Sundry Pictures

Uber Applied sciences, Inc. (NYSE:UBER) has recovered from its June/July lows, as we urged buyers to disregard the pessimism.

Nonetheless, UBER has didn’t make sustained positive aspects since forming its September highs, which subsequently noticed UBER pulling again almost 35% to its October lows. It is a stark reminder for brand spanking new UBER buyers to abstain from chasing momentum spikes, usually “disguised” as alternatives for astute market operators to take earnings/lower publicity.

However, we imagine the market setting has continued to enhance for Uber since its Q3 earnings card.

Administration highlighted its confidence in its Q3 commentary that shopper spending remained sturdy. As well as, the latest earnings commentary from the main US banks has continued to corroborate sturdy shopper spending, regardless of the prospects of a downturn later this 12 months.

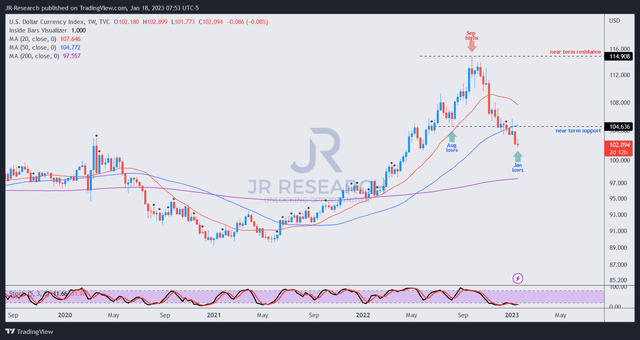

DXY worth chart (weekly) (TradingView)

Furthermore, the foreign exchange headwinds that hampered Uber considerably in 2022 have abated markedly. The Greenback Index (DXY) has declined greater than 11% from its September highs, as market operators anticipate a much less hawkish Fed in 2023.

Notably, DXY bulls didn’t assist its worth motion above its pivotal 50-week transferring common or MA (blue line), suggesting that DXY’s medium-term bullish bias is probably going over. Therefore, we imagine it forebodes effectively for Uber, given the affect on its This fall outlook it promulgated beforehand. Accordingly, administration indicated an “anticipated 7 share level YoY forex headwind” to its gross bookings steering.

With the DXY dropping to lows final seen in June 2022, it ought to present a welcome uplift for Uber’s This fall and FY23 outlook.

Regardless of that, the corporate remains to be mired in a latest lawsuit with New York Metropolis’s Taxi and Limousine Fee (TLC). Nonetheless, Uber prevented the TLC from instituting a worth hike because it argued the fee’s methodology was “flawed.” Nonetheless, the choose overseeing the case inspired the TLC to return with an improved foundation to justify its hikes appropriately. Therefore, buyers ought to proceed to pay shut consideration to the developments.

Uber is not new to such regulatory challenges, with the newest ones involving the classification of gig economic system employees, as mentioned in its Q3 earnings commentary.

As such, buyers have to assess whether or not the regulatory panorama may favor Uber’s means to proceed scaling constructively towards its FY24 adjusted EBITDA goal of $5B.

The impetus for the corporate to proceed scaling up should not be understated. Accordingly, UBER final traded at an NTM EBITDA a number of of almost 23x or an NTM P/E of 87x. Due to this fact, it ought to be clear {that a} vital stage of ahead working leverage has been baked into its valuation.

Regardless of the continuing regulatory challenges, we imagine investor focus stays on the corporate’s means to navigate a difficult macro panorama. We imagine Uber’s management within the ride-hailing house ought to proceed to assist it acquire market share within the supply phase because it penetrates additional with its Uber One membership program.

Consequently, we imagine the corporate’s confidence in its means to proceed increasing its 10M membership base is well-placed. Furthermore, its smaller supply opponents have been hampered by price rationalization initiatives as funding campaigns dried up because of the hawkish Fed and market volatility.

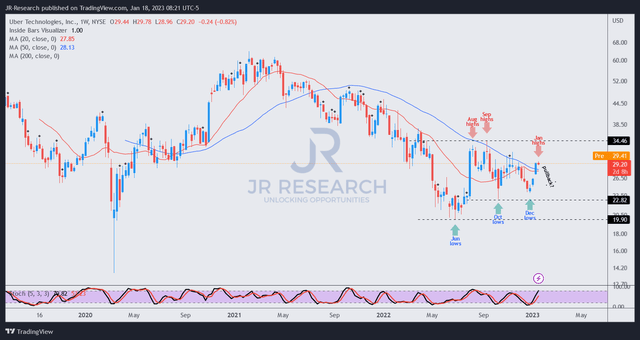

UBER worth chart (weekly) (TradingView)

UBER stays mired in a medium-term downtrend, however inexperienced shoots of restoration have continued to kind.

We imagine its June lows is not going to doubtless be retaken, as essential headwinds (macro, foreign exchange, shopper spending) that impacted its working efficiency are anticipated to weaken additional. Whereas regulatory challenges stay a tail danger, we’re constructive over UBER’s worth motion.

Regardless of that, UBER has already recovered markedly from its December lows, resembling one other momentum spike we cautioned about earlier.

Buyers contemplating including publicity ought to stay affected person and wait for one more pullback first.

Score: Maintain (Reiterated).