HeliRy

Navios Maritime Companions (NYSE:NMM) stays one of the undervalued delivery corporations by a big margin, and maybe one of the undervalued corporations available in the market usually. The corporate’s money move from operations is hovering round all-time highs, exceeding $200 million for FY 2021 and is poised to surpass the $500 million mark for FY 2022. The information will get even higher for the years forward as a significant factor of income and, consequently, money from operations is locked in for a number of years, due to the booming containership market over the previous two years, which enabled NMM to lock in its 47 containerships on extremely profitable multi-year contracts.

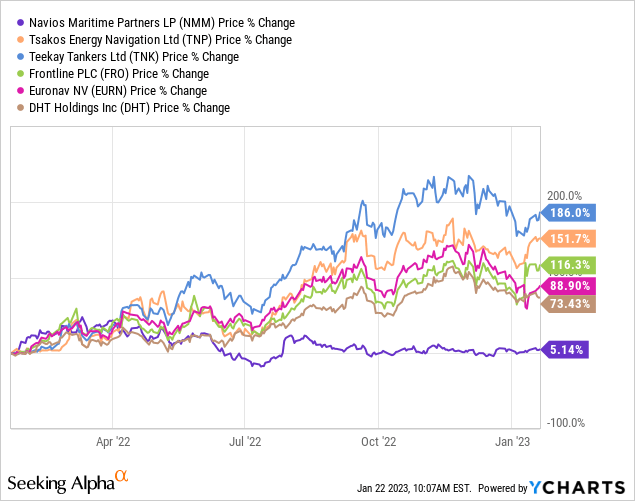

The corporate has locked in $3.2 billion in contracted income, of which roughly $2.3 billion is attributed to containerships. The remaining steadiness of roughly $663 million in backlog pertains to tankers and roughly $226 million relates to the dry bulk fleet. It is very important word that whereas the containership and dry bulk markets have softened, the tanker market has been on fireplace, as mirrored within the efficiency of most tanker shares. For instance, tanker friends similar to Tsakos Vitality Navigation (TNP), Teekay Tankers (TNK), Frontline (FRO), Euronav (EURN) and DHT Holdings (DHT) have all seen beneficial properties starting from 73.43% to 186% over the previous 12 months. In the meantime, NMM has solely seen a achieve of 5.14%.

The market has not appreciated NMM’s diversification technique. In 2021, NMM merged with Navios Maritime Acquisition, buying a big tanker fleet and changing into the biggest U.S. publicly-listed delivery firm by way of vessel rely, consisting of 55 dry bulk carriers, 43 containerships, and 45 tankers. Since then, NMM has grown additional and now has 87 dry bulk carriers (a rise of 32 vessels following the acquisition of the dry bulk fleet from Navios Maritime Holdings (NM)), 47 containerships (4 vessels enhance), and 51 tankers (6 vessels enhance).

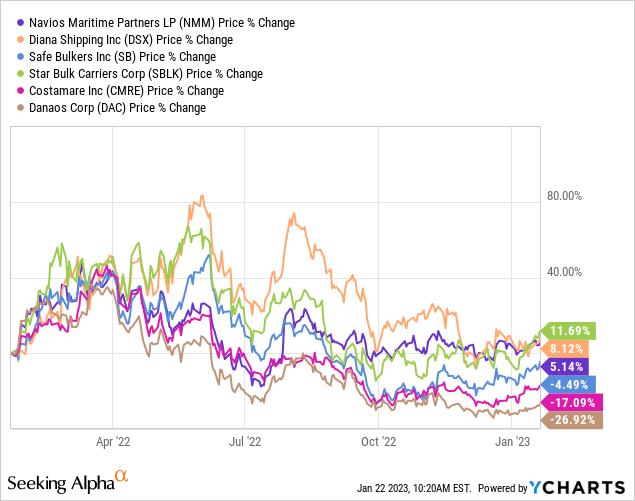

Regardless of making substantial progress in lots of areas, together with simplifying its company construction, increasing its fleet, and securing profitable long-term constitution contracts, NMM’s unit value has not seen the identical hype as different tanker corporations. Its efficiency has been mediocre, extra akin to that of dry bulk and containership corporations, as illustrated within the graph under.

Although NMM advantages from the soundness of long-term money flows from its containership vessels and the upside potential from its tanker and dry bulk market fleets, it appears that evidently the market isn’t absolutely recognizing its worth. The end result is kind of perplexing: NMM is a money move machine, producing greater than half a billion {dollars} per 12 months in working money move, however its unit value is buying and selling properly under its internet asset worth (NAV). And we aren’t speaking a couple of 10-15% low cost to NAV, we’re speaking a couple of 70% low cost!

Particularly, the gross fleet worth exceeds $5.0 billion, based mostly on common publicly accessible valuations derived from VesselsValue and Clarksons’ Analysis. This determine consists of vessel values of roughly $545 million for 3 Kamsarmaxes and 4 VLCCs underneath bareboat-in agreements which have been categorized as Working lease liabilities within the steadiness sheet.

Alternatively, complete debt together with bareboat liabilities is roughly $2.3 billion. This determine consists of roughly $385.7 million of implied loans for seven vessels underneath bareboat-in agreements which have been categorized as Working lease liabilities within the steadiness sheet, in addition to roughly $185 million of assumed loans for 5 charter-in vessels which have been categorized as finance lease liabilities within the firm’s steadiness sheet. The latter determine, that of assumed loans, is included within the calculation to be conservative and subsequently assume a worst-case situation.

As such, after making some minor changes to additionally take note of the opposite belongings and liabilities, the NAV equates to roughly $2.7 billion. Nonetheless, the market capitalization stays extraordinarily properly under $1 billion, nearer to $800 million on the time of writing. In different phrases, NMM trades at an approximate 70% low cost to NAV or round 30 cents on the greenback. That is excessive and outrageous, particularly because the firm is a money move machine, as mentioned above, and ought to be shopping for again its models proper and left.

The excellent news is that in Q2 earnings on July 28, 2022, NMM introduced a $100 million unit repurchase program to shut the hole. On the time of the announcement, the CEO Angeliki Frangou commented:

Our board approved a unit repurchase program for as much as $100.0 million. At present costs, this program would cowl roughly 17% of the general public float. The timing of the repurchases and the precise variety of models to be repurchased shall be decided by the Firm based mostly on market situations and monetary and different issues, together with working capital and deliberate or anticipated progress alternatives. Whole return to traders, we consider, is the way in which to measure our success, and can use this device as a way of attaining this consequence for our unitholders.

The disappointing information is that in Q3 2022 outcomes, on November 10, 2022, there was no important progress on this regard. Actions communicate louder than phrases. NMM has traditionally been gradual to benefit from its undervalued unit value. This has occurred a number of occasions prior to now, however beforehand there was some justification, primarily because of the complicated construction of the Navios Group. It is very important word that NMM is the product of a number of mergers, starting with Navios Containers, adopted by Navios Acquisitions, after which the acquisition of your entire dry bulk fleet from Navios Holdings. At the moment, each Navios Holdings and Navios Companions have distinct methods, with Navios Holdings specializing in South American logistics and NMM specializing in delivery. Each entities have additionally de-risked their steadiness sheets and there’s no longer a necessity for inter-company transactions, which has eradicated any conflicts of curiosity. Regardless of this, NMM persists in its ultra-conservative method, paying a really low distribution, sustaining a particularly low distribution payout ratio in addition to its MLP (Grasp Restricted Partnership) standing, and believing that over time the market will admire its diversification, low leverage, and retention of most internally generated money move to extend its asset base and subsequently NAV.

For my part, provided that NMM is buying and selling at such a big low cost to its NAV, and contemplating the corporate’s prudent leverage metrics and substantial working money move, the largest danger lies in its personal actions. The persistent undervaluation of its unit value hinders the corporate’s capability to lift accretive capital (not vital at current, contemplating the substantial money move technology) or use its share value as a way for aggressive M&A. In consequence, it should persistently depend on internally generated money move, which, whereas ample at current, is limiting in the long run. For my part, NMM ought to be extra assertive in repurchasing its personal models (as an alternative of buying vessels at NAV), after which devise a way to compensate its unitholders, similar to restoring a progressive distribution that may by no means lower once more (step by step however certainly, since we’re ranging from a particularly low base) and in addition take into account changing its construction from an MLP to an everyday C-Corp. To be candid, the MLP construction doesn’t supply a lot profit to unitholders nevertheless it does function a way for the CEO to retain management by the GP (common companion).

In closing, Navios Companions is being ignored and undervalued by the market, regardless of its sturdy steadiness sheet and important money move technology. The corporate’s diversification technique is being ignored, and its models are being bought at a staggering low cost to their NAV. This can be a uncommon alternative for traders to benefit from and purchase a bit of a money move machine at grime low-cost costs, in addition to for the corporate to do the identical by way of unit repurchases and ship a robust sign to the market. It’s well-known that the delivery business is liable to volatility, nevertheless, the present depressed unit value of NMM presents an unusually massive margin of security. The corporate is buying and selling at a mere 30 cents on the greenback, whereas concurrently producing a big quantity of free money move, surpassing the speed of depreciation, which signifies that the NAV will most probably proceed to develop, all else fixed. For my part, the best danger dealing with the corporate is the administration’s lack of motion to bridge the hole between the unit value and internet asset worth, reasonably than the volatility of the delivery market itself.