JHVEPhoto

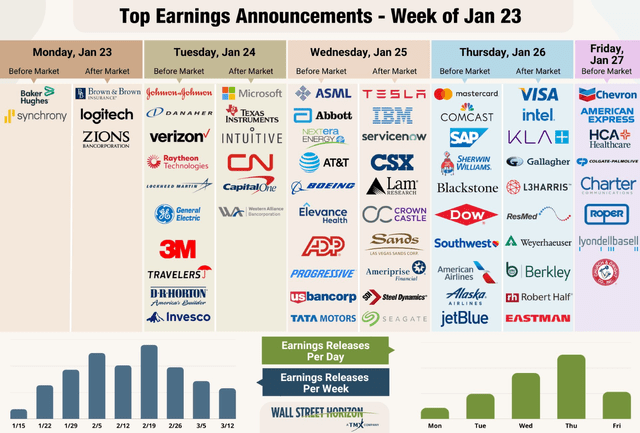

Earnings season rolls on. The week of Jan. 23 contains a various vary of industries reporting This fall outcomes earlier than the foremost market cap companies’ earnings cross the wires late this month and in early February. To date, mixture earnings are verifying about 4% forward of expectations, however the firm beat price is just not significantly spectacular. Wall Avenue bulls hope that this previous quarter will not be the primary unfavourable YoY earnings development interval since Q3 2020 – will probably be an in depth name, it seems.

One under-the-radar capital markets inventory stories on Tuesday, and I see improved circumstances for the asset supervisor.

Earnings Forward

Wall Avenue Horizon

In response to Financial institution of America International Analysis, Invesco (NYSE:IVZ) is a worldwide asset supervisor with over $1.5Tn in AuM and greater than 8,000 staff globally with a presence in over 20 nations. The corporate gives funding administration companies to institutional and retail purchasers throughout completely different asset lessons together with mounted revenue, fairness, options, balanced/multi-asset, and cash market funds. In October 2020, activist investor Trian Fund Administration (Trian) introduced that it has acquired a 9.9% stake in Invesco.

The Georgia-based $8.7 billion market cap capital markets trade firm inside the Financials sector trades at a low 9.3 trailing 12-month GAAP price-to-earnings ratio and pays a excessive 4.0% dividend yield, in line with The Wall Avenue Journal.

The agency’s AuM slipped 2% in December, as reported earlier this month, and simply earlier than that launch, UBS minimize its score on IVZ to impartial whereas DB has a maintain, too, on shares. Elsewhere within the sell-side house, Wells Fargo is bullish on the capital markets firm.

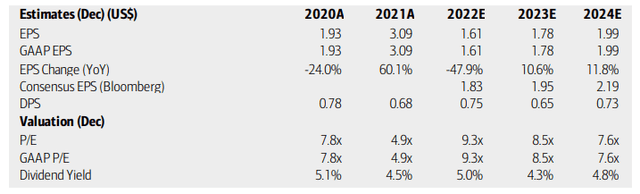

On valuation, analysts at BofA see earnings having fallen by an enormous 48% final 12 months, however then recovering to a strong 10% to 12% development price within the subsequent two years. The Bloomberg consensus is extra sanguine in comparison with BofA’s outlook. Dividends, in the meantime, are seen as falling this 12 months to $0.65 on an annualized foundation however then bumping up in 2024. After a bruising decline, shares now seem decently priced, with each IVZ’s working and GAAP P/Es within the single digits (the newest print on In search of Alpha exhibits an 11.5 ahead working earnings a number of).

With double-digit development and a single-digit P/E, the PEG is round or slightly below 1, which is engaging. Invesco’s price-to-book ratio has an A+ score at simply 0.59, too. General, earnings volatility could possibly be behind the corporate, so I like the place shares commerce as we speak.

Invesco: Earnings, Valuation, Dividend Yield Forecasts

BofA International Analysis

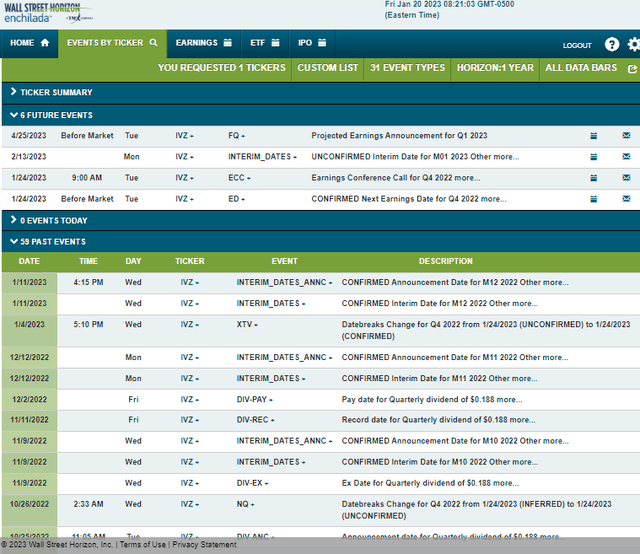

Trying forward, company occasion information from Wall Avenue Horizon present a confirmed This fall 2022 earnings date of Tuesday, Jan. 24, BMO with a convention name instantly after outcomes hit the tape. You’ll be able to hear reside right here. Invesco additionally points January flows and AuM information in its interim report on Feb. 13.

Company Occasion Calendar

Wall Avenue Horizon

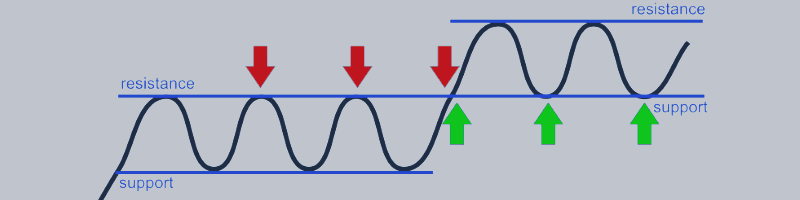

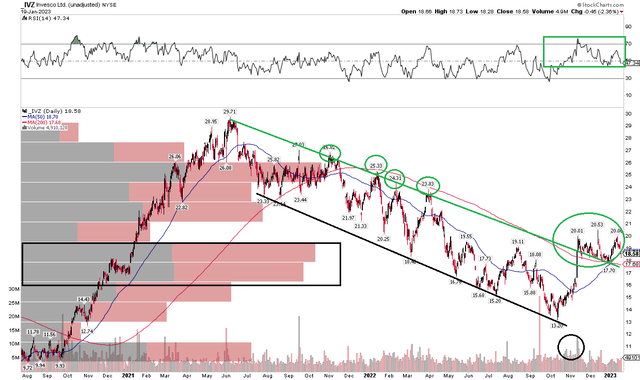

The Technical Take

Final 12 months, I used to be bearish on Invesco amid a protracted technical downtrend that confirmed few indicators of a bullish reversal. It took a plunge below $14 to ascertain a ground. Discover within the chart beneath that IVZ fell to its downtrend help line, adopted by a pointy restoration on massive quantity. The inventory ultimately climbed above its downtrend resistance line and is now merely consolidating above the 200-day shifting common. In the meantime, the momentum RSI gauge on the prime of the chart exhibits a extra bullish zone between 40 and 90 ongoing.

What’s encouraging about latest value motion is that the inventory is holding above the 200-day, whereas earlier makes an attempt have been repeatedly rejected. Furthermore, I see some draw back help with vital demand for shares within the $15 to $19 vary as measured by the volume-by-price indicator on the left.

General, I just like the bullish reversal. I wish to see the inventory maintain the $17 to $18 vary. On the upside, the present sample, if damaged out from, may result in a bullish value goal close to $27.

IVZ: Shares Breakout Above The Downtrend

StockCharts.com

The Backside Line

I like Invesco’s basic story higher now than throughout Q3 final 12 months. The technical image has additionally markedly improved together with a lot stronger momentum. I am reversing my promote to a purchase on IVZ forward of earnings on the twenty fourth.