tupungato

Financial institution of America Company (NYSE:BAC) launched its 4Q-22 earnings report final week, and the financial institution outperformed expectations by a large margin.

Having mentioned that, credit score high quality is deteriorating, and the CEO’s feedback a couple of “gentle” recession are regarding.

The Wall Road financial institution has seen a major enhance in credit score losses within the final 12 months (and the fourth quarter), and whereas Financial institution of America beat revenue expectations, 2023 is more likely to be an exceptionally tough 12 months for the financial institution.

I consider, as I warned repeatedly in 2022, that Financial institution of America is headed for a reduction valuation, and the financial institution’s 4Q-22 outcomes strongly recommend that that is the case.

Financial institution of America Beats 4Q-22 Earnings

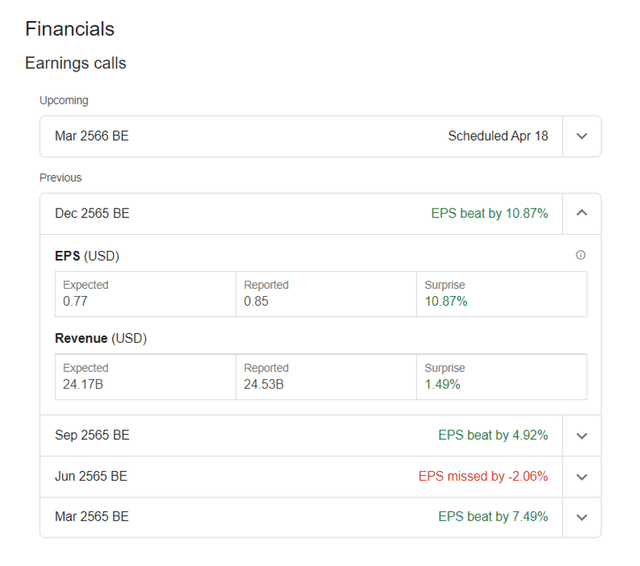

Financial institution of America’s fourth-quarter earnings exceeded expectations by a large margin. The second-largest financial institution in america by belongings reported earnings of $0.85 per share, exceeding the consensus estimate of $0.77 per share.

Financial institution of America additionally outperformed by way of income, which got here in at $24.53 billion, 1.5% greater than the consensus estimate.

Earnings Calls (Financial institution Of America)

A Key Focus For Traders In 2023: Deteriorating Asset High quality

Financial institution of America exceeded 4Q-22 earnings expectations, benefiting from greater rates of interest. With the central financial institution’s focus shifting to inflation management in 2022, the rise in rates of interest final 12 months resulted in a major enhance within the financial institution’s web curiosity earnings.

Financial institution of America earned $14.8 billion in web curiosity earnings from the central financial institution in 4Q-22, a 29% enhance YoY. If the Fed continues to lift charges, Financial institution of America might earn $18.6 billion in web curiosity earnings (assuming a 100% change in the important thing rate of interest).

With that mentioned, I’m involved about Financial institution of America’s deteriorating asset high quality. Throughout an financial downturn, asset high quality sometimes deteriorates as debtors fail to fulfill their monetary obligations and fall behind on funds for bank cards, mortgages, and automotive loans. Provided that Financial institution of America’s CEO, Brian Moynihan, anticipates a light recession in 2023, it stands to cause that the financial institution’s steadiness sheet will deteriorate within the coming quarters.

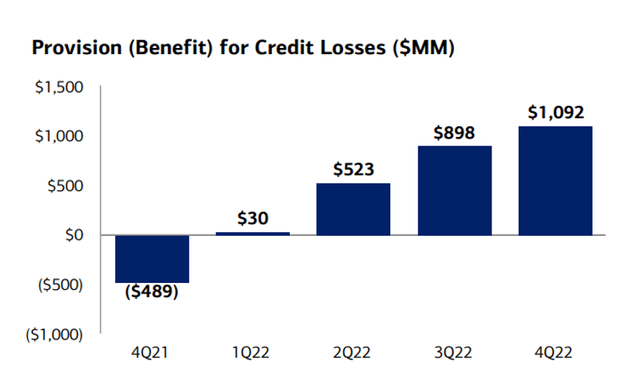

Traders had a style of what this might imply for the corporate’s provisioning state of affairs. Financial institution of America needed to put aside roughly $1.1 billion for credit score losses in 4Q-22, which was greater than double the quantity put aside simply two quarters prior. In different phrases, a deteriorating macroeconomic outlook raises the dangers emanating from Financial institution of America’s mortgage portfolio, and traders ought to brace themselves for a worsening state of affairs.

Financial institution of America’s pattern in credit score loss provisions over the past twelve months is extremely regarding, pointing to extra bother for the financial institution’s mortgage portfolio, particularly if america financial system enters recession this 12 months.

Provision For Credit score Losses (Financial institution Of America)

Low cost Valuation

Even though the financial institution’s CEO has ready the marketplace for a recession and the potential for worsening credit score issues, Financial institution of America’s inventory continues to commerce at a premium valuation, which I consider is sort of inappropriate. Financial institution of America’s inventory is at present buying and selling at a 15% premium to e book worth, which I consider won’t maintain if america enters a recession this 12 months.

Why Financial institution Of American May See A Larger Valuation (Dangers)

A light recession might restrict the draw back that Financial institution of America’s mortgage portfolio represents. A light recession won’t be corresponding to the deep recession that adopted the subprime mortgage crash in 2007, however banks will really feel the pinch by means of greater mortgage default charges.

Consequently, traders ought to anticipate Financial institution of America persevering with to construct bigger reserves to account for the growing threat of credit score losses throughout a recession.

If the anticipated recession is gentle and transient, I consider Financial institution of America has restoration potential, however I anticipate the market to drive cyclical shopper financial institution valuations again into low cost territory.

My Conclusion

Regardless of Financial institution of America’s strong fourth-quarter earnings report (which exceeded expectations), the comparatively giant enhance in credit score provisions over the past twelve months is extremely regarding, pointing to a weaker steadiness sheet and mortgage portfolio in 2023. The dramatic enhance in credit score losses in 4Q-22 is a recreation changer, indicating that the financial institution’s shareholders will face further ache this 12 months.

Moreover, the CEO’s forecast of a “gentle” recession strongly means that Financial institution of America’s asset high quality pattern will proceed to deteriorate for at the very least a pair extra quarters, implying that the financial institution will report softer earnings as rising credit score losses weigh on outcomes.

I consider the danger/reward tradeoff is at present unappealing, and I anticipate Financial institution of America to revert to a reduction valuation in 2023.