Tippapatt/iStock through Getty Pictures

The share worth of LivePerson, Inc. (NASDAQ:LPSN) has been beneath huge stress over the past couple of years, falling from a 2-year excessive of roughly $72.00 per share on February 15, 2021, to a 52-week low of $7.96 on October 14, 2022.

Since then, it has been buying and selling unstable, the place it seems to have discovered a backside of about $9.20 per share, and a ceiling of roughly $13.00 per share, primarily based upon a double backside and a double prime at these ranges. It has traded under and above these ranges however hasn’t sustainably damaged both manner since its 52-week low.

TradingView

I believe that is going to vary as a result of LivePerson, Inc. continues to hemorrhage cash, even because it’s beginning to present indicators of income slowing down over the past three quarters, and primarily based upon steerage, is more likely to proceed in that route.

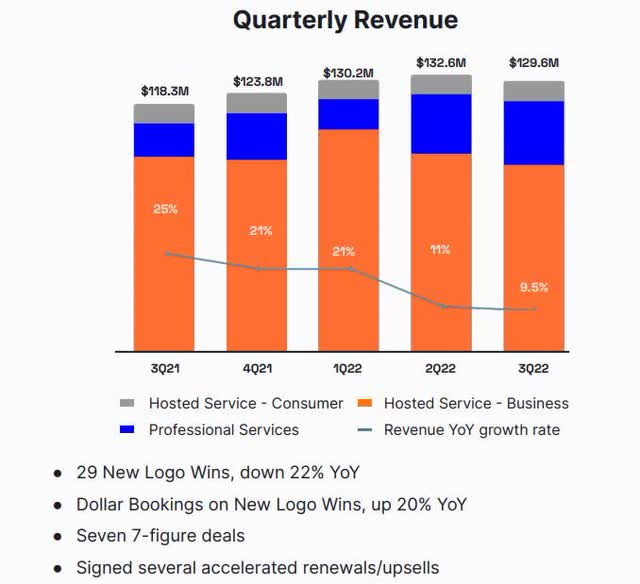

Whereas new emblem wins have been down 22 % within the third quarter, the corporate has managed to e book increased worth from the enterprise in enterprise it has been successful, primarily as a result of they’re frontloaded within the preliminary stage of doing enterprise.

On this article we’ll take a look at a few of the numbers from its newest earnings report and the place issues seem like trending, the significance for the corporate to execute on its technique to chop prices, and why it is crucial that it constantly wins new logos in enterprise.

A few of the numbers

Income within the third quarter of 2022 was $129.6 million, up 9.5 % the $118.3 million in income generated within the third quarter of 2021, however barely down from income within the first quarter of 2022, the place income was $130.2 million, and the second quarter of 2022, the place income was $132.6 million.

Investor Presentation

For the primary 9 months of 2022 income was $392 million, in comparison with income of $346 million within the first 9 months of 2021.

Income from Hosted Service has been dropping in 2022, whereas income from Skilled Providers over the past couple of quarters has been rising.

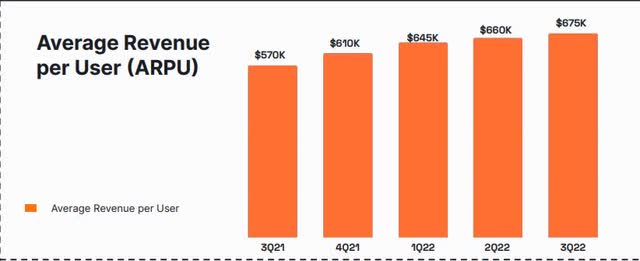

One constructive from the third quarter was the continuing enchancment in common income per consumer (ARPU), which climbed to $675,000, up from $570,000 within the third quarter of 2021.

Investor Presentation

Complete prices and bills continued to climb, coming in at $178 million within the third quarter of 2022, leading to loss from operations of $48.5 million. Complete prices and bills within the third quarter of 2021 have been $139 million, producing a lack of $20.8 million in that point interval.

Complete prices and bills within the first 9 months of 2022 have been $575 million, producing a loss from operations of $183 million, in comparison with whole prices and bills of $394 million within the first 9 months of 2021, lead to loss from operations of $48 million.

Adjusted EBITDA within the reporting interval was $9.1 million, beating prior steerage of $4.8 million. Non-GAAP gross margins within the third quarter have been 74 %, which have been on the highest of its steerage vary, and was attributed to reducing prices and focusing on enterprise that had scalable excessive margin income potential.

Administration stated that restructuring within the third quarter ought to lead to a discount of its expense run price in comparison with the primary half of 2022, shifting the corporate towards its objective of reaching double-digit adjusted EBITDA and constructive free money circulation in 2023.

Primarily based upon the numbers under, it has a whole lot of work to do to realize these outcomes, as internet losses within the third quarter and for the primary 9 months of 2022 proceed to develop.

Web loss within the third quarter of 2022 was $(43.2) million, or $(0.56) per share, in comparison with a internet lack of $(33) million, or $(0.47) per share within the third quarter of 2021.

Web loss within the first 9 months of 2022 have been $(184) million, or $(2.39) per share, in comparison with a internet loss within the first 9 months of 2021 of $(75) million, or $(1.09) per share.

The corporate guided for adjusted EBITDA within the fourth quarter to be in a variety of $14.9 million to $24 million, far above full-year 2022 steerage of $1.0 million to $10.0 million. Adjusted EBITDA margin was guided to be in a variety of 12 % to 19 %, additionally considerably above full-year 2022 steerage of 0 % to 2 %.

Money and money equivalents on the finish of the third quarter of 2022 was $393 million, in comparison with money and money equivalents of $521.8 million on the finish of calendar 2021.

Implication of latest emblem wins being down

Within the third quarter, the corporate had 29 new emblem wins, down 22 % year-over-year. On the identical time, the greenback bookings from the brand new emblem wins jumped 20 % year-over-year.

When CEO Rob LoCascio was requested about this within the Q&A portion of the earnings name, he stated the third quarter had some nice new logos, with a few of them being larger offers that partially got here from them being optimized to deal measurement by the gross sales consultant.

A lot of the development in greenback bookings got here from focusing on the enterprise market, however LoCascio stated that it adjustments on a quarterly foundation, including that it is not a development. Regardless that the reserving worth elevated within the quarter, administration was fast to level out it desires to get as many new logos as it could possibly with the intention to drive firm worth sooner or later. With the corporate saying its enterprise prospects have been shifting from 30 % to 50 % of their contact quantity to LPSN, it is vital to win new logos with the intention to take full benefit of that development.

New logos in enterprise initially generates increased reserving worth, which is why it was up even when new logos have been down within the quarter, however over the long run, it is the lifetime worth of the enterprise logos that can decide the efficiency of the corporate.

So, whereas elevated reserving worth is essential as a result of it displays new emblem wins of upper, short-term worth, a decline in new emblem wins takes away the longer term development momentum within the firm in income and margins. In different phrases, it is not a great factor to see the momentum in new emblem wins slowing down. It may be lined over by new enterprise wins producing increased reserving worth within the preliminary stage, which can give a short lived income increase. However the main factor for buyers to look at is what number of new logos are being gained, as a result of it displays the long-term development potential of the corporate.

Ideally what we wish to be searching for is a rise in new logos wins in enterprise, which might be a major, short-term tailwind, and the corporate efficiently upselling these prospects over the long run. That is what the corporate was primarily referring to when it talked about reducing prices whereas focusing on enterprise that had scalable excessive margin income potential. It is the scalability potential that’s misplaced if the brand new logos wins proceed to fall.

I imagine that is confirmed within the common income per consumer persevering with to climb. But when the variety of new emblem wins is dropping, there isn’t any ARPU to develop if you do not get the preliminary enterprise. That is a significant problem the corporate faces going ahead.

Conclusion

Presently, the efficiency of LPSN is combined at greatest. It’s exhibiting indicators of lowering prices, which it should do with the intention to transfer towards profitability. Even so, losses from operations proceed to soar, and a whole lot of issues must go proper for the corporate to reverse route in regard to ongoing losses.

I see the important thing to that occuring to be in regard to new emblem wins in enterprise, which has each vital short-term and long-term potential for the corporate, if it could possibly get extra constant in wins and efficiently upsell over time, which it has confirmed it could possibly do if it could possibly get its foot within the door.

Presently, I imagine the corporate might go both manner over the following yr or so, as there are a whole lot of questions that should be answered in reference to reducing prices, successful new logos, and what influence the macro-economic atmosphere can have on the corporate.

I do imagine it has a whole lot of future potential as a result of AI use in buyer contact goes to proceed to extend. However with higher administration pulling spending selections additional up the hierarchy, it is apparent there may be a whole lot of prioritizations occurring in relationship to spending due to the shortage of visibility within the quarters forward, and that can most likely have a detrimental influence on the efficiency of LPSN in 2023.

With the income numbers exhibiting weak point on a quarterly foundation, and new emblem wins in decline, I believe the corporate goes to battle to realize its income and earnings objectives in 2023.

At greatest I believe the corporate will commerce sideways for now, but when income and earnings fail to satisfy expectations, it is going to take a a lot additional dive and doubtless stay there till its efficiency improves.

I believe the corporate has a far increased proportion probability of underperforming than overperforming in 2023.