FeelPic

Funding Thesis

Eaton Company’s (NYSE:ETN) inventory is up ~16% since my earlier bullish article. The corporate is continuous to learn from the sturdy demand within the industrial, knowledge middle, and utility finish markets. This led to a wholesome order charge and strong backlog ranges, which ought to profit the corporate’s income within the close to time period. Given the sturdy order and backlog ranges, the corporate plans to spend money on its provide chain and capability to effectively full its order e book. In the long run, ETN ought to profit from the secular traits in electrification, digitization, and vitality transition in addition to from the U.S. infrastructure act. The margins ought to profit from restructuring actions, portfolio actions, quantity development, and pricing actions, partially offset by investments in know-how and capability constructing. The inventory is at present buying and selling at 19.13x FY23 consensus EPS estimate of $8.21, which is consistent with its five-year common ahead P/E of 19.29x. I like the corporate’s good development prospects, however consider they’re getting appropriately mirrored within the inventory worth on the present valuations. Therefore, I’m transferring to a impartial ranking on the inventory.

Income Outlook

ETN is experiencing energy throughout all of its companies, particularly within the Electrical Americas, eMobility, and car segments, which is benefiting its quantity development. The corporate can be successfully managing increased enter prices by rising costs. These tailwinds are greater than offsetting the hostile FX impression.

Given the continued sturdy demand in its finish markets, the corporate reported a powerful order charge within the third quarter of 2022, which ought to assist its future revenues. Orders on a 12-month rolling foundation within the Electricals enterprise had been up 27%, leading to 75% Y/Y development within the backlog. The orders within the Electrical Americas section elevated by 36% Y/Y, and within the Electrical World section, orders elevated by 14% Y/Y, leading to a backlog improve of 97% Y/Y and 22% Y/Y, respectively. Along with the sturdy order and backlog, the undertaking pipeline within the Electrical Americas section greater than doubled as a result of strong traits in manufacturing, knowledge facilities, industrial, and utility finish markets. The orders within the utility markets had been up 60% sequentially as a result of elevated investments in vitality transition and grid resiliency.

Within the Aerospace section, the corporate noticed energy in its order charge throughout its finish markets as journey continues to speed up inside the business markets. Moreover, protection spending internationally elevated put up the Ukraine warfare. On a 12-month rolling foundation, aerospace orders elevated by 22% whereas the backlog grew by 17%. The business aftermarket orders elevated 40% YTD.

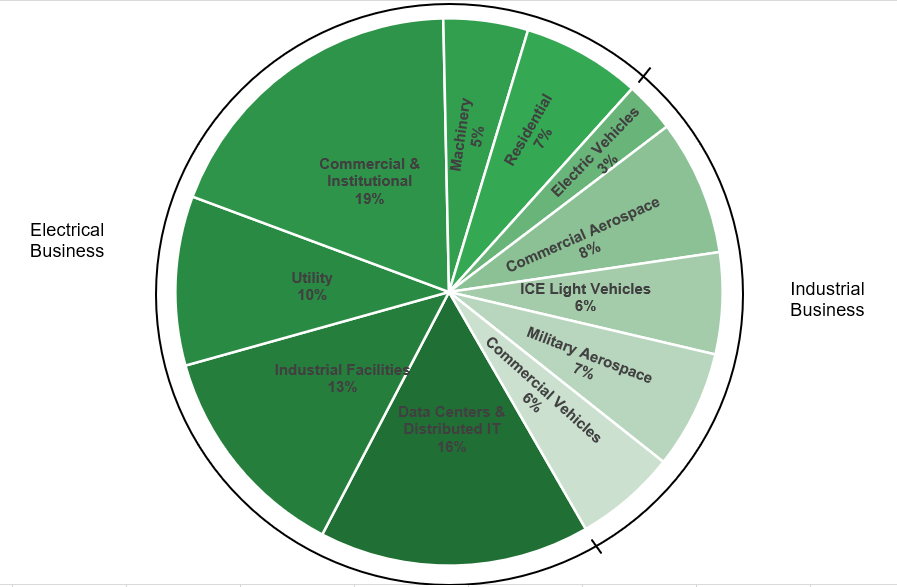

ETN’s finish markets (Firm knowledge, GS Analytics Analysis)

Wanting ahead, I consider the corporate ought to be comparatively much less impacted by the weakening macroeconomic circumstances given its sturdy order charge, secular traits in its finish markets, and wholesome backlog ranges. In its Electrical enterprise, the corporate is anticipating strong development in knowledge facilities, industrial services, and utility finish markets. Business & Institutional (C&I) in addition to equipment end-market are additionally anticipated to develop modestly as a result of sturdy orders from the federal government and establishments. The expansion in these finish markets ought to greater than offset the weak residential market.

Within the Industrial enterprise, rising authorities laws and incentives, and numerous new EV introductions ought to profit the electrical car finish market. The business aerospace and light-weight motor industries are anticipated to see a cyclical restoration. The car makers are rebuilding their stock ranges, which had been beforehand impacted by the availability chain challenges. The expansion within the aerospace aftermarket and ramp-up in business OEM manufacturing ought to drive aerospace markets increased. Roughly 85% of ETN’s finish markets are anticipated to see optimistic natural development in 2023.

Given the sturdy order charge, the corporate is continuous to spend money on capability and functionality and bettering the availability chain to finish its orders.

The corporate’s long-term development ought to profit from the three secular traits in its enterprise. This consists of electrification, vitality transition, and digitalization. The corporate booked ~$700 mn of latest wins within the final quarter that had been tied to this pattern. Inside Electrification, numerous manufacturing tasks within the U.S. have been introduced. This consists of new semiconductor services, large investments in new electrical car manufacturing crops, new EV battery investments, and investments in EV charging infrastructure. Within the vitality transition enterprise, the shift from fossil to renewable vitality is accelerating, and each addition of a renewable useful resource requires electrical infrastructure. It requires investments in know-how to maintain the grid steady and investments in batteries to retailer extra vitality. ETN is properly positioned with its merchandise to serve this market. Moreover, with the acute climate circumstances and elevated demand for vitality independence, the corporate is seeing investments in grid resiliency enchancment. One other secular pattern is digitalization, which ought to assist drive increased promoting costs as the corporate provides know-how to its legacy merchandise and introduces new software program platforms. Aside from these secular traits, the corporate also needs to profit from the tasks associated to the U.S. infrastructure act. This could assist speed up development over the subsequent three to 4 years.

I consider the corporate’s income ought to enhance within the close to time period given the wholesome backlog ranges and powerful order charge. In the long run, the secular traits in the long run markets ought to assist drive income development.

Margin Outlook

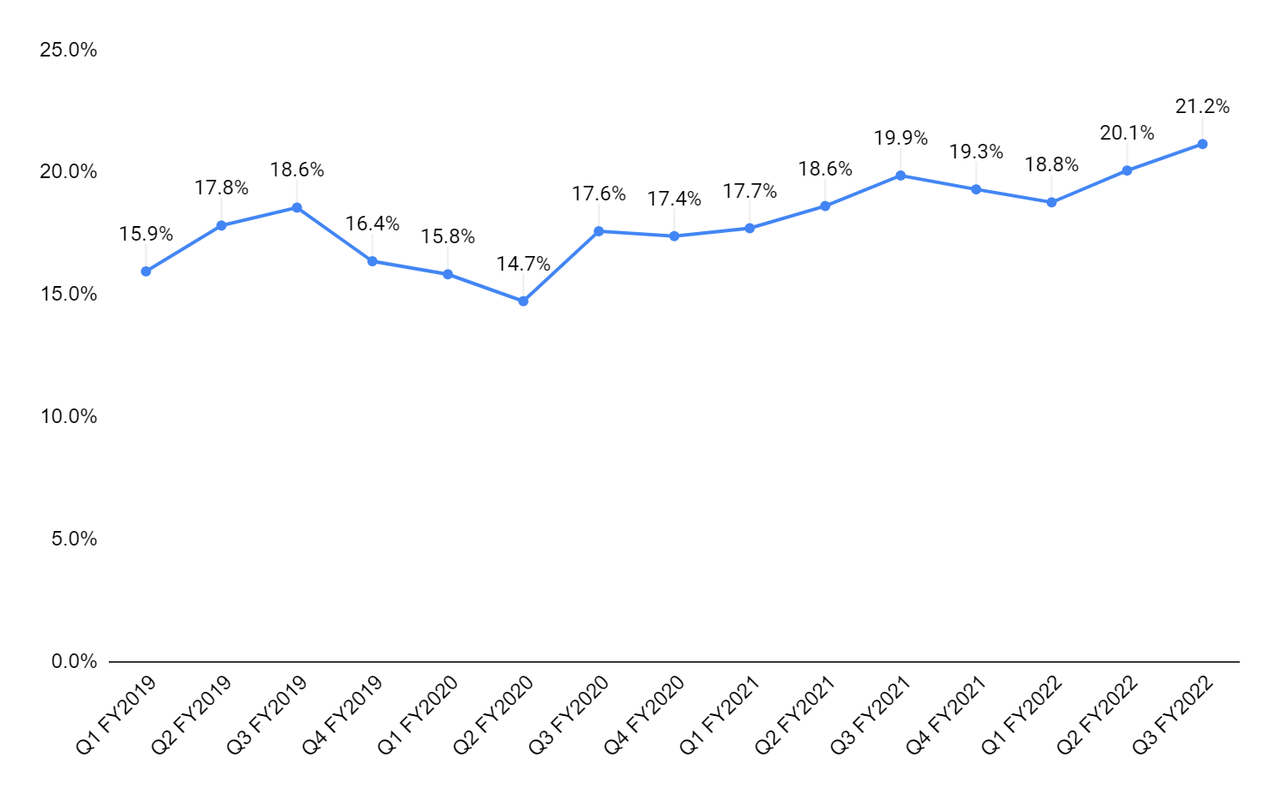

The corporate’s section working margin has been on an upward pattern for the previous few quarters. This enchancment is pushed by pricing actions, quantity development, portfolio adjustments, and restructuring financial savings. The corporate has been taking restructuring actions by rightsizing its enterprise and eliminating fastened prices. The corporate has additionally been making adjustments to its enterprise portfolio by means of acquisitions and divestitures. The transformation of its portfolio has resulted in improved enterprise high quality with increased margins. The corporate acquired Tripp Lite (March 2021), Mission Techniques (June 2021), and Royal Energy Options (January 2022), and divested its Hydraulics enterprise in August 2021.

ETN’s section working margin (Firm knowledge, GS Analytics Analysis)

Wanting ahead, I consider the corporate’s restructuring actions ought to proceed to learn the margins. Moreover, the amount development, together with the pricing actions, ought to assist drive margin enchancment in 2023. The corporate is seeing a discount in commodity prices reminiscent of metal, copper, and aluminum in addition to freight prices. This could profit the gross margins within the coming quarters. Whereas these positives ought to be partially offset by the corporate’s future investments in know-how and capability constructing, I count on the margins to enhance in 2023 and past.

Valuation & Conclusion

The inventory is at present buying and selling at 19.13x FY23 consensus EPS estimate of $8.21, which is consistent with its five-year common ahead P/E of 19.29x. The corporate’s income within the close to time period ought to profit from a strong finish market, wholesome order charges, and powerful backlog ranges. Secular traits reminiscent of electrification, vitality transition, and digitalization ought to profit the corporate in the long run. The margins ought to profit from restructuring actions, portfolio actions, quantity development, and pricing actions, partially offset by investments in know-how and capability constructing. Whereas I like the corporate’s development prospects, I consider they’re already mirrored within the inventory worth on the present valuation. Therefore, I’ve a impartial ranking on the inventory.