Picture credit: SergiyN/Depositphotos

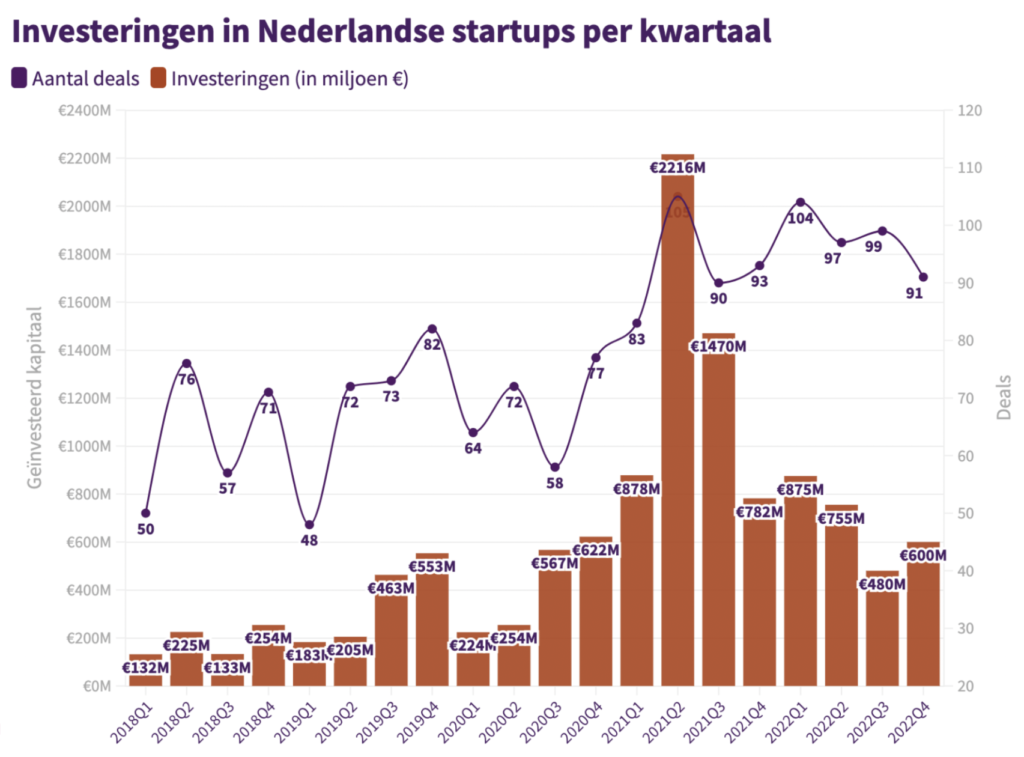

The Quarterly Startup Report for This fall 2022 is out! This quarter, Dutch startups have raised €600M in enterprise capital, 25 per cent greater than in Q3, reveals the quarterly information evaluation.

The Quarterly Startup report was revealed in collaboration with Dealroom.co, Golden Egg Examine, KPMG, the Regional Improvement Firms (ROMs), Dutch Affiliation of Participation Firms (NVP), Dutch Startup Affiliation (dSa), and Techleap.nl.

Listed below are key insights from the report.

Raised €600M

In keeping with the quarterly information evaluation, Dutch startups raised €600M in enterprise capital in This fall, 25 per cent greater than within the third quarter however lower than in the identical quarter final yr (€760M).

Drop in late-stage offers

The variety of offers remained steady in 2022 at 415 in comparison with the earlier yr, nevertheless, there’s a change in dynamics, states the report.

![]()

The report says there was a rise in early-stage offers (below €15 M) and a pointy drop in late-stage offers (over €15M) from 57 to 37 as a consequence of uncertainty within the (public) markets in 2022.

The lower in bigger rounds explains the sharp drop in investments in comparison with the distinctive yr 2021. Massive rounds then raised by Dutch scaleups akin to Mollie, Messagebird and Bunq primarily got here from overseas buyers.

The evaluation states these funds have fallen again to the degrees seen through the early days of the coronavirus pandemic by way of participation.

High 5 offers in This fall, 2022

As per the quarterly report, the highest 5 offers in This fall 2022 are:

Mews – $185MCrisp – €75Meconic – €40MDwarves – €30MAxelera AI – $27M

€2.6B funding in Dutch startups

The quarterly information evaluation says that in 2022, a complete of €2.6B was invested in Dutch startups. After the document yr 2021 (€5.3B), 2022 is the perfect yr ever measured, highlights the report. Additional, the investments have been one and a half occasions greater than in 2020 (€1.7B).

“Making an allowance for the pre-corona period, a long-term, structural progress may be noticed in investments in Dutch startups,” says the report.

High 10 offers all through 2022

The report additionally listed the highest 10 offers all through 2022. They’re:

Mews – $185MLeyden Labs – $140MBackbase – €120MPyramid Analytics $120MIn3 – €81MLightyear – €81MCrisp – €75MSMART Photonics – €75MAmbagon Therapeutics – €75MTestGorilla – $70M

Lack of bigger Dutch funds

In keeping with the report, the shortage of enormous Dutch funding funds for startups stays a priority. Dutch startups are majorly depending on overseas events for giant rounds of progress capital.

“Not solely does the return disappear overseas, however the organisations are additionally involved concerning the retention of revolutionary firms and necessary applied sciences within the Netherlands,” the report calls out.

Dutch pension funds are in an excellent place to assist improve the scale of Dutch enterprise capital funds. Doing so would scale back the extent of reliance startups have on bigger (notably US-based) funds, says the report.

Along with a lot of new funds, an excessive amount of uninvested cash (‘dry powder’) can be accessible from Dutch funds, provides the report.

“Structural progress in funding is anticipated to proceed, following the present sample of extra early phases, if these are sufficiently boosted, after which the extra late section,” says the report.

The X components behind funding

The report states that these investments are pushed by our present urgent challenges akin to local weather change, vitality utilization, well being considerations, and security.

Local weather startups have been hottest with buyers for the most important rounds final yr.

Worldwide laws, public opinion, and the post-corona period challenges present an excellent alternative to ascertain a long-term wave of sustainable startups and investments.

Nevertheless, Dutch funds and laws might be key for figuring out how a lot the Netherlands will profit from this effort and its worldwide aggressive place and enterprise local weather to regain.

Lucien Burm, chairman of the Dutch Startup Affiliation, says, “The true financial system is experiencing nice uncertainties, and scaleups are feeling this. Younger startups should not but as a consequence of restricted progress or turnover. Investments have subsequently shifted extra to the early section.”

“Native capital for follow-up rounds, subsequently, stays a serious concern for the long run; The Netherlands is just too depending on overseas international locations for this,” says Burm.

“It is crucial that fiscal measures are launched to stimulate this and that institutional buyers flip their eyes to startup funds, given their give attention to sustainable growth, an space the place startups can generate a whole lot of returns,” provides Burm.

Maurice van Tilburg, Managing Director of Techleap.nl, says, “It’s encouraging to see that, regardless of the present financial challenges, there’s nonetheless a structural improve within the accessible progress cash for startups that present options to the most important societal challenges of this period.”

“To proceed the expansion and to make sure that we proceed to develop important expertise in our nation sooner or later, we’ve got extra lively participation from Dutch buyers, akin to pension funds, each themselves and as a part of a co-investment with overseas buyers,” he provides.