PeopleImages/iStock through Getty Pictures

Funding thesis

The unfavourable influence of KDDI’s (OTCPK:KDDIY) community outage incident in July 2022 seems transitory. The corporate continues to transform customers to 5G elevating knowledge ARPU, producing steady free money circulate technology, and continues to extend dividends. We reiterate our purchase ranking.

Fast primer

KDDI is Japan’s second-largest cellular service with round 32% of the cellular subscriber market share with its ‘au’ model. It operates fixed-line operations with a cable tv channel and has a prime market share as a cellular operator in Mongolia and Myanmar. Its largest shareholders are Kyocera (OTCPK:KYOCY) with 14.5%, and Toyota Motor (TM) with 13.7%. Its key friends are NTT (OTCPK:NTTYY), SoftBank Corp. (OTCPK:SOBKY) and Rakuten (OTCPK:RKUNY).

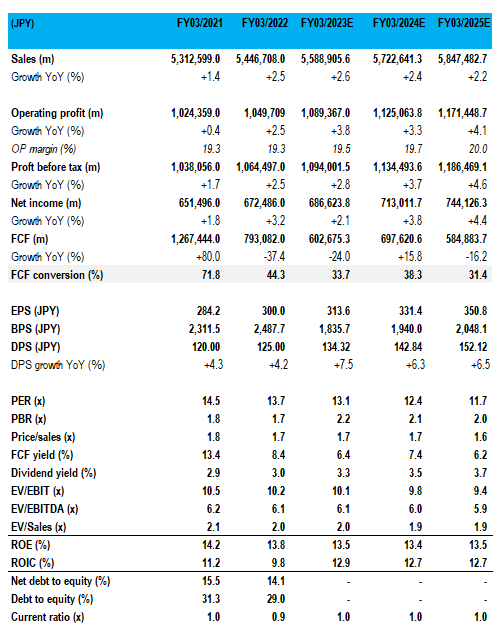

Key financials with consensus forecasts

Key financials with consensus forecasts (Firm, Refinitiv)

Our targets

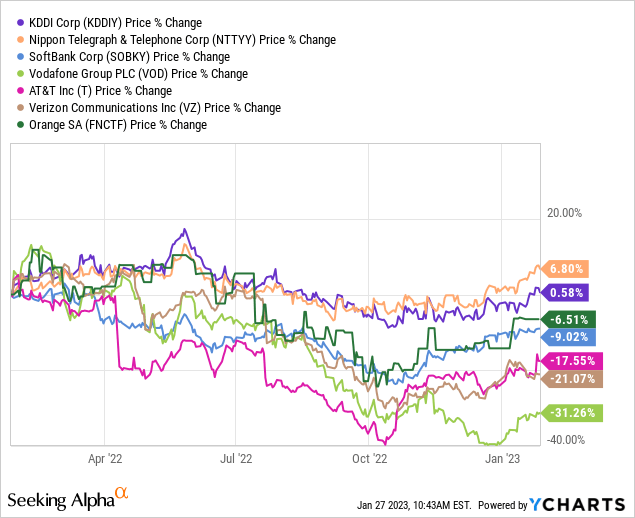

We replace our view on KDDI from March 2021 the place we rated the shares as a purchase; the shares have comparatively outperformed during the last 12 months versus its world friends. Latest buying and selling has been weak, given the foremost service outage skilled in July 2022 the place 22.71 million individuals have been stated to be affected by voice providers, and seven.65 million by knowledge providers. KDDI stated it’s going to compensate (web page 13) 2.71 million customers closely affected by the community outage by returning two days’ price of their month-to-month primary charges and plans to pay ¥200 to all of its 35.89 million subscribers, together with these receiving the additional compensation. Given the reputational points for the reason that incident with the race for 5G prospects accelerating, we need to see whether or not the shares current a possibility.

Community failure will not be a terminal problem

KDDI’s community failure started on July 2 2022 because the agency was altering a setting on a router for its core community. Upkeep employees enter an incorrect setting disrupting the cellular connection. Whereas making an attempt to repair the glitch, the service skilled heavy concentrations of visitors in different elements of the community which exacerbated the outage.

On a optimistic observe, the promised compensation cost is predicted to value round JPY7.3 billion/USD56 million, amounting to lower than 0.5% of the annual FY3/2023 estimated income. The anticipated decline QOQ in ARPU in Q2 FY3/2023 which skilled the outage was seen however not acute, with voice-related ARPU dropping 1.2% QoQ, and value-added ARPI (knowledge and different providers) rising 18.9% QoQ however pushed by primarily by electrical energy charges (KDDI and different carriers act as energy utility corporations).

While the optics of falling voice ARPU is unfavourable, after a slight bounce in person churn in July 2022, complete person numbers in September 2022 recovered again to June 2022 (pre-incident) ranges (web page 11). We put this right down to KDDI’s immediate motion and an honest PR train to confess to their errors and conduct a optimistic marketing campaign of enterprise enchancment. All in all, we conclude that this incident is unlikely to trigger long-term injury to the corporate. There may be some concern over the churn charge hitting 0.94% in Q2 FY3/2023 (versus beneath 0.7% for FY3/2022), however this may be partly defined by the outage.

Long term outlook

In a mature home market, KDDI’s technique focuses on person retention mixed with providing new providers and merchandise to boost ARPA (common income per account). The corporate has been profitable on this regard, though the tempo of development has limitations. The corporate is regularly gaining scale in monetary providers, vitality, and digital transformation. Different market verticals into consideration embody schooling, mobility, and healthcare.

Within the shorter time period, the corporate will expertise customers shifting over from 4G to 5G, which naturally brings increased pricing as pre-set knowledge volumes are changed by ‘all-you-can-eat’ knowledge plans. With 5G penetration at 44.3% in September 2022, there’s nonetheless some option to go to extend knowledge ARPU.

The corporate stays well-capitalized, with a web debt-to-equity ratio of round 15%. The corporate continues to generate free money circulate on a steady foundation, though consensus expects money conversion ratio to fall beneath 50% which is a slight concern given the corporate’s have to steadiness enterprise funding and shareholder returns (nearer to 100% is most popular). A sign of enhancing future returns is the ROIC which stays comfortably excessive at round 10%.

Whereas no main developments are at the moment disclosed, Toyota is working with KDDI on the potential of linked automobiles. While we count on efforts to be centered extra on R&D versus industrial exercise, there’s potential for the service to have extra revenue-generating alternatives from mobility-related providers.

From a aggressive standpoint, we consider KDDI will stay the quantity 2 service in Japan with a 30% market share, with Softbank remaining in third and Rakuten (OTCPK:RKUNY) remaining a comparatively minor participant.

Valuation

On consensus forecasts (see Key financials desk above), the shares are buying and selling on PER FY3/2024 12.4x, a free money circulate yield of seven.4%, and a potential dividend yield of three.5%. While the dividend yield will not be very excessive, the speed of DPS development is increased than gross sales or web earnings which is optimistic.

Dangers

Upside danger comes from person churn dropping visibly into H2 FY3/2023 as the corporate experiences no long-lasting results of the community outage, and prospects revert to extra normalized conduct.

The shift to 5G by customers accelerates into H2 FY3/2023, permitting general ARPU to rise above market expectations.

Draw back danger comes from an unlikely repetition of a community outage, which may set off an exodus of consumers in addition to set off a unfavourable directive from the telecommunications regulator.

The corporate struggles to restrict person churn, leading to KDDI conducting costly discounting and advertising and marketing campaigns to stem the circulate.

Conclusion

KDDI has managed the community outage incident effectively, and any injury to its popularity seems short-term. The telecom sector’s optimistic attributes are steady and defensive earnings, steady free money circulate technology, and enhancing shareholder returns – and KDDI continues to supply them. On undemanding valuations and a steady outlook, we reiterate our purchase ranking.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.