Galeanu Mihai

Intro

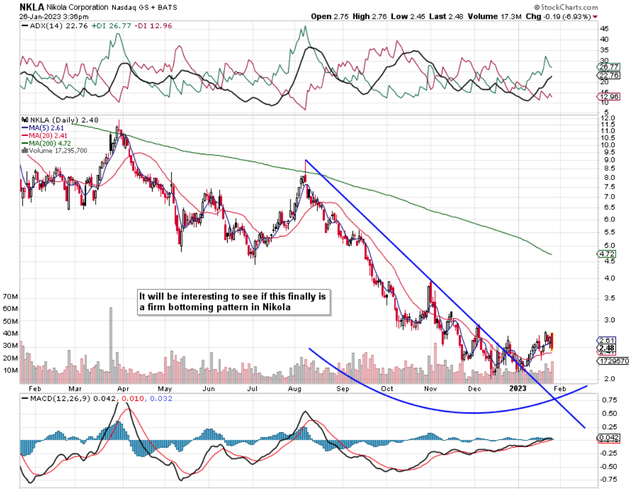

After we pull up a technical chart of Nikola Company (NASDAQ:NKLA), the query which involves thoughts is whether or not this current consolidation shares have been present process can be extra of the identical (leading to extra decrease lows) or if certainly shares have lastly bottomed. Nikola went public some years in the past and managed to rally properly above its set IPO worth for a lot of months submit the float. Nonetheless, after that preliminary spike within the Summer season of 2020, shares of the EV firm have constantly made decrease lows which have disgruntled long-term holders, to say the least. The quick-interest ratio stays very excessive at near 30% as decrease lows have been the norm for fairly a while now.

From a technical perspective, nevertheless, the taking out of that down-cycle pattern line depicted under undoubtedly supplies room for encouragement. Why? As a result of typically the market (basically the inventory’s share-price motion) is the most effective barometer on the place shares are headed, at the very least over the close to time period. To place it one other means, we consider that each piece of data that might probably have an effect on Nikola’s enterprise has been absolutely embedded within the worth at this stage.

NKLA Technical Chart (Stockcharts.com)

Many Unknowns

Why can we state this? Properly contemplating Nikola’s over 1.3 billion greenback market cap, its gross sales stay just about meaningless. Moreover, the corporate stays unprofitable though murmurs of chapter are unfounded at this stage at the very least over the close to time period given its capability to concern inventory and its $319+ million of money on the stability sheet on the finish of the corporate’s most up-to-date quarter.

Nonetheless, understanding when Nikola’s electrical vans will achieve traction or when industrial deliveries of the corporate’s gasoline cell vans will go mainstream stay very tough inquiries to reply at this stage. Furthermore, with inflation remaining at stubbornly excessive ranges, Nikola’s prices are one other space that can be laborious to foretell say 12 to 18 months from now.

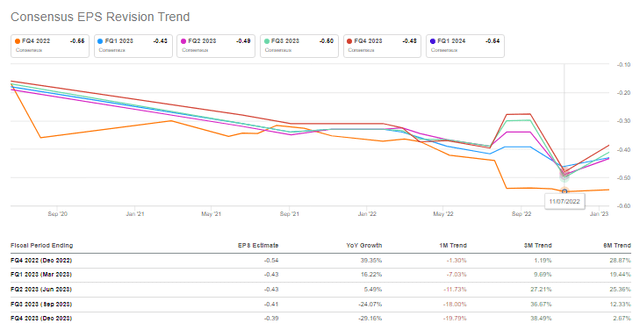

What we now have seen, nevertheless, is a few stabilization concerning Nikola’s forward-looking gross sales and earnings estimates in upcoming quarters. The upcoming -$0.54 EPS estimate for This fall, for instance, has managed to remain just about flat over the previous thirty days. Moreover, revenues are nonetheless set to high $30 million within the quarter adopted by $43+ million in Q1 of subsequent 12 months. We consider so long as revenues carry on rising at a wholesome clip (270%+ anticipated subsequent 12 months), the market won’t unduly punish the inventory even within the occasion of bottom-line profitability being non-existent for a while to come back. The reason is is that sustained top-line development will give the market a line of sight to future profitability. Due to this fact so long as current tendencies proceed, draw back danger ought to stay fairly restricted going ahead.

Nikola Consensus EPS Revisions (In search of Alpha)

Choices Play

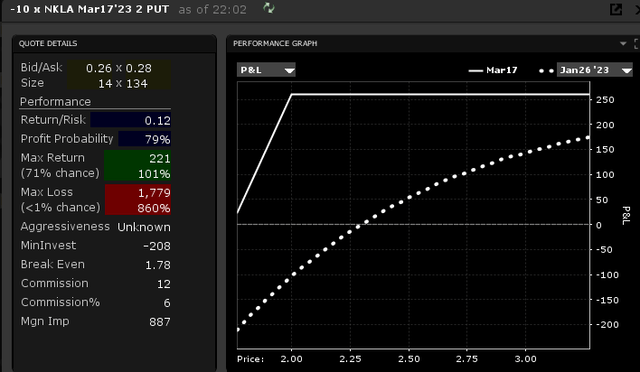

Due to this fact contemplating NKLA’s choices liquidity in addition to its above-average stage of implied volatility (52-week IV Rank of 70), we consider the sale of the common $2 March put provides us a excessive likelihood of revenue (79%) and a low breakeven ($1.78 per share) which limits our danger on this play. Buyers ought to think about that the breakeven worth or cost-basis of this place is available in nearly 30% decrease than the prevailing share worth of NKLA at its shut right this moment ($2.53 per share).

NKLA: 10 x Sale of March $2 Put Choices (Interactive Brokers)

There are two principal the explanation why we might favor this selection technique over shopping for the inventory outright. Though a inventory place gives limitless upside potential, Nikola has actually a wall of resistance above it which implies a big transfer greater (Barring an aggressive short-squeeze) can be tough to attain, to say the least.

Secondly and most significantly is the power to defend a unadorned put place. What we imply by that is that if the place had been to go towards us, a liquid low-value inventory corresponding to Nikola ought to allow us to roll down and out for credit score in every cycle if we time our rolling trades accurately. The important thing right here is to roll choices properly earlier than expiration when choices nonetheless have loads of extrinsic worth in them. Moreover, the truth that Nikola is a low-priced inventory in greenback phrases means rolls can be restricted in length in comparison with higher-priced shares.

Conclusion

Due to this fact, to sum up, current stability in Nikola’s forward-looking earnings estimates has resulted in shares consolidating in current weeks. Though not overly bullish, we like the chance/reward of put promoting (Bullish Play – lengthy Delta) in Nikola at current. Let’s have a look at what the subsequent few periods deliver. We look ahead to continued protection.