panorios

Now we have beforehand lined Common Motors (NYSE:GM) right here as a post-FQ3’22-earnings article in November 2022. At the moment, the corporate reported exemplary high and bottom-line progress QoQ and YoY in FQ3’22, because of its sustained gross margins of 14.1% in opposition to 14.4% in FQ3’21. These boosted its EPS to $2.25 in opposition to the consensus estimate of $1.88. Nonetheless, the lowered FCF era has additionally triggered a extra prudent dividend payout for the quarter, doubtlessly disappointing some buyers.

For this text, we are going to give attention to GM’s prospects within the close to time period, partly attributed to Tesla’s (TSLA) aggressive worth cuts in early January. The latter’s transfer has immediately impacted the automaker business as a complete, as a result of perceived concern of lowered profitability through the unsure macroeconomics by 2023. The pessimism has naturally helped set off the current correction within the former’s worth goal by -14.8%. We will focus on this additional.

This Is Why Mr. Market Has Discounted GM’s Ahead Execution

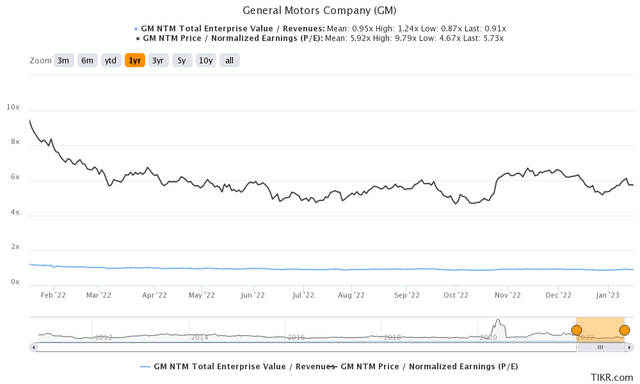

GM 1Y EV/Income and P/E Valuations

S&P Capital IQ

GM is at the moment buying and selling at an EV/NTM Income of 0.91x and NTM P/E of 5.73x, decrease than its 3Y pre-pandemic imply of 0.94x and 6.21x, respectively. In any other case, it’s nonetheless decrease than its 1Y imply of 0.95x and 5.92x, respectively.

GM 1Y Inventory Worth

In search of Alpha

Based mostly on GM’s projected FY2024 EPS of $6.01 and present P/E valuations, we’re a average worth goal of $34.43. Market analysts are naturally extra bullish at $43, suggesting a notable 18% upside potential from present ranges. This optimism is unsurprising certainly, for the reason that inventory is at the moment buying and selling at a traditionally low P/E valuation, indicating Mr. Market’s bearish sentiments.

Nonetheless, the pessimism is warranted for now in our view, with TSLA throwing a curve ball on 13 January 2023. The latter has drastically slashed the costs of its automobiles bought within the US to qualify for the Inflation Discount Act’s $7.5K tax rebates from 2023 onwards. Analyst, Daniel Ives of Wedbush, stated:

This can be a clear shot throughout the bow at European automakers and U.S. stalwarts (GM and Ford) that Tesla just isn’t going to play good within the sandbox with an EV worth struggle now underway. Margins will get hit on this, however we like this strategic poker transfer by Musk and Tesla. (NPR)

TSLA’s Mannequin Y and Mannequin 3 now price $52.99K and $43.99K, respectively, suggesting a drastic -19.6% and -6.4% lower from 2022 costs of $65.99K and $46.99K. Then once more, we should spotlight that the automaker has additionally hiked the MSRP a number of occasions attributed to the rising inflationary pressures, in opposition to 2019 costs of $39K and $36.2K, respectively.

Nonetheless, the market development just isn’t promising both, with the December CPI exhibiting a deceleration within the new car index at -0.1%, in comparison with 0.0% in November and 0.4% in October 2022. That is most likely as a result of elevated rates of interest decreasing the affordability of automobiles, regardless of the elevated availability of automobiles as the worldwide provide chain eases and automakers ramp up manufacturing.

Extra auto customers within the US are paying over $1K on their month-to-month auto loans, attributed to the elevated rates of interest of 6.5% for brand new autos by December 2022, in comparison with 4.1% in late 2021. Whereas the group could also be capped at 15% now, it’s obvious that the development is constant, with common month-to-month funds for brand new autos rising to $717 by the top of 2022, in comparison with $617 in 2021 and $525 in 2018.

Notably, the typical down fee for brand new autos has additionally risen to $6.78K by the top of 2022, in comparison with $6.02K in Q2’22 and $4.74K in Q1’21. With the Feds set to lift rates of interest to over 5% by mid-2023 and a pivot solely from 2024 onwards, it’s no marvel market analysts seem bearish about the entire automotive market as a complete.

As A End result, Will GM Additionally Slash Its MSRP?

That is a very powerful query certainly, although our greatest guess is unlikely. That is why. GM simply raised costs for the 2023 Chevy Bolt EV by $600 to $27.8K on 03 January 2023, probably attributed to its eligibility for the total $7.5K tax credit score, as a substitute of the unique $3.75K.

Nonetheless, this quantity is reflective of the administration’s effort in providing the perfect worth, since it’s notably cheaper by -$3.7K in comparison with the 2022 mannequin, -$8.7K to the 2021 mannequin, and -$9.7K to the unique launch in 2017. Because the mannequin stays the most affordable EV out there within the US, this naturally improves the corporate’s probabilities of success at a time of tightened discretionary spending. However, it stays to be seen how the mannequin will have an effect on market sentiments, as the corporate is barely planning to ramp up manufacturing to 70K items yearly in 2023.

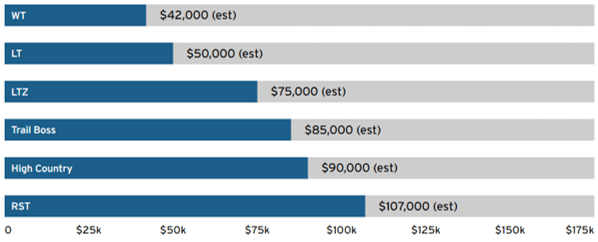

GM’s Silverado EV Introductory Worth Vary

Automobile&Driver

GM’s worth hikes for different fashions have additionally matched business tendencies to date, just like its friends reminiscent of TSLA and Ford (F). The previous’s flagship truck, Chevy Silverado EV, was initially launched with an MSRP of $42K, naturally pointing to the entry-level Work Trim [WT].

Nonetheless, current bulletins have proven that the 3WT will begin from $72.9K and the 4WT from $77.9K onwards, with the WT not being out there till later. Notably, these numbers will place it nearer to the mid-level LTZ on the earlier estimated MSRP of $75K or the RST (high-end absolutely loaded) model at $107K.

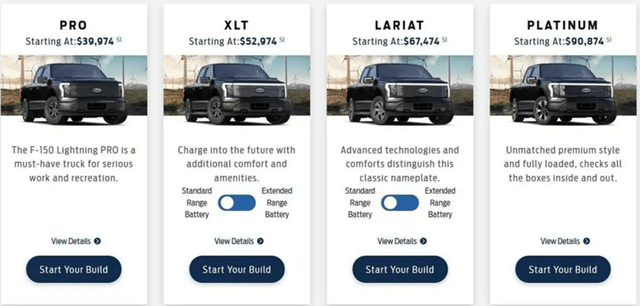

F’s F-150 Lightning Introductory Worth Vary

insideevs

These numbers are usually not too far off from F’s F-150 Lightning entry-level model as nicely, which has been raised by 40.1% from the introductory debut worth of $40K to $56K by December 2022. The corporate has additionally raised XLT, its mid-trim stage to $66.01K (+24.6%), with the Platinum, top-trim stage going at $97.81K (+7.6%) now.

As well as, GM has raised its Hummer EV costs by $6.25K from the unique vary between $79.99K and $99.99K. These raises are naturally attributed to the rising inflationary strain throughout labor and materials prices, equally skilled by many different automakers.

On one hand, GM administration has been extremely competent in providing EVs throughout totally different worth factors, to cater to a large group of loyal followers with numerous spending powers. Its long-term prospects additionally look sturdy, subsequently, particularly if the Fed achieves its goal inflation fee of two% by mid-2024. Market analysts count on the corporate to ship FY2025 revenues of $169.25B and EPS of $6.69, suggesting a good CAGR of seven.4% and -1.4%, respectively.

Nonetheless, we can not deny that there could also be some recessionary pressures by 2023, with rates of interest remaining elevated within the quick time period. Whereas present reservations will nonetheless be honored accordingly, it isn’t arduous to see why future shopper demand might briefly taper off. These might doubtlessly set off extra headwinds to GM’s inventory valuations, considerably worsened by a possible worth struggle.

Whereas GM’s 2022 deliveries have been glorious, its revenue margins have additionally been compressed. The corporate reported automotive gross margins of 11.3% and automotive working margins of 4.3% over the previous three quarters, in opposition to TSLA’s market-leading automotive gross margins of 29.5% on the similar time.

It’s obvious that GM’s monetary section has been the star of the present, contributing working margins of 33.2% then, boosting the corporate’s whole working margins to eight.8%, in opposition to TSLA’s whole working margins of 17.1%. Subsequently, it’s unsurprising that market analysts are growingly involved concerning the former’s subsequent transfer, since a worth reduce might naturally impression its already tight automotive margins.

Subsequently, we want to fee the GM inventory as a Maintain for now, as a result of potential volatility forward. Within the meantime, for the reason that firm is slated to announce its FQ4’22 earnings on January 31, 2023, it could be prudent to listen to extra from the administration as nicely.