Fahroni

A number of the most tasty firms I’ve seen from a valuation perspective over the previous 12 months or so function within the automotive retail house. Issues over the financial system extra broadly and the influence that prime rates of interest could have on the manufacturing and sale of vehicles has led to many of those firms being ignored or underappreciated by market individuals. However this isn’t to say that each participant is being unjustly handled by the funding neighborhood. As a consequence of a change in basic situation, a number of the companies, reminiscent of America’s Automotive-Mart (NASDAQ:CRMT), possible deserved some draw back. With extra ache probably across the nook, this agency, which actually must be handled extra like a finance enterprise than only a plain automobile dealership, may expertise much more deterioration in its backside line outcomes. This isn’t to say that the corporate makes for a nasty prospect for individuals who are prepared to carry it for the lengthy haul. However given the place we’re in what could possibly be a continued downturn within the automotive retail house, there are much better prospects to contemplate at this cut-off date.

I underestimated this one

Right now, I run a really concentrated portfolio. In whole, this portfolio consists of 9 particular person holdings. Considered one of them, the third largest by asset worth at the moment, operates within the automotive retail house. So evidently, I am an enormous fan of this market and I consider that, for essentially the most half, it’s drastically undervalued. However this isn’t to say that each participant out there must be regarded upon in the identical gleaming gentle. And that was a mistake that I made after I first wrote about America’s Automotive-Mart in January of 2022. At the moment, I referred to as the corporate an intriguing enterprise that had a historical past of engaging prime line and backside line development. This isn’t to say that I used to be utterly beneath its sway. In spite of everything, I acknowledged that it was an advanced agency that actually ought to have been thought-about extra a finance enterprise than only a automobile dealership. However regardless of these dangers, I felt as if shares of the corporate have been low-cost and that the enterprise would supply engaging upside for long-term buyers. That in the end led me to charge it a ‘purchase’ to replicate my view that shares ought to outpace the broader marketplace for the foreseeable future. Thus far, nonetheless, that decision has been flawed. Whereas the S&P 500 is down 16.3% because the publication of that article, shares of America’s Automotive-Mart have skilled draw back of 27.4%.

Creator – SEC EDGAR Information

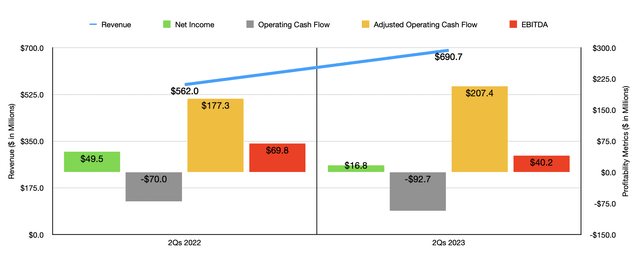

Curiously, this return disparity exists though gross sales development for the corporate continues. Take into account how the corporate fared through the first half of its 2023 fiscal 12 months. Income throughout that point got here in at $690.7 million. That is 22.9% greater than the $562 million generated the identical time one 12 months earlier. This improve was pushed by a few elements. Firstly, the variety of shops that it had in operation grew from 152 to 154. An increase within the common items bought per retailer additionally benefited buyers, with that quantity climbing from 33.2 to 34 in a median month. That translated to the variety of retail items that the corporate bought climbing from 30,043 to 31,421. Additionally benefiting the agency was the truth that the common retail gross sales worth of the vehicles in its portfolio elevated from $15,567 to $18,045.

That is nice in and of itself. However what’s not nice is that the corporate reported a decline in profitability. Internet earnings dropped from $49.5 million within the first two quarters of 2022 to $16.8 million the identical time of its 2023 fiscal 12 months. There have been three major drivers behind this decline in earnings. Though gross sales elevated, the price of gross sales for the corporate, excluding depreciation, jumped from 63.1% of gross sales to 66.8%. This improve, administration mentioned, was largely attributable to wholesale losses and stock procurement challenges, the latter of which concerned greater direct and oblique prices associated to restore elements, transportation charges, gas prices, and price of sale bills.

Additionally problematic was the truth that the availability for credit score losses for the corporate jumped by 55.2%, climbing from 21.6% of gross sales to 27.6%. This, administration mentioned, was pushed by a rise in each the frequency and severity of losses when it got here to internet charge-offs 12 months over 12 months. Complete internet charge-offs of finance receivables through the six-month window coated got here out to 11%. That is up from 8.4% seen on the identical time one 12 months earlier. And at last, curiosity expense for the corporate elevated from 0.9% of gross sales to 2.6%. Naturally, this stemmed from a common rise in rates of interest, mixed with the influence that that they had on an increase in common borrowings made by the enterprise. These challenges impacted different profitability metrics as effectively. Working money circulate went from unfavourable $70 million to unfavourable $92.7 million. It’s true that the adjusted determine for this, which ignores modifications in working capital, improved from $177.3 million to $207.4 million. However offsetting this to a point is the truth that EBITDA worsened from $69.8 million to $40.2 million.

Creator – SEC EDGAR Information

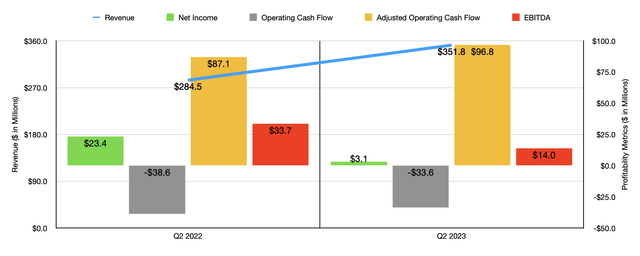

Issues for the corporate have been current in each quarters. Within the second quarter, as an example, gross sales have been nonetheless robust, coming in at $351.8 million. That is 23.7% above the $284.5 million reported one 12 months earlier. A rise in retail items bought and an increase in common retail gross sales costs have been instrumental within the second quarter simply as they have been within the first half of the 12 months in its entirety. However due to the identical aforementioned elements, internet earnings plunged from $23.4 million to $3.1 million. Working money circulate went from unfavourable $38.6 million to unfavourable $33.6 million, whereas the adjusted determine for this went from $87.1 million to $96.8 million. Though the working money circulate figures are nice to see, I reiterate my level from my first article on the corporate that its publicity to the finance house makes working money circulate a reasonably poor metric to have a look at. Maybe extra acceptable can be EBITDA, which declined from $33.7 million to $14 million.

Creator – SEC EDGAR Information

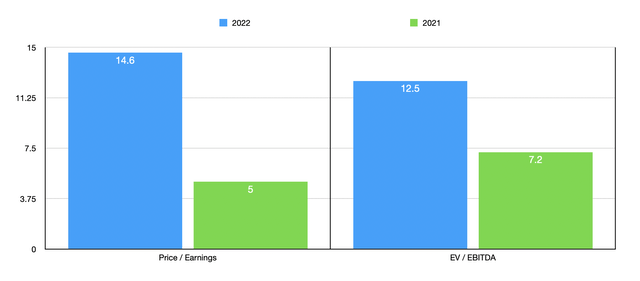

Fact be advised, we actually do not know what to anticipate for the remainder of the 2023 fiscal 12 months. If we merely annualize the outcomes skilled thus far, we’d get internet earnings of $31.7 million and EBITDA of $78 million. This might suggest a ahead price-to-earnings a number of for the corporate of 14.6 and a ahead EV to EBITDA a number of of 12.5. To place this in perspective, if we have been to make use of the information from 2022, these multiples can be significantly decrease at 5 and seven.2, respectively. As a part of my evaluation, I did additionally examine America’s Automotive-Mart to 5 different gamers on this market. On a price-to-earnings foundation, these firms ranged from a low of 4.5 to a excessive of 18.4. Solely one of many 5 was dearer than our prospect. In the meantime, utilizing the EV to EBITDA strategy, the vary was from 4.4 to twenty. On this state of affairs, as soon as once more, solely one of many 5 firms was dearer than America’s Automotive-Mart.

Firm Worth / Earnings EV / EBITDA America’s Automotive-Mart 14.6 12.5 CarMax (KMX) 18.4 20.0 AutoNation (AN) 4.5 4.4 Penske Automotive Group (PAG) 6.4 5.9 Group 1 Automotive (GPI) 4.5 4.6 Asbury Automotive Group (ABG) 5.2 5.7 Click on to enlarge

Takeaway

From what I can see within the knowledge, I do discover it fascinating that the corporate continues to extend its gross sales. This by itself is a superb factor. If we knew for positive that the rate of interest setting wouldn’t worsen materially from right here, I’d even be prepared to nonetheless charge it a ‘purchase’ since I’d consider {that a} return to normalcy can be quickly coming. However as a result of we have now uncertainty in that regard and since backside line outcomes proceed to deteriorate, I consider {that a} downgrade to a ‘maintain’ ranking is acceptable at the moment.