IvelinRadkov/iStock through Getty Photographs

“It is apparent that we do not know one millionth of 1 % about something.” – Thomas Edison

The Macro View

Now that January is winding down, it is time to assessment the professionals and cons as we enter the subsequent part of Q1.

Positives

1. Peak Inflation

2. Greenback Weak point

3. Earnings

4. Bonds

5. Market Breadth

6. International Markets

7. Political Cycle

8. Jobs

9. Seasonality

10. Purchase and Maintain (All the time a Professional)

Peak Inflation

The listing of indicators pointing to decrease inflation is way exceeding the listing of these persevering with to point out accelerating inflation. Whereas CPI is simply beginning to roll over, the online variety of commodities rising in worth has plunged into adverse territory.

Bespoke Funding group:

“Traditionally, when the online variety of commodities rising in worth has been adverse, the common y/y studying in CPI six months later was simply 0.8%.”

This development performs to the notion that inflation and related Fed motion will take a again seat as Q1 continues. Subsequent up for traders to ponder, is how the financial system will begin to look in Q2 and past, because the Fed charge hikes begin to make an influence.

A Weak Greenback

The march larger for the US Greenback went hand in hand with the downtrend in fairness markets all through the primary three quarters of 2022. The buzzword on convention calls final 12 months was “FX headwinds”. The greenback’s uptrend was damaged in the midst of This fall, and it is now down ~7% since This fall started. Quick-term technicals are not bullish for the Greenback, which is a professional for US equities. Whereas FX was a headwind throughout Q3 earnings calls, it needs to be a tailwind once we begin getting This fall earnings reviews.

Earnings

Whereas there hasn’t been a number of excellent news to go round over the past couple of months, firms have quietly been beating estimates at a excessive clip. For the reason that earnings “low season” started on 11/15, 271 firms have launched quarterly numbers. 73% of them have overwhelmed EPS estimates and 71% have overwhelmed gross sales estimates. That is a lot larger than the 10-year common. Firms reporting have additionally been reacting positively when reporting earnings.

The beginning of “official” earnings season has simply begun and whereas it is rather early the preliminary reviews usually are not aligned with that constructive improvement. If this early development continues, “earnings” will simply fall again into the listing of market negatives.

Bonds Stabilizing

Final 12 months’s Bear market debacle was “one among a form”. Fastened revenue provided no assist for traders when fairness markets fell aside. The standard “60/40” allocation into shares (60%) and bonds (40%) that tens of millions of retirees are invested in taking a serious hit. That in flip damage investing sentiment. During the last 4 months, we have seen bonds lastly stabilize. To that finish, the iShares Company Bond ETF (LQD) was a part of my listing of “favorites” for ’23.

Breadth And Internals

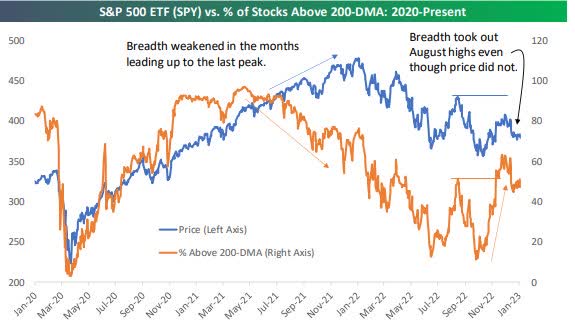

Whereas the long-term worth chart for the S&P 500 continues to be in a downtrend, internals and breadth measures look fairly a bit higher than what’s on the floor.

Breadth (bespokepremium.com)

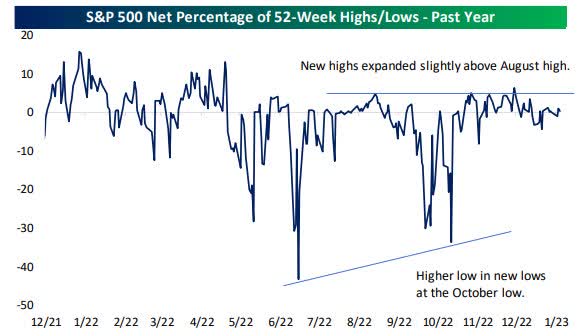

“New highs” made the next low in October and have trended larger ever since. Excessive yield spreads are displaying constructive divergence with the S&P, and readings on the share of shares above their 50- and 200-day transferring averages are additionally wholesome.

New Highs (bespokepremium.com)

The Worldwide Scene

There may be life in worldwide equities for the reason that begin of This fall 2022. That’s occurring after underperforming US markets for over a decade. A number of ETFs monitoring the remainder of the world (CWI), Europe (FEZ), rising markets (EEM), and China (MCHI) have all damaged above the highest of downtrend channels not too long ago, and technicals are beginning to look extra bullish. After I evaluate the relative energy line of the remainder of the world versus the US, there’s a notable breakout from its multi-year downtrend.

MSCI Rising Markets Index is outperforming the S&P 500 over the past three months by practically 20%. I imagine the chance is excessive that this might be the beginning of a seismic shift in asset class efficiency within the fairness area. Worldwide publicity is excessive on my listing of potential ‘outperformers’ this 12 months.

Political Cycle

Yr two of the four-year Presidential Election cycle has traditionally been the worst for the S&P 500 going again to 1928. The administration’s second 12 months actually adopted the script, given the 12 months we had in 2022. Yr three of the Election cycle has traditionally been one of the best, nonetheless, with the S&P averaging a achieve of 13.5% all through historical past.

Whereas the pattern measurement is small, the present set-up in Washington with a Democratic President, Democratic Senate, and GOP Home has traditionally been a great one for the inventory market.

Goldilocks Jobs Scene

Bulls could not have requested for rather more from the current Non-Farm Payrolls report. Whereas the headline studying got here in higher than anticipated for a report ninth straight month, the roles market is hardly overheating. Month-to-month payroll development has slowed, common hourly earnings have been weaker than anticipated even after the final two months have been revised decrease, and common weekly hours got here in decrease than anticipated.

Seasonality

Seasonals will keep within the “Professional” column from now via April. There may be little doubt since historical past exhibits the majority of fairness good points over time have come in the course of the interval from November via April. I will aspect with historical past now and preserve this within the PRO column with a caveat. Whereas Seasonality would appear to be on the aspect of the BULLS, let me remind everybody that the Jan-April efficiency in ’22 was a poor one with the S&P shedding 13.8%.

Purchase And Maintain

We will all the time convey up “Purchase and Maintain” in our Professionals part since equities have traditionally posted sturdy annualized returns no matter short-term market volatility. Sure, the long run is unsure and previous efficiency is not any assure of future outcomes however placing cash to work within the inventory market when costs have declined has all the time finally been the proper resolution with a protracted sufficient timeframe.

The S&P’s median annualized return within the 5 years after the S&P has first entered correction territory is basically the identical because the 5-year annualized return over all durations. And keep in mind, the longer your timeframe, the upper the probability of constructive returns. Something can happen within the brief time period, however if you happen to’re betting the market will not be larger over TIME, it is a mistake.

Negatives

1. The Fed continues to be hawkish.

2. That is nonetheless a BEAR market.

3. Recession Looming

4. Yield Curve

5. Shopper Sentiment at lows

6. Housing

7. TAMRA

8. Mega-Cap Tech

Do not Struggle The Fed

The Fed could also be getting much less hawkish as inflation cools, however it’s nonetheless hawkish. Rates of interest have risen on the quickest tempo in over 40 years. The FOMC is projecting larger Fed Funds than the market presently costs over the subsequent couple of years. With the Fed anticipating charges over 5% at year-end, the market is pricing 50+ bps decrease than that. That larger coverage charge expectation is joined by a forecast for unemployment charges to rise over 1 share level over the 12 months; that might be in line with a recession, to say the least. The Fed’s regional knowledge (and loads of different knowledge) is displaying inflation cooling shortly, however to this point Powell and Co. are staying with the upper for longer stance.

Bear Markets

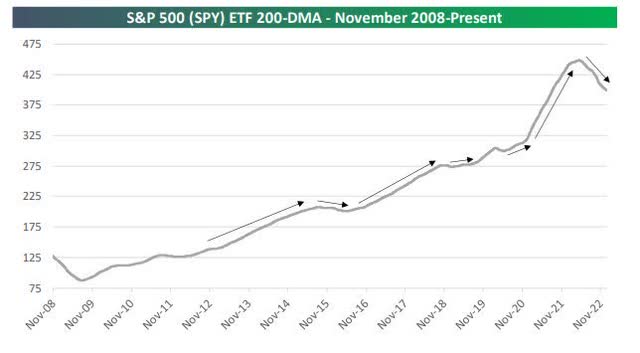

The S&P 500’s bear market low of the present cycle got here on October twelfth with the index down 25.4% at that time over 282 days. That is lower than the bear market common decline of 32% over 339 days. Till we see the long-term MONTHLY BEAR development traces decisively damaged, we’re nonetheless in a bear market. Which means till additional discover the BEARS management the scene.

The S&P 500 must rally again as much as the 4200 degree (20 MONTH MA) to exit BEAR market territory. It would require a decisive MONTHLY shut to perform that after which it is going to be incumbent for the Index to remain above that trendline. Friday’s shut at 4014 leaves the index roughly 5% from that objective. The a part of this image that issues me probably the most is the declining nature of that MONTHLY trendline. It is rolling over and historical past has proven a “rejection” at this essential PIVOT level results in extra draw back. The latest prevalence was in August of final 12 months which led to a two-month 17% decline.

One other strategy to depict this ‘concern’ is proven within the chart beneath. Taking a look at simply the S&P’s smoothed-out 200-day transferring common, which eliminates the day-to-day noise of the inventory market, you’ll be able to see that this trendline has rolled over sharply after an excessive transfer larger in the course of the post-COVID rally.

S&P 200-day MA (bespokepremium.com)

It might not be shocking to see the 200-Day transferring common proceed to imply revert decrease after seeing such a parabolic spike in late 2020 and 2021.

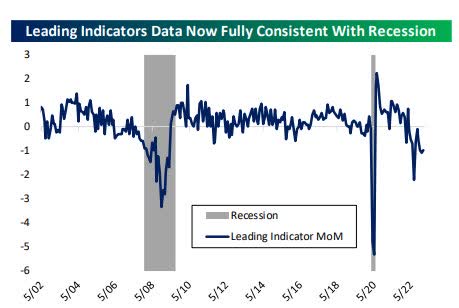

Recession Indicators

We have seen the financial knowledge are available at very weak ranges not too long ago. There are additionally quite a lot of totally different indicators that are usually correlated with recessions which might be sending indicators {that a} broad financial contraction is coming.

The ISM’s Providers Index not too long ago unexpectedly plunged beneath 50. The one time that studying has been logged and not using a recession was within the aftermath of the 2001 recession when the US introduced the invasion of Iraq. Main indicators, that are a composite of assorted underlying sequence that have a tendency to steer the financial system, are down nearly 5% Yr over 12 months. All earlier declines of that magnitude for the reason that Fifties have led to recession. Equally, the ratio of main indicators to extra lagging coincident indicators has collapsed in current months. That too is a robust indicator of a looming recession.

Consensus forecasts are calling for a brief, delicate recession. The “different” aspect of that argument asks, what’s going to change the info? Ask your self are we in a professional or anti-business atmosphere? Is that this a interval of kind of regulatory oversight? Is that this backdrop one that’s inclined to advertise larger or decrease taxes? Relying on what you imagine, your solutions to these and different associated questions will assist decide your view of the financial system going ahead and your funding technique.

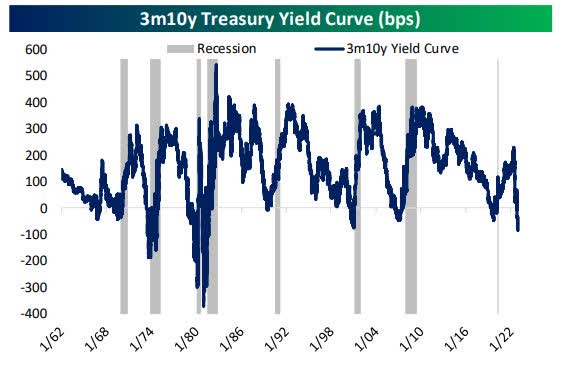

Yield Curve

Together with loads of financial indicators flashing recession, the inverted yield curve is flashing one too. The three-month/10-year yield curve – the one the Fed follows most carefully – is inverted by greater than 100 foundation factors. For the reason that Nineteen Sixties, we have all the time had a recession after an inversion of this magnitude. One-year ahead fairness returns have traditionally been comparatively weak when the curve has been this inverted as effectively.

Yield Curve (bespokepremium.com)

Except this time is totally different, a recession is nearly assured. Typical BEAR market declines common about 35%, suggesting in some unspecified time in the future the percentages counsel decrease lows for shares.

Shopper Sentiment

Certain there was been a modest rebound in December, however each client knowledge level is at or close to historic lows. Sentiment in direction of private funds is working off a report low reached in November, and it stays effectively beneath the vary of readings over the past decade. In the meantime, slightly below half of respondents report dwelling paycheck to paycheck, and spending expectations for discretionary objects are at ranges seen within the early days of the pandemic.

Housing

Whereas mortgage charges are off their worst ranges, house costs are nonetheless dropping for now. Transaction volumes have nonetheless not bottomed out, and the result’s quickly slowing housing funding. Single-family permits and begins have collapsed. The result’s a brutal bear marketplace for the housing sector. It would take a while for housing to return to a degree to assist the financial system.

Much like the “caveat” I utilized to seasonality, the current worth motion within the homebuilders provides me pause. That motion suggests housing has bottomed and the subsequent “change” goes to be a constructive one. Due to this fact Housing can as a minimum turn into a “impartial” knowledge level.

TAMRA – There Are Many Affordable Options

For years, the “TINA” commerce (there isn’t any different) made shares engaging as a result of there was merely nowhere to go along with nonexistent yields that Treasuries and the broader fixed-income market provided. Two years in the past on the finish of 2020, the S&P 500’s dividend yield was larger than each level on the Treasury curve from the 1-month T-Invoice out to the 20-year bond. Solely the 30-year provided the next yield. Now, the S&P’s dividend yield seems puny in comparison with yields above 4% for short-term Treasuries from the 1- month T-Invoice out to the 3-year bond.

This issue will are inclined to preserve any avalanche of cash that’s essential to spark a raging BULL market effectively in verify.

Mega Cap Tech Shares

Whereas mega-cap Tech shares have already gotten crushed, their motion stays weak and their technicals are adverse. That is not bullish given how massive of a weight they nonetheless carry within the S&P 500. Names like AAPL, AMZN, MSFT, and so on. ran up a lot over the past ten years that they nonetheless may fall fairly a bit farther and nonetheless be above the degrees they traded at only a few years in the past. Each Mega Cap Tech inventory is in a BEAR market development.

Relying in your tackle “valuations”, these shares are nonetheless promoting at premium multiples. That takes us to what’s all the time controversial and naturally topic to vary as company earnings are reported.

Valuations

For my part, this situation is within the NEUTRAL camp. Traders by no means actually noticed a capitulation that took valuations to severely depressed ranges, however we’ve got seen them drop to extra cheap ranges. Many are going to argue that “worth” has come down sufficient to position the S&P’s valuation at ‘engaging” ranges. The argument is {that a} PE of ~16-17 it is commensurate with what we’ve got seen in previous market declines. The S&P bought at a PE of 14-16 out there decline in 2014, 15, 18, and 2020.

Nevertheless, there’s a caveat. Apart from the 2020 expertise (attributable to an exogenous “Well being” Occasion), the entire prior incidents didn’t lead to a BEAR market or a recession. We’re in a BEAR market and if we imagine the “indicators”, we can be in a recession. That means earnings will go into recession and when “E” comes down so does “P”. The standard PE when inflation hovers round ~7% is round 11-12. We have now in all probability seen Peak inflation. Different components come into play but when inflation sticks round at elevated ranges, the market can not be known as “pretty valued” within the present vary.

It’s early on this earnings season, however to this point it’s telling me, “Valuation” can simply fall again into the adverse column.

The Week On Wall Road

The most important US indices began the week following via on the current rally that introduced the indices nearer to their mid-December highs. The S&P added one other 1.1% in the course of the session on Monday. The NASDAQ outperformed with a achieve of barely greater than 2%. Expertise (XLK) was the top-performing sector rising 2.2% and Communication Providers was not far behind rising 1.7%. These two beaten-down sectors at the moment are main shares larger.

Monday’s rally locked in back-to-back good points of 1%+ for the S&P 500 and back-to-back good points of two%+ for the Nasdaq. The indices traded cautiously with a lean to the draw back on Tuesday however the lean was a fall throughout preliminary buying and selling on Wednesday. In one other instance of dips being purchased the entire indices clawed their method again to a breakeven shut.

That set the stage for a two-day end-of-week rally that stored this mini uptrend in place. It was the third week out of the final 4 the place the S&P posted good points that now whole ~6%. One week does not make a development however how about 4 weeks? That’s what the NASDAQ has accomplished with 4 weekly good points in a row yielding ~11%. Sentiment has modified and proper now the BULLS are in management.

The Financial system

A story of the previous and the current.

GDP posted a better-than-expected 2.9% development charge within the Advance This fall report. It’s barely decrease that the three.2% clip in Q3. The financial system contracted at a -0.6% tempo in Q2 and -1.6% in Q1.

The main index fell one other 1.0% to 110.5 in December, a bigger droop than anticipated, following the 1.1% drop to 111.6 (was 113.5) in November and the 1.0% decline to 112.8 in October. That is the tenth straight month-to-month slide with the index falling each month in 2022 besides February. It’s the longest string of drops for the reason that 22 consecutive months within the 2007-08 recession. It’s the greatest decline since April 2020 and is now on the lowest index degree since November 2020.

LEI (bespokepremium.com)

A lot of the parts declined, led by ISM New Orders (-0.23%) and client expectations (-0.19%). The one will increase out of the ten parts have been nondefense capital items orders excluding plane (0.02%) and client items orders (0.01%).

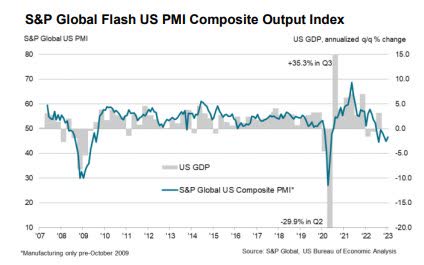

Personal sector contraction within the US continues into the brand new 12 months, with proof that the poor knowledge is stabilizing.

US PMI Composite Output Index at 46.6 (December: 45.0). 3-month excessive. Providers Enterprise Exercise Index at 46.6 (December: 44.7). 3-month excessive. Manufacturing Output Index at 46.7 (December: 46.2). 2-month excessive.

Manufacturing PMI at 46.8 (December: 46.2). 2-month excessive.

US PMI (pmi.spglobal.com)

The Chicago Fed Nationwide Exercise Index edged as much as -0.49 in December of 2022 from -0.51 in November, indicating a softer financial contraction within the US financial exercise.

CFNAI (chicagofed.org)

Shopper

The ultimate Michigan sentiment report revealed a headline climb to an upwardly-revised 9-month excessive of 64.9 in January from 59.7, versus a 4-month low of 56.8 in November. Michigan sentiment nonetheless sits beneath the early pandemic backside of 71.8 in April 2020.

Analysts have seen a confidence updraft since mid-2022, although the entire measures have deteriorated sharply from mid-2021 peaks, and Michigan sentiment is fluctuating round remarkably weak ranges. The surveys face headwinds from the mortgage charge surge via October, earlier than the following pull-back, and mounting recession fears.

Housing

New house gross sales within the US elevated 2.3% month-over-month to a seasonally adjusted annualized charge of 616K in December of 2022, the best worth in 4 months, in comparison with market forecasts of 617K. The gross sales charge stays above the 6-year low charge of 543k in July. The median worth of recent homes bought was $442,100 whereas the common gross sales worth was $528,400.

Pending House Gross sales improved for the primary time since final Might indicating that the worst might be within the rearview mirror. The PHS index improved by 2.5% to 76.9 in December. Yr-over-year, pending transactions dropped by 33.8%. An index of 100 is the same as the extent of contract exercise in 2001. NAR Chief Economist Lawrence Yun;

“This current low level in house gross sales exercise is probably going over. Mortgage charges are the dominant issue driving house gross sales, and up to date declines in charges are clearly serving to to stabilize the market.”

Housing shares (XHB) have been already signaling a backside and it seems the info is beginning to verify that.

Inflation

The higher information can be seen on the inflation entrance. It’s stabilizing.

U.S. private revenue rose 0.2% and spending declined 0.2% in December. The December revenue print tied April for the smallest enhance since January. The decline in December spending equaled December 2021 for the biggest decline.

Wage and wage revenue additionally elevated by 0.3% after November’s 0.3% achieve. The financial savings charge jumped to a 3.4% clip from 2.9% and has dwindled from 7.5% final December.

The PCE deflator was up 0.1% final month from 0.1% in November. These have been the smallest good points since final July. The core charge elevated by 0.3% from the prior 0.2% achieve. On a 12-month foundation, the deflator slowed to five.0% y/y from 5.5% y/y. The core charge decelerated to 4.4% y/y from 4.7% y/y.

The International Scene

The UK knowledge exhibits the sharpest drop in enterprise exercise in two years.

PMI Composite Output Index at 47.8 (Dec: 49.0). 24-month low.

Providers PMI Enterprise Exercise Index at 48.0 (Dec: 49.9). 24-month low.

Manufacturing Output Index at 46.6 (Dec: 44.4). 6-month excessive.

Manufacturing PMI at 46.7 (Dec: 45.3). 4-month excessive.

The Eurozone

Sees a transfer again into development in the beginning of 2023.

PMI Composite Output Index at 50.2 (Dec: 49.3). 7-month excessive. Providers PMI Exercise Index(2) at 50.7 (Dec: 49.8). 6-month excessive.

Manufacturing Output Index at 49.0 (Dec: 47.8). 7-month excessive.

Manufacturing PMI at 48.8 (Dec: 47.8). 5-month excessive.

That is the “change” the EU inventory markets sniffed out sending their indices to begin the 12 months in rally mode. An instance of markets turning earlier than the financial system. Now the markets can be figuring out if this modification has endurance.

Japan

A return to development;

au Jibun Financial institution Flash Japan Composite PMI Index, January: 50.8 (December Ultimate: 49.7)

Providers Enterprise Exercise Index, January: 52.4 (December Ultimate: 51.1)

Manufacturing Output Index, January: 47.1 (December Ultimate: 46.6)

Political Occasion

A “Wild Card” that will have an effect on the markets. I am not going to spend so much of time on “specifics” apart from to say we have been down this street earlier than with Congress. The 2011 disaster resulted in a credit score downgrade and the debt ceiling debacle contributed to the Dow Jones Industrial Common falling 2,000 factors in late July and August.

The US authorities hit the debt restrict on January nineteenth, triggering the Treasury Division’s use of “extraordinary measures” to pay debt obligations on time via the X-date. Markets are watching with heightened concern given the excessive probability of brinkmanship across the debt restrict debate, particularly contemplating the goals of Home GOP members to pair any debt ceiling raises with vital spending and entitlement reductions which might be prone to be rejected by Senate Democrats and the Biden administration.

The timing of the X-date-when the Treasury will exhaust the “extraordinary measures”-is unsure, however indicators level to it hitting as quickly as early summer time. To be clear, I don’t imagine the U.S. authorities will default on its debt obligations. The general public nature of the battle might make it seem the scenario is direr than in different years, and that may roil markets. It is extra political nonsense, however on the finish of the day, it can get resolved. Anybody citing particular knowledge as to what a US default will imply is just grandstanding and making irresponsible claims.

The Each day Chart of the S&P 500 (NYSEARCA:SPY)

We now can see a decisive break and shut above the 200-day transferring common within the DAILY chart, and to this point that transfer has held. The index has set sail for the 4100 degree, and if profitable can take a shot on the subsequent hurdle. The 4200-4300 resistance vary. Late-day profit-taking left the S&P 500 at 4070 on the shut on Friday.

S&P 500 (FreeStockCharts.com)

There may be loads of resistance overhead, however because the chart exhibits, there may be additionally loads of near-term assist as effectively. The battle traces have been drawn, and it may come right down to how lengthy the glass-half-full mentality stays round.

Funding Backdrop

Lengthy-time followers of my ramblings know that I’m a agency believer in following the “development”. It certain sounds simple however it’s not as black and white because it initially seems. The “development” is within the eye of the beholder primarily based on which timeframe the beholder occurs to be watching at any cut-off date. That leaves loads of room for debate and particular person interpretation. A dealer can discover a BULL market inside the context of a BEAR market. It additionally generally permits us to concurrently maintain contrasting viewpoints throughout totally different time horizons. As an example, I nonetheless have my issues concerning the inventory market within the larger image, however for the time being having fun with a BULL development in choose areas of the market.

When the broad market remained in a downtrend throughout 2022, with solely Power and Healthcare, defying that development, there was no method I used to be going to step out and begin recommending shopping for throughout the board. There stays an affordable likelihood we may see additional draw back occasions within the months and years forward. Nevertheless, followers additionally know I do not deal in “years forward” forecasting. I acknowledge that there may even be durations when shares carry out effectively and make massive sufficient upside strikes to justify taking extra dangers. In different phrases, there can be occasions when the development is “up” on shorter time frames, even when it is going down inside a broader downtrend.

We have certain seen that not too long ago, and there may be sufficient proof introduced to begin adopting that mindset. The inventory market reacts to vary and I all the time need to have the ability to establish if situations are getting higher or worse. It does not matter how unhealthy the scenario seems at present. The query is does it seem like it will probably get higher?

In order that leaves traders with the duty of weighing ALL of the symptoms to try to piece collectively a plan. Black and White seem on a chessboard however hardly ever do they seem within the inventory market. This inventory market nonetheless presents a problem.

The 2023 Playbook is All About Shares in or About to Enter BULLISH Uptrends.

Sectors

Shopper Discretionary

The primary shall be final and the final shall be first. Nicely, one thing like that’s occurring within the inventory market this 12 months. At 18 buying and selling days into the brand new 12 months, Communication Providers (XLC) is presently the best-performing sector YTD with a achieve of 14.6%. From a technical viewpoint, the sector is definitely the farthest above its 50-Day transferring common of any sector, propelled final week by massive strikes larger in names like Netflix (NFLX) and Alphabet (GOOGL).

Bear in mind, Communication Providers was the worst-performing sector of 2022 with a decline of greater than 37%. It isn’t simply the mega-caps driving Communication Providers larger both. 84% of shares within the sector are presently above their 50-Day transferring averages; the best studying for any sector. It’s obvious there may be some backside fishing this 12 months in final 12 months’s hardest-hit areas of the market.

Power

As WTI stays round $80, the power sector (XLE) is taking one other run on the previous highs. Within the meantime, the Oil explorers (XOP) proceed to consolidate, whereas the Oil Providers group (IEZ) is at new highs.

Choose your entry factors rigorously, however by all means, keep invested in Power ETFs and/or particular person shares. This sector stays in a robust BULLISH sample.

Pure Fuel

I famous that the Nat Fuel (UNG) scenario was trying dire. Nothing has modified that outlook. The downtrend continues. Nat Fuel costs are hovering round $3.35 and as talked about final week, I do not see a lot assist till the $2.50 vary. Help both exhibits up round these ranges or we may see Nat Fuel proceed its slide.

I proceed to carry my UNG place (It’s a long-term HOLD) and proceed to promote upside calls to buffer the losses.

Financials

The financials (XLF) is following the overall market these days or as some could be inclined to say, it is main this market. Traders noticed a failure at resistance adopted by a robust bounce. The near-term transferring averages are sloping upwards and if “worth” can trip that above the November highs it can go a great distance in protecting the near-term BULL case alive. The ETF closed proper on the November excessive at $36.27. Subsequent week might be an essential one for the sector.

Commodities

Here’s a sector (DBC) of the market that’s in a sideways sample inside the context of a BULL market. I view this example as a consolidation interval after the big rally in 2022. That means a lean towards a Bullish decision of this sample that leads to one other leg larger.

Healthcare

The Healthcare ETF (XLV) was an outperformer final 12 months however begins 2023 was the one sector posting a loss (-2,2%). My outlook for the group stays constructive, and this can be an space of alternative throughout occasions of weak point.

Biotech – Sub-Sector

Final week I discussed that the Biotech ETF (XBI) regarded coiled and able to escape. That has occurred and what I’m on the lookout for now’s a follow-through. XBI was a giant winner final 12 months and I proceed to imagine there are extra good points forward.

Gold

My entry into the Gold sector through the gold miner ETF (GDX) continues to work out. Technically the ETF is in a typical “saucer” sample that always accompanies a BEAR to BULL transition. Long run charts of (GDX) and (GLD) have each bounced again into BULL market mode. The longer they keep at these ranges the extra credence that this BULL market is certainly real. There may be resistance across the $33 degree for GDX, so I would not be shocked to see a pullback earlier than the rally continues. Dips are for BUYING.

Silver

The silver (SLV) rally has stalled and gone sideways. Like Gold, a pullback would not be out of the norm. Except we get an entire reversal (unlikely), right here is one other scenario the place the BULL market might have simply begun.

Uranium

The short-term view signifies a breakout of the near-term development. However the extra essential information is; Uranium (URNM) ($35.62) (URA) has joined the opposite metals in what can be a “new” BULL market development. All three of those rising BULL developments within the metals may turn into massive winners in ’23.

Expertise

The NASDAQ has come out of the gate sturdy to begin the 12 months by main the entire main indices with an 8.5% achieve. Nevertheless, trying on the one-year charts of the “massive Tech” mega-caps, bulls nonetheless have A LOT of labor to do even after the bounce we have seen to begin the 12 months.

Apple (AAPL) made a decrease low to begin the 12 months and has but to make the next excessive. Amazon (AMZN) additionally stays in a steep long-term downtrend and is effectively beneath its 200-Day MA. Alphabet (GOOGL) made the next low when it bottomed in early January, but it surely has but to make the next excessive or transfer above the highest of its long-term downtrend channel. Tesla (TSLA) has rallied ~60% off its low however stays down greater than 40% since mid-September. Meta (META) is the one inventory beneath that has managed to interrupt above its one-year downtrend after getting bombed out final October/November. Microsoft (MSFT) stays in a long-term downtrend although it did make the next low a couple of weeks in the past.

Semiconductors Sub-Sector

The Bulls proceed to look at the semiconductors for clues. They need to see this group (SOXX) as soon as once more lead any rallies. Semiconductors have considerably outperformed the S&P 500 for the reason that begin of the 12 months with a 17% achieve in January. Within the course of, the relative energy line of the group has damaged out above its 200 Day transferring common in addition to its vary from late 2022.

Semiconductors are usually a number one indicator for the broader market, so which method this relationship strikes can be a key determinant of the place the markets go within the the rest of Q1. That is my “go-to” indicator to measure the well being of the general market.

ARK Innovation ETF (ARKK)

So the place are we now once we look to the ‘speculative’ areas of the market? The Ark Innovation ETF (ARKK) has behaved like the overall market with conflicting indicators and volatility that shakes out each BULL and BEAR merchants.

It regarded like the start of the subsequent leg down when the long-term assist line that goes again to 2018 on the $34 vary was damaged. That shook out a number of the BULLS. A fast retake of that degree then took the BEARS that loaded up on the brief aspect for a “shedding” trip.

Backside line; In addition to the double-digit rips and dips in between, the ETF has gone nowhere since Might of ’22. So the “case for a base” is again on the scene, and people with a LONG TERM time horizon can take into account a place on this HIGH development space of the market.

Worldwide Markets

I’ve posted charts and knowledge for the reason that 12 months started that have been depicting a “change” within the world funding scene. The STOXX 600 was up 6.4% YTD within the first 15 buying and selling days of 2023. That could be a RARE prevalence, and it is much more startling contemplating this world financial system’s backdrop. Going again to 1987, that ranks as one of the best efficiency via the primary 15 buying and selling days of a 12 months and simply the fifth 12 months with a YTD achieve of 5%+.

The EU has seen nothing however subdued returns for the reason that post-financial disaster interval. From 1987 via the top of 2009, the STOXX 600’s median annual return was a achieve of 12.8%. From 2010 via the top of 2022, although, the median annual achieve was simply 6.8%.

Bespoke Funding Group:

As not too long ago as late August, the European 350 ETF (IEV) was underperforming SPY by one among its widest margins on report and probably the most for the reason that European debt disaster. Since these current extremes, although, we have seen an entire reversal. Within the final three months, IEV has outperformed SPY by a report margin of greater than 19 %. Within the short-term, European shares have been on a tear, so that they’re in all probability due for a breather.”

After a misplaced decade, at the very least on a relative foundation, are European shares within the early phases of a brand new period? That begs the query – are these markets proclaiming an finish to their bear markets as a result of their economies are going to rebound?

This transfer will be associated to China changing into the ONLY financial system that can produce any signal of development within the subsequent couple of years – development that can drag the EU and different economies depending on China with it

It is probably not a well-liked stance, however I’m a agency believer that China is a giant winner within the “new period/new inexperienced deal” – Give it some thought– the US and the EU are going to SPEND trillions going inexperienced, that’s appropriate TRILLIONS -and China has all of the inexperienced marbles. So whereas many vilify China for the best way they function, the identical folks can be paying them to proceed on their path.

Whether or not or not an investor desires to embrace any of those worldwide markets and take a place is their resolution. Full Disclosure; I do have China-related (ASHR) (FXI) and (KWEB) investments. I used to be brief the EU by proudly owning a place in (EPV). After giving this some thought, I will not dispute the value motion seen within the EU indices, so the “brief” place was closed out for a loss.

Cryptocurrency

After uneven motion earlier within the week, massive good points for Bitcoin on Friday reconfirmed its current actually because it’s now on the highest degree on a closing foundation since September. Given the rally, costs stay overbought to an excessive diploma with Bitcoin presently 2.5 commonplace deviations above its 50-Day transferring common. Overbought situations have traditionally been adopted by extra momentum to the upside for Bitcoin, which is not usually what you see when the value will get overbought.

Given the 2 largest cryptos (Bitcoin and Ethereum) are rather more overbought, the relative energy of the 2 has risen versus the remainder of the crypto market.

Bitcoin/Ethereum (bespoepremuim.com)

Ultimate Ideas

Thomas Edison had it proper, and we see examples of that performed out in our on a regular basis lives. Market individuals should proceed their seek for solutions because the 12 months unfolds. Conflicting knowledge, and opinions that vary from doom to euphoria will proceed to bewilder traders.

Traders are trying at the moment scenario with a glass-half-full mentality. A case will be made for that within the brief time period, however sadly, a case will be made that view incorporates a number of wishful considering. For people who name {that a} noncommittal, wishy-washy forecast, you might be appropriate, it’s.

Anybody that desires to declare they know the place this inventory market goes within the subsequent couple of months or so with the entire uncertainty surrounding the scene is merely “guessing”. My inventory market outlook relies on knowledge and factual info. That’s sprinkled with a typical sense method that analyzes the “background” we’re working with. These background points all the time have an unlimited influence on the funding scene.

“Fact is an unpopular topic BECAUSE it’s unquestionably appropriate.”

Avoiding and dismissing FACT (Fact) will all the time result in poor leads to any endeavor.

THANKS to the entire readers that contribute to this discussion board to make these articles a greater expertise for everybody.

Better of Luck to Everybody!