There could also be no recession in 2023, only a interval of slower progress

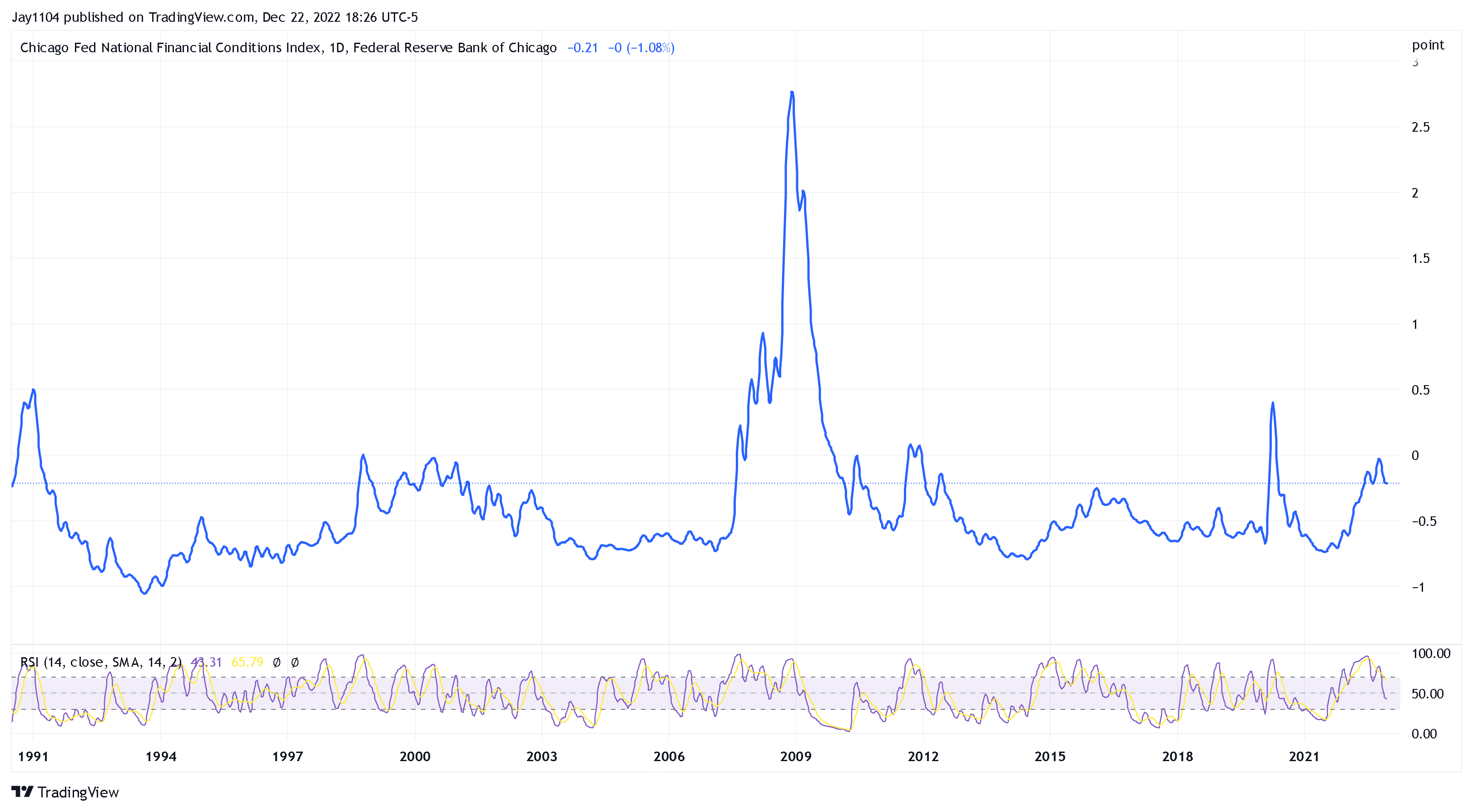

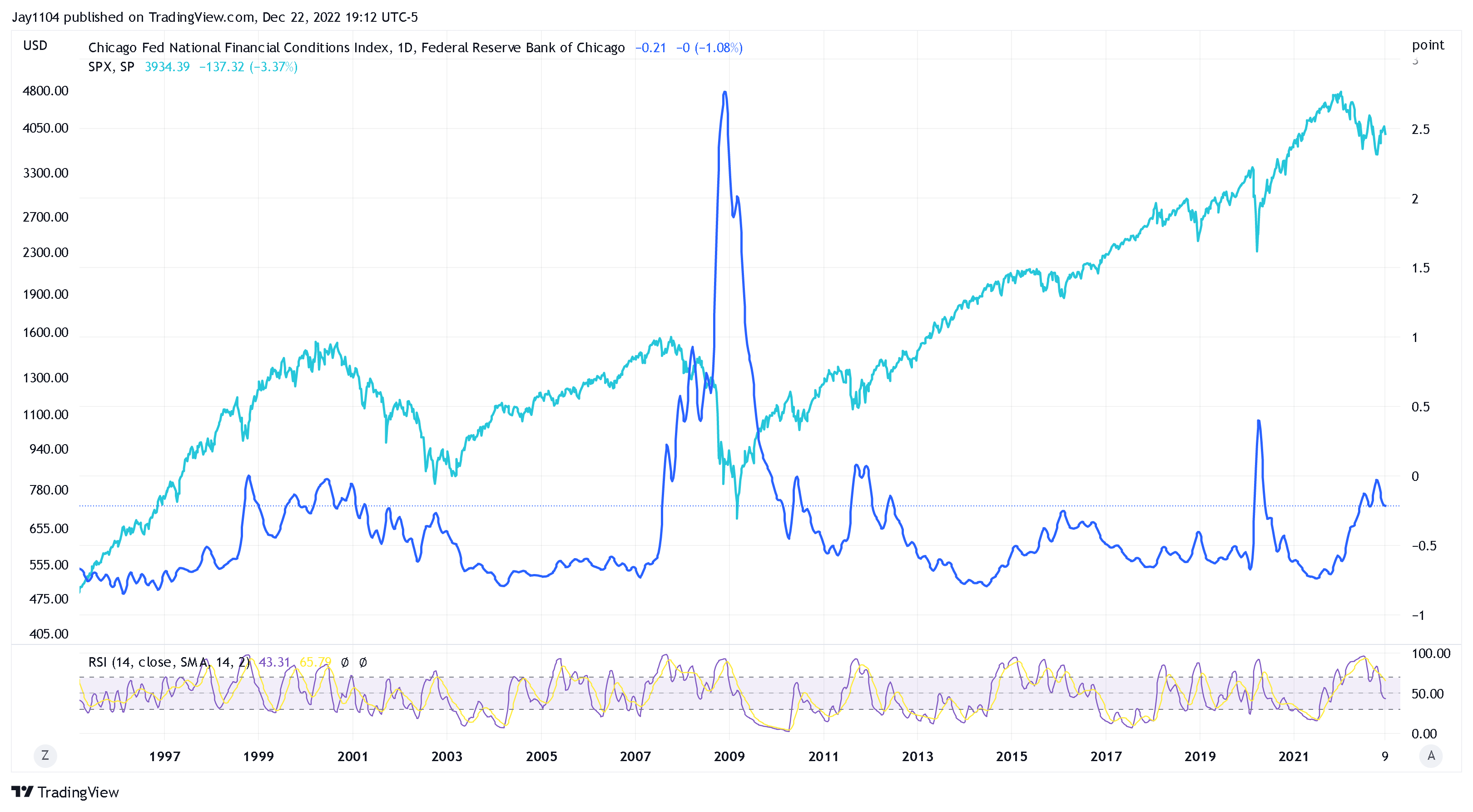

It can permit the Fed to maintain monetary circumstances tight.

Tight monetary circumstances imply a stronger greenback, increased charges, and stagnant shares

The theme heading into the tip of 2022 is concentrated on expectations for a recession in 2023. Whereas that could be the case, it’s onerous to seek out any goal proof of that occuring, regardless of a couple of information factors right here and there. was revised sharply increased just lately, and the Atlanta Fed GDPNow suggests fourth quarter progress is more likely to be stable.

There could possibly be a recession in 2023, however at this level, it appears extra seemingly that we’re heading in direction of a interval of stagnation, the place progress slows materially as inflation keep sticky and above the Fed’s goal. This in all probability results in a Fed that sticks to its December FOMC abstract of financial projections, holding charges increased for longer and holding monetary circumstances tight.

For monetary circumstances to stay tight, it means the greenback stays robust, Treasury charges keep elevated, and shares battle in 2023.

It doesn’t need to imply the climbs to a brand new excessive; the chances don’t favor that now that the Financial institution of Japan has indicated a willingness to shift in direction of a extra hawkish financial coverage stance, which is able to assist strengthen the . But it surely in all probability additionally means the greenback index doesn’t come crashing down as many buyers appear to be anticipating.

Stronger Greenback

Whereas this will solely be a short-term viewpoint at present, the greenback index is attempting to backside between 103.70 and 106, and it has an RSI turning increased. This implies that the greenback may rally again towards that 110 degree within the weeks forward.

Larger Charges

Just like the greenback, the doesn’t need to make a brand new excessive for monetary circumstances to tighten; it merely must rise again to its highs and keep there. Just like the greenback, the 10-year seems to be breaking freed from a bullish reversal falling wedge sample, indicating the speed could also be heading again to its highs.

A stronger greenback and better charges will probably be essential for tightening monetary circumstances. Monetary circumstances had eased for the reason that center of October because the greenback weakened and charges fell.

Stagnant Shares

The ultimate piece of the equation would be the fairness market, and with monetary circumstances tight, we aren’t more likely to see equities rally. It doesn’t imply they need to fall, however from a monetary circumstances standpoint, they will’t rally meaningfully both. If shares rally, it can work to ease monetary circumstances; subsequently, shares are more likely to transfer decrease or keep vary sure. The opposite subject is that if monetary circumstances are tight and work as meant, they need to sluggish financial progress in 2023, which is able to seemingly damage the economic system and earnings.

That, total, will make 2023 a fancy panorama to navigate, and with the economic system in all probability drawing near the no-growth part and flirting with recession, as many predict, it might make 2023 tougher than 2022.

***

This report incorporates unbiased commentary for use for informational and academic functions solely. Michael Kramer is a member and funding adviser consultant with Mott Capital Administration. Mr. Kramer will not be affiliated with this firm and doesn’t serve on the board of any associated firm that issued this inventory. All opinions and analyses offered by Michael Kramer on this evaluation or market report are solely Michael Kramer’s views. Readers shouldn’t deal with any opinion, viewpoint, or prediction expressed by Michael Kramer as a particular solicitation or suggestion to purchase or promote a specific safety or observe a specific technique. Michael Kramer’s analyses are based mostly upon info and unbiased analysis that he considers dependable, however neither Michael Kramer nor Mott Capital Administration ensures its completeness or accuracy, and it shouldn’t be relied upon as such. Michael Kramer will not be underneath any obligation to replace or appropriate any info offered in his analyses. Mr. Kramer’s statements, steerage, and opinions are topic to vary with out discover. Previous efficiency will not be indicative of future outcomes. Previous efficiency of an index will not be a sign or assure of future outcomes. It isn’t doable to take a position instantly in an index. Publicity to an asset class represented by an index could also be out there by investable devices based mostly on that index. Neither Michael Kramer nor Mott Capital Administration ensures any particular final result or revenue. It is best to know the true threat of loss in following any technique or funding commentary offered on this evaluation. Methods or investments mentioned might fluctuate in worth or worth. Investments or methods talked about on this evaluation is probably not appropriate for you. This materials doesn’t contemplate your specific funding targets, monetary scenario, or wants and isn’t meant as a suggestion acceptable for you. You should make an unbiased determination relating to investments or methods on this evaluation. Upon request, the advisor will present a listing of all suggestions made throughout the previous twelve months. Earlier than appearing on info on this evaluation, it is best to contemplate whether or not it’s appropriate on your circumstances and strongly contemplate looking for recommendation from your individual monetary or funding adviser to find out the suitability of any funding. Michael Kramer and Mott Capital obtained compensation for this text.