Blockchain know-how and networks ipopb

Introduction

Keep in mind when inflation was principally transitory and the US Federal Reserve stored its rates of interest close to zero for a number of quarters at a stretch? What comparatively calm occasions these had been. And what superb occasions they had been for crypto and blockchain associated shares.

However now, as governments world wide have embraced aggressive price hikes, the crypto market has come crashing down. Bitcoin (BTC-USD) itself is 76% down from its all-time highs.

On this article, I share my outlook for World X’s Blockchain ETF (NASDAQ:BKCH):

BKCH ETF Composition

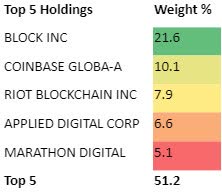

BKCH ETF High 5 Holdings (BKCH ETF Web site, Writer’s Evaluation)

BKCH’s prime 5 holdings embody Block Inc. (SQ), Coinbase World (COIN), Riot Blockchain (RIOT), Utilized Digital Corp. (APLD), and Marathon Digital (MARA). General, these prime 5 holdings make up 51.2% of the general publicity. This means some reasonably excessive focus.

This is a dialogue of among the basic drivers of BKCH:

The Bitcoin Indicator

Although the cryptocurrency and blockchain industries have many shifting components and basic drivers, Bitcoin (BTC-USD) is indisputably the one most essential issue. If Bitcoin smiles, the market bursts out laughing, and if Bitcoin frowns, agony envelopes the market.

That stated, Bitcoin presently trades at painful lows, dragging your complete market right into a crypto winter and BKCH to all-time lows.

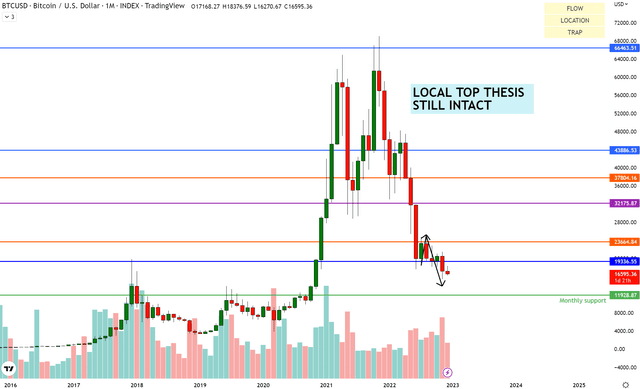

My outlook on Bitcoin has been bearish since November 2021. I’ve publicly raised warning indicators on Twitter a few native prime formation. It has up to now performed out superbly as per expectations:

BTCUSD (TradingView, Writer’s Evaluation)

I anticipate costs to proceed grinding all the way down to month-to-month assist at near $12,000.

Market Confidence within the Abyss

Aside from the high-interest price local weather bedeviling the crypto and blockchain markets, the string of unlucky blowups, layoffs, and bankruptcies seen by crypto corporations this 12 months has made a notable dent in traders’ confidence ranges. This will take a very long time to get better, which is typical for bubble pop recoveries.

Internally too, there are indicators of weak spot. For instance, Coinbase (COIN), a crypto alternate occupying the quantity two place on the BKCH portfolio with a ten.1% weight, has laid off 1,160 workers within the present crypto winter.

Different corporations similar to Core Scientific (CORZ), by which the BKCH has a 3.8% weight, not too long ago filed for Chapter 11 chapter safety, with its inventory down 98%. The post-bankruptcy vultures are in all probability watching Michael Saylor’s Marathon Digital Holdings (MARA) with eager curiosity too.

Danger-Off Temper Stays a Headwind for BKCH

The high-interest price hikes by the US Fed and different governments has triggered a basic risk-off sentiment throughout the monetary markets, inflicting traders to flip from being adventurous and optimistic to cautious and pessimistic. The crypto and blockchain markets are linked to excessive speculative actions, which is related to traders being adventurous and taking dangers. Thus, the present market temper is a direct hit on BKCH’s prospects.

The Fed’s rate of interest selections will set the tone for this risk-on or risk-off temper, which is able to impression whether or not BKCH might be swimming with or in opposition to the tide.

Now let’s take a look on the technicals of BKCH:

If that is your first time studying a Looking Alpha article utilizing technical evaluation, you could need to learn this submit, which explains how and why I learn the charts the best way I do, using the ideas of Move, Location, and Entice.

Learn of Relative Cash Move

BKCH vs. SPX500 Technical Evaluation (TradingView, Writer’s Evaluation)

The BKCH/SPX500 pair is in a literal free fall for the time being, with no assist for the pair to focus on. Whereas the indicators are overwhelmingly bearish, the instrument has but to satisfy all of my commerce setup standards. Particularly, I must see a bull entice to enter the bearish performs. There is no such thing as a proof of that but.

Learn of Absolute Cash Move

BKCH Technical Evaluation (TradingView, Writer’s Evaluation)

On the standalone BKCH ETF, it is a comparable story. BKCH floats round $12.80 and is in worth discovery mode, creating a good opening for a promote. Nonetheless, worth is just not on the very best bull entice location presently to immediate a promote place.

If I see a return to the $30.58 month-to-month resistance adopted by a false breakout to the upside, then I might be rather more to be bearish. Until then, I’ve a ‘maintain’ stance.

Abstract

General, I acknowledge that the incumbent circulate on BKCH is convincingly bearish. Nonetheless, to affix in on the sells, I must see a bull entice, and so I proceed ready for the excessive likelihood (>70% probability based mostly on my statistics) entries. In the meantime, remember that a turnaround within the crypto market interprets to an instantaneous turnaround within the BKCH ETF, given the tight correlation shared. And a turnaround within the crypto market in-turn (pardon pun) will comply with the drum-beat of central financial institution insurance policies, which make {that a} key monitorable.

Editor’s Word: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.