gchapel/iStock Editorial through Getty Photos

Lithium The Subsequent Huge Factor

On this sport that’s the markets, it has been my expertise that you simply solely see sea change alternatives about as soon as a decade or so. Granted, since 2008 the markets have not likely operated accurately for my part, however in a typical market, business game-changing alternatives are uncommon.

Those that come to thoughts throughout my investing voyage are shopping for Atari at $1 and 1/16 when the Tremendous Nintendo / Sega Genesis (and dare I say it Turbo Graphics) dominated. I made fairly a sum when Atari launched the (arguably) 64-bit Jaguar console with the assistance of IBM (IBM).

The graphics card revolution of the mid 1990’s was the subsequent large sport changer. I used to be launched to {hardware} acceleration through the sport ‘Half-Life’ for the primary time at my cousin’s home. The sheen on that .357 revolver in sport: thoughts blowing. I noticed the longer term and wager arduous on Nvidia (NVDA). For sure, I did effectively.

Within the early 2010’s or so, AMD (AMD) imploded, going all the best way all the way down to the excessive $1’s by 2015 after its ill-fated ‘bulldozer’ CPU. Given the patents, Jim Keller designing a brand new CPU; the brand new however strong Lisa Su as CEO; I suspected if a person purchased and held it could be profitable with just a few years’ time. I wrote on this fairly obsessively at Looking for Alpha.

Now this isn’t to say I didn’t have disasters, however I had entered the sport pre-internet when all I had was a newspaper for my quotes and information. You possibly can not ask somebody how X labored. Perhaps books existed on investing, however on the time I by no means noticed one. It was trial & error by fireplace.

All that apart, now I am trying on the subsequent large factor. It will likely be a feast or a famine and in case you have learn my writings, you realize the place I am going… geopolitics, electrical automobiles, and lithium.

Comply with The Lithium Cash

I’ve heard the nay-sayers preach the anti-gospel regarding EV: They don’t work effectively within the chilly; vary is restricted; too costly; they nonetheless pollute. I say, “Responsible as charged” and albeit it doesn’t matter. Very similar to any expertise, EV will evolve and overcome the chilly climate points. Perhaps you utilize a heater like one does with a diesel engine. Vary will enhance because the expertise improves as effectively (power density). Costs will come down as innovation reduces prices. This may open up value factors that can permit the plenty to then afford EV’s. EV’s will enhance. Presently the factor to think about is which chess items are being set into place? The place is the large cash shifting? What are the politicians banking on? Are the battery makers and automotive producers investing billions into EV? In the event that they weren’t, then I might forecast that EV won’t be prepared for prime time. Nevertheless, what if we see that the battery makers ARE investing? What if the automotive producers ARE spending billions to construct the infrastructure wanted? What if the politicians ARE realizing that China dominating lithium refining won’t be an excellent long-term factor and thus applicable steps are being taken?

Let’s poke round just a bit bit and see if any actual cash is flowing into lithium tasks, be it battery corporations, carmakers, or politicians’ actions.

Lithium Eco System Shift

Power prices in Europe impression future EV tasks in Europe. In the meantime, North American governments are supporting the EV business. It is a good storm for North American EV performs, as we would count on extra consideration from corporations to maneuver future tasks to North America. Europe has realized this and has sounded the alarm that if they don’t match the Inflation Discount Act with a European act, corporations can and can find tasks to North America as an alternative of Europe. Volkswagen has voiced these issues.

Europe Power Disaster

Volkswagen Passenger Automobiles CEO Thomas Schaefer put out some somewhat grim information for future EV manufacturing in Europe, however that is nice information for the USA in the case of tasks finding to the U.S. somewhat than Europe. Per LinkedIn through ZeroHedge:

“Except we handle to cut back power costs in Germany and Europe rapidly and reliably, investments in energy-intensive manufacturing or new battery cell factories in Germany and the EU shall be virtually unviable,”

and

“The worth creation on this space will happen elsewhere.”

How unhealthy is the power disaster in Europe? Switzerland is pondering limiting EV use to preserve energy, which brings us again to the place we would see EV tasks positioned to extra favorable shores.

Favorable Shores for EV and Lithium

Canada just isn’t idly sitting by. They’re on the forefront of pushing EV through a really supportive and aggressive authorities push.

One may ponder the place capital flows for future EV expansions and probably the most seemingly targets is Canada and the USA. Add authorities help through varied payments to the combination and you’ve got a really favorable surroundings for something EV associated, be it near-term cobalt refiner Electra Battery Supplies (ELBM) or near-term lithium miner Lithium Americas (NYSE:LAC).

Clearly, if the speed of EV associated business shifts to North America it will bode effectively for lithium / cobalt demand and we are able to already monitor the shift taking place through the assorted tasks finding in North America:

Tesla to construct a Gigafactory in Mexico.

$4.9 billion in EV upgrades for Ontario per Stellantis & LG Power Resolution.

$3.5 billion through Redwood Supplies for a SC plant.

$2.36 billion in a Michigan battery element plant through Goition.

$1.6 billion per the Canadian gov.

$1.5 billion for Ottawa and Ontario per Umicore.

$1.4+ billion over 5 years for Ontario per Honda.

$1 billion CDN per Basic Motors.

$400 million for a GM / Poscho CAM plant in Canada.

$180 million through Albemarle (ALB) for a NC lithium analysis facility.

Ford (F) and CATL pondering a battery plant within the US.

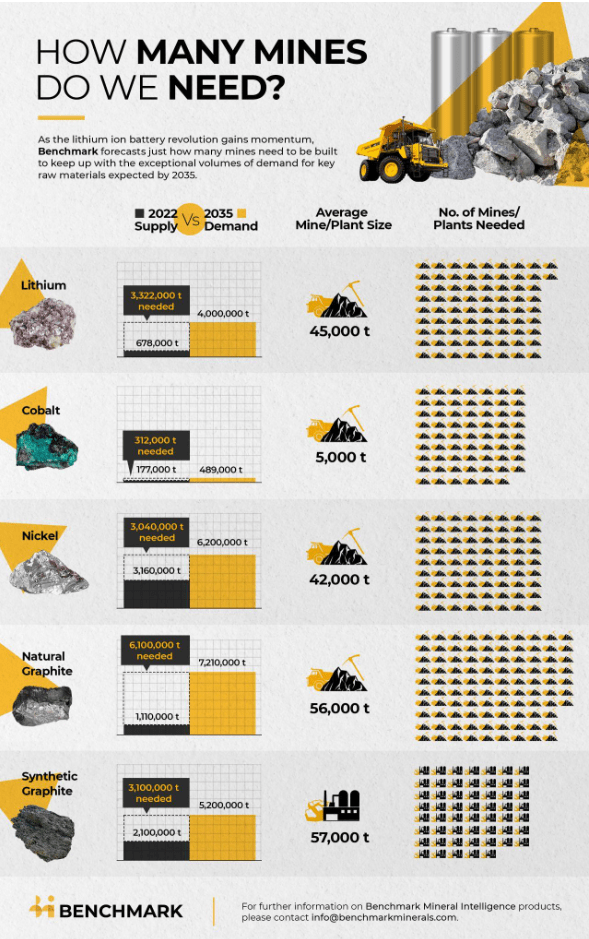

Whereas the above paints among the large image demand for lithium that’s coming, allow us to see what Benchmark Mineral Intelligence tasks.

Lithium Demand

Taking a look at Benchmark, we see the estimation for 2022 lithium demand is 678,000 tonnes and the projection for 2035 is 4,000,000 tonnes: A 590% improve if it pans out.

Cobalt stands at 2022 demand of 177,000 tonnes whereas the 2035 estimation is 489,000 tonnes: A 276% improve. That’s fairly a little bit of demand; on the flip facet, so much can change in a decade plus. One factor to look at are actions which can be occurring proper now that may trace at demand and the general lithium / cobalt ecosystem. We have to research the place the large cash is finding and the way a lot capital they’re throwing at our alternative metals.

Lithium Demand Projection (2035) (Benchmark)

A Selection Lithium Choice

This market is gravitating in the direction of lithium producers which can be both in manufacturing (similar to Albemarle (ALB)) or near-term producers. By now, you will have been studying for months concerning the upcoming lithium demand. You might need even seen Goldman Sachs ‘shake the tree’ by placing out questionable doom and gloom stories, solely to later disclose they’re, in truth, shopping for lithium.

That is GS 101. Regular and anticipated. Why the SEC permits that is past the scope of this dialogue, however the level stays that GS is bullish on lithium. So are we, however we now have to be practical. Some lithium corporations aren’t going to pan out for fairly a while (if ever). Others (similar to LAC) may pan out sooner as they’re nearer to manufacturing, with the inherent caveat that LAC is in a harmful time period given its courtroom case.

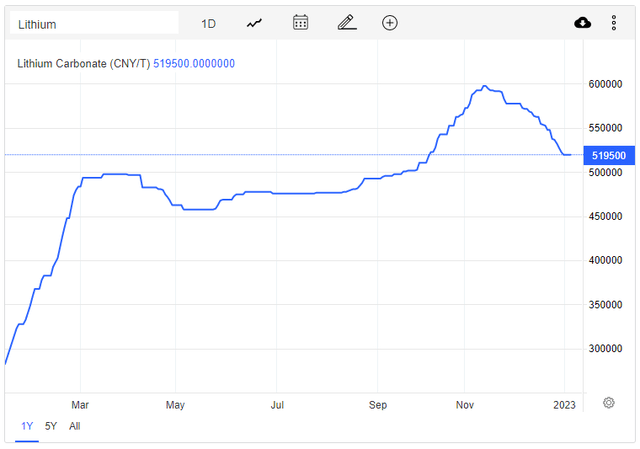

Goldman Sachs has acknowledged they assume costs will come down for lithium. Guess what, provide will improve in 2023 through LAC and SGML, but demand can also be rocketing off. Might lithium come down in value some? Positive. Might it go up as effectively? Why not. Now we have seen some value decreases within the spot market (versus contract costs — should anticipate SQM to replace us on these).

Lithium Carbonate Costs 1/4/2023 (Tradingeconomics)

Click on to enlarge

My general consensus is IF lithium have been to return down, this isn’t a foul factor for the broad business. Increasingly carmakers will proceed to undertake lithium in addition to battery corporations, however I am going to wager that Benchmark is appropriate and I believe GS is aware of this. They’ve been responsible up to now of enjoying enjoyable and video games through spreading FUD (concern, uncertainty and doubt) to push a value down after which (per SEC paperwork) they purchase. I’ve coated this in previous articles.

Lithium Americas Threat: Authorized Points

Whereas I believe LAC will turn into a really giant firm, it isn’t to say they don’t have points: All corporations have points. Allow us to discover some dangers.

1. Authorized – As most readers know varied tribes, environmentalists, and a rancher are taking the BLM to courtroom and LAC is appearing as an advisor. In danger is the very mine that LAC has spent over a decade to attempt to carry into being. From a nationwide strategic standpoint this mine is smart and each Trump and Biden have supported it. The state of Nevada helps it as effectively. Some locals help: Some don’t. Additionally concerned are just a few out of state actors.

I used to be requested about my opinion on the brand new courtroom paperwork. Not being a lawyer, I can solely make a guess, however I might enterprise that is the Choose appearing neutral. If the Choose doesn’t handle the apparent points dominated on up to now by different environmental circumstances, then the Court docket of Appeals must. It’s higher to air out the case now on the decrease courts after which anticipate any potential Court docket of Appeals case to kick off to additional discover points.

Irrespective of who wins, I might count on an enchantment and the related delays, however does it finish with the Court docket of Appeals? Presumably no. If we have a look at a Rio Tinto case for any foundation, we see the decrease courtroom ruling (that is the place LAC is at the moment at legally), then the appeals courtroom, adopted by speak of going to the Supreme Court docket (assuming they comply with hear it). The purpose being this might proceed for an unknown period of time or perhaps all of it wraps up and the opposition throws within the towel based mostly on what the Choose guidelines. The takeaway is that this might be removed from over for both occasion. I have no idea the timeframes for this section of the authorized dance. I don’t assume it’ll resolve on day one. I might guess it takes a while so plan any choices trades accordingly.

Conclusion

Regarding Geopolitics, Canada has informed varied Chinese language gamers that they’ll divest of holding small Canadian useful resource miners. With China changing into very daring regarding Taiwan, the long-term thinkers in Canada are clearly involved of the implications of China holding sway over home North American lithium.

One thing to recollect is irrespective of the end result for Nevada’s Thacker Move, the South American plant is coming on-line with the related output together with future enlargement plans AND they’ve extra property per the acquisition of Millennial Lithium and Enviornment Minerals (OTCQX:AMRZF).

Threat adversarial traders may do higher to simply wait and see what occurs. Keep away from potential danger and ache. Granted, if the choice is favorable, the inventory might do fairly effectively and danger adversarial traders may miss a possibility. If the Thacker Move wins in courtroom, I believe we’ll see a financing deal someday after to push the challenge ahead together with authorities funding. This might need a positive impression on neighboring clay-based tasks similar to Cypress Growth (OTCQX:CYDVF) who’re additionally in search of authorities funding pending a Q2 DFS, having produced enhanced grade lithium carbonate.

Our Play – Not Monetary Recommendation

We’re shopping for the January 2024 $25 calls in addition to shopping for the widespread inventory.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.