Darren415/iStock by way of Getty Photos

The Amplify CWP Enhanced Dividend Revenue Fund (NYSEARCA:DIVO) provides buyers publicity to a curated portfolio of top of the range blue-chip firms with a historical past of dividend and earnings progress.

The fund has robust historic returns and is presently yielding 4.8%. I imagine it could be appropriate for income-oriented buyers.

Fund Overview

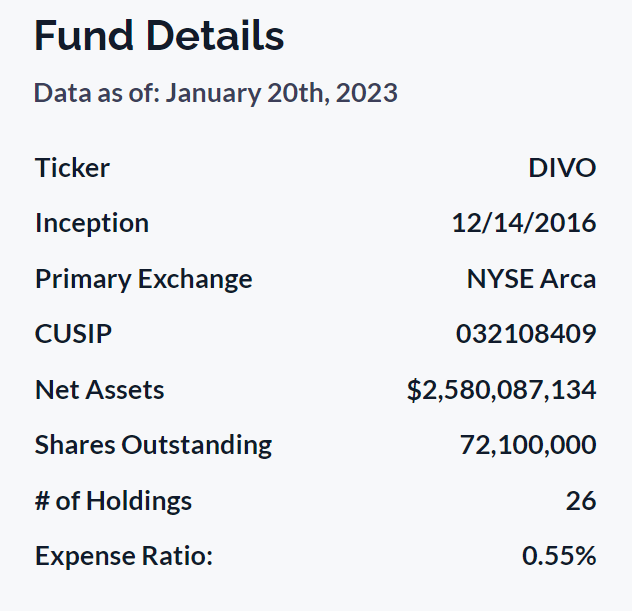

The Amplify CWP Enhanced Dividend Revenue Fund is an actively managed ETF that provides buyers publicity to large-cap firms with a historical past of dividend progress. The fund additionally has a tactical name writing technique on particular person shares. DIVO has over $2.5 billion in property and prices a 0.55% expense ratio (Determine 1).

Determine 1 – DIVO fund particulars (amplifyetfs.com)

Technique

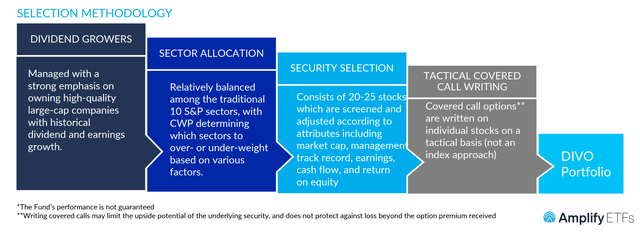

DIVO’s inventory choice technique focuses on blue-chip shares with a historical past of earnings and dividend progress. First, the supervisor, Capital Wealth Planning (“CWP”) screens the funding universe for firms with robust historic dividend and earnings progress. Then, CWP decides what sectors to over- or under-weight. Lastly, a portfolio of 20-25 shares is chosen (Determine 2).

Determine 2 – DIVO inventory choice technique (amplifyetfs.com)

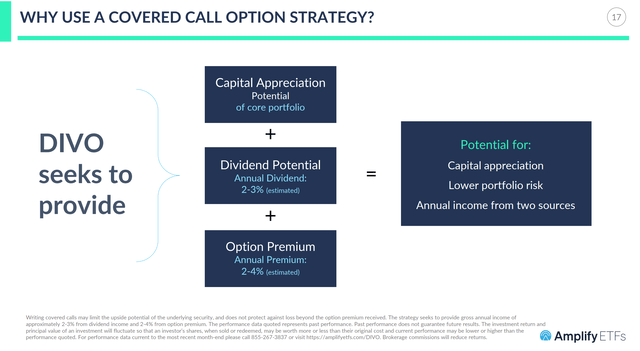

The DIVO ETF additionally tactically write coated calls on particular person shares to generate further earnings. The tip result’s a portfolio that advantages from the capital appreciation of the core portfolio and pays 2-3% in annual dividend earnings plus an extra 2-4% in premium earnings from promoting coated calls (Determine 3).

Determine 3 – DIVO advantages from writing calls (amplifyetfs.com)

Portfolio Holdings

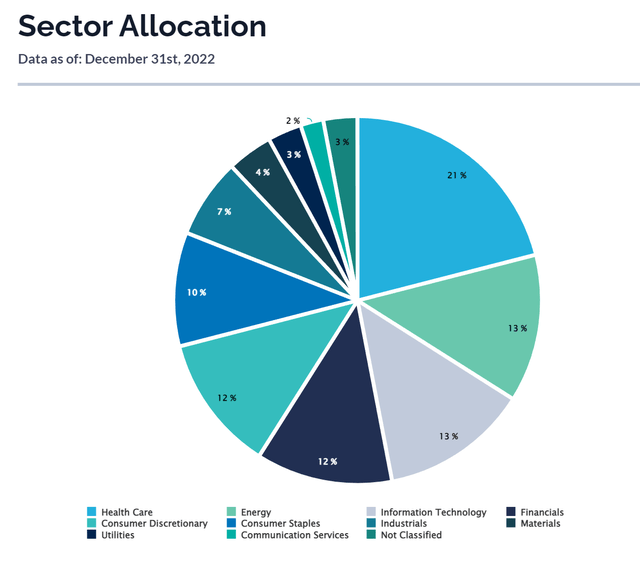

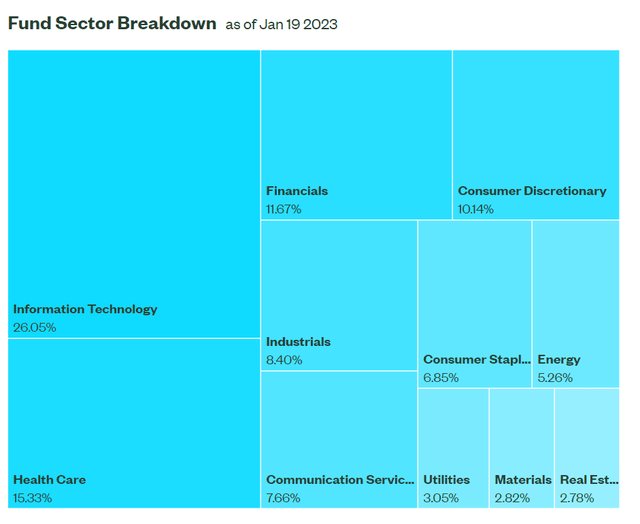

Determine 4 reveals DIVO’s present sector allocation. The fund’s largest sector weights are healthcare (21%), vitality (13%), expertise (13%), and financials (12%).

Determine 4 – DIVO sector allocation (amplifyetfs.com)

Notice that relative to the market as represented by the SPDR S&P 500 ETF Belief (SPY) as proven in determine 5, the DIVO fund has giant overweights in healthcare (21% vs. 15%) and vitality (13% vs. 5%) and a big underweight in expertise (13% vs. 26%) and communication providers (2% vs. 8%).

Determine 5 – SPY sector allocation (amplifyetfs.com)

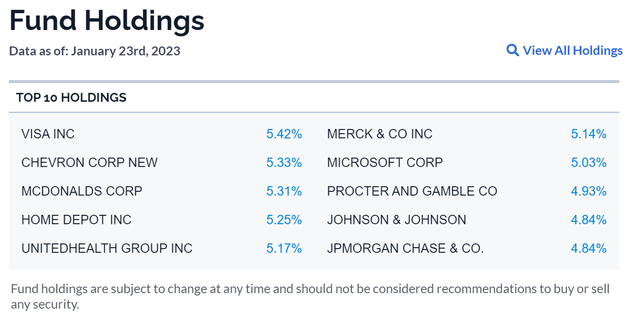

Though DIVO is a concentrated fund with solely 20-25 holdings (it presently has 23 positions), the person positions are extra equal-weighted, with place weights starting from 1.7% to five.4% and averaging 4.0% (Determine 6).

Determine 6 – DIVO prime 10 holdings (amplifyetfs.com)

Returns

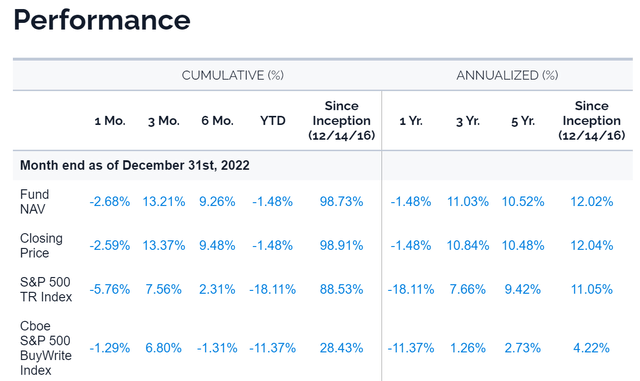

The DIVO ETF has carried out nicely since inception in late 2016, with spectacular 3 and 5Yr annualized returns of 11.0% and 10.5% respectively to December 31, 2022. Regardless of markets struggling a steep drawdown in 2022, the DIVO ETF was comparatively unscathed with a -1.5% return (Determine 7).

Determine 7 – DIVO historic returns (amplifyetfs.com)

Distribution & Yield

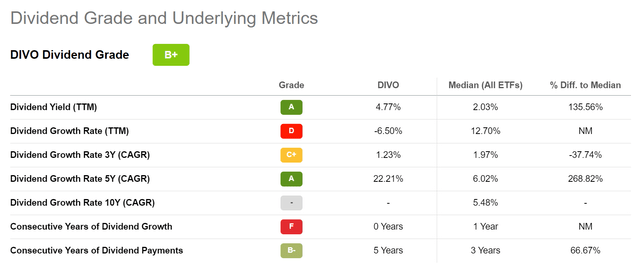

As designed, the DIVO ETF pays a excessive distribution, with a trailing 12 month distribution of $1.71 or a trailing yield of 4.8%. DIVO’s distribution is paid month-to-month and Looking for Alpha grades DIVO’s distribution a B+ (Determine 8).

Determine 8 – DIVO distribution grade (Looking for Alpha)

DIVO’s distribution has additionally grown at a formidable 22.2% CAGR up to now 5 years, though the 3Yr CAGR is far slower at 1.2%. Buyers ought to observe the 3Yr dividend progress CAGR fee is skewed decrease by a particular distribution of $0.86 / share that was paid in 2019.

DIVO vs. SCHD; Lively vs. Passive

Judging by the data and details I’ve reviewed to date, the DIVO appears like an distinctive fund. It has generated excessive historic returns and was in a position to navigate the difficult 2022 interval comparatively unscathed. It pays a excessive distribution yield that has been rising at a quick tempo. The one query I’ve in my thoughts is how does the DIVO ETF evaluate, relative to my present excessive dividend decide, the Schwab U.S. Dividend Fairness ETF (SCHD)?

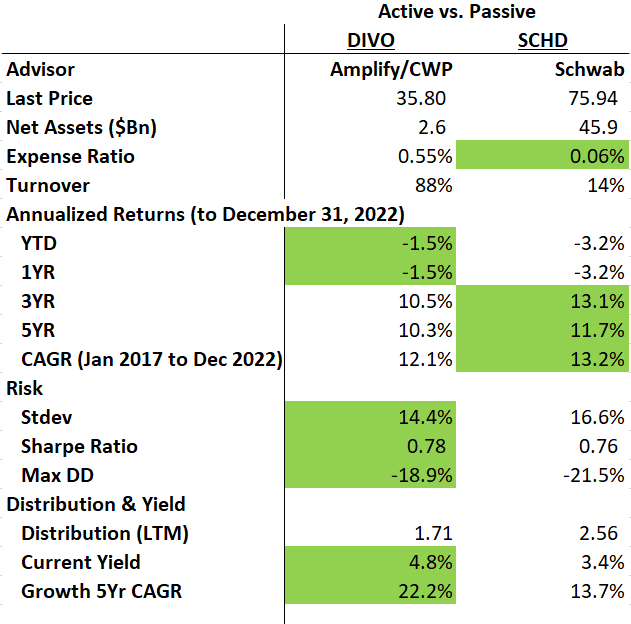

Determine 9 reveals a comparability of DIVO vs. SCHD utilizing my proprietary scorecard. The DIVO ETF is an lively ETF and prices a a lot increased expense ratio, which is comprehensible.

Determine 9 – DIVO vs. SCHD (Writer created with fund particulars and distribution from Looking for Alpha and returns and danger metrics from Portfolio Visualizer)

When it comes to returns, we are able to see that SCHD has carried out higher traditionally, though DIVO outperformed throughout 2022.

On volatility and danger, the DIVO ETF has decrease volatility and a smaller most drawdown. Regardless of having decrease returns, its decrease volatility permits it to edge out SCHD on the Sharpe Ratio (i.e. DIVO has barely higher danger adjusted return).

DIVO additionally has the next dividend yield as a result of it generates further premium earnings from writing calls, and its distribution has grown at a sooner fee.

All-in-all, the DIVO ETF is a positive challenger to the SCHD. For income-oriented buyers, its increased distribution yield might outweigh the decrease historic returns and better charges.

Doable Threat With DIVO

For me, if there’s to be any criticism of the DIVO ETF, it must be on the lively nature of its funding course of. Having been a fund supervisor myself, I can inform first hand that this can be very troublesome to outperform over the long term, year-after-year.

In accordance with a latest FT article, “over the last decade to mid-2022 a mere 12 per cent of US fairness funds beat the market.” Educational research present that only a few lively managers are in a position to constantly outperform their friends and benchmarks.

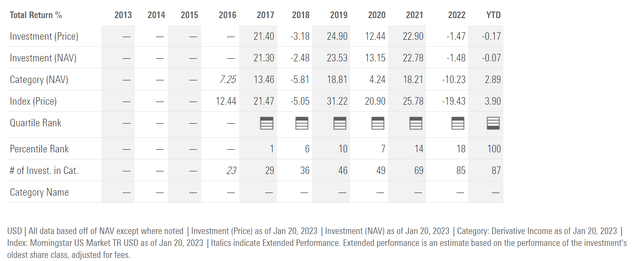

Lively managers have biases, strengths, and weaknesses. What works in a single setting might not work in one other. For instance, whereas DIVO has an impressive efficiency monitor report over 5 years, YTD to January 20, 2023, the fund has been flat and is ranked within the a centesimal percentile.

Determine 10 – DIVO annual returns (morningstar.com)

Whereas this underperformance is probably going because of the brief measurement interval (3 weeks), it does spotlight a possible danger.

Moreover, writing name choices expose the fund to proper tail danger, i.e. particular person shares might rally considerably because of some unexpected information or occasion (takeover for instance), and the fund misses out as a result of it has offered the ‘upside’.

Conclusion

The DIVO ETF provides buyers publicity to a curated portfolio of top of the range blue-chip firms with a historical past of dividend and earnings progress. The fund has delivered robust historic returns, together with being comparatively unscathed from a difficult 2022. It’s presently yielding 4.8% from a mix of portfolio dividends and premium earnings from writing calls. I just like the DIVO ETF and imagine it could be appropriate for income-oriented buyers.