TU IS

Kyndryl: Funding Thesis

Again in February 2022, with the Kyndryl (NYSE:KD) share worth at $15.82 I printed article, “Kyndryl: Path To Earnings Unclear”, with a Promote ranking. That evaluation was made on the idea of proforma monetary knowledge by means of September 30, 2021 contained in SEC filings and a presentation by Kyndryl CFO in November 2021. Since that point, the Kyndryl share worth has fallen by 19.09% to $12.80, in comparison with a fall of 8.39% for the S&P 500, per Determine 1 beneath.

Determine 1

SA Premium

Some water has handed underneath the bridge since my earlier article, some precise outcomes are in for Kyndryl post-spinoff from IBM (IBM), and I made a decision to take one other look.

After unscrambling a really advanced presentation of knowledge contained in Kyndryl SEC filings, I nonetheless discover the trail to earnings is unclear and preserve a Promote ranking. Under I stroll the reader by means of the method that leads me to that conclusion.

Kyndryl: Precise Efficiency Versus Proforma Historic Efficiency

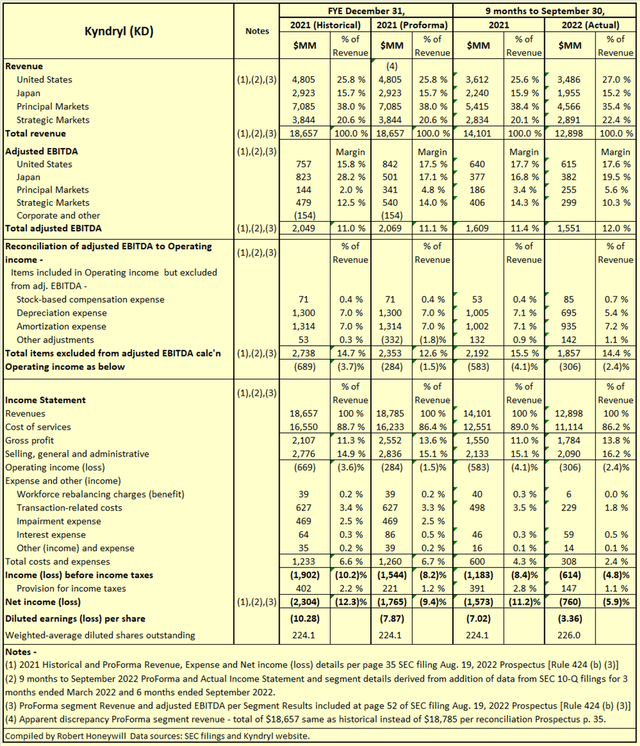

For my earlier evaluation of Kyndryl’s prospects I relied on historic and proforma knowledge from the Kyndryl Draft Registration Assertion (the “DRS”), filed with SEC on June 22, 2021, and the Kyndryl Q3 2021 10-Q, filed Nov. 22, 2021. Since that point, Kyndryl has lodged a last Prospectus with SEC on Aug. 19, 2022 and 10-Q’s offering quarterly outcomes for 3 months ended March 2022 and for six months ended September 2022. From these experiences I’ve been capable of put together abstract financials for 9 months precise outcomes to finish of September 2022 with comparisons to ProForma outcomes for the corresponding earlier interval. I’ve additionally included a abstract of yr finish December 2021 historic and proforma financials together with particulars of adjusted EBITDA. I’ve to say that Kyndryl haven’t made this activity straightforward by a complicated set of reconciliations within the Prospectus missing readability on whether or not figures included are historic or proforma, and likewise by throwing in a change in monetary yr finish to March 31, which implies they may by no means need to report immediately in opposition to Prospectus proforma figures ready on a December fiscal yr finish foundation. Desk 1 beneath displays the outcomes of my efforts to deliver some higher readability to the Kyndryl reporting.

Desk 1

SA Premium, SEC filings and Kyndryl web site.

In my earlier article, linked above, I used to be capable of discern the next in relation to phase earnings,

The Americas phase is the biggest contributor to gross revenue – 2018 59.2%, 2019 53.2%, 2020 54.5%, and 9 months ended Sept. 30, 2021, 59.9%. Europe/Center East/Africa phase is the worst performing and that efficiency is worsening over time. In all intervals, promoting, basic and administrative (SG&A) expense exceeds complete gross revenue by a substantial quantity. As a separate entity with out dad or mum help, that is unsustainable.

Nicely, administration have successfully put a cease to that form of evaluation by re-jigging the segments and ceasing to report phase earnings on the Gross revenue stage. Corporations (together with Kyndryl friends listed by SA Premium) typically report phase earnings on the Working revenue stage , which takes account of each Price of gross sales and Promoting, distribution and administrative bills (“SD&A”). Kyndryl was beforehand offering phase evaluation on the gross revenue stage, thus reporting higher outcomes than can be the case if SD&A had been included. The adjustments in reporting are disclosed within the September 2022 10-Q submitting,

Our reportable segments correspond to how the chief working choice maker (“CODM”) critiques efficiency and allocates sources….The measure of phase working efficiency utilized by Kyndryl’s CODM is adjusted EBITDA….. Using income and adjusted EBITDA aligns with how the CODM assesses efficiency and allocates sources for the Firm’s segments. The Firm has recast the prior-period outcomes to mirror the change in phase construction that grew to become efficient within the fourth quarter of 2021.

Desk 1 above exhibits particulars of changes to Working revenue to reach at adjusted EBITDA (Earnings Earlier than Curiosity, Depreciation, and Amortisation). For the 9 months ended September 30, 2022 a complete of $1.857 billion has been adjusted out of the Working lack of $306 million to reach at an adjusted EBITDA of $1.551 billion revenue. There are two points I’ve with this,

If the key gadgets of Depreciation expense ($695 million), and Amortization expense ($935 million), adjusted out of Working revenue had been analysed by phase elsewhere within the report, that might be extra acceptable disclosure. The main inclusions in Amortization expense of $935 million are prices of Pay as you go software program, Capitalized prices to acquire contracts, and Capitalized prices to fulfil contracts. It’s obscure how a CODM could possibly be adequately reviewing efficiency and allocating sources if main expenditures on software program and contract acquisition and fulfilment are excluded from the first efficiency measure.

Desk 1 above exhibits Kyndryl wants stellar income development and margin growth to show losses into revenue. Actually, income declined for the 9 months to September 30, 2022 in comparison with the identical interval for 2021. Adjusted EBITDA and Working revenue margins did enhance. That may be a welcome signal however far higher enchancment is required.

Kyndryl: Outlook

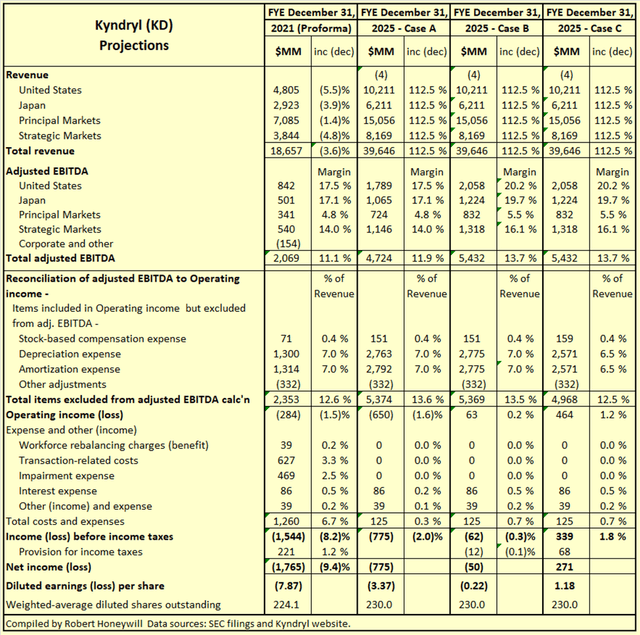

In Desk 2 beneath, I take the FYE 2021 proforma outcomes and use as a base to venture a spread of “what if?” outcomes for Kyndryl for FYE Dec. 31, 2025, to see what it would take to justify the present share worth.

Desk 2

SEC filings and Kyndryl web site

Feedback on Desk 2 –

Income –

The underlying enterprise of Kyndryl is a mature operation, but Desk 1 signifies the enterprise is presently unprofitable. This raises the query how Kyndryl may improve revenues to beat this lack of profitability. Per Kyndryl’s CFO, David Wyshner, in a Nov. 4, 2021, presentation:

Our separation will greater than double our addressable market from $240 billion pre-spin to $510 billion by 2024, with market development pushed by quite a few interrelated tailwinds. That is greater than twice our potential after we had been a unit of IBM. It is a rising market that’s being pushed by companies’ large push to automate processes, the explosive development of knowledge and the necessity for higher cybersecurity throughout all industries. A key a part of enlarging our market is the liberty of motion that comes with being a standalone entity. We’re a real providers firm, propelled by the wants of our clients, somewhat than the providers arm supporting an organization that sells expertise merchandise. We’re free to develop our ecosystem of companions and providers with a technology-agnostic method that advantages our clients.

Case A –

Reaching proportionate development in Kyndryl’s revenues to match the expansion in its addressable market by 2024 requires a 112.5% development in revenues over 2019 ranges by 2024. Seeing income has declined from 2019 by means of 2021, I’ve assumed a 112.5% improve over 2021 revenues by 2025. In Case A it is assumed adjusted EBITDA margin and Depreciation and Amortization expense as a proportion of revenues stay fixed at 2021 proportion ranges. As will be seen, quantity alone is not going to lead to reaching profitability. Actually, the advance over 2021 is because of assuming nil Transaction-related and Impairment expense in 2025.

Case B –

Case B is just like Case A, besides it’s assumed gross revenue margins in 2025 have elevated by 15% over 2021 ranges. It needs to be famous earlier makes an attempt to extend margin in 2019 resulted in income decline of seven%, and didn’t result in enchancment within the ongoing loss state of affairs. Excerpted from the DRS:

In 2019, we reported $20.3 billion in income, a decline of seven.0 % when in comparison with the prior yr, which was pushed by declines within the Americas and EMEA segments, and a forex headwind. Like our purchasers, we prioritized increased worth alternatives in 2019. Discrete account and portfolio actions had been taken to enhance our profitability in the long run despite the fact that they’d an influence on our 2019 outcomes. Gross revenue margin of 12.8 % improved by 1.1 factors, reflecting the profit from structural actions taken to enhance contract profitability. Complete expense and different revenue of $3.2 billion was flat when in comparison with the prior yr. Losses from operations had been $0.9 billion, according to the prior yr.

Desk 1 exhibits the share margin beneficial properties in 2019 have been given up in subsequent intervals. Case B exhibits even a 112.5% improve in Revenues and a 15% improve in adjusted EBITDA margin just isn’t enough to attain revenue.

Case C –

Case C is just like Case B, besides it’s assumed Kyndryl, because it grows revenues, is ready to leverage its operations in relation to make use of of Pay as you go software program, and Contract acquisition and Contract fulfilment. In Instances A and B it’s assumed prices for this stuff stay on the similar proportion of income as for 2021. In Case C it’s assumed these prices don’t improve proportionately to will increase in income. Only a 0.5 proportion level (7% discount) in these prices as a proportion of income turns the loss in Case B to a revenue in Case C. Utilized Industrial Applied sciences (AIT) is a superb instance of this leveraging of working capabilities as mentioned intimately in my current article, “Utilized Industrial Applied sciences: Nonetheless A Purchase”.

Justifying The Present Share Worth

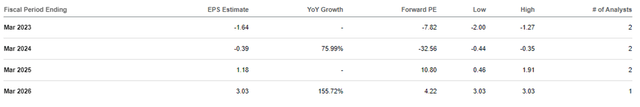

Determine 2 beneath exhibits present analysts’ EPS estimates per Looking for Alpha Premium.

Determine 2

SA Premium

Primarily based on SA Premium analysts’ consensus estimates, Kyndryl will first obtain optimistic EPS of $1.18 in 2025, which, not fully by chance, accords with Case C in Desk 2 above. If we apply a a number of of 16.5 to $1.18 we get a share worth at finish of 2025 of $19.47. Shopping for Kyndryl inventory at Jan. 24 closing worth of $12.80 and promoting at finish of 2025 at $19.47 would lead to common yearly return of 15%. Given the uncertainties associated to reaching enough income and margin development to attain earnings, I might take into account 15% per yr return a minimal goal for an funding in Kyndryl inventory.

Abstract and Conclusions

Kyndryl requires very important development in revenues and margins to develop into worthwhile. Within the 9 months of absolutely impartial operation, revenues have declined in comparison with the prior corresponding interval. Margins have improved barely however not almost enough to attain optimistic web revenue. Given the duty forward and the speed of progress to this point I’ve to conclude I nonetheless don’t see a transparent path to earnings for Kyndryl. This might change sooner or later as this now impartial (from IBM) firm hopefully finds its ft and establishes a development path. Within the meantime, a Promote ranking is maintained.