Duncan_Andison

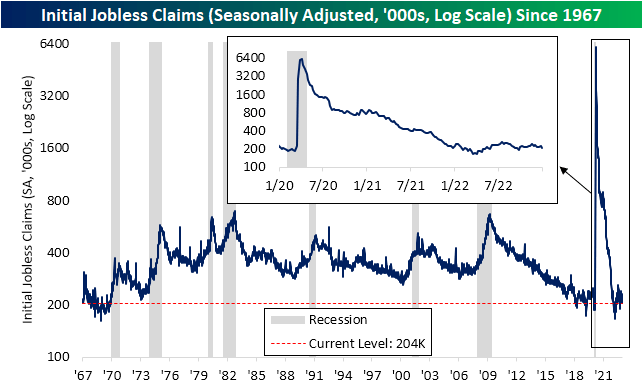

Sadly for equities, between a stronger-than-expected ADP payrolls quantity and stronger-than-expected jobless claims information, Thursday’s information confirmed some power within the US labor market. Honing in on the weekly claims print, preliminary claims dropped all the way in which all the way down to 204K this week. That marked a 19K decline from final week’s 2K downwardly revised degree of 223K and brings claims to the bottom degree for the reason that final week of September once we final noticed a sub-200K print. Expectations have been calling for the studying to go unchanged from the unrevised degree of 225K from final week.

Writer

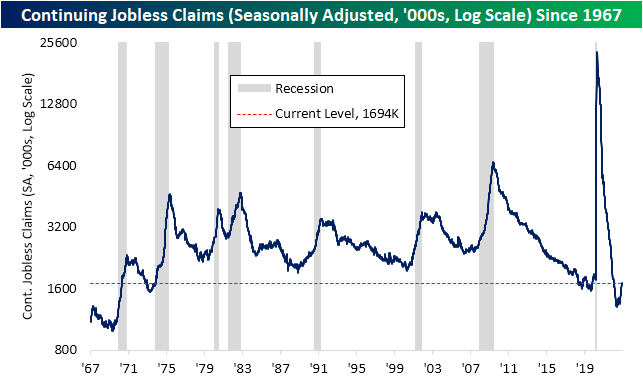

Even persevering with claims improved falling to 1.694 million as an alternative of the forecasted improve to 1.728 million. Final week’s studying of 1.71 million had been the best since February 2022 as persevering with claims have steadily risen (at a tempo per previous recessions) prior to now a number of months.

Writer

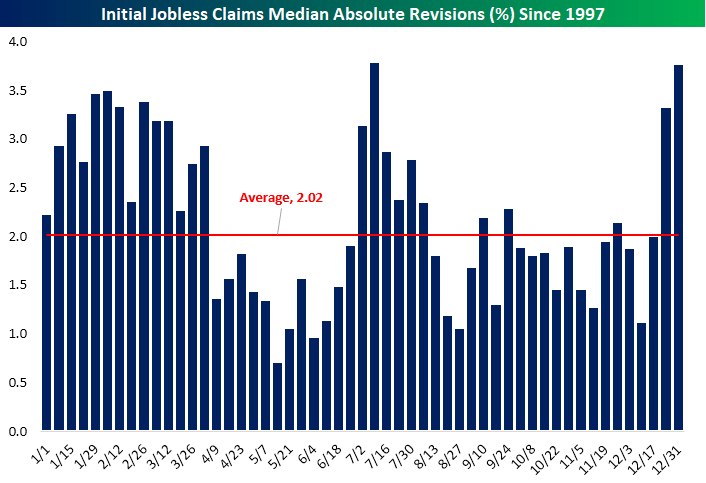

Though each preliminary and persevering with claims had sturdy showings, there may be the caveat that the present interval was smack dab in the midst of the vacations. For starters, that would have some affect on the weekly seasonal adjustment, however extra importantly, we’d observe that these are among the weeks of the 12 months most susceptible to revisions.

Within the chart under, we present the median revision (expressed as an absolute % change from the primary launch) for every week of the 12 months since 1997. The ultimate week of the 12 months has sometimes skilled a revision of +/-3.8%, tying the week of the July 4th vacation for the most important revision of the 12 months. That signifies that whereas claims did present enchancment this week, it may not be price studying too deep into that single quantity. Additional information shall be useful to assist affirm this print (by way of revisions or lack thereof) in addition to present a clearer image of the development, which had been one in all deterioration main into the tip of the 12 months.

Writer

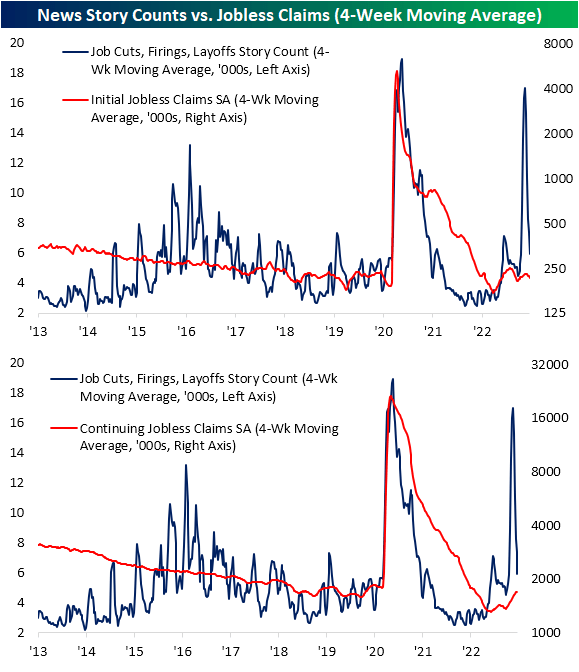

One different barely extra anecdotal issue price noting on the stronger-than-expected jobless claims information is that the sturdy studying this week has gone opposite to the variety of layoffs which have made their method into headlines recently. Though the corporate initially introduced the layoffs again in November, Amazon (AMZN) introduced on Wednesday that it plans to put off a better variety of staff than beforehand acknowledged (18K versus 10K initially). That additionally follows an announcement of a major discount of roughly 10% of the workforce of Salesforce (CRM) yesterday.

Over the previous few months, information story mentions (in information aggregated from Bloomberg) of issues like job cuts, firings, and layoffs have surged reaching a excessive of 16.5K on a four-week rolling common foundation in November (across the time of Amazon’s preliminary announcement). Though that studying has pulled again within the a number of weeks since then, information counts on the subject remained elevated by way of the tip of 2022 and are prone to get an extra bump with this week’s headlines. Over the previous decade, these story counts have usually adopted the trail of each preliminary and persevering with claims. Extra lately, nevertheless, there was considerably of a divergence with story counts far outpacing precise claims figures.

That divergence may very well be for an array of causes akin to staff shortly discovering different roles and never needing to use for unemployment insurance coverage, however one other factor to contemplate is the timing of the announcement of layoffs versus once they really occur. For instance, within the case of Amazon, whereas the preliminary announcement was all the way in which again in November, these cuts weren’t deliberate to enter impact till mid-January. In different phrases, whereas not within the information now, increased claims could very nicely be on the horizon.

Writer

Unique Put up

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.