Teamjackson/iStock Editorial by way of Getty Photos

Introduction

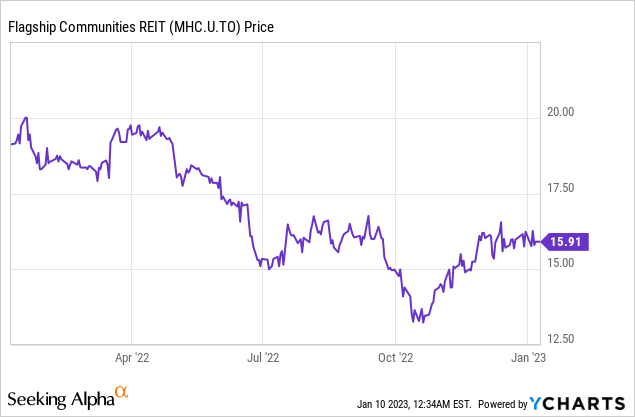

Flagship Communities (OTCPK:FLGMF) (MHC.UN:CA) (MHC.U:CA) is a comparatively new REIT because it was solely shaped within the ultimate quarter of 2020 to supply its shareholders publicity to manufactured housing communities within the US. The IPO was priced at US$15 and now, extra than two years later, the share worth is again the place it began, regardless of a couple of years of progress and finishing its most up-to-date substantial capital elevate at US$19.25 per share in 2021.

Flagship Communities Investor Relations

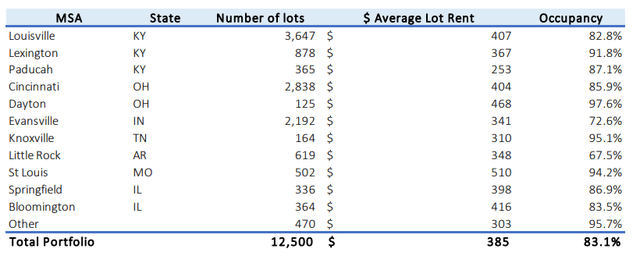

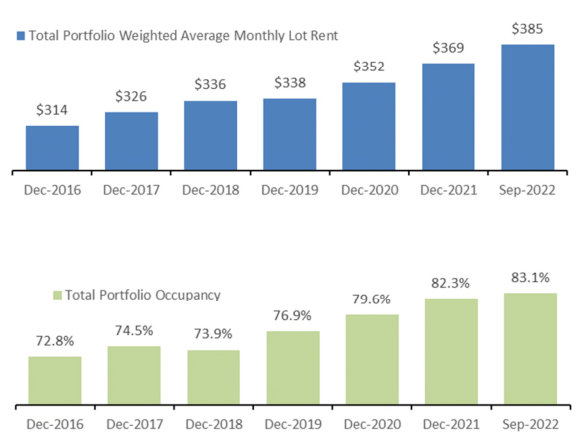

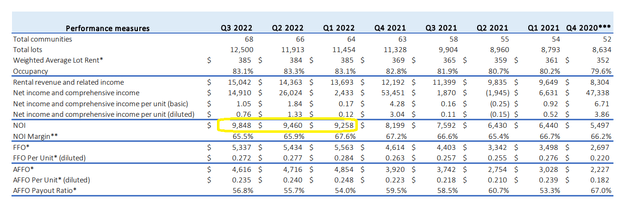

The REIT operates a complete of 12,550 tons throughout 68 communities in a handful of States. The REIT was capable of enhance its occupancy ratio in addition to the typical month-to-month lot hire in virtually each single yr up to now six years.

Flagship Communities Investor Relations

The enterprise mannequin is fairly easy: the overwhelming majority of the income is generated by leasing the tons to the house homeowners and in some uncommon instances, Flagship additionally owns the house on the lot. The important thing phrase for Flagship is ‘affordability’. The REIT focuses on Kentucky, Indiana, Ohio and Tennessee as its most necessary states. It isn’t a Sunbelt-focused operator specializing in retirees, however on the working class inhabitants on the lookout for inexpensive housing.

Flagship’s most liquid itemizing is in Canada the place it’s buying and selling with MHC.U and MHC.UN as ticker symbols. The U-listing has the USD as base foreign money however the CAD itemizing is extra liquid. Each the U and UN itemizing ought to transfer in tandem though the illiquidity of the U itemizing could trigger the unfold to be bigger. MHC reviews its monetary ends in US {Dollars}, and I’ll use that foreign money all through this text. There are at the moment 14.14 million models excellent and a further 5.47 million Class B models which might be transformed into frequent models. The overall unit rely I’ll use to calculate the per-share efficiency is nineteen.7 million models.

Flagship’s FFO and AFFO are steadily rising

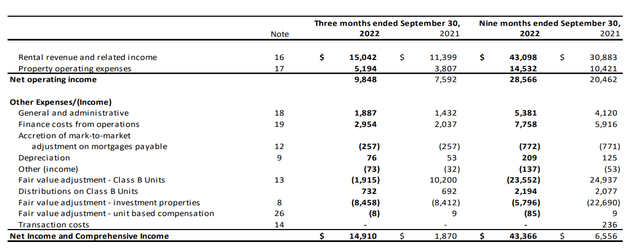

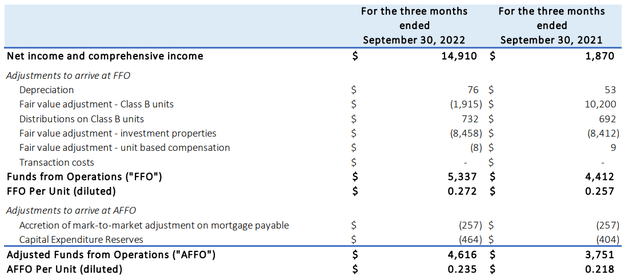

The REIT reported a complete rental income of simply over $15M throughout the third quarter, which resulted in a web working earnings of $9.85M. Whereas the web earnings of $14.9M appears to be like nice, it’s clearly extra necessary to take a look at how the FFO and AFFO outcomes had been evolving.

Flagship Communities Investor Relations

It’s possible you’ll instantly discover a small lower within the FFO and AFFO regardless of an elevated lot rely, an elevated hire worth per lot and the steady occupancy.

Flagship Communities Investor Relations

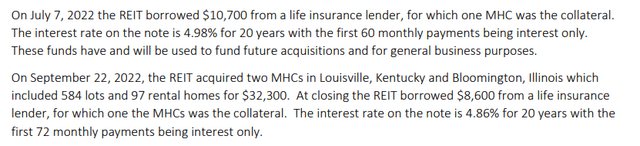

The wrongdoer is the curiosity bills as Flagship is clearly not immune for rising curiosity bills. The REIT continues to develop and pursues small bolt-on acquisitions within the very fragmented market of MHCs. Subsequent to the tip of the third quarter, Flagship closed one more acquisition, buying two MHCs in Kentucky and Illinois for a complete of US$32.3M. Based mostly on the present occupancy, I count on these new properties to contribute $1.5M in NOI in 2023. And in November, it introduced it acquired a 100% occupied 100 lot resort-style MHC in Ohio.

The upper curiosity bills are weighing on the FFO and AFFO, and now it’s as much as Flagship to enhance the efficiency of the acquired property to make sure a constructive contribution to the full consequence. Through the third quarter, Flagship’s FFO got here in at $5.3M whereas the AFFO was $4.6M or $0.235 per share.

Flagship Communities Investor Relations

This implies the 9M 2022 AFFO per share already got here in at $0.733, and for the complete monetary yr we are able to most likely count on a consequence north of US$0.95 however decrease than US$1. $0.97-$0.98 appears to be a good expectation for Flagship at this level. It ought to be capable of improve its rental earnings once more in 2023 and that ought to additional enhance the AFFO per share by a low single digit share: don’t count on any miracles or sudden FFO and AFFO will increase. A gradual annual AFFO improve of 2-3% is sensible.

Luckily Flagship has locked in its mortgage rates of interest. As of the tip of 2021, the present mortgages had a mean value of debt of three.43% and had a weighted time period to maturity in extra of 10 years. The brand new acquisitions got here with the next mortgage price ticket and this pushed the typical value of debt to three.68% as of the tip of September.

I applaud Flagship for offering detailed breakdowns on its borrowing procedures as each new mortgage and mortgage is clearly documented. The phrases of the 2 new loans obtained throughout the third quarter appeared okay.

Flagship Communities Investor Relations

Certain, the rates of interest are greater, however Flagship has been capable of safe the rates of interest for 20 years. And through these 20 years, it ought to be capable of additional improve its web rental earnings and money flows.

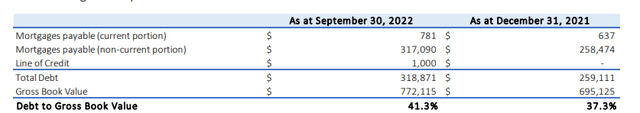

As of the tip of September, Flagship’s debt to gross guide worth was 41.3%. This didn’t embody the present money place, and I’m additionally undecided how the gross guide worth is a related metric. The guide worth of the funding properties was $754M and the web debt of $314M would signify an LTV ratio of 41.6%.

Flagship Communities Investor Relations

After all it’s additionally necessary to know how Flagship ended up with its $772M in asset worth. In keeping with the footnotes of the monetary statements, the REIT used a capitalization charge of 4.72% and for each 0.25% improve (there seems to be a typo within the sensitivity evaluation under because the ‘0.025%’ ought to be ‘0.25%’ and a rise within the capitalization charge ought to end in a lower of the truthful worth) the guide worth would lower by $40.4M. A rise of the capitalization charge to five.22% would thus trigger the guide worth to lower to $674M which might consequence within the LTV ratio rising to 46.6% (and that’s clearly nonetheless manageable).

Funding thesis

In November, the REIT hiked its month-to-month distribution to US$0.0468 per unit, for an annualized distribution of $0.562 per yr. Based mostly on the present share worth of $15.90, this represents a dividend yield of simply over 3.5%. That’s not excessive, however consider this represents a payout ratio of lower than 60% of the AFFO. This implies Flagship is at the moment retaining roughly $5-$6M per yr, which might be used to pursue further acquisitions on this extremely fragmented market.

Accessing multi-year mounted charge debt will additional enhance the monetary efficiency of Flagship as new communities will possible be acquired at greater capitalization charges to mirror the 4-5% value of debt nowadays.

Flagship’s closest competitor could be UMH Properties (NYSE:UMH) (for a latest evaluation of UMH Properties, take a look at Gen Alpha’s article) which is buying and selling at roughly 16 instances the 2023 FFO estimate of $0.99 per share. I’m Flagship from an AFFO perspective (and I count on $1.00-$1.02 in AFFO per share this yr) and the FFO per share ought to be a tad greater at roughly $1.10-$1.15 per share. If I’d use $1.12 per share and apply UMH’s a number of of 16.3 instances the FFO, Flagship’s truthful worth ought to be north of US$18. All the time work with restrict orders as a result of restricted liquidity in Flagship’s inventory.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.