moxumbic/iStock through Getty Pictures

Written by Nick Ackerman, co-produced by Stanford Chemist. This text was initially printed to members of the CEF/ETF Revenue Laboratory on January twelfth, 2023.

Earlier in 2022, I checked out Clough World Alternatives (NYSE:GLO) and PIMCO World StocksPLUS & Revenue Fund (NYSE:PGP). I had concluded that PGP could possibly be the higher choice going ahead. This ended up being the ultimate end in each of my earlier updates. Nevertheless, my opinion recently is beginning to shift as many of the harm seems to be finished with GLO now. So as we speak, I wished to supply a fast replace on these funds.

The Fundamentals

GLO

1-12 months Z-score: -2.22 Low cost: -12.67% Distribution Yield: 11.36% Expense Ratio: 2.60% Leverage: 32.25% Managed Belongings: $510 million Construction: Perpetual

GLO’s funding goal is “to supply a excessive stage of complete return.” The fund makes an attempt to realize this by “making use of a elementary research-driven funding course of and can spend money on fairness and equity-related securities in addition to fixed-income securities, together with each company and sovereign debt.” In addition they embody that the fund will “spend money on each U.S. and non-U.S. markets.”

Within the final annual report, the fund confirmed a complete expense ratio with leverage included at 4.57%. That is definitely on the upper finish, however with diminished leverage – as we’ll contact on – that expense might come down. An expense ratio excluding leverage of two.60% remains to be excessive.

PGP

1-12 months Z-score: 0.69 Premium: 4.40% Distribution Yield: 10.91% Expense Ratio: 1.63% Leverage: 39.43% Managed Belongings: $135 million Construction: Perpetual

The target of PGP is to “search complete return comprised of present earnings, present positive factors and long-term capital appreciation.” They try to realize this by means of an “modern StocksPLUS strategy, pioneered by PIMCO…” They may “construct a worldwide fairness and debt portfolio by investing no less than 80% of the fund’s internet property in a mix of securities and devices that present publicity to shares and/or produce earnings.”

Apparently sufficient, PGP runs the decrease expense ratio of the 2. In fact, that may assist the longer-term outcomes, however PIMCO usually expenses excessive expense ratios. The 1.63% remains to be comparatively excessive for extra vanilla funds; being a extra complicated fund may be the rationale. The full expense ratio comes as much as 2.30% when together with leverage bills.

The Outcomes

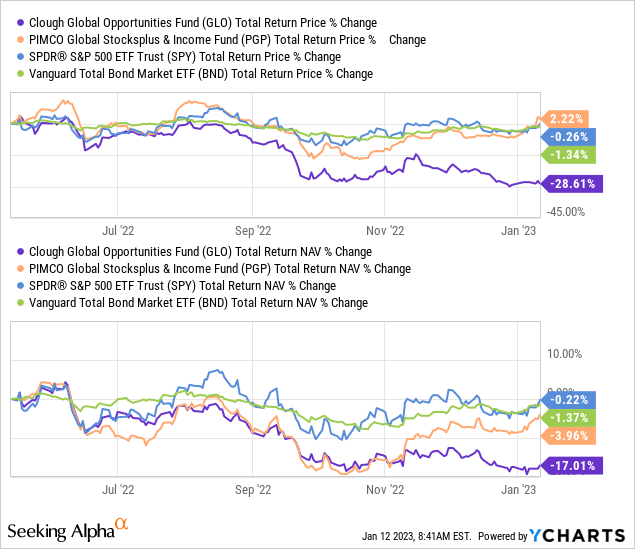

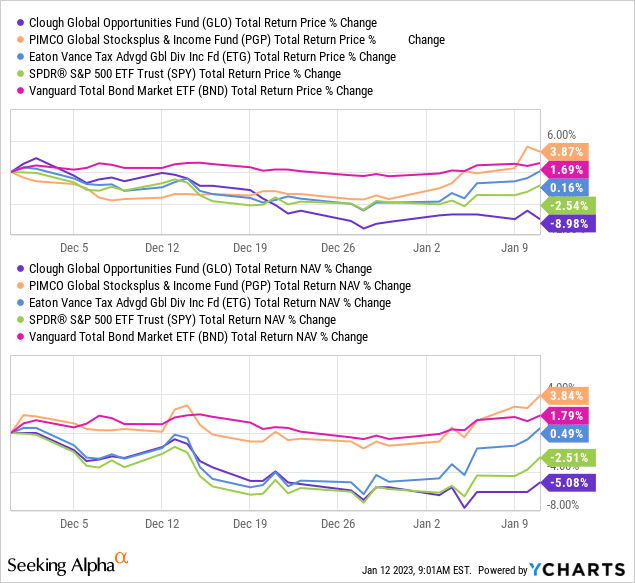

My first article was posted publicly on Could fifteenth, 2022; at this level, listed below are the most recent outcomes. I’ve additionally included the SPDR S&P 500 ETF (SPY) and Vanguard Complete Bond Market ETF (BND) efficiency for some context. Though, these should not applicable direct benchmarks for both of those somewhat uncommon funds with a excessive quantity of flexibility.

Presently, GLO was sporting a premium, and PGP was at a reduction, bizarrely sufficient. That low cost/premium switching sides definitely helped the fairly anticipated outcomes we see under.

YCharts

For probably the most half, PGP and GLO adopted one another on a complete NAV return foundation fairly carefully. It was in November that the divergence actually occurred on that metric. Nonetheless, on a complete share worth foundation, the divergence occurred a lot faster because of valuation variations.

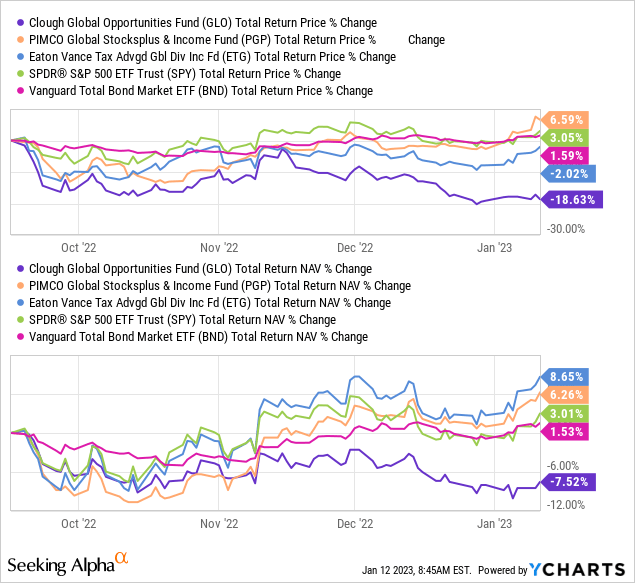

Later within the 12 months, I touched on GLO as soon as once more. On this case, the market continued to battle, and GLO was having a very tough time. I as soon as once more completed that piece by saying PGP was a extra engaging potential place. I even included Eaton Vance Tax-Advantaged World Dividend Revenue (ETG) as a possible different as a extra vanilla kind closed-end fund.

That when once more proved to be the appropriate name. The article was posted publicly on September sixteenth, 2022. As we will see right here, a better take a look at when the entire NAV return efficiency began to diverge.

YCharts

I titled that final article “Restoration Does not Appear Seemingly.” I believe some missed the primary level, but it surely ended up coming to fruition. My principal takeaway was meant to say that it was a extremely leveraged fund that was prone to deleveraging. That it was buying and selling at too slender of a reduction regardless of that vast threat.

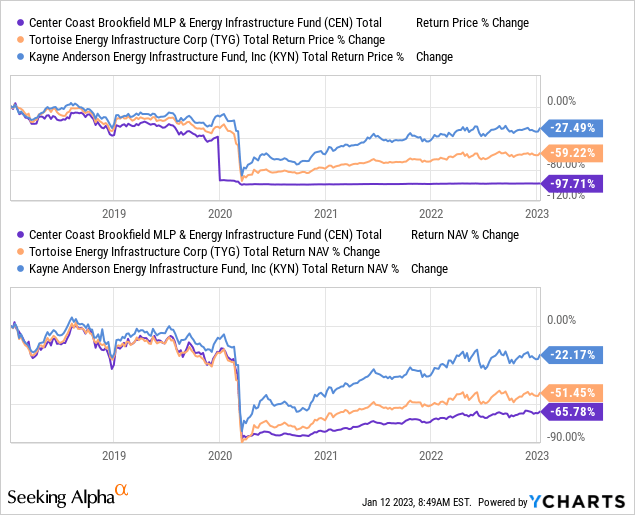

When deleveraging occurs, it turns into an nearly everlasting lack of capital. When promoting at lows, they’ve much less capital to remain invested for the restoration. Try leveraged power CEFs from pre-COVID to after. These present a few of the most excessive examples however, regardless, illustrate the issue.

Beneath are Middle Coast Brookfield MLP & Power Infrastructure Fund (CEN), Tortoise Power Infrastructure Corp (TYG) and Kayne Anderson Power Infrastructure Fund (KYN) as examples. Necessary to notice that TYG is not a pure-play power fund.

YCharts

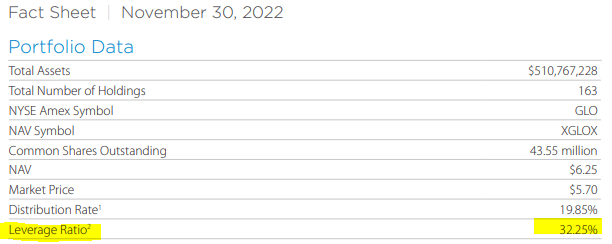

GLO had $257 million in borrowings on the finish of April thirtieth, 2022, they usually listed $204 million on the finish of October thirty first, 2022. That left leverage at a nonetheless very elevated stage of round 43%.

Now, it might seem on the finish of November thirtieth, 2022; leverage was slashed even additional. At round 32%, we’re taking a look at a extra commonplace stage of leverage for one of these fund.

GLO Portfolio Stats (Clough (highlights from writer))

This may recommend that leverage is now all the way down to round $165 million. Apparently sufficient, this was in all probability useful for GLO as a result of, for the reason that finish of November, the fund hasn’t carried out properly. So losses would have been even bigger in the event that they have been nonetheless extremely leveraged. Albeit, this can be a very brief time interval, PGP, BND and ETG managed to place up constructive outcomes on this interval.

YCharts

Now What?

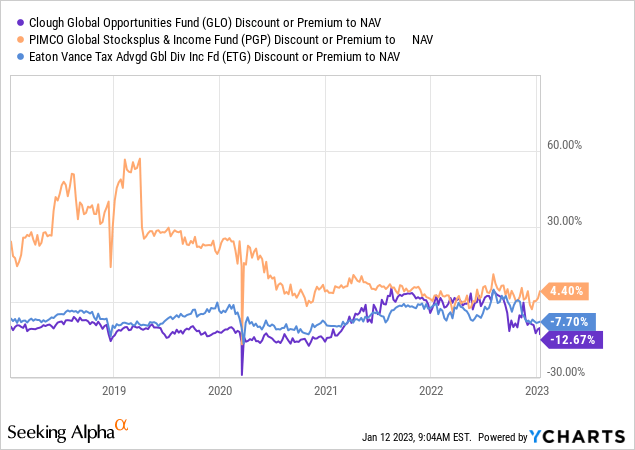

Regardless of the fund’s lack of efficiency within the brief time period, I consider that GLO is wanting like a significantly better concept at the moment. It might nonetheless be thought of a speculative play, however the valuation means it’s rather more tempting. The low cost has widened out significantly on this fund relative to PGP. ETG has additionally change into extra tempting, too, for what it is price.

YCharts

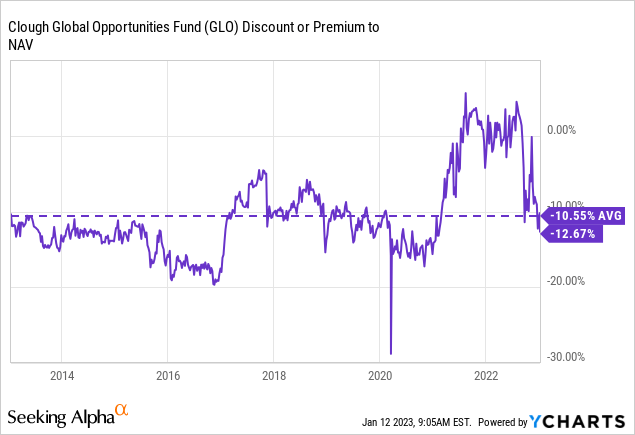

Extra particularly, we have now crossed below the longer-term decade-long common low cost/premium for GLO. We will see above that PGP has trended a decrease and decrease premium. So whereas PGP might make sense too, GLO’s is rather more engaging right here.

YCharts

One of many causes for the drop is due to the fund’s managed distribution; it resets yearly at 10%. When the fund had such a poor 12 months, the distribution was slashed from $0.0943 to $0.0483. ETG additionally lower their distribution not too long ago, which might have seemingly spurred their newest decline regardless of the comparatively engaging outcomes. ETG would not have a managed distribution when it comes to a focused NAV.

GLO distribution Historical past (Looking for Alpha)

All shareholders ought to have anticipated it as a result of it is spelled out for traders. And to be honest, lots of traders understand this. Nonetheless, it all the time looks like there may be no less than a small group of traders who do not see it coming and begin panic promoting.

In the long term, the fund ought to alter decrease. It is because it means much less capital erosion, which suggests they’ve extra property to rebound with when that occurs. The actual query can be if they need to preserve it set at a ten% plan within the first place. They have not been capable of obtain this in the long term. Nevertheless, it supplies a predictable distribution as traders can observe the NAV.

Conclusion

The harm is completed for GLO; it is wanting like a way more tempting fund. Albeit, there are some critical headwinds we face in 2023, and they’re nonetheless leveraged. However now that their leverage has decreased considerably, they’re comparatively much less prone to everlasting harm.

I might nonetheless contemplate this fund extra of a short-term play as a result of, traditionally, they’ve proven poor efficiency. A complete NAV return of 1.76% within the final ten years ought to be proof sufficient. One can evaluate that to 7.87% for PGP and eight.39% for ETG.

The most recent leads to the final 3 and 5 years are worse for all three of those funds however present GLO because the worst of them once more, with detrimental leads to each time frames. PGP had detrimental returns within the 3 years and constructive within the 5 years. ETG put up constructive leads to each of those similar time frames. The poor leads to the shorter-term time frames are anticipated as, during the last 12 months, most property have taken a considerable hit.

A poor historic observe document doesn’t suggest going ahead, it is going to even be poor, however even latest outcomes present important underperformance. Therefore, there is not a lot proof that issues will change as their technique hasn’t modified.

To sum it up as concisely as attainable, PGP seems extra like a strong maintain at this level, and GLO looks like a purchase however could possibly be considered as a shorter-term speculative purchase.

Editor’s Notice: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.