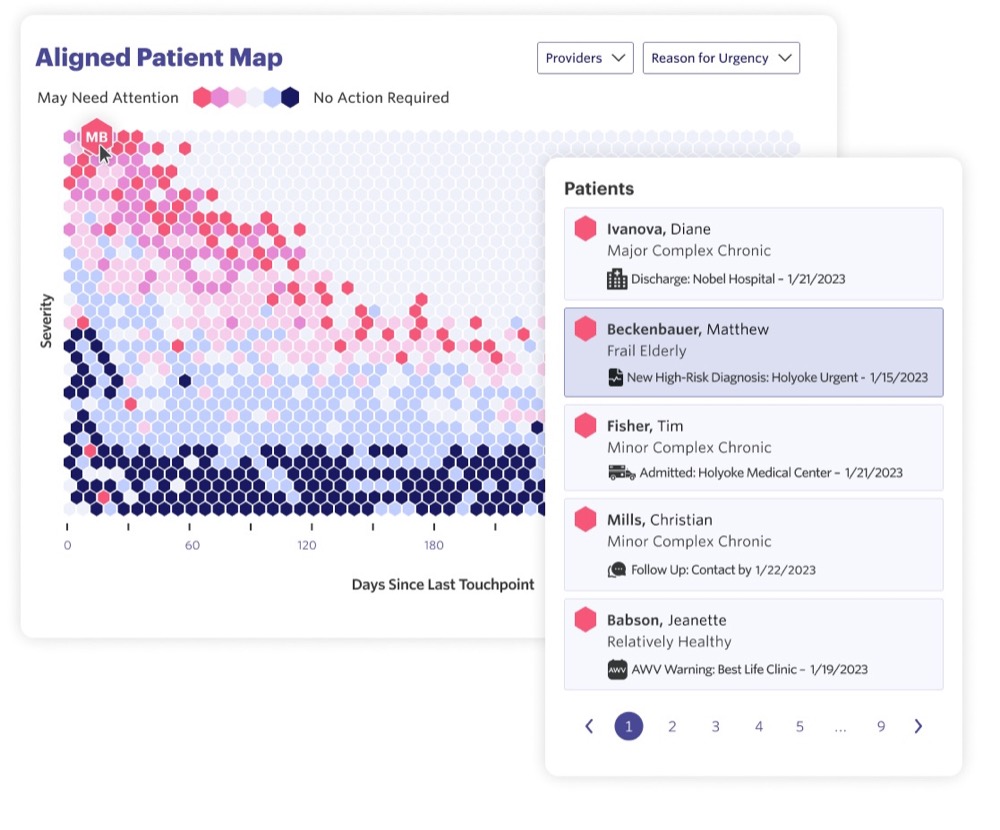

Main care is the muse of the healthcare system accounting for 50% of outpatient visits. But, spending on main care solely accounts for 5-7% of complete medical spending within the US. With such demand and tight margins, main care physicians are requested to do extra with much less time as declining main care capability is resulting in 85 deaths per day. Pearl Well being is a platform designed for main care suppliers that makes use of information science to optimize a doctor’s time to make sure they’re taking good care of the sufferers that want it probably the most on the proper time. The platform provides visualizations to present suppliers a holistic view of their sufferers in addition to every affected person’s historical past. By taking a proactive strategy to affected person administration, suppliers are capable of present higher care at a decrease price whereas making certain they’re constructing sustainable practices. It’s been predicted that the US is predicted to have a big scarcity of main care suppliers by 2032 and healthcare applied sciences like Pearl Well being mixed with Medicare reform would be the determinants of attracting new suppliers and retaining current ones to keep away from the healthcare system from hitting a breaking level.

AlleyWatch caught up with Pearl Well being Cofounder and CEO Michael Kopko to be taught extra concerning the enterprise, the corporate’s strategic plans, newest spherical of funding, which brings the corporate’s complete fairness funding raised to $75.5M, and far, far more…

Who had been your traders and the way a lot did you increase?

Pearl Well being has raised $75M in an oversubscribed Sequence B funding spherical, led by Andreessen Horowitz’s Development Fund and Viking International Traders, with participation by AlleyCorp, SV Angel’s Development Fund, and different main traders. The spherical is comprised of $55M in fairness capital and an anticipated $20M in a line of credit score, and brings Pearl’s complete funding so far to greater than $100M.

Inform us concerning the services or products that Pearl Well being provides.

Pearl Well being makes use of information science and workflow optimization know-how to assist main care suppliers focus their consideration on the sufferers who’re probably to want it, enabling physicians and scientific workers to supply proactive, customized therapies and put money into preventative care.

What impressed the beginning of Pearl Well being?

We now have at all times seen main care as an under-appreciated and under-equipped asset in nice healthcare supply. As our inhabitants demographics shift towards extra Medicare enrollment and rising medical prices, our founders and early group knew we had been at an inflection level of healthcare sustainability and entry. The chance to carry a renaissance to main care and thru true know-how enablement and contribute to extra reasonably priced Medicare and higher well being outcomes for our seniors has been significant work from day one.

How is Pearl Well being totally different?

Pearl helps suppliers remodel the way in which they supply care for his or her sufferers. We allow a transition from a reactive, volume-oriented care mannequin, the place suppliers are centered on who’s of their ready room and seeing what number of visits they will squeeze right into a day, to a mannequin the place they will take a step again and strategically allocate their time to the sufferers who want it most — usually, these are the sufferers who haven’t arrange an appointment and aren’t within the ready room.

We consider this as a shift towards proactive panel administration, and our job is to make that transition as simple as attainable, distilling information from throughout the healthcare system to what’s most necessary for suppliers to successfully handle healthcare danger and care supply throughout their affected person panels.

Our strategy differs from different value-based care and doctor enablement corporations in some crucial methods.

Many corporations are purportedly in value-based care however nonetheless predominantly give attention to enabling suppliers inside the fee-for-service fee system, which aligns income for the observe with the amount of companies supplied. We imagine that the deeply entrenched fee-for-service mannequin inherently misaligns incentives, which has profound penalties on each well being outcomes and price of care in our healthcare system. Pearl permits suppliers to transition away from fee-for-service and align incentives with protecting sufferers wholesome.

Our partnership mannequin shouldn’t be fee-based. Somewhat, it’s based mostly on shared danger and outcomes: we succeed when suppliers succeed, and suppliers succeed when they’re offering extra proactive, holistic affected person care.

In distinction to the flurry of acquisitions of doctor practices by well being methods, PE teams, and different doctor enablement corporations, at Pearl Well being, we aren’t looking for to have better management over practices. As an alternative, we give them better entry to economics which might be extra in step with the worth they create for the healthcare trade and allow them to reap the benefits of that chance.

The enablement we offer shouldn’t be merely sending them extra staffing sources. We take a technology-first strategy, enabling them with information and insights that assist them to really remodel the way in which they supply care.

What market does Pearl Well being goal and the way huge is it?

Pearl permits main care suppliers throughout the US to serve aged sufferers in a greater means. We began in conventional Medicare, which at present serves roughly 30 million Individuals. The Facilities for Medicare and Medicaid Providers has set a aim that 100% of individuals with conventional Medicare can be a part of an accountable care relationship, invested in value-based care applications like what Pearl permits, by 2030.

Whereas we began with conventional Medicare, we are going to more and more be working to develop partnerships with forward-thinking Medicare Benefit plans, so our supplier companions can deal with all seniors in a proactive, data-driven means. And be rewarded for it.

In keeping with US Census Bureau information and projections, folks age 65 and older represented 16% of the inhabitants within the yr 2019 however are anticipated to develop to be 21.6% of the inhabitants by 2040; the 85 and older inhabitants is predicted to greater than double from 6.6 million in 2019 to 14.4 million in 2040. This demographic shift makes the impression that Pearl may doubtlessly make on our healthcare system better and better within the a long time forward.

What’s your enterprise mannequin?

Our enterprise mannequin will naturally change into more and more diversified as we proceed to evolve our product choices and develop into new traces of enterprise, with the final word aim of changing the complete affected person panel of our main care companions to worth.

How are you getting ready for a possible financial slowdown?

We serve main care organizations that present look after sufferers with Medicare. The US inhabitants is growing old and the Medicare belief fund is on the verge of monetary insolvency, which signifies that an already overstretched system is reaching a monetary breaking level. Pearl is on the forefront of making a system to alleviate that pressure and we imagine these demographics and market pressures will supersede a possible financial slowdown in different sectors.

With that context in thoughts, we might be remiss to not acknowledge the results that market volatility can have on all companies. We now have at all times had a give attention to capital effectivity at Pearl, and we imagine our accountable monetary stewardship has been one of many components that has contributed to each our success in securing funding from such esteemed traders and our execution as a quickly scaling enterprise. Having a constant ethos of environment friendly capital administration positions us to each function extra nimbly and be higher ready for troublesome financial situations once they come up.

With that context in thoughts, we might be remiss to not acknowledge the results that market volatility can have on all companies. We now have at all times had a give attention to capital effectivity at Pearl, and we imagine our accountable monetary stewardship has been one of many components that has contributed to each our success in securing funding from such esteemed traders and our execution as a quickly scaling enterprise. Having a constant ethos of environment friendly capital administration positions us to each function extra nimbly and be higher ready for troublesome financial situations once they come up.

A part of environment friendly capital administration is responsibly scaling as an organization. Whereas we’re at present hiring throughout features — together with engineering, product, gross sales, advertising, buyer success, and finance — we imagine that working in a lean means offers us better agility as a enterprise. At Pearl, we imagine that our group — and above all, our tradition — would be the final cause for our success or failure. As we enter the subsequent section of development, we’re very conscious of constructing the suitable group and tradition to fulfill the second.

What was the funding course of like?

Whereas it was after all necessary to boost adequate capital to empower us to attain our subsequent set of milestones — it was equally crucial to have traders who had been aligned with our imaginative and prescient for the corporate, whose judgment we valued, and whom we believed can be the most effective advisors and companions to us over the long run.

In the end, this was a mutually evaluative course of via which we had many conversations with present and potential traders, educating them on our mission, technique, group, and our thesis on the area as an entire. Now that we’re on the opposite facet of this course of, we really feel assured that our traders are the most effective companions for Pearl as we enter the subsequent section of our development.

What are the largest challenges that you just confronted whereas elevating capital?

Our Sequence B increase coincided with among the most troublesome market situations in years for accessing enterprise capital. We had been lucky to have a enterprise mannequin that was remoted from most of the macro developments occurring presently. On the similar time, we acknowledge that the managerial finest practices round lean, deliberate development had been crucial in establishing our traders’ belief in our management. We really feel extraordinarily lucky to have had such a profitable increase and are humbled by the caliber of our traders.

What components about your enterprise led your traders to write down the examine?

Listed below are some quotes from our traders that present perception into what excites them about Pearl Well being and our know-how:

“Pearl Well being arms suppliers with information insights and superpowers to assist them handle the well being of a complete affected person panel,” stated Vineeta Agarwala, Andreessen Horowitz Common Companion, Bio + Well being, and Board Director for Pearl Well being. “We imagine this know-how ought to allow suppliers throughout the nation to be on the forefront of our healthcare trade’s transformation in direction of worth, reaching improved outcomes and decrease complete price of care.”

“Pearl Well being has finished a fantastic job of creating software program to assist suppliers obtain their targets round value-based care,” stated Scott Kupor, Managing Companion at Andreessen Horowitz, who lately joined Pearl Well being’s Board of Administrators. “This new spherical of funding will assist them considerably develop their market presence and produce their resolution to a a lot wider viewers.”

“Sufferers deserve medication aligned with their true wants,” stated Pearl Cofounder and Govt Chairman Jeffrey De Flavio, MD. “Pearl’s physicians have the instruments to ship more practical and compassionate care.”

“We’re proud to help corporations like Pearl Well being which have the potential to drive constructive change and disruption of their industries,” stated AlleyCorp Founder and CEO Kevin Ryan. “We’re excited to see the impression that Pearl Well being can have on affected person outcomes and are proud to be part of their development since day one.”

What are the milestones you intend to attain within the subsequent six months?

Over the previous yr, greater than 800 main care suppliers throughout the nation partnered with Pearl to align funds with affected person well being and leverage rising information and know-how to attain higher outcomes extra effectively. Over the subsequent six months, we’ll proceed to develop our community of enabled suppliers who can cooperate in risk-based preparations.

Over the previous yr, greater than 800 main care suppliers throughout the nation partnered with Pearl to align funds with affected person well being and leverage rising information and know-how to attain higher outcomes extra effectively. Over the subsequent six months, we’ll proceed to develop our community of enabled suppliers who can cooperate in risk-based preparations.

We’ll additionally proceed to make long-term investments in our know-how and companies, together with enhancements to the algorithm that surfaces insights inside the Pearl Platform, new sources of information to proceed to supply a extra nuanced understanding of particular person affected person care journeys, and pilot partnerships that can assist facilitate extra holistic care coordination.

What recommendation are you able to supply corporations in New York that would not have a contemporary injection of capital within the financial institution?

We really feel blessed and humbled to be within the place we’re given the robust broader local weather we’re all constructing in. We share insights within the hope they assist fellow entrepreneurs however not in any method to counsel we all know higher than others or are higher than them.

Having a transparent thesis and worth add that’s more and more measurable on a shorter time cycle is crucial on this new macro atmosphere.

Working with a lean methodology that ensures core milestones are achieved and key metrics round LTV/CAC and future profitability align with investor expectations is crucial.

De-emphasizing giant raises and large valuations and specializing in core proof factors and glorious execution are crucial.

Having fun with necessary work with colleagues that you just worth and bringing optimism grounded in actuality is extra crucial than ever.

For entrepreneurs simply beginning, I encourage you to benefit from the expertise and be able to put within the arduous work. Entrepreneurship might be discovered in lots of locations, so don’t create a false idol of what profitable entrepreneurship seems to be like. It’s hardly ever what you learn within the information, and it’s by no means the identical factor twice.

What’s your favourite restaurant within the metropolis?

Bellini (Italian) or Rosa Mexicano (enormous fan of Mexican meals!).