Genuine Photos/E+ by way of Getty Photos

2022 was not a very nice yr for many corporations associated to the development market. However one agency that ended up performing fairly properly within the second half of the yr in comparison with the broader market is TopBuild (NYSE:BLD). Pushed by strong efficiency in each its high and backside strains, the insulation set up and distribution firm has seen some appreciation in its share value. Add on high of this elementary efficiency the truth that shares look low-cost in comparison with most related enterprises, and I imagine that the ‘purchase’ score I assigned the corporate beforehand remains to be warranted.

Constructing worth

Again in the midst of July of 2022, I wrote an article discussing my bullish stance on TopBuild. In that article, I talked about how engaging the income and money move image of the corporate had been. This strong efficiency made shares low-cost on a ahead foundation, regardless that the corporate was a bit dear in comparison with different corporations I stacked it up in opposition to. However on the finish of the day, the engaging progress of the agency was interesting sufficient for me to maintain the ‘purchase’ score I had beforehand hooked up to the corporate. Though it hasn’t been by an excellent deal, the corporate has managed to outperform the market throughout this time. Whereas the S&P 500 is up 0.9%, shares of TopBuild have seen upside of three.6%.

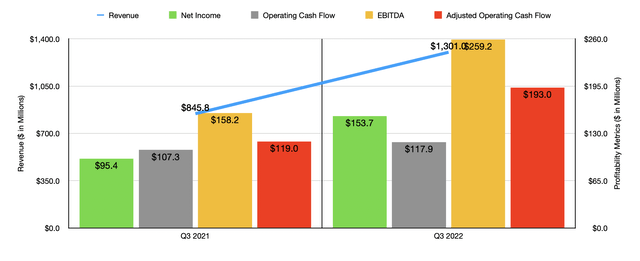

Writer – SEC EDGAR Knowledge

Had the numbers the corporate reported come out throughout any regular yr, I’d have anticipated the efficiency of shares relative to the market to be far better. However on the finish of the day, the supreme pessimism that is reigning on this area has prevented this upside from transpiring. The explanation why I say that shares would have risen extra in a typical market is as a result of the general elementary efficiency of the corporate has been unimaginable. Gross sales, for example, within the third quarter of the corporate’s 2022 fiscal yr got here in at $1.30 billion. That is 53.8% larger than the $845.8 million reported the identical time one yr earlier. To be clear, acquisitions the corporate made added 31.2% to its high line. However that does not change the truth that the corporate benefited to the tune of 13.6% from larger promoting costs on its merchandise and to the tune of 9.1% from an increase in gross sales quantity.

The underside line for the corporate adopted the highest line. Web earnings jumped from $95.4 million to $153.7 million. Along with benefiting from a rise in gross sales, the corporate noticed its gross revenue margin climb from 29.6% to 30.4%. This can be a testomony to the corporate’s capability to extend promoting costs whereas concurrently experiencing an increase in gross sales quantity. Promoting, common, and administrative prices additionally improved relative to income, dropping from 13.8% to 13.3%. Naturally, different profitability metrics adopted an identical trajectory. Working money move went from $107.3 million within the third quarter of 2021 to $117.9 million within the third quarter of 2022. If we regulate for adjustments in working capital, the image was even higher, with the metric rising from $119 million to $193 million. And over that very same window of time, EBITDA for the corporate jumped from $158.2 million to $259.2 million.

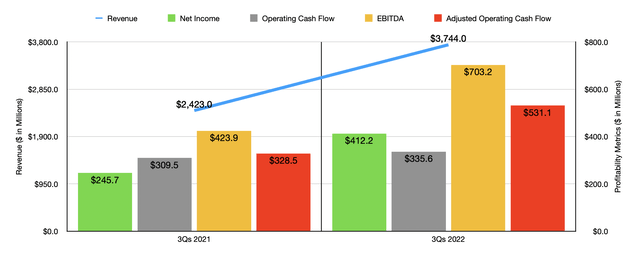

Writer – SEC EDGAR Knowledge

For the primary 9 months of 2022, the elemental efficiency achieved by TopBuild was fairly strong. Gross sales jumped from $2.42 billion to $3.74 billion. That interprets to a year-over-year improve of 54.5%. Profitability adopted a really related path. Web earnings, for example, skyrocketed 67.8% from $245.7 million to $412.2 million. Working money move rose from $309.5 million to $335.6 million, whereas the adjusted determine for this grew from $328.5 million to $531.1 million. And eventually, EBITDA for the corporate elevated from $328.5 million to $531.1 million. With regards to 2022 as an entire, administration anticipates income of between $4.95 billion and $5 billion. On the midpoint, that will translate to a year-over-year improve of 42.7%. Naturally, the aforementioned acquisition actions that the corporate engaged in led the way in which. In the meantime, EBITDA is forecasted to be between $915 million and $935 million. If we assume that different profitability metrics will develop by as a lot as EBITDA has been forecasted to, then we should always anticipate web earnings of $494.6 million and adjusted working money move of $670.7 million.

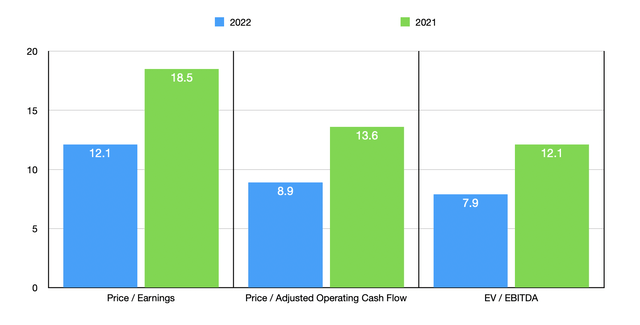

Writer – SEC EDGAR Knowledge

Based mostly on these numbers, the corporate must be buying and selling at a price-to-earnings a number of of 12.1. The value to adjusted working money move a number of must be significantly decrease at 8.9, whereas the EV to EBITDA a number of must be roughly 7.9. Even when we assume that the corporate experiences weak point transferring ahead and reverts again to what it generated in 2021, it is laborious to think about shares being thought of overvalued. As you may see within the chart above, these multiples in that occasion can be 18.5, 13.6, and 12.1, respectively. Additionally, as I do with most corporations that I analyze, I made a decision to match TopBuild to 5 related corporations. On a price-to-earnings foundation, these corporations ranged from a low of 12.1 to a excessive of 23.5. On this occasion, TopBuild was tied as being the most cost effective. Utilizing the worth to working money move strategy, the vary was from 13.4 to 25.8. On this situation, our prospect was the most cost effective of the group. And eventually, with regards to the EV to EBITDA strategy, the vary must be 7.1 to 14. On this situation, solely one of many 5 corporations was cheaper than our goal.

Firm Value / Earnings Value / Working Money Circulation EV / EBITDA TopBuild 12.1 8.9 7.9 Put in Constructing Merchandise (IBP) 16.0 13.4 8.5 Masonite Worldwide (DOOR) 12.1 14.0 7.1 CSW Industrials (CSWI) 23.5 25.8 14.0 JELD-WEN Holdings (JELD) 19.2 25.7 8.3 Gibraltar Industries (ROCK) 17.8 20.3 10.9 Click on to enlarge

Takeaway

From the information at my disposal immediately, it appears to me as if TopBuild is doing fairly properly for itself. Sure, I do perceive that there might be some uncertainty transferring ahead due to broader financial considerations, probably the most vital of which might be the influence that rate of interest hikes could have on this market. However within the worst case, I can’t think about the corporate being thought of any worse off than pretty valued. And in the perfect case, sturdy efficiency transferring ahead may push shares even larger. Due to this, I’ve no downside holding the corporate rated ‘purchase’ like I had it at beforehand.