Panorama Pictures

Small-Cap Shares vs. Giant-Cap Shares in 2023

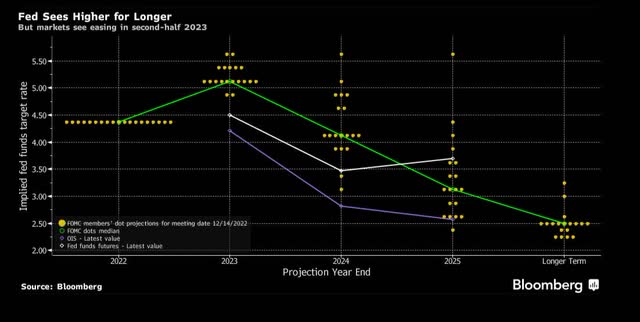

Uncertainty within the markets, coupled with the Fed’s coverage steering, has prompted many buyers to fret about development prospects in 2023 and potential funding alternatives. Though retail gross sales fell 1.1%, and rents skilled a slight uptick of 0.8% month-over-month, the markets within the first 2-weeks of the yr have reacted favorably, regardless of Fed officers emphasizing that charges will stay above 5%.

FED’s December 2022 Dot Plot

FED’s December 2022 Dot Plot (Bloomberg)

With small-cap shares on the transfer, we’re specializing in getting in on the motion by shopping for a couple of low-cost shares with small market caps. Whereas shares beneath $10 are sometimes small-cap, I’ve additionally included three shares beneath $10 with massive market caps. I’m impartial by way of large- versus small-cap shares, but when we see one other leg down, small-cap shares might dump greater than large-cap, presenting a chance to purchase the dip. Long run, if we see one other reversal after the downturn or this present uptrend, we’re experiencing in 2023 holds, the anticipated return on the small-cap might count on to be higher than the large-cap.

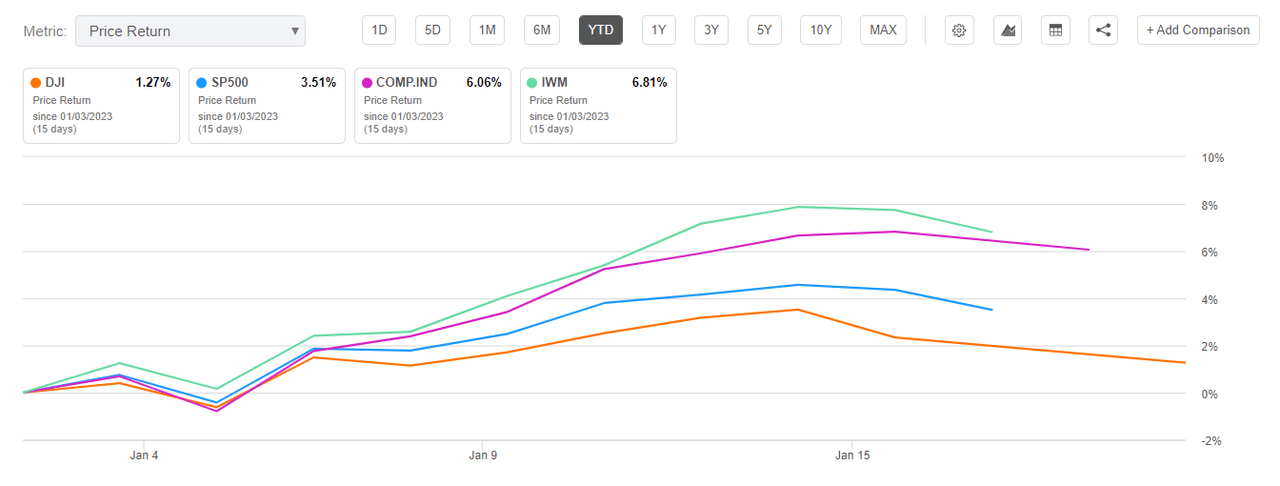

Small-Cap Shares Outperform YTD to Kick-off 2023

Small-Cap Shares Outperform YTD to Kick-off 2023 (SA Premium)

For over a decade, small-cap shares have outperformed large-caps. To start out the brand new yr, iShares Russell 2000 ETF (IWM) is up 6.81%, outperforming the large-cap shares YTD, as evidenced within the chart above, and small-caps are very engaging on a valuation foundation. Usually smaller-sized corporations with market capitalization between $300 million and $2B are typically among the extra dangerous fairness courses. In diversifying even additional, my favourite picks for this text are all overseas shares, quant-rated Sturdy Buys, and chosen and sorted by market caps $1B or higher utilizing a display screen referred to as High Shares Underneath $10. Whereas I typically don’t suggest shares beneath $10, the important thing to sensible investing is figuring out shares that possess robust fundamentals and, on this case, with low costs.

5 Low-cost Worldwide Shares Underneath $10 To Make investments In

Excessive inflation and adverse macroeconomic components make investing within the present surroundings troublesome. Fluctuating currencies, excessive inflation, and rates of interest pose challenges to many corporations. As a result of small-cap corporations have a tendency to not be as worthwhile as bigger ones, they sometimes undergo excessive development durations and possess larger leverage. In rising charge environments, this may pose issues to smaller corporations with numerous leverage, as they have an inclination to dump sharply when rising rates of interest are threatened. Think about worry of slowdown, recession, or contraction; small-cap shares sometimes dump extra from a day-to-day buying and selling perspective than massive caps.

As a result of globalized economies are in a rut attributable to inflation, now could also be a superb time to hunt out bargains, particularly worldwide shares and/or rising markets which have the potential to ship upside over the long run. During times of downturn, cut price looking for engaging shares together with collective monetary traits like valuation, development, EPS revisions, profitability, and momentum can repay handsomely.

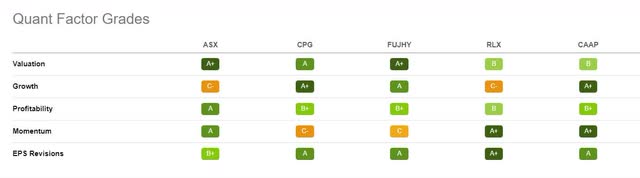

Every Inventory Has High Quant Grades On Elementary Elements

Every Inventory Has High Quant Grades On Elementary Elements (SA Premium)

Constancy’s Asset Allocation Analysis Crew forecasts that:

“Worldwide shares will outperform US shares over the following 20 years. Certainly, they count on even mature, developed markets resembling Europe to outperform the US over that point. These forecasts mirror the expectation that spending by shoppers in EM international locations might be a significant supply of financial development and earnings for corporations over the following 20 years. EM shares are estimated to be among the best-performing shares over that point partly as a result of many EMs have comparatively younger and rising populations whose incomes will rise as their economies develop. India, for instance, already boasts a higher variety of households with disposable revenue of greater than $10,000 than does Japan. The expansion of those home client markets is a key motive why Constancy’s Asset Allocation Analysis Crew forecasts that EMs will develop to comprise about half of worldwide gross home product in 20 years, in contrast with about 40% now and 25% 20 years in the past.”

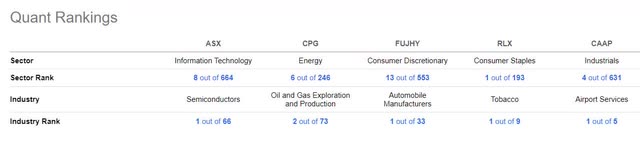

Every of Our Picks Quant Ranks At or Close to #1 In Their Trade

Every of Our Picks Is At or Close to #1 In Their Trade On A Quant Rating (SA Premium)

With this in thoughts, together with our evaluation showcasing the important qualities present in my prime 5 worldwide shares beneath $10, take into account these robust purchase shares for a portfolio in 2023.

1. ASE Expertise Holding Co., Ltd. (NYSE:ASX)

Market Capitalization: $14.26B

Quant Ranking: Sturdy Purchase

Worth (as of 1/18/23): $7.11 per share

Quant Sector Rating (as of 1/18/23): 8 out of 663

Quant Trade Rating (as of 1/18/23): 1 out of 66

Connecting the digital technology, ASE Expertise Holding Firm provides superior semiconductor packaging and testing, together with 3D and flip chip ball grid array (BGA). With the developments in 5G and sensible digital purposes, ASX provides digital design and manufacturing providers (EMS) and complicated integration, together with the event of engineering checks, wafer probing, modules, and supplies, to call a couple of. Headquartered in Taiwan, ASX additionally has amenities globally and employs greater than 95,000 worldwide. Given the recognition of semiconductors and robust demand, it is smart that ASX has managed to develop regardless of market volatility. Buying and selling at an excessive low cost with bullish momentum, ASX is a tech inventory primed for a portfolio.

ASE Expertise Inventory Valuation & Momentum

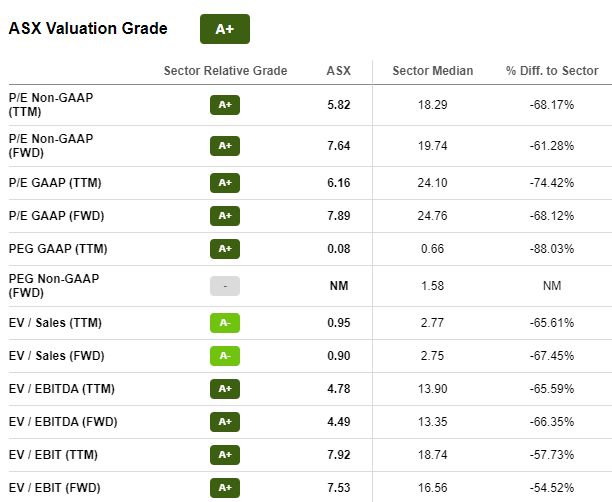

Buying and selling beneath $10/share, ASX is strongly bullish, with buyers actively buying shares to drive the value larger, with many analysts calling the inventory overbought. Though the inventory is -7.54% over the past yr, it beat the sector and S&P 500, and the inventory is on an uptrend, beginning the brand new yr +13% YTD. ASE Expertise’s ahead P/E ratio is 7.89x in comparison with the sector median of 24.76x, almost 70% under the sector median; the trailing PEG ratio is powerful at 0.08x, an -88% distinction to the sector.

ASX Valuation (SA Premium)

Regardless of geopolitical considerations and an surroundings riddled with provide chain constraints, ASX produced strong earnings, maintained free money move, and elevated its dividend. With bullish momentum, the inventory’s six-month price-performance is up 1,390%. As we await the official This fall 2022 Earnings figures being launched at month-end, preliminary December internet income is down roughly 19.2% Y/Y. Nonetheless, FY revenues are up 10.7%. Though there are provide scarcity constraints and dangers which have affected the trade as an entire, there are numerous execs to contemplate if including ASX to a portfolio that may function tailwinds to assist its development and profitability.

ASX Progress & Profitability

Regardless of the worldwide recession threat in 2023, the bulls and my quant rankings point out ASX is a robust purchase, and bettering provide chains can function tailwinds. Regardless of forex fluctuations and better prices amid an unfavorable macro surroundings, ASX was capable of offset the impacts given its native forex depreciation and passing larger prices off onto shoppers. Final yr was tough on many shares, particularly tech, and ASX bottomed in early July, buying and selling at $4.45 however has managed to get better, buying and selling close to its 52-week excessive of $7.82.

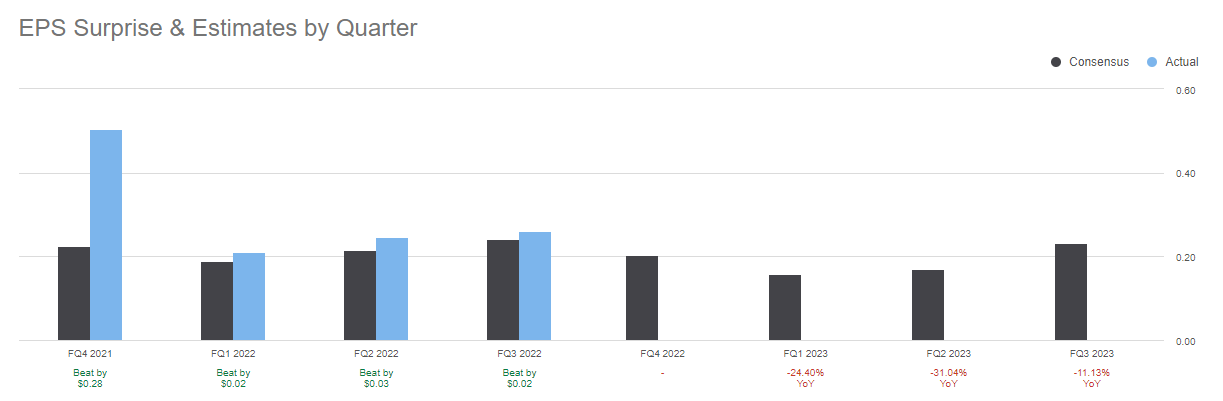

ASE Expertise EPS

ASX Inventory EPS (SA Premium)

Though we’re awaiting This fall earnings that will not be as strong as its most up-to-date consecutive top- and bottom-line earnings beats, ASE Expertise showcases continued power and momentum and document ATM enterprise revenues for Q3.

Third quarter EPS of $0.26 beat by $0.02, and income of $5.88B beat by $290.30M (8.5% Y/Y). Regardless of the slowing enterprise surroundings, ASX’s general profitability elevated, and it managed to ship document income and working earnings for each ATM and EMS enterprise models. Providing an ‘A’ Profitability grade, a strong steadiness sheet, and almost $3B in money from operations, ASX is ready for a possible slowdown or “normalized pricing surroundings” for 2023. When requested about subsequent yr and the corporate’s stock controls and pricing, ASE Expertise’s CFO, Joseph Tung, states:

“It’s going to be a normalized pricing surroundings. And there might be value hikes all year long. Our place does give us higher pricing functionality once we begin the negotiation course of, and we consider that we’ll have the potential to give you an acceptable pricing technique that works for each ourselves and our clients. We do consider, and we stay very assured, that the margin that we’re going to have will transfer up from beforehand between cycles, 20% to 25%, now to mid-20 % to 30%. So we stay assured that we’ll have a structural margin enchancment.”

With anticipated development and higher revenue margins, ASX provides robust fundamentals in a preferred trade used for on a regular basis merchandise worldwide, substantiating its Sturdy Purchase score.

2. Crescent Level Vitality Corp. (NYSE:CPG)

Market Capitalization: $4.02B

Quant Ranking: Sturdy Purchase

Worth (as of 1/18/23): $7.21 per share

Quant Sector Rating (as of 1/18/23): 6 out of 246

Quant Trade Rating (as of 1/18/23): 2 out of 73

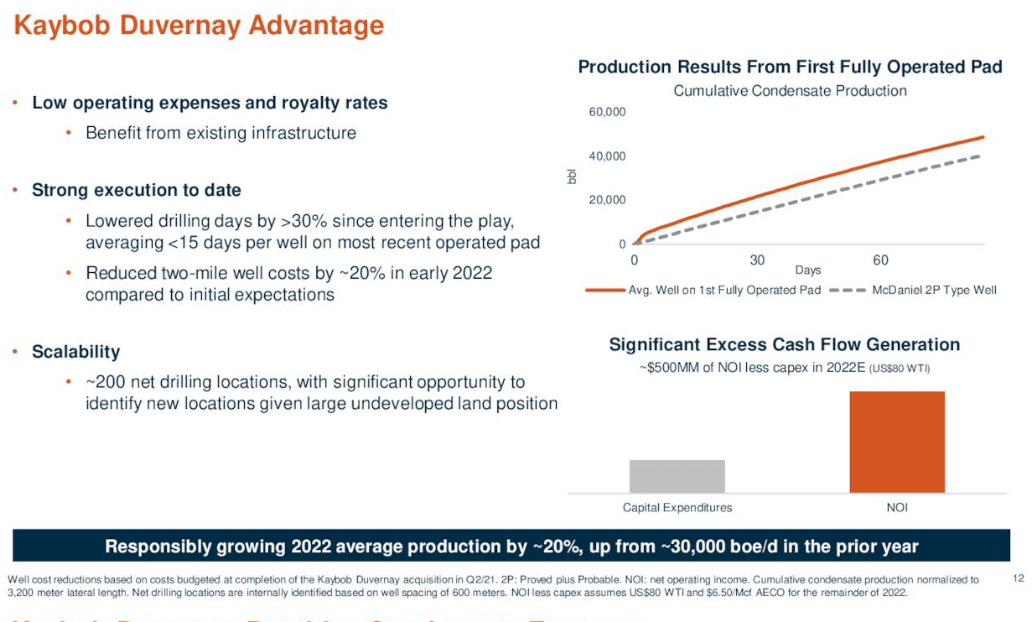

Crescent Level Vitality Corp. has been certainly one of my prime power shares since early 2022, providing super metrics, upside within the sector, development, and money move. A Canadian-based crude oil and pure gasoline firm in western Canada, CPG, is drilling house the outcomes. Providing high-return assets and producing vital extra money move is estimated to succeed in $1.25B in 2023 at $80 WTI based mostly on annual manufacturing of 138,000 to 142,000 boe/d. CPG’s third-quarter success led to a particular dividend of CAD 0.035 (USD .026) per share along with its common CAD 0.08 dividend, and Crescent Level raised its full-year CAPEX outlook.

CPG’s acquisition of Shell Canada Vitality’s Kaybob Duvernay property has supplied vital extra money move and alternative for development, profitability, and dividend yields.

Kaybob Duvernay Manufacturing Particulars (CPG Investor Presentation)

The preliminary acquisition was so profitable that CPG just lately introduced an extra 130 Kaybob internet places. The addition will improve its base dividend by 25%, returning vital capital to shareholders, together with 50% discretionary extra money move.

“We proceed to generate robust full cycle returns from our Kaybob Duvernay property, that are prime quartile inside our general portfolio. By way of this acquisition, we’re rising our drilling stock within the play to over 20 years based mostly on present manufacturing. As well as, our land place will improve to roughly 400,000 internet acres. We’re additionally including base manufacturing with an estimated internet current worth of roughly $200 million at present strip commodity costs. The acquisition contains a lovely ESG profile in step with our current Kaybob Duvernay property, together with low emissions depth and minimal asset retirement obligations,” stated Craig Bryksa, President and CEO of Crescent Level.

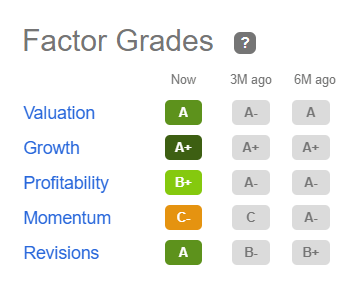

I selected this inventory as a result of it has robust issue grades, which charge funding traits on a sector-relative foundation. Along with robust development and profitability grades, CPG is undervalued, highlighted in its valuation framework. With an ‘A’ valuation grade, CPG is buying and selling greater than 70% under its sector, with a ahead P/E ratio of two.49x and a robust ahead EV/EBITDA. Beneath, the Progress and Revisions Grades point out that CPG has glorious potential and is basically sound in comparison with the sector. With A+ Progress and A+ Earnings Revision, CPG is likely one of the fast-growing corporations in its sector.

CPG Issue Grades

CPG Inventory Issue Grades (SA Premium)

Not solely have there been 5 upward analyst revisions over the past 90 days and 0 downward, as power costs stay elevated and CPG maintains $1.52B money on the sidelines. Take into account using the momentum of this inventory thought-about strongly bullish, as buyers actively purchase shares, leading to analysts calling the inventory overbought.

3. Subaru Company (OTCPK:FUJHY)

Market Capitalization: $11.92B

Quant Ranking: Sturdy Purchase

Worth (as of 1/18/23): $7.94 per share

Quant Sector Rating (as of 1/18/23): 13 out of 553

Quant Trade Rating (as of 1/18/23): 1 out of 33

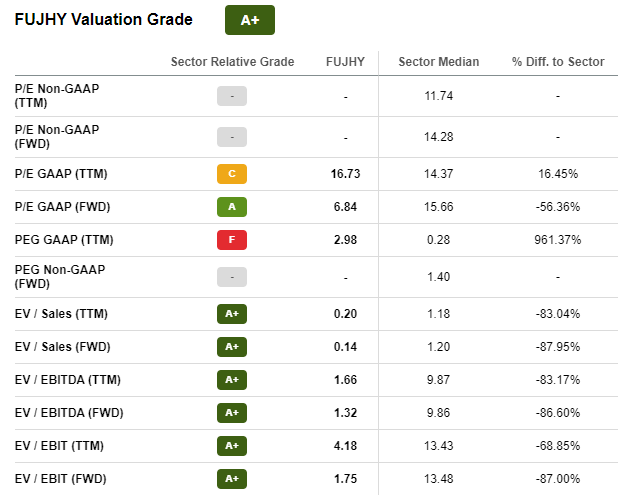

The car trade has been on fairly the rollercoaster experience for the reason that pandemic. Rallying to highs on the heels of demand that producers couldn’t sustain with, adopted by lows amid semiconductor shortages, lockdowns, and macroeconomic components which have nonetheless not totally labored themselves out. However Subaru Company has remained resilient. Regardless of falling 15% over the past yr, the inventory stays quant-rated a robust purchase. Subaru trades at a major low cost, showcasing an A+ general valuation grade. Ahead P/E ratio is 6.84x, a greater than 56% low cost to the sector, ahead EV/Gross sales and EV/EBIT with greater than 87% reductions to its sector friends, and bullish momentum.

FUJHY Valuation Grade (SA Premium)

Providing robust financials that embrace a internet money place 50% over the market cap (as of November 4, 2022), manufacturing and revenue will increase are anticipated to proceed into the brand new yr. The Japanese model, identified for high quality and reliability, is anticipated by analysts to have robust income development for 2023 and 2024 and projected income for FY23 of 38% and 10% for FY2024.

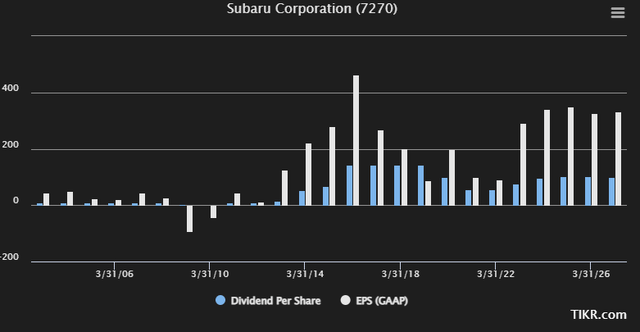

Consolidated income for Q2 FY23 elevated 30.5% Y/Y, with earnings rising almost 51% Y/Y. And as world economies anticipate slowing, which might result in decreases in gross sales and client discretionary spending, Subaru has displayed indicators that they’re vulnerable to slicing their dividend. Just a few phrases on their unstable dividend historical past. Looking for Alpha likes to alert buyers when an organization’s dividend is vulnerable to performing badly by displaying a warning banner.

Subaru has historically supplied an inconsistent semi-annual dividend, so in case you’re searching for an organization explicitly providing an everyday dividend cost, take into account our High Rated Quant Dividend Shares. However, as Wolf Report writes,

“The corporate’s shareholder dividend has been an fascinating story to observe – and it is one which’s probably to enhance for the following few years in case you’re to consider the analysts forecasting the enterprise. As you’ll be able to see, latest outcomes for the corporate have been constructive – and 2022 might be a down yr, however 2023 forecasts are considerably higher. Different analysts’ forecasts and the corporate’s quarterlies have been consistent with these expectations.”

Subaru EPS/Dividends (TIKR.com)

Regardless of ongoing provide chain challenges, Subaru has proven continued power. It’s guided by and capitalizes on making constructive impacts on the earth and markets to its group dedication, which in flip aids in its car gross sales that skilled an +11% bounce in December, constructing the case for a robust purchase firm for 2023.

4. RLX Expertise Inc. (RLX)

Market Capitalization: $4.04B

Quant Ranking: Sturdy Purchase

Worth (as of 1/18/23): $2.59 per share

Quant Sector Rating (as of 1/18/23): 1 out of 193

Quant Trade Rating (as of 1/18/23): 1 out of 9

RLX Expertise Inc., along with its subsidiaries, is a Chinese language e-vapor product firm that researches, develops, and sells tobacco merchandise. Whether or not there’s a recession or no recession, a slowdown is anticipated for 2023, and folks use tobacco merchandise in good and dangerous instances. Providing robust fundamentals and a $2.2B money hoard, RLX is a robust purchase consideration for portfolios undervalued at a mere $2.59 per share.

RLX Valuation & Momentum

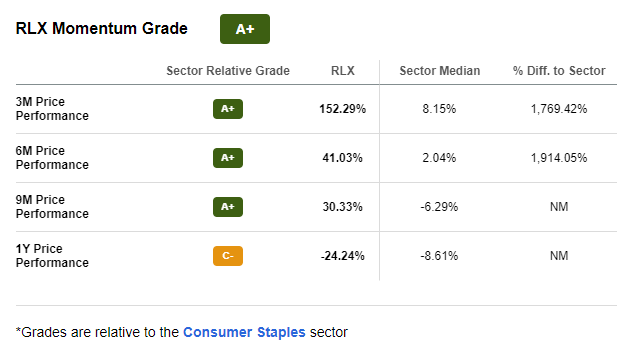

With a ahead P/E ratio of 16.67x versus 20.93x and trailing PEG of 0.15x in comparison with the sector median of 0.65x, RLX trades at a reduction and provides bullish momentum. Though the inventory’s one-year value efficiency is -30%, it’s on an uptrend, with a six-month value efficiency of +35%. The momentum grade under exhibits that RLX outperforms its sector median friends quarterly.

RLX Momentum Grade (SA Premium)

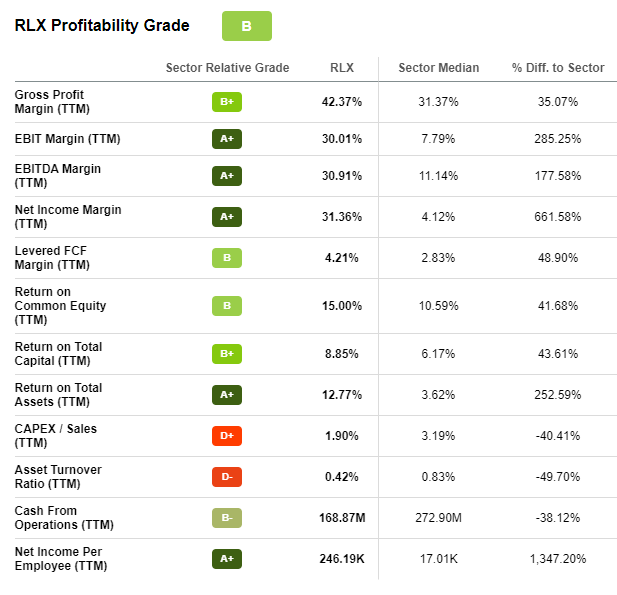

Though vaping comes with well being dangers, from an funding stance, there are additionally authorized points, warning labels, taste banning, and general regulation and taxation, to be thought-about when investing in e-cigarette corporations. It has expanded its product portfolio and geographies to alleviate among the c consumption tax that may have an effect on RLX. RLX has additionally improved operational effectivity and requirements by discontinuing older merchandise to fulfill rules. General strategic adjustments have resulted in a 30.9% quarter-over-quarter lower in non-GAAP working bills and Q3 internet revenues of RMB 1.0B (USD ~$150M).

RLX Inventory Profitability (SA Premium)

Sturdy development and profitability grades delivered Q3 gross margins of fifty% in comparison with the identical interval final yr of 39.1%. As RLX Chief Monetary Officer Chao Lu states:

“We stay assured that our enterprise’s resilience and operational excellence will empower us to navigate the challenges as we discover new alternatives for development and growth. In the meantime, we consider all trade members throughout the worth chain will work collectively to beat this difficult time and adapt to the paradigm of the brand new period.”

With China’s smoking charge above 25% and people who smoke persisting globally, RLX is a novel client staple with robust general metrics, together with my closing choose from Luxembourg, Corporación América Airports S.A.

5. Corporación América Airports S.A. (CAAP)

Market Capitalization: $1.59B

Quant Ranking: Sturdy Purchase

Worth (as of 1/18/23): $9.88 per share

Quant Sector Rating (as of 1/18/23): 4 out of 631

Quant Trade Rating (as of 1/18/23): 1 out of 5

Headquartered in Luxembourg and working 53 airports in six international locations throughout Latin America and Europe, Corporación América Airports S.A. is a number one personal airport operator by way of its subsidiaries. Regardless of the bouts of negativity surrounding airways and the trade for the reason that pandemic, CAAP is on a bullish pattern, with a 200-day transferring common that’s upward-sloping. Not solely is the inventory’s bullish momentum inflicting buyers to buy shares actively, however CAAP’s passenger visitors can be at 87.4% of pre-pandemic ranges, which included a 34.5% Y/Y improve in November.

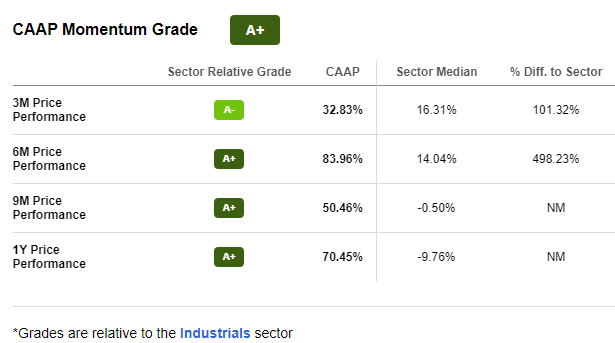

CAAP Inventory Momentum Grade (SA Premium)

CAAP is buying and selling close to its 52-week excessive of $10 however comes at a reduction with a ahead P/E ratio of 12.51x, a -35.02% distinction to the sector. Though CAAP’s ahead Worth/Gross sales is a modest 1.13x in comparison with 1.32x, based mostly on present revenues, CAAP is showcasing the power for super upside. As Market writer Ian Bezek writes:

“CAAP goes to provide greater than $1.5 billion of revenues in 2023 in opposition to a market cap of $1.4 billion. Over the long term, airports are inclined to earn not less than 50% EBITDA margins and may get near 70% with succesful administration and favorable concession agreements. Airports are pure monopolies and have constantly grown at a number of instances world GDP…CAAP inventory continues to be profoundly mispriced at $9. Admittedly $9 is a barely much less egregious valuation than $6 final quarter or $2/share again in 2020. However that is nonetheless a worldwide airport empire promoting at far under any affordable calculation of its honest worth immediately, to say nothing of the place it is going to be as its development tasks and acquisitions bear fruit.”

CAAP Inventory Progress & Profitability

CAAP posted document ranges of strong top-and-bottom-line outcomes for Q3 2022. Along with a 78.6% Y/Y improve in passenger visitors that reached 18.7M, CAAP’s consolidated revenues of $395.5M was a whopping 111.6% Y/Y improve. Adjusted EBITDA of $131M was pushed by success throughout enterprise models and geographies. As post-pandemic restoration continues, CAAP workers anticipates will increase in passenger visitors throughout all airports. They may give attention to including extra routes for worth creation and in search of higher funding alternatives. The place the inventory is +72% over the past yr, it continues upward, +13% YTD. With glorious issue grades and an trade primed for restoration, Corporación América Airports could also be flying excessive in 2023, together with our earlier 4 picks.

Take into account 5 Low-cost Shares Underneath $10

Like U.S. shares, worldwide corporations have been affected by excessive inflation, rising rates of interest, geopolitical considerations, and slowing financial development. Along with the struggle in Ukraine, additional challenges embrace potential rising headwinds from China, lower-than-expected earnings from corporations across the globe, provide chain points, unstable power costs, and central financial institution tightening. As a result of these points are well-known, most of the components could also be discounted within the small-cap phase, and this may increasingly result in bargains within the new yr.

For my part, undervalued small-cap shares with robust development potential can supply upside within the new yr. And though some small caps have fewer earnings on the books in comparison with massive caps, these with robust funding fundamentals and strong steadiness sheets, as showcased by our Quant System, can supply the risk-reward wanted for portfolios. NWG, CPG, FUJHY, RLX, and CAAP are 5 distinctive corporations that will assist to diversify your portfolio into the brand new yr. If worldwide shares don’t suit your threat tolerance, you’ll be able to select from many extra High Shares Underneath $10.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.