wildpixel

A number of weeks in the past, I wrote a bearish article on the ProShares UltraPro Brief 20+ 12 months Treasury (NYSEARCA:TTT), warning that it was time to money out winnings on probably the most worthwhile trades of 2022. On the time, recession expectations have been ratcheting greater, and long-term rates of interest have been inflecting decrease in response.

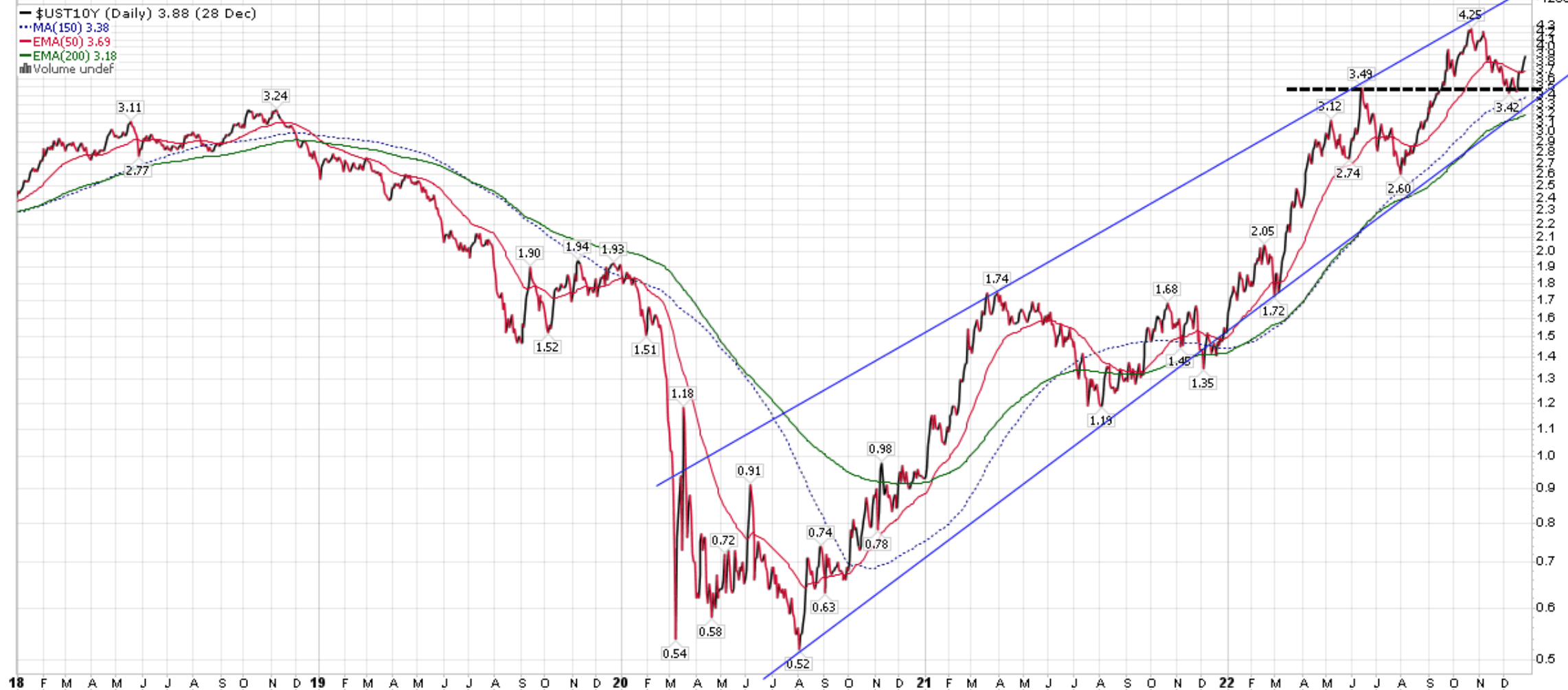

Nevertheless, my preliminary evaluation seems to have been untimely, because the U.S. 10Yr Treasury yield reversed close to necessary assist at 3.50%, and has been widening within the ultimate weeks of 2022 (Determine 1).

Determine 1 – U.S. 10Yr treasury yield bounced at 3.50% assist (Creator created with value chart from StockCharts.com)

What has been driving this newest reacceleration in rates of interest and is that this transfer greater sustainable?

Central Banks Stay Hawkish

For the reason that Nice Monetary Disaster in 2008, central banks all over the world have erred on the facet of dovishness. For instance, in 2018, whereas Chair Powell initially urged financial tightening was on autopilot, after a fast 20% selloff within the S&P 500, he rapidly modified his tune and the Fed stopped elevating rates of interest by early 2019. In actual fact, by mid-2019, the Fed had begun chopping rates of interest, serving to inventory markets rally to new all-time highs.

In distinction, at the newest FOMC assembly on December 14th, regardless of inventory markets having fallen by an identical 20% in 2022, the Federal Reserve reiterated its hawkish ‘greater for longer’ message, indicating extra rate of interest will increase have been probably in 2023.

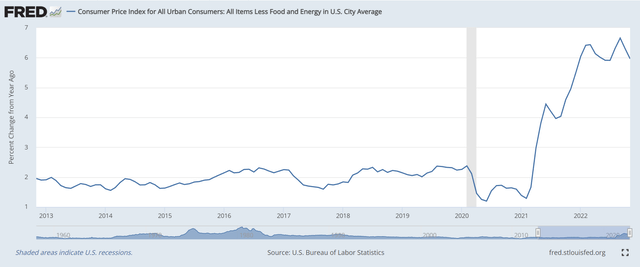

The important thing distinction between 2018 and 2022 is that in 2018, inflation was low and regular, so the Fed had room to chop rates of interest. Nevertheless, in 2022, inflation has been uncomfortably excessive, with the newest core inflation studying nonetheless at 6%, far above the Fed’s goal of two% (Determine 2). This implies the Fed should now err on the facet of hawkishness, lest inflation turns into entrenched.

Determine 2 – Core CPI inflation (St. Louis Fed)

Financial Knowledge Nonetheless Coming In Sturdy

Moreover, whereas economists have been predicting a pending recession for a lot of months, precise financial knowledge have continued to come back in stronger than anticipated. For instance, the newest U.S. GDP studying confirmed the U.S. economic system grew at a 3.2% annualized fee in Q3/2022, and preliminary unemployment claims proceed to point out power within the U.S. labour market.

Mockingly, good financial knowledge is now thought of unhealthy, because it offers the Federal Reserve cowl to stay to its ‘greater for longer’ coverage. Till knowledge exhibits that inflation is on pattern to return to 2% or the economic system begins contracting, the Fed is more likely to preserve its restrictive insurance policies.

Carry Trades Unwound On BOJ Shock

Maybe probably the most impactful short-term driver for the rise in rates of interest has been the Financial institution of Japan’s (“BOJ”) shock resolution to boost the yield restrict for 10Yr Japanese Authorities Bonds (“JGBs”) to 0.50%, from a earlier restrict of 0.25%.

This BOJ transfer appeared to have caught macro traders off-guard and sparked an unwind of tens, if not lots of of billions in ‘carry trades’. A carry commerce is the place traders borrow in a low-yielding foreign money and put money into higher-yielding belongings. Because the BOJ had been steadfast on its 0.25% yield cap on JGBs, the Japanese Yen was a favorite funding foreign money for a lot of macro merchants partaking within the ‘carry commerce’.

The BOJ shock precipitated the Yen to leap probably the most in 24 years and certain triggered cease losses for these macro merchants. As carry trades are unwound, overseas belongings like U.S. treasuries have been probably offered off, resulting in rising rates of interest.

Greater Japanese Yield Means Much less Demand For U.S. Treasuries

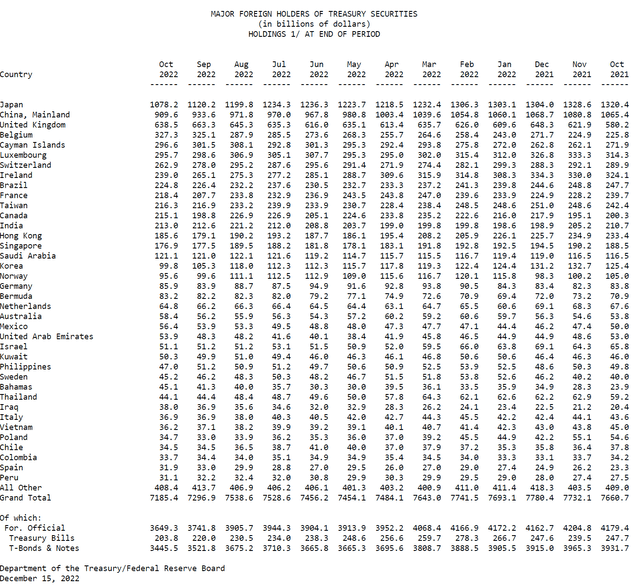

The reversal of the carry commerce could take away a key supply of demand for U.S. treasuries at a crucial time. In response to treasury knowledge, Japan is the most important overseas holder of U.S. treasuries. Whereas the influence from the BOJ shock is probably going short-term in nature, with greater home rates of interest, there shall be much less Japanese demand for U.S. treasuries going ahead (Determine 3).

Determine 3 – High overseas holders of U.S. treasury securities (treasury.gov)

Studying from Russia’s latest expertise with U.S. sanctions, China can also be unlikely so as to add to its hoard of U.S. treasuries, lest it will get frozen/confiscated attributable to a possible geopolitical confrontation between China and the U.S.

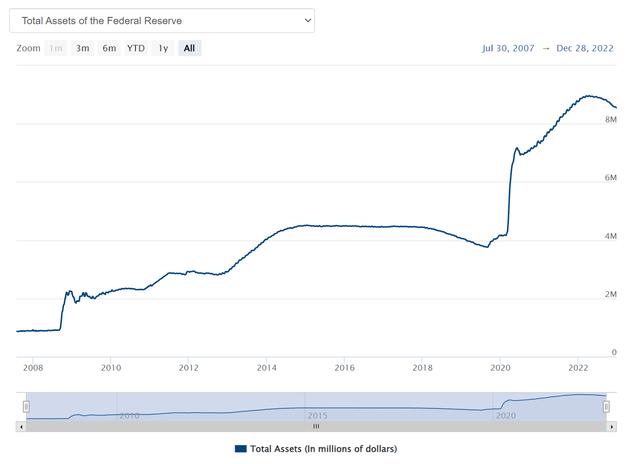

With the U.S. authorities set to run trillion-dollar deficits for the foreseeable future, it’s unclear the place the demand for treasury securities will come from, particularly because the Federal Reserve engages in Quantitative Tightening (“QT”) and permits its steadiness sheet to run-off at a tempo of $95 billion per thirty days (Determine 4).

Determine 4 – Federal Reserve steadiness sheet operating off from QT (U.S. Federal Reserve)

2022 Unlikely To Repeat; Beware Of two Manner Volatility

TTT’s efficiency in 2023 is unlikely to repeat its stellar 2022 returns. It is because in early 2022, long-term rates of interest have been coming off their lowest ranges ever attributable to extraordinary COVID-pandemic financial insurance policies. Lengthy-term rates of interest primarily moved 1-way for a lot of months, resulting in TTT’s convex returns.

Going ahead, so long as financial knowledge continues to come back in line or higher, I count on the Fed will keep on with its ‘greater for longer’ message, pressuring long-term yields greater. Nevertheless, each main financial report will even include elevated danger, because the delayed influence from the Fed’s 2022 rate of interest hikes circulate by the true economic system. Weak financial knowledge will result in selloffs in treasury yields, as traders brace for a recession.

The stress between the Fed and incoming financial knowledge will result in elevated volatility in treasury yields, performing as a headwind to inverse levered ETFs just like the TTT attributable to their every day rebalancing volatility decays (please discuss with my prior articles on levered ETFs for a extra detailed clarification of volatility decay).

As a substitute of inverse levered ETFs, I like to recommend traders hedge rising rates of interest with a fund just like the Simplify Curiosity Price Hedge ETF (PFIX). The PFIX ETF owns a portfolio of OTC swaptions that’s “functionally much like proudly owning a place in long-dated put choices on 20-year US Treasury bonds”. Nevertheless, as a substitute of every day rebalancing decays, the PFIX has a every day theta decay that ought to be small compared, attributable to its portfolio’s long-dated nature. I not too long ago wrote an article in regards to the PFIX right here.

Dangers To My Name

The rise in long-term rates of interest in latest weeks might merely be attributable to one-time occasions just like the BOJ shock. As soon as the carry commerce unwind strain subsides, long-term treasury yields could resume its decline, as traders place for a 2023 recession. This might be unfavourable for the TTT ETF.

Alternatively, if long-term rates of interest have been to maneuver greater in a straight-line sample over the approaching months prefer it did in early 2022, the TTT ought to as soon as once more ship convex returns.

Whereas it’s unclear for the time being what might be the driving force for such a transfer greater in long-term treasury yields, weirder issues have occurred up to now few years to rule out such a transfer. For instance, U.Okay. treasuries suffered a large run in September/October 2022, as traders misplaced confidence in Theresa Might’s authorities (Determine 5).

Determine 5 – U.Okay. treasuries suffered a run in mid-2022 (tradingeconomics.com)

Conclusion

In abstract, it seems my prior warning on the TTT ETF was untimely, because the Fed is sticking to its ‘greater for longer’ coverage and the economic system seems extra resilient than anticipated. Nevertheless, TTT’s returns in 2023 are unlikely to repeat its stellar 2022, as I count on elevated 2-way volatility in treasury yields.

As a substitute of inverse levered ETFs just like the TTT with every day rebalancing volatility decay, I like to recommend traders hedge rising rates of interest with the PFIX ETF, which acts like a long-term put possibility on 20-year treasury bonds.