PM Photographs

Indisputably, one of many largest issues confronted by People at the moment is the pervasive inflation that has each side of our society. This inflation is on the highest ranges that we’ve seen in additional than forty years and has precipitated actual incomes to say no for 41 straight months. As is likely to be anticipated, this has compelled many individuals to tackle second jobs or enter the gig financial system with the intention to get hold of the cash that’s wanted to pay their payments or cowl different bills. That is notably true amongst folks of restricted means that won’t have the flexibleness of their finances to deal with the rising bills for all the pieces.

Happily, as traders, we’ve different strategies that we will make the most of with the intention to get hold of the extra cash that we have to help ourselves. One of the vital efficient of those strategies is to buy shares of a closed-end fund (“CEF”) that focuses on the era of earnings. It is because these funds present quick access to a professionally-managed and diversified portfolio of belongings that may often ship a better yield than any particular person asset possesses.

On this article, we are going to talk about the PIMCO Excessive Revenue Fund (NYSE:PHK), which is one CEF that falls into this class. As of the time of writing, this fund boasts an 11.64% yield, so it definitely can present its traders with ample earnings to show anybody’s head. Sadly, any asset with a yield that prime is often surrounded by considerations that it’ll quickly be compelled to scale back the distribution. Thus, we should always examine the fund’s monetary state of affairs earlier than investing in it. As long-time readers might recall, I’ve mentioned this fund earlier than, however greater than a 12 months has handed since that point so clearly, a terrific many issues have modified. This text will due to this fact focus particularly on these adjustments in addition to present an up to date evaluation of the fund’s funds with the intention to decide if it might be an acceptable goal for funding at the moment.

About The Fund

Based on the fund’s webpage, the PIMCO Excessive Revenue Fund has the said goal of offering its traders with a excessive present earnings. That is hardly stunning for a PIMCO fund. PIMCO is usually thought of to be a fixed-income fund home and certainly it is a fixed-income fund. As I’ve famous in varied earlier articles, fixed-income securities are typically considerably missing in terms of their potential to generate capital positive factors. It is because these securities haven’t any direct hyperlink to the expansion and prosperity of the issuing firms. In spite of everything, an organization is not going to improve the rate of interest that it pays on its loans simply because its profitability will increase. As such, the worth of a bond or different fixed-income safety is not going to improve as the corporate grows and prospers. Reasonably, these securities commerce based mostly on rates of interest.

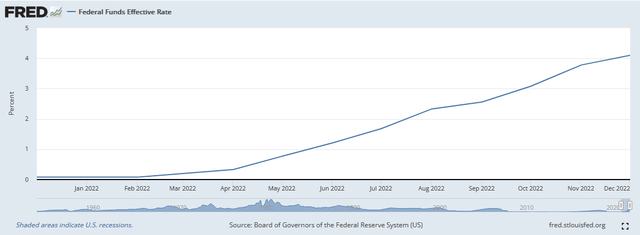

In brief, when rates of interest improve, bond costs lower, and vice versa. It is because the yield-to-maturity of current bonds wants to regulate to match that of newly-issued bonds with the intention to entice traders to buy securities within the secondary market. As everybody studying that is definitely nicely conscious, the Federal Reserve has been aggressively elevating rates of interest since March of 2022 in an effort to fight inflation. We will see this fairly clearly by trying on the benchmark federal funds price, which is the speed at which industrial banks lend to one another within the in a single day market:

Federal Reserve Financial institution of St. Louis

As we will see right here, the efficient federal funds price was 0.08% again in February 2022. It sits at 4.10% at the moment. This has definitely had an influence on bond costs, with the Bloomberg U.S. Combination Bond Index declining by 10.92% over the previous 12 months.

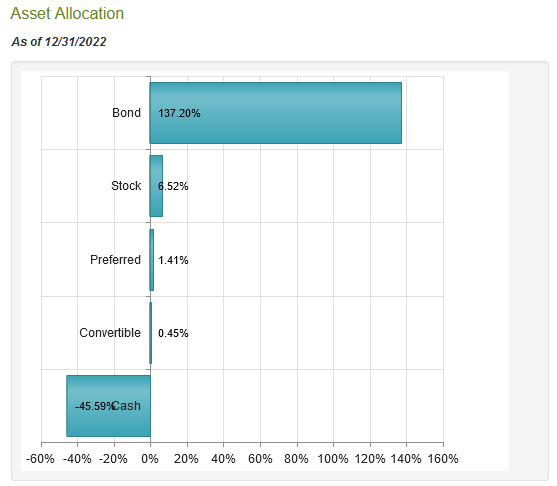

The PIMCO Excessive Revenue Fund has definitely not been spared from the weak point within the bond market. In spite of everything, the fund could be very extremely invested in bonds:

CEF Join

The fund is down 20.93% over the previous twelve months so it has underperformed the index. This isn’t precisely stunning since most bond funds have underperformed the index. One motive for that is that the PIMCO Excessive Revenue Fund makes use of leverage, which we are going to talk about later on this article. One more reason for that is that the fund has a 37.00% annual turnover, which is far greater than a comparable index fund. The explanation that this has an influence on the efficiency of the fund is that it prices cash to commerce bonds or different belongings. These bills are billed to the holders of the fund and thus create one thing of a drag on the portfolio’s efficiency. In spite of everything, administration must generate ample extra returns to each cowl these buying and selling prices and match the index.

There are only a few administration groups which can be in a position to efficiently do that over an prolonged interval, which is why actively-managed funds are inclined to underperform their comparable indices. The PIMCO fund clearly fails to match the efficiency of the mixture bond index, though it does have a a lot greater yield that reduces the efficiency disparity considerably.

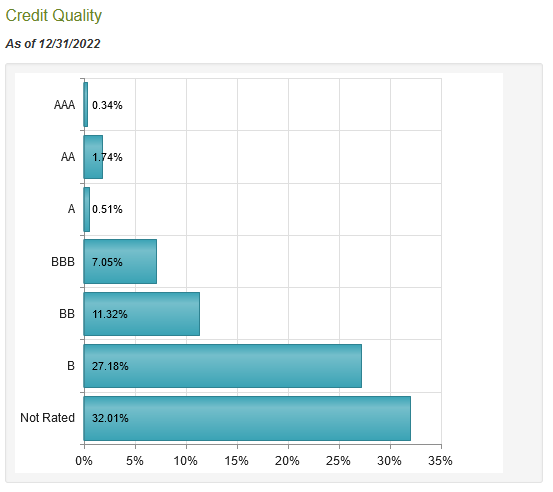

With that mentioned, the PIMCO Excessive Revenue Fund doesn’t spend money on the very same bonds because the Bloomberg U.S. Combination Bond Index so that isn’t an ideal benchmark for this fund. The PIMCO fund differs because it invests closely in high-yield bonds, that are what many traders name “junk bonds.” We will see this by trying on the credit score scores of the bonds within the fund’s portfolio. Right here they’re:

CEF Join

An investment-grade bond is something rated BBB or greater. As we will clearly see, that’s solely 9.64% of the portfolio. The overwhelming majority then consists of junk bonds. That is one thing that will concern risk-averse traders contemplating that we’ve all heard concerning the excessive threat of losses as a consequence of defaults that accompany these bonds. These are legitimate considerations, though admittedly the chance of default-related losses is just not as excessive as many within the media have led you to consider. Throughout the aftermath of the 2007-2008 monetary disaster, default charges hit 12% however they had been solely 3% in 2019. Thus, the stronger the financial system, the decrease the chance of default. Even that 12% quantity is decrease than what some folks may assume and thus typically the upper yield provided by these bonds is definitely greater than what is really wanted to compensate for the upper default threat. Within the case of this fund, we will see that 38.5% of the bonds have both BB or B scores. These are the 2 highest scores for speculative-grade bonds and are typically issued solely to these firms which have robust sufficient stability sheets to climate short-term financial shocks with out defaulting (see right here). Though there is likely to be some threat of losses throughout the fund’s portfolio throughout a chronic financial downturn, we’ve not had a type of because the Nice Melancholy in order that could be very a lot an unlikely occasion. General, the final dangers right here will not be as nice as they could at first seem.

One widespread methodology for a fund to scale back its threat of losses as a consequence of defaults is to carry a considerable variety of positions. It is because that situation ensures that any particular person firm solely accounts for a really small proportion of the portfolio. Thus, if any given firm had been to default, it might solely have a negligible influence on the portfolio that may rapidly be offset by the curiosity funds obtained from the opposite belongings. The PIMCO Excessive Revenue Fund at present has 373 positions so it’s definitely doing this.

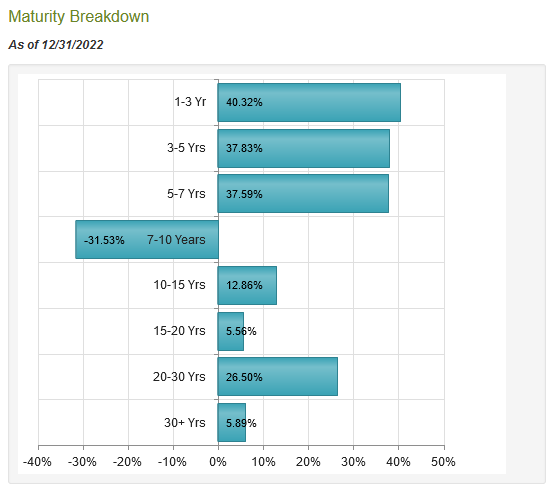

One main change from the final time that we appeared on the fund is that the fund has considerably modified its portfolio composition when it comes to period. We will see this right here:

CEF Join

The most important factor that we discover is that the fund has gone brief seven to ten-year bonds. That is most likely in response to the yield curve inversion that occurred in October of 2022. A yield curve inversion implies that the ten-year Treasury is promoting with a lesser yield-to-maturity than the three-month Treasury, which is an indication that the market expects the Federal Reserve to scale back rates of interest within the close to future. It’s thought of a warning signal of a recession since each single time that this has occurred prior to now, america entered a recession inside two years.

Admittedly, the prediction of a recession is unlikely to be a shock to anybody studying this, since each analyst and economist is predicting a recession in 2023. That makes this brief place very curious since a brief place signifies that the fund’s administration expects the value of the bonds to say no. That will push up their yields and thus repair the yield curve inversion. That situation is considerably unlikely if the Federal Reserve had been to chop its charges in response to a recession. The fund seems to be betting right here that there’ll both be no recession or that the Federal Reserve will proceed to hike charges in a recession, which is in stark distinction to the predictions of just about all people else out there. Will probably be curious to see how precisely this place performs out. The scale of it although might end in some pretty giant losses if the fund’s administration crew is incorrect on this.

Leverage

Within the introduction to this text, I said that closed-end funds just like the PIMCO Excessive Revenue Fund have the power to generate yields far in extra of these possessed by any of the underlying belongings within the portfolio. We additionally noticed in our description of the fund’s portfolio that it has a adverse money place. It is because the fund is using leverage, which is a typical technique meant to extend the yield of a portfolio. Principally, the fund borrows cash after which makes use of these borrowed funds to buy high-yield bonds. So long as the bought belongings pay a better yield than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly nicely to spice up the general portfolio yield. As a fund like this one is ready to borrow at institutional charges, that are considerably under retail charges, it will often be the case.

Nevertheless, the usage of leverage is a double-edged sword as a result of debt boosts each positive factors and losses. That is seemingly one motive why the fund has underperformed the mixture bond index to the diploma that it has. As such, we need to be certain that the fund is just not using an excessive amount of leverage since that may expose us to an excessive amount of threat. I don’t typically prefer to see a fund’s leverage exceed a 3rd as a proportion of its belongings for that reason. As of January 13, 2023, the PIMCO Excessive Revenue Fund had levered belongings comprising 31.59% of its portfolio. This can be a bit under the one-third degree that I prefer to see so this fund does seem like operating a fairly good stability between threat and reward. General, there’s little to complain about right here.

Distribution Evaluation

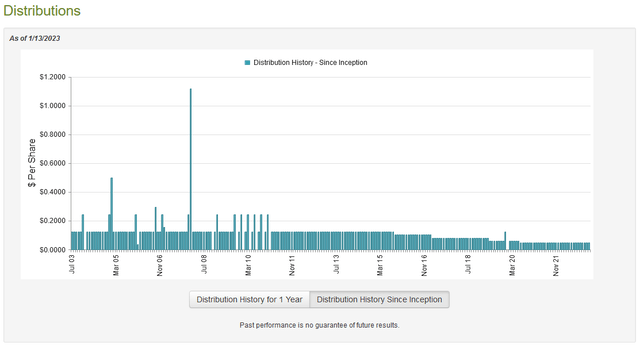

As said earlier on this article, the first goal of the PIMCO Excessive Revenue Fund is to offer its traders with a excessive degree of present earnings. In an effort to accomplish this, it invests in a portfolio that primarily consists of junk bonds after which leverages them up with the intention to enhance the yield of the portfolio. After we take into account that junk bonds themselves are inclined to have pretty excessive yields, we will seemingly assume that the fund itself may even have one. That is definitely the case, because the fund pays out a month-to-month distribution of $0.048 per share ($0.576 per share yearly), which provides it an 11.64% yield on the present worth. Sadly, the fund has not been notably constant about this cost and has, in reality, decreased it a number of occasions over its historical past:

CEF Join

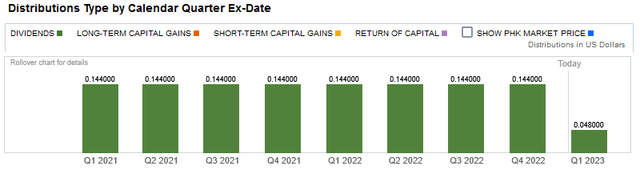

The truth that the fund’s historical past reveals typically constant declines over the previous half-decade or so is prone to be a little bit of a turn-off for any investor that’s in search of a protected and safe supply of earnings with which to make use of to pay their payments or cowl different bills. That is notably regarding for a bond fund contemplating that almost all of these years had been characterised by a reasonably robust bull market in bonds. Nevertheless, there could also be some consolation in the truth that the fund’s distributions are solely categorized as dividend earnings:

Constancy Investments

The explanation that this can be comforting is that dividend earnings is usually essentially the most sustainable type of distribution for a closed-end fund. It is because a return of capital distribution is usually a signal that the fund is returning the traders’ personal a refund to them. That is clearly not sustainable over any form of prolonged interval. A capital positive factors distribution, in the meantime, requires that the fund even have capital positive factors to distribute. That could be very tough to perform for a bond fund during times of rising rates of interest. A dividend distribution, in the meantime, is funded solely out of dividends and curiosity funds that the fund receives from its belongings so it’s theoretically rather more sustainable. Nevertheless, I’ve identified earlier than that it’s attainable for these distributions to be misclassified. As such, we should always examine the fund’s funds with the intention to decide how they’re truly being funded and sustainable they’re prone to be.

Sadly, we should not have an particularly current doc that we will seek the advice of for that function. The fund’s most up-to-date monetary report corresponds to the eleven-month interval that ended June 30, 2022 (it stretches from August 1, 2021, to June 30, 2022). As such, it should embody no information on how the fund carried out through the second half of final 12 months, which was seemingly a difficult time for it given the rising rate of interest surroundings. Nevertheless, it’s nonetheless a a lot newer doc than we had accessible the final time that we reviewed the fund and can nonetheless embody the primary couple of months of the Federal Reserve’s rising price regime. Throughout the eleven-month interval, the fund obtained a complete of $69.252 million in curiosity and $2.477 million in dividends from the investments in its portfolio. This offers the fund a complete earnings of $71.729 million through the interval. The fund paid its bills out of this quantity, leaving it with $63.684 million accessible for the shareholders. This was sadly not sufficient to cowl the $71.078 million that the fund truly paid out through the interval, which is definitely regarding.

The truth that the fund didn’t cowl its distributions is an indication that the distributions had been in reality not solely dividends, though its annual report is certainly classifying them in that method. This isn’t a case of dividends earned in earlier years being paid out, both, as a result of the fund’s distributions have exceeded its internet funding earnings throughout every of the previous three years:

FY 2022

FY 2021

FY 2020

Internet Funding Revenue

$63.684

$74.602

$85.274

Distributions Paid

$71.078

$76.790

$93.463

Click on to enlarge

(All figures in hundreds of thousands of U.S. {dollars})

Though the fund didn’t cowl its distributions by means of internet funding earnings, it nonetheless has the potential to cowl them by means of different means. In spite of everything, the fund may need capital positive factors that it might use to finance the distribution. As is likely to be anticipated from the Federal Reserve’s establishment of a financial tightening coverage, the fund failed to perform this through the interval. It had internet realized positive factors of $104.357 million through the eleven-month interval however this was offset by internet unrealized losses of $258.669 million. General, the fund’s belongings declined by $152.352 million through the interval after accounting for all inflows and outflows.

With that mentioned, PIMCO Excessive Revenue Fund did handle to earn sufficient in internet funding earnings and internet realized positive factors to cowl the distribution. Thus, the state of affairs might not be as unhealthy because it appears. Nevertheless, the fund’s belongings are down significantly since August 1, 2019, in addition to down since August 1, 2020, so it does seem that it can not truly preserve the distribution and might have to chop the distribution within the close to future. This explains why the present yield of the fund is so excessive as any yield over 10% is an indication that the market expects a distribution lower within the close to future.

Valuation

It’s all the time important that we don’t overpay for any asset in our portfolios. It is because overpaying for any asset is a surefire technique to generate a suboptimal return on that asset. Within the case of a closed-end fund such because the PIMCO Excessive Revenue Fund, the standard technique to worth it’s by trying on the fund’s internet asset worth. The online asset worth of a fund is the overall present market worth of the entire fund’s belongings minus any excellent debt. It’s due to this fact the quantity that the fund’s shareholders would obtain if the fund had been instantly shut down and liquidated.

Ideally, we need to buy shares of a fund after we should buy them at a worth that’s lower than the fund’s internet asset worth. It is because such a situation implies that we’re buying the fund’s belongings for lower than they’re truly price. That’s sadly not the case with this fund at the moment. As of January 13, 2023 (the latest date for which information is at present accessible), the PIMCO Excessive Revenue Fund had a internet asset worth of $4.70 per share however the shares truly commerce for $4.95 per share. This offers the fund’s shares a 5.32% premium to the web asset worth. This can be a very costly worth to pay for this fund, particularly contemplating that the shares have traded for a 1.94% premium on common over the previous month. It, due to this fact, can be prudent to attend for some time and see if a extra enticing entry worth presents itself.

Conclusion

In conclusion, PIMCO is undoubtedly one of many best-known and most-renowned fund homes for bond traders. As such, it might not be stunning to study that the PIMCO Excessive Revenue Fund definitely seems to be like a strong bond fund on the floor. It’s extremely well-diversified and may pose a really minimal threat of losses as a consequence of defaults regardless of investing closely in junk bonds.

Nevertheless, PIMCO Excessive Revenue Fund could also be taking up some speculative threat with the brief place in seven-to-ten-year bonds that might end in losses. As well as, the fund is failing to cowl its distribution and has seen its asset values decline so it might be compelled to chop the distribution within the close to future with the intention to preserve the dimensions of its portfolio.

PIMCO Excessive Revenue Fund additionally seems to be pretty costly proper now. General, whereas PIMCO Excessive Revenue Fund does definitely have some redeeming qualities, it seems to be like it’s most likely finest to take a seat on the sidelines for a bit and monitor the fund for a greater entry place.