CHUNYIP WONG

Flashback to early 2021: Share costs of high-growth and expertise firms are making new highs. Pleasure is working excessive and buyers are piling into the most well liked areas of the market, with out considering an excessive amount of about enterprise fashions, profitability, aggressive benefits and return on invested capital.

At the moment, Chevron (NYSE:CVX) and plenty of different well-run companies had been in no-go territory for many retail buyers as narrative pushed funding philosophies weren’t made to conceive an funding thesis exterior of the most recent and hottest shares.

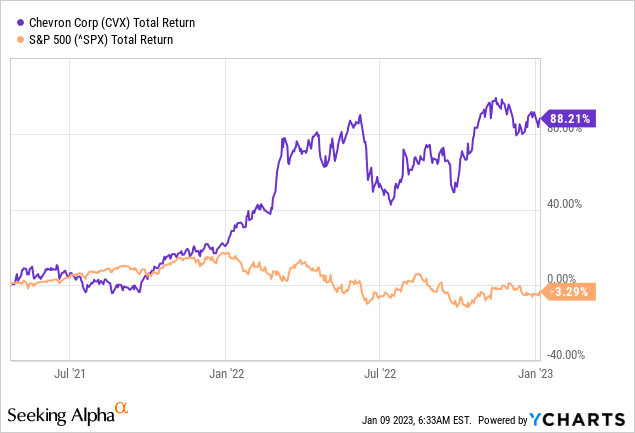

Opposite to the favored opinion, I took a protracted place in Chevron and defined why the corporate is well-positioned to carry out, regardless of the continued business headwinds. Though it did not get the eye {that a} thought piece on Tesla (TSLA) would have gotten again then, Chevron delivered 88% complete return since April 2021, whereas the broader market fell by greater than 3%.

Again in September of final yr, I additionally took a deep dive at Chevron for my subscribers of The Roundabout Investor, the place I outlined an in depth thesis on why the corporate was engaging even because it traded at all-time highs.

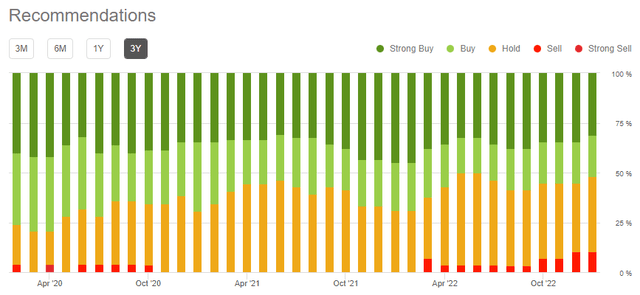

Apparently sufficient, analysts’ sentiment has not modified materially previously few years. As a matter of reality, if we combination all of the suggestions given by Wall Avenue Analysts, the sentiment has really gotten worse.

Chevron (In search of Alpha)

The adverse narrative round Chevron has shifted from a enterprise that’s heading to extinction to at least one that might be challenged as recession hits and demand for its merchandise falter.

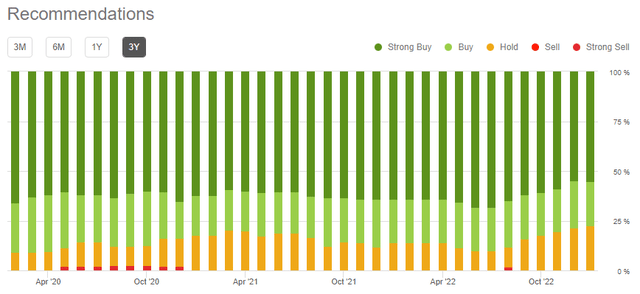

On the similar time, the sentiment round companies which have seen their share costs plunge and are actually dealing with issues continues to be close to an all-time excessive. Take for instance Salesforce (CRM), a inventory which I’ve been warning about since December of 2020 when it was buying and selling close to all-time highs.

Salesforce (In search of Alpha)

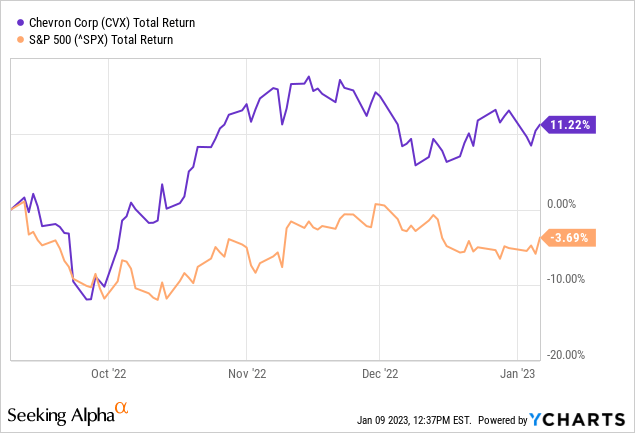

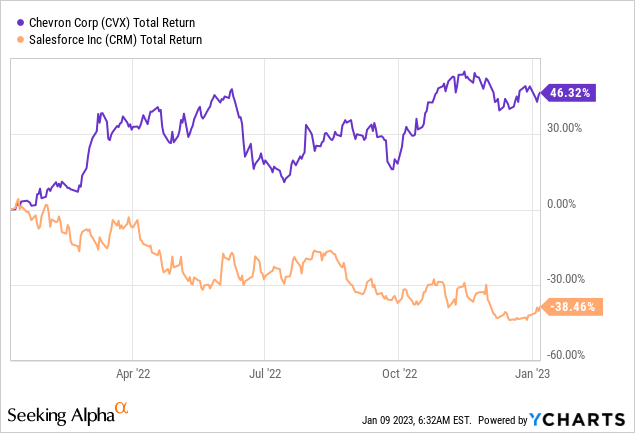

And whereas sentiment round these two firms has been vastly totally different, Chevron delivered practically 50% return over the previous yr alone, whereas Salesforce fell by virtually 40%.

In fact, as one share value is falling it definitely turns into much less dangerous and vice versa, nonetheless, the entrenched sentiment of analysts and retail buyers alike have been their worst enemy in 2022 and I do not see a cause for this to vary in 2023 both.

Firing On All Cylinders

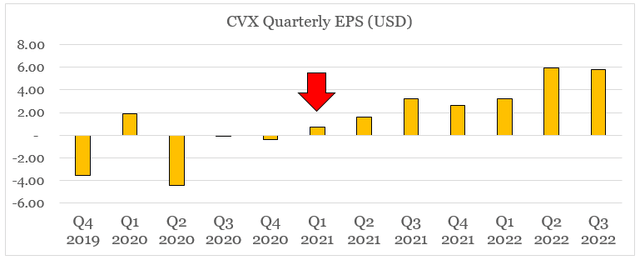

Whereas fears of a deeper than at present anticipated recession are well-grounded, Chevron continues to generate file excessive earnings on the again of its sturdy enterprise mannequin and administration crew that remained centered on reaching sustainable and excessive return on capital, versus managing the enterprise on a quarter-by-quarter foundation.

ready by the writer, utilizing information from In search of Alpha

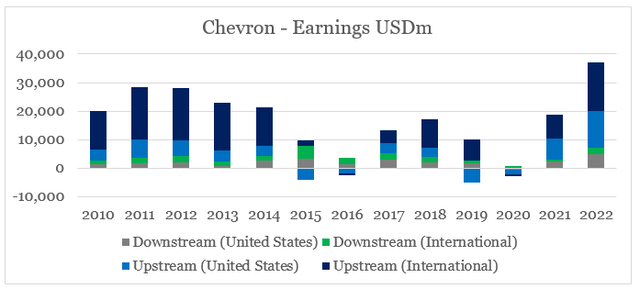

On an annual foundation, Chevron’s main enterprise models are firing on all cylinders with the upstream section being by far the most important contributor to the corporate’s file excessive earnings.

ready by the writer, utilizing information from In search of Alpha

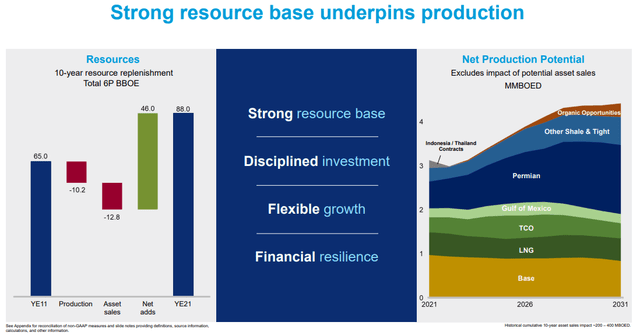

Sturdy Positioning To Ship In The Lengthy Run

After a decade of file excessive capital expenditure, regardless of all of the business headwinds, and efforts to enhance effectivity, Chevron is now among the many best-positioned international vitality firms to develop manufacturing and spend money on new applied sciences.

We’re extra capital and value environment friendly than we have ever been.

Supply: Q3 2022 Earnings Transcript

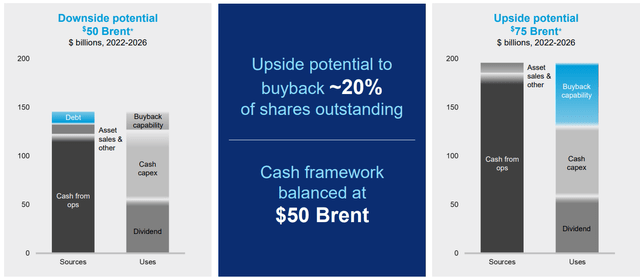

Chevron Investor Presentation

On a money movement foundation, the corporate is well-equipped to face extra business headwinds, whereas not compromising dividend funds and deliberate capital expenditures.

Chevron Investor Presentation

Priorities of the administration additionally stay unchanged with dividend funds and investments to safe long-term aggressive benefits of conventional and new companies being by far an important ones over the approaching years.

I will simply level out that we elevated our dividend 6% earlier this yr. We have been rising our dividend at a compounded annual development charge of 6% for 15 years. And that’s our first monetary precedence. So there’s a variety of rigidity on the buyback, but it surely’s clearly our fourth precedence after sustaining and rising the dividend, investing to develop each conventional and new vitality companies, sustaining a powerful stability sheet. And as Mike mentioned, we intend to do it throughout the cycle for a number of years.

Supply: Q3 2022 Earnings Transcript

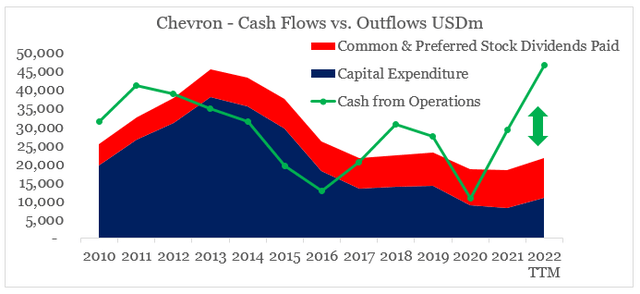

And whereas cyclical swings are to be anticipated within the Oil & Fuel sector, Chevron’s excessive money movement permits for a significant ramp-up in capex and constant development in dividends over the approaching years.

ready by the writer, utilizing information from In search of Alpha

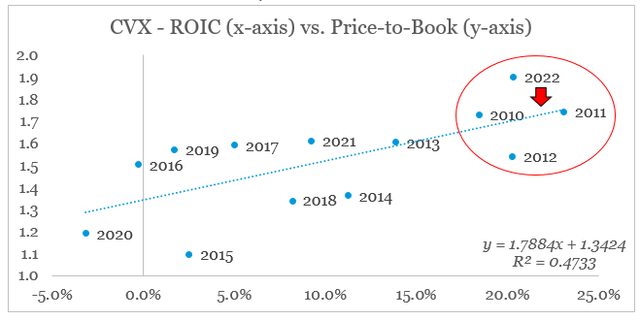

By way of valuation multiples, Chevron’s share value now trades at file excessive premium to its guide worth which makes buyers anxious of a pullback within the short-run. If we examine the P/B ratio to the corporate’s Return on Invested Capital, we must also be aware {that a} short-term repricing is feasible.

ready by the writer, utilizing information from In search of Alpha

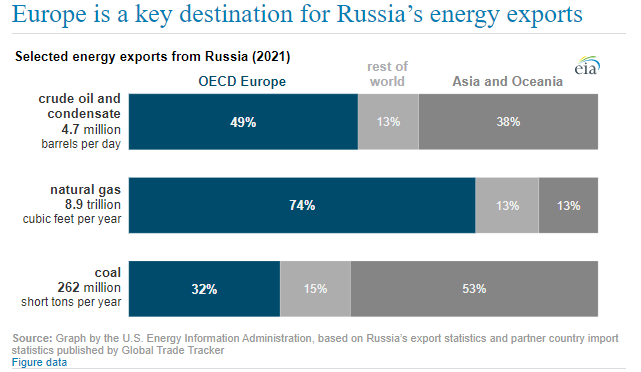

And whereas this is sufficient to scale most short-term speculators, they as soon as once more are lacking the forest for the bushes. Despite all of the close to time period volatility, Chevron is as soon as once more reaching record-high return on capital and would play a significant function in a world the place vitality safety and sustainability can be paramount.

U.S. Power Data Administration

Conclusion

After a yr of exceptionally excessive returns, Chevron might face near-term volatility, however there are sturdy the reason why long-term buyers shouldn’t fall sufferer to narratives and market speculations. Before everything, current downturns within the Oil & Fuel area have allowed Chevron to considerably enhance its effectivity and concentrate on excessive return on capital tasks. It has additionally change into a significant pillar in guaranteeing vitality safety of the USA and its companions internationally. Whereas returns in 2023 are unlikely to be as excessive as they had been again in 2021 and 2022, I count on the corporate to proceed to outperform the market.