner within the gold market and {that a} pullback is pending within the short-term. Solely a stable every day closing worth above 1,830 USD would possible unlock additional upside potential in the direction of 1,850 USD and perhaps 1,900 USD. Given the constructive seasonality and the moderately doubting sentiment (“wall of fear”), gold might definitely proceed its grind greater into January and February. Nevertheless, it appears essential {that a} medium-term directional resolution will solely be doable by way of decrease costs and a revisit of the world round 1,750 USD.

Whatever the short- to medium-term outlook, although, we’re optimistic not just for the second half of the approaching yr however for the subsequent two to 3 years. As soon as the everyday 8-year low within the gold market is clearly established, a powerful uptrend with new all-time highs ought to observe.