One all the time learns one thing from the World Financial Discussion board. On the very least, one learns what wealthy and highly effective folks assume is occurring. They could be incorrect: certainly, they typically are. The world is, as we now have just lately been reminded, stuffed with surprises. However listed here are my reactions.

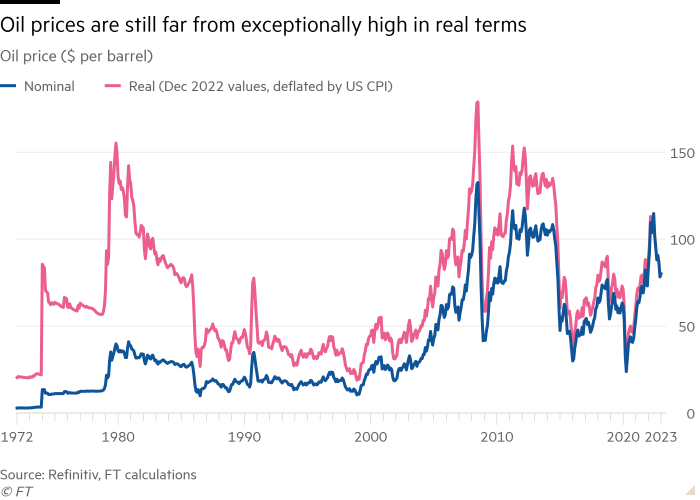

The businesspeople are feeling extra cheerful. Sure, they’re nonetheless affected by the legacies of Covid, the inflationary post-pandemic reopening and Russia’s assault on Ukraine. They’re nonetheless threatened by the hostility between the US and China. However the information has been extra constructive: Ukraine has been doing higher in its battle for survival; the lunatics fared worse than anticipated within the US midterm elections; fuel costs have tumbled; headline inflation might have peaked; recession worries have lifted; and China has reopened.

With that background, allow us to contemplate a number of the extra necessary matters, beginning with the financial outlook.

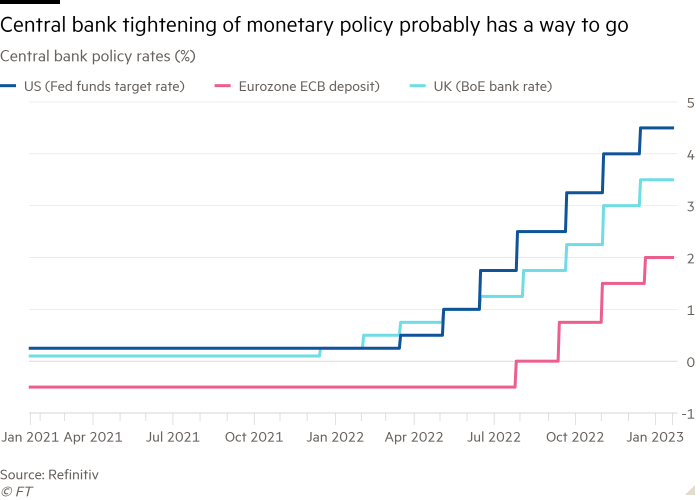

The overall temper on the economic system within the high-income nations is one in all larger optimism concerning the near-term future. But these optimists could also be getting forward of themselves. The expansion of US nominal GDP has been far too quick to be according to inflation at 2 per cent. US wages have additionally grown at shut to five per cent, over the previous yr, whereas unemployment stays low. None of that is according to hitting the inflation goal on a sustained foundation. If one takes the Fed significantly (I do), this means tighter financial coverage and a weaker economic system than many anticipate. Alternatively, the Fed might hand over too quickly, solely to be pressured to tighten once more a yr or two later. As for the ECB, it’s a good wager that it’ll search to get inflation again to 2 per cent as quickly as doable.

The temper in lots of creating nations is anxious, nonetheless. The legacy of Covid, excessive meals and vitality costs, excessive rates of interest and a powerful greenback have put many low and decrease center earnings nations into severe difficulties. The troubles of some policymakers, particularly these from Africa, had been palpable.

The tales popping out of China and India, the world’s large rising economies, had been relatively completely different. Liu He, the outgoing vice-premier, got here to inform individuals that China isn’t just open once more, at house and overseas, however can be embracing its personal sector. A western businessman I do know effectively, lengthy resident in China, confirmed the shift. A believable clarification is that Xi Jinping has determined that development issues. This yr, it should clearly be robust. Whether or not the brand new method shall be sustained in the long run is unsure. That’s inevitable when energy is so concentrated. The urge for tight management will certainly return.

The Indians had been the biggest delegation in Davos. Their enterprise group is clearly feeling optimistic concerning the prospects of what might now be the world’s most populous nation. Certainly, except issues go incorrect (all the time doable), this needs to be the quickest rising giant economic system on this planet over the subsequent couple of many years. Alternatives ought to abound.

One other enormous story issues commerce and industrial coverage. The misnamed US Inflation Discount Act is mesmerising European companies, a lot of that are contemplating shifting operations there, partly to take advantage of its alternatives, but additionally to benefit from decrease US vitality costs. That is the start of a subsidy battle, one through which the US, with its huge federal funds, has the higher hand, although Ursula von der Leyen, head of the European Fee, proposed doable responses. I’ve little doubt that these insurance policies shall be wasteful. However they need to speed up the introduction of latest local weather applied sciences. Financial nationalism might now be the one method to take action. It is usually splitting the west at a vital second.

Nearly as putting was how Katherine Tai, US commerce consultant, framed US commerce coverage when it comes to employee pursuits and employee rights. But what was most vital was not this, however relatively the obvious absence of any US view of how the worldwide buying and selling system ought to function. The erstwhile hegemon has not simply developed deep suspicions of China, this being the one really bipartisan coverage; it has deserted curiosity within the system.

A remaining space of focus was know-how. Briefly, I concern (and completely, I hope) the hype over cryptocurrencies has abated. This leaves the sector open for the dramatic enhancements in international funds techniques that central financial institution digital currencies may ship. On the setting, probably the most pleasure this time gave the impression to be on the shift in direction of hydrogen. That does certainly appear like a vital factor in a extra environmentally sustainable economic system.

The best hype, nonetheless, was over synthetic intelligence. ChatGPT has for the second stolen the present. The flexibility of individuals engaged in AI to really feel unabashedly obsessed with their creations is as comprehensible as it’s terrifying. The extra I watch the creations of the tech business, the extra I concern that I’m watching the sorcerer’s apprentice in actual life. The distinction is that no one has the power to show this spell off.

Lastly, very current all through was the assault on Ukraine. In a breakfast assembly, Boris Johnson was reborn, informing the viewers that there was no likelihood that Vladimir Putin would use nuclear weapons. I hope he’s proper. However the subject the dialogue raised was clear: Putin’s try to recreate the Russian empire can’t be allowed to face. It will make Europe radically and completely insecure. It will embolden neo-imperialists in every single place. It should be defeated.

In all, the information has certainly been higher in latest months. The absence of one other enormous shock is nice information in itself. However many unresolved challenges stay, not least discovering a swift and profitable finish to the battle and attending to grips with local weather change. Issues could also be a bit higher. They’re removed from good.

Observe Martin Wolf with myFT and on Twitter

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)