DNY59

The Aiguille du Midi, neighboring well-liked Mont Blanc within the French Alps, is legendary for having the very best vertical ascent cable automobile on the planet, a vertigo-inducing journey that’s equal components scary and awe-inspiring (see Determine 1). The mountain is so excessive, and the incline so steep, that there’s a relaxation cease full with bar and café alongside the 9,200-foot vertical journey, virtually anticipating that some riders will inevitably be too impatient, or frightened, to proceed. Skiers who do full the journey to the highest are rewarded by over 14 miles of exhilarating slopes as they coast effortlessly (in good situations) again all the way down to the village of Chamonix, nestled within the valley beneath.

Determine 1: Aiguille du Midi Cable Automobile, Chamonix-Mont-Blanc, France

{Photograph} by Navin Saigal, February 12, 2020

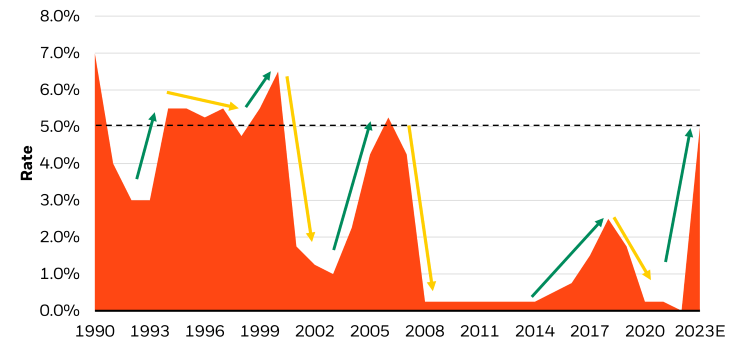

For a lot of fixed-income traders, the ascent of rates of interest in 2022 has been equally vertigo-inducing. Nonetheless, historical past means that the upper the low cost charge mountain rises, the longer the runway of optimistic returns {that a} fixed-income investor can “coast” down on the opposite aspect – it is simply very tough to determine precisely how excessive that peak (terminal charge) is, or as soon as that peak is reached, what the slope on the opposite aspect seems to be like. Certainly, the present mountaineering cycle is the steepest in 15 years, and the market is projecting its peak to rival these of the ’90s – creating plenty of vertical on the opposite aspect (see Determine 2).

Determine 2: The Fed Funds charge is predicted to peak near the place it did within the Nineteen Nineties

Federal Reserve and Bloomberg, information as of December 2, 2022

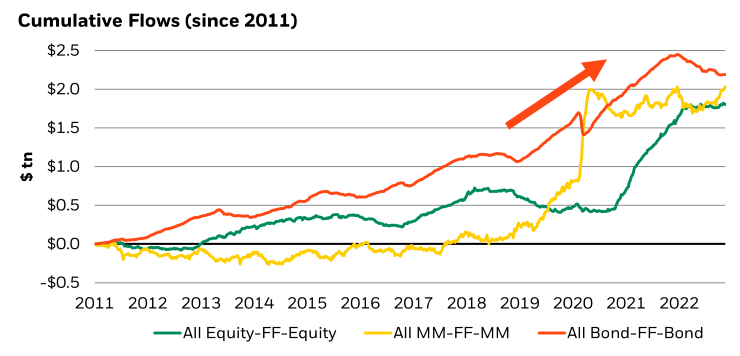

Opposite to what one would possibly count on, funding inflows are inclined to dry up at larger yields, and speed up the decrease bond yields go, the equal of a skier prematurely disembarking a chairlift, after which rushing up as they method the tip of that truncated run (see Determine 3). At occasions, this conduct could be the results of what an investor might must do moderately than what they might need to do, as we wrote extensively about in our Could 2021 Market Insights commentary, “Buyers’ Needs May be Very Totally different From Their Wants,” briefly excerpted beneath:

“Buyers usually need to “purchase low, promote excessive” – to purchase extra bonds at larger yields (decrease costs) and fewer bonds at traditionally low yield ranges. Nonetheless, what traders usually must do is to fulfill earnings necessities with the intention to match liabilities. Therefore, they’re usually compelled to purchase extra bonds at decrease yields (to lift enough {dollars} of future annual earnings), such that they find yourself being chubby when yields are at their lowest.”

Determine 3: Bond and fairness flows peaked as bond yields approached 0% and equities all-time highs

EPFR, information as of November 30, 2022

Nonetheless, there’s one other contributing issue to this phenomenon: for the reason that Nice Monetary Disaster, central banks have virtually totally decided what the terrain for monetary property ought to seem like, and consequently have cajoled traders into shopping for property when there isn’t a different (TINA), or to promote them when costs have cheapened markedly (for worry that central banks will not step in to halt stated falling costs). This additionally helps clarify the ethical hazard behind gamma playing (a time period we coined and defined in our final commentary), and why traders immediately pore over central financial institution press statements. In actual fact, some traders virtually behave like mobile biologists, peering by their microscopes, painstakingly making an attempt to decipher the distinction between “some members,” “many members,” or “most members,” because it pertains to Committee coverage charge selections. Sadly, these sorts of questions have grow to be crucial in navigating immediately’s funding panorama.

May this be altering in 2023?

As an alternative of utilizing a microscope, which is not very useful in observing a mountain, maybe traders would possibly discover a zoomed-out wide-angle lens extra helpful in navigating 2023, and past. Development and inflation are slowing globally, from liquidity-charged ranges towards one thing nearer to equilibrium, suggesting that central banks might lastly be taking a again seat, thereby permitting for the extra dramatic regional, sector, and idiosyncratic differentiation to manifest. In response to Goldman Sachs forecasts, world nominal GDP is prone to drop from 10% in 2022 to six% in 2023, with the U.S. following an analogous trajectory.

The place as soon as it could have made sense for traders to focus their energies on determining central banks’ subsequent transfer whereas utilizing passive instruments to implement funding methods oriented round these strikes, in a vacuum of central-bank-driven information move, selecting what to personal based mostly on security-by-security evaluation turns into the extra interesting strategy to differentiate return.

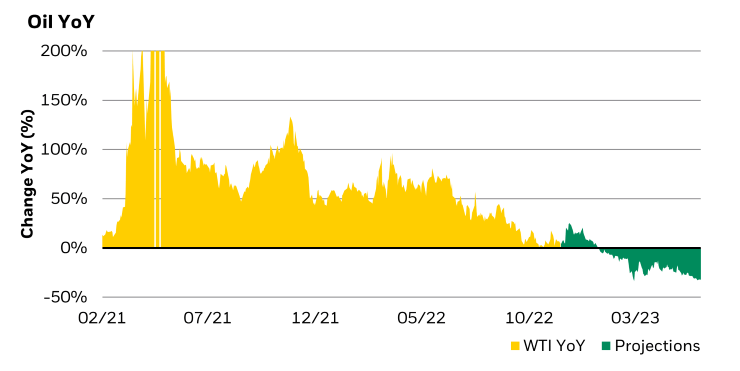

The Fed’s rate of interest and liquidity instruments are blunt devices, notably in a service-oriented economic system. As we speak, these devices are getting used to fight inflation, however there are clear indicators of inflation slowing, even past the trickle decrease in onerous inflation information over the previous couple of months. In addition to meals and used automobile costs, that are easing from battle and supply-chain-driven spikes, respectively, uncooked materials inputs (like oil) are quickly going to grow to be a deflationary impulse, weighing on each different secondary and tertiary product down the worth chain. By merely staying put at $80 a barrel, a double-digit annual oil inflation charge in 2022 turns into a double-digit deflation charge in 2023, as base results catch up (see Determine 4). Making use of the identical logic to different elements within the consumption basket ex-shelter (merely extrapolating latest worth traits) would lead to a fabric slowdown in headline inflation to between 4% and 5% by the tip of 2023, and with some modest worth depreciation, maybe even to between 2% and three%.

Determine 4: Oil is certainly one of a number of inflation tailwinds that flips right into a headwind in 2023

Bloomberg, information as of November 18, 2022

Shelter, the biggest part within the consumption basket, is exhibiting much more proof of moderating, after a torrid run. New and current residence gross sales transaction volumes have dried as much as virtually the pandemic-era lows of early 2020, confirming what main indicators of home costs, and rental charges, are suggesting: {that a} correction is in movement. Nonetheless, the scarce stock of current properties, which is close to its lowest degree in 40 years, ought to place a flooring underneath costs and forestall them from going into freefall.

Therefore, it’s believable that the economic system doesn’t must be engineered right into a housing bust-style recession to gradual inflation. In actual fact, the labor market doesn’t mean a recession is imminent. Whereas it’s slowing on the margin (most notably by quite a lot of employment PMI surveys), taking a look at onerous information like payrolls, layoffs, hires and jobless claims by a zoomed-out lens is encouraging, as all are in sturdy multi-decade positions, even when they are not on the file ranges of late-2021 and early-2022. So, what does this imply for monetary property, and the place we’re on the low cost charge mountain?

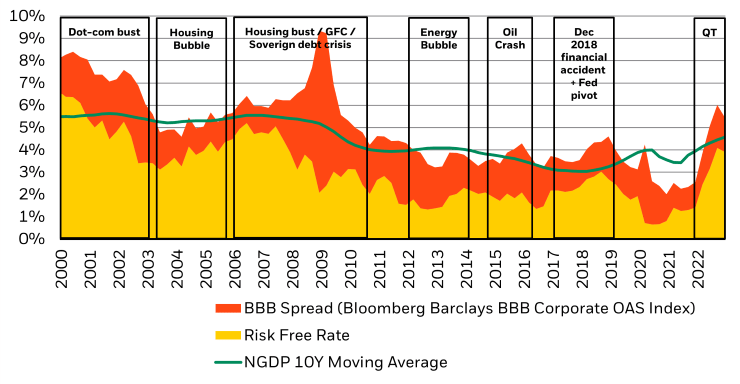

When the marginal borrowing price to dangerous debtors rises too far above the pure progress charge of the economic system it acts as a self-fulfilling brake, as borrowing prices exceed future money flows, disincentivizing new tasks (see Determine 5). The other can also be true – when borrowing prices are too low, they induce a bubble, as tasks with sub-par money flows find yourself getting funded. As we speak, the marginal dangerous borrowing charge has gone from the bottom it has been relative to long-run nominal GDP, to the very best it has been relative to long-run nominal GDP, in only a matter of 1 yr. In different phrases, it’s now a lender’s market.

Determine 5: Larger charges can act as a self-fulfilling brake to the economic system

Bloomberg, Gavekal, and BlackRock, information as of December 4, 2022

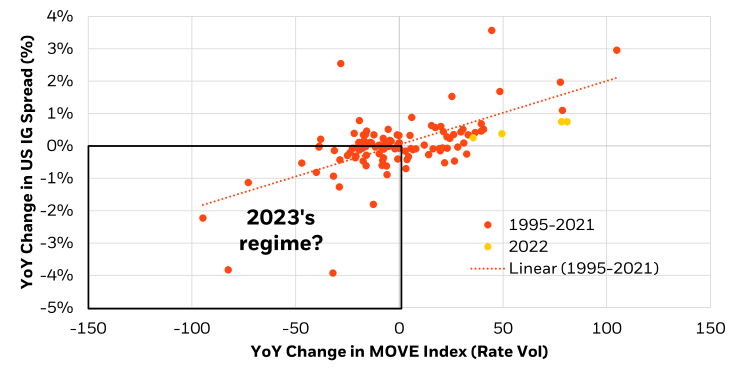

If inflation certainly moderates from right here, it’s seemingly that rate of interest volatility moderates alongside it, since it’s the uncertainty across the peak in inflation that has pushed the uncertainty across the peak in rates of interest. Central banks might not essentially decrease rates of interest, however merely holding them steady for some time would already be a dramatic departure from the sample of 2022. This leaves fastened earnings yields in a singular place – dangerous spreads have responded negatively to an increase in charge volatility, in a uncommon second when charge volatility has risen as a result of charges themselves have exploded larger (see Determine 6).

Determine 6: A fall in charge vol (MOVE Index) in 2023 might reverse 2022’s unfold widening

Bloomberg and BlackRock, information as of December 2, 2022

This may occasionally arrange a singular, “double-barreled” return setting someday sooner or later ought to charge vol normalize. Dangerous asset returns could also be boosted by each the surplus return and charge return part – and on the very least by having the ability to clip a steady (and excessive) coupon.

In lots of respects upside inflation surprises from immediately’s yield ranges, whereas leading to short-term losses, would probably ship a fair bigger alternative set for traders which are in a position and keen to zoom out and widen their “digicam aperture” to a 2-year time horizon. The Fed has certainly communicated this yr that it’s keen to tighten coverage extra. With a still-moving Fed, traders should fear about monetary situations tightening even additional. But if the Fed tightens additional, then the self-fulfilling financial brake kicks in more durable – capital expenditures gradual and debt burdens grow to be much more burdensome, resulting in much less room for fiscal stimulus, larger mortgage charges, and decrease consumption. Arguably, this will create a fair higher alternative set in fastened earnings going ahead, by establishing a fair larger peak to the low cost charge mountain, and much more, runway to coast down on the opposite aspect.

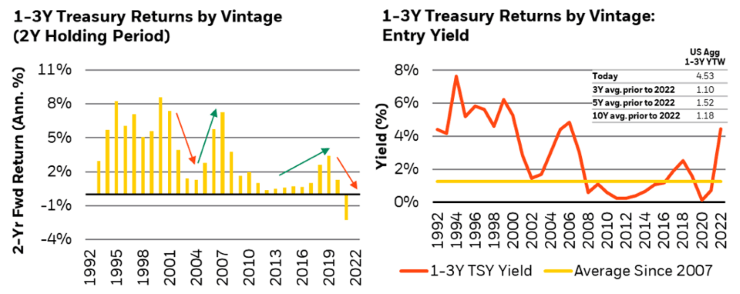

At generational inflection factors like these, it’s value taking a look at public markets by a non-public market lens, which frequently has a wider aperture (longer time horizon) which may be extra acceptable for taking over slopes at these heights, moderately than the microscope that public market traders often use to handle day by day, weekly and month-to-month occasions. What if we seemed on the entrance finish of the U.S. Treasury market by the lens of a 2-year lockup? The 2021 classic would look terrible, however immediately’s yield seems to be extraordinarily engaging for ahead 2-year returns (see Determine 7).

Determine 7: Present entry yields traditionally resulted in 5% to six% annualized returns in front-end Treasuries

Bloomberg and BlackRock, information as of December 2, 2022

Together with some rolldown, it is onerous to disregard a possible 6% return, two years in a row, in a risk-free asset. The chance price of placing money into an funding apart from the risk-free charge should certainly be a consideration for a lot of traders now, particularly whether it is decrease charge volatility that’s the predominant catalyst for returns in stated different funding. Throughout main asset courses, the yield contribution from the risk-free charge has doubled from a mean of underneath 2% from 2014 to 2022, to larger than 4% immediately.

That implies that a diversified basket of high-quality fastened earnings (resembling short-term U.S. Treasuries and Funding-Grade company bonds, or IG) can probably ship a fair larger whole return. Shifting out the curve into 10-year IG bonds, and including riskier devices, like European excessive yield, Collateralized Mortgage Obligations (CLOs), Rising Market (EM) bonds, and equities to the combo can bump up the yield of that portfolio, however not by a lot. Nonetheless, the volatility of this higher-yielding portfolio would have elevated considerably, suggesting a vastly inferior risk-adjusted return profile, in our estimation. The implications of this can’t be understated – it implies that traders, particularly pension and endowment funds, can get near their return targets for the subsequent few years with out having to take a lot period, credit score, convexity or illiquidity threat. Portfolio threat budgets can be utilized way more effectively than at any time within the final 15 years.

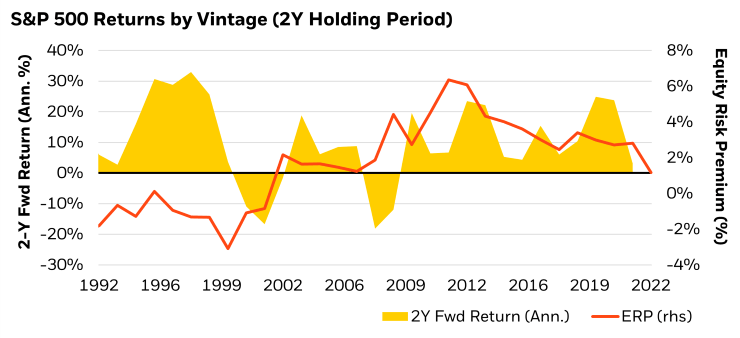

Going even additional down the capital stack, the asset allocation alternative seems to be fairly completely different. Whereas spreads in fastened earnings have widened in sympathy with heightened charge volatility, the fairness threat premium has compressed, leaving equities wanting as unattractive to fastened earnings as they’ve in additional than a decade (see Determine 8). That’s not to say that equities is not going to ship optimistic returns ought to rate of interest volatility decline (such a rising tide might certainly float all boats), however that the surplus return over U.S. Treasuries that one would possibly obtain in equities is unlikely to be well worth the threat (and potential unfavorable returns) of being mistaken.

Determine 8: An unattractive entry in fairness threat premium

Bloomberg and BlackRock, information as of November 30, 2022

Our sense is that the carry regime in fastened earnings is a lot better than in equities; and that the monetary asset regime will probably be higher in 2023 than in 2022, albeit with some aftershocks of the volatility after 2022’s earthquake. Certainly, the way forward for Japan’s yield curve management continues to be the “1,000 trillion-yen elephant within the room” that would produce one other bout of central bank-induced volatility in 2023. That alone could also be an earthquake in fastened earnings worthy of its personal spillovers and aftershocks, particularly in foreign money markets.

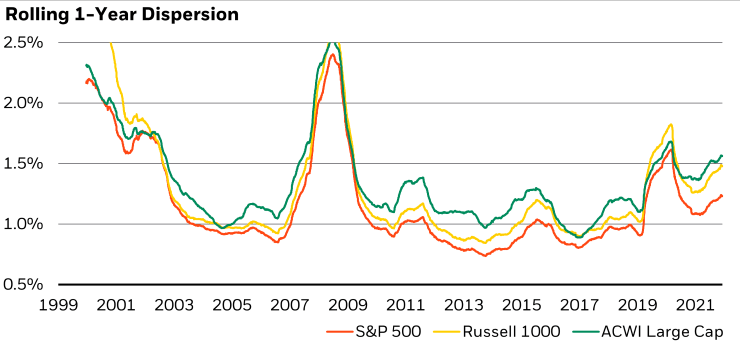

Nonetheless, actively managing asset dispersion is turning into more and more vital.

Financial coverage has created the asset-on/asset-off framework, which we now have grown accustomed to for the reason that world monetary disaster. But our sense is that coverage volatility, and consequently, charge volatility (and foreign money volatility) ought to all come down from right here. Therefore, we like proudly owning extra monetary property in 2023 than we did coming into 2022, however we’re being notably selective about which of them.

Determine 9: After a decade of slumber, dispersion is on the rise

Refinitiv Quantitative Analytics and Barra GEM3, information as of December 2, 2022

Whereas traders must zoom out and widen their apertures to accurately determine the place and when the low cost charge mountain peaks, and navigate the slopes that observe, we additionally assume it is important to concurrently slide stability sheets and earnings statements underneath our microscopes. In a world the place dispersion drives return (see Determine 9), traders who can’t handle their full suite of optical instruments threat falling down the mountain in 2023. In a separate Market Insights commentary, our “Christmas Buying Listing and 2023 Prognostications,” we determine the particular markets we like on this new world of larger dispersion.

This publish initially appeared on the iShares Market Insights.

Editor’s Word: The abstract bullets for this text have been chosen by Searching for Alpha editors.