lindsay_imagery

Introduction

We’re in pre-earnings interval for lots of corporations we have lined. Choose Power Companies, Inc. (NYSE:WTTR) is one we have lined on a number of events, and it is best to give these earlier articles a learn for deep background on the corporate.

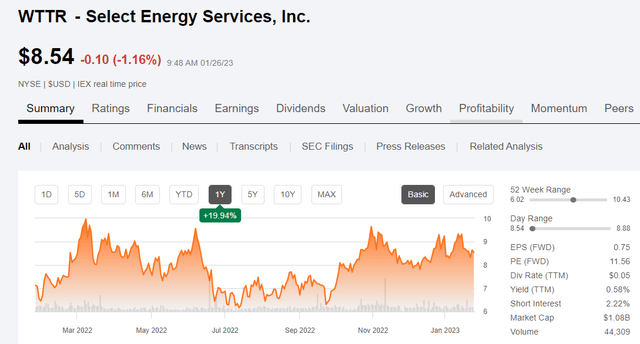

Worth chart for Choose Power Companies (Searching for Alpha)

I’ve usually been optimistic on Choose Power Companies, Inc., however am discovering it onerous to maintain the religion. During the last 12 months, the corporate peaked at $10 on the top of the Ukraine battle oil value spike, and fell to the low $6’s because the air got here out of that balloon. The inventory value traditionally appears to be purely a baby of the whims of the oil value, and the futures curve, with little or no relationship to the widely robust fundamentals driving its core water therapy enterprise.

In this text, we are going to take a look at Q3 outcomes and administration’s commentary to see if we are able to discover a catalyst for the inventory. WTTR will report This fall on or about February, twenty third 2023. Is there a motive to purchase in?

Some common commentary in regards to the OFS sector

There’s a dichotomy between the large three service corporations, or perhaps, the large 4 if you wish to depend Weatherford (WFRD) as huge, and the billion greenback and beneath microcaps. The small corporations haven’t responded to sustained oil costs above $80 for many of the final 12 months. No less than a part of the reason being there may be a lot competitors at this stage, the little guys – though they’ve and are persevering with to lift costs – would not have the pricing energy of Huge Blue, Huge Crimson, and even Huge Aqua.

The purpose of this be aware is we have to be particularly cautious about entry factors for shares like Choose Power Companies, Inc.

Contrarily, I count on 2023 goes to be a progress 12 months within the frac water administration enterprise. Horizontal legs are getting longer, and rock high quality is changing into marginal. This all means extra inputs will likely be required to generate the identical or develop the quantity of oil produced. That is bullish for WTTR.

The thesis for WTTR

On a excessive stage, water is required for fracking and have to be reused for this course of to stay viable. A lot of the shale basins are in water-challenged areas, no less than as regards recent, floor water and the calls for of fracking-20-30 million gallons per nicely, are too nice in any other case. Thankfully water reclamation is a excessive artwork and really nonetheless bettering with desalination on the horizon. One other level I’ve made repeatedly, there is no onshore oil or gas-to communicate of, with out fracking, so the water enterprise is a long run play.

Choose is within the enterprise of managing frac water used to stimulate the reservoir upon completion of shale wells. It additionally handles the cleanup or “flowback” sequence that follows after the plugs are drilled out between frac levels. Along with the automated monitoring and therapy of unpolluted and spent frac water, WTTR sources new water from floor sources, builds empoundments for water storage, and constructs pipelines to maneuver water lengthy distance to work website. In addition they present chemistry for numerous in situ remedies to reinforce the circulate of oil to the wellbore. Right here is the hyperlink once more if you’d like extra colour on their enterprise mannequin.

WTTR is current in all main shale basins and is likely one of the dominant corporations on this class.

They’ve a robust stability sheet with no long-term debt, and rising revenues and earnings. WTTR has additionally just lately reinstituted a small dividend as an indication of economic well being, and bettering market circumstances.

A catalyst for Choose

The corporate has been a long-term enterprise agglomerator, gobbling up opponents and merging their operations-without taking up loads of debt. Since 2017 they’ve accomplished quite a lot of strategic acquisitions with out destroying their stability sheet. They embody: Rockwater, Full Power Companies, Agua Libre Midstream, Nuverra Environmental Options, and most just lately Breakwater Power Companions and Cypress Environmental Options.

Privately held Breakwater was one of many market leaders in superior water recycling infrastructure, disposal and logistics options. Breakwater overlapped Choose’s broad capabilities throughout your entire Permian Basin with complementary water logistics operations within the Eagle Ford. Its core footprint consists of strategic business recycling amenities serving the guts of the Midland Basin. Breakwater caused 600,000 barrels per day of energetic recycling capability at its 4 main fastened amenities with a further 1.4 million barrels per day of permitted capability accessible for improvement.

Breakwater additionally operates 9 energetic modular recycling amenities with 1.5 million barrels per day of throughput capability. Breakwater’s amenities are supported by 46 miles of gathering and distribution pipelines, 70,000 barrels per day of disposal capability and 4.7 million barrels of storage capability with a further 3.7 million barrels of permitted storage capability accessible for improvement. This footprint expands Choose recycling capabilities to almost 3 million barrels of complete every day capability throughout fastened and cell capabilities.

The Cypress acquisition added a portfolio of strategic wastewater disposal amenities in North Dakota. Additional consolidating the Bakken area following their latest acquisition of Aqua Libre Midstream and Nuverra. Along with the strategic advantages, each transactions present clear and rapid monetary advantages as nicely.

On a full-year 2022 mixed foundation, the acquired operations from Breakwater and Cypress are anticipated to generate roughly $110 million to $115 million of income and greater than $30 million of adjusted EBITDA.

The catalyst is the profitable pickup of energetic amenities with long-term supporting contracts, skilled personnel, ongoing enterprise relationships, and naturally, taking out a competitor. Supply.

Q3 2022 for WTTR

Income of $375 million grew by 12%, and $39 million and 59% of this income enhance fell by to increased gross income. All three segments-water, chemical substances, infrastructure, elevated their gross margins from second to 3rd quarter, ensuing of their highest quarterly web revenue and adjusted EBITDA for the reason that third quarter of 2018. QoQ, Choose Power Companies, Inc. noticed 70% progress in web revenue and 32% progress in adjusted EBITDA, $24.7 mm and $62.8 mm respectively.

The Water Companies section grew its income sequentially by 13% to $221 million, whereas advancing gross margins over 3 share factors to 22.8%. web working capital elevated by $54 million through the third quarter, leading to free money circulate of unfavourable $10.7 million in Q3. Gross CapEx of $19.8 million for the third quarter translated to web CapEx of $16.1 million after asset gross sales.

Choose completed the quarter with a web money place of $13.2 million and no financial institution debt. Whole liquidity stood at $245 million when contemplating their asset backed lending facility, up from $221 million as of final quarter.

In Q3, Choose started paying a small dividend of $0.05 quarterly. Not a lot, nevertheless it’s an indication of confidence of their enterprise outlook for 2023. Supply.

Dangers to our thesis

I do not see a lot draw back threat in Choose Power Companies, Inc. at its current value. Certain if oil goes to $40, the enterprise will tank. Wanting that, I feel they’ve a transparent area to develop income and margins because the 12 months goes on.

The actual threat is lifeless cash on this one. The very fact the enterprise is well-run and carries a stable stability sheet and has glorious progress prospects, seems to be meaningless at current. Will it’s meaningless perpetually? Let’s hope not, however on the similar time acknowledge it has been an extended slog within the single digits.

Your takeaway

When the acquisitions of Breakwater and Cypress are added in, earnings for Choose Power Companies, Inc. needs to be within the neighborhood of $0.35-40 per share. A 60% bump from Q3. Let’s maintain our toes on the bottom and acknowledge unhealthy climate in December could minimize into this a bit. A modest security issue places consolidated earnings at $0.30 per share, or $29.4 mm for the quarter, a 15% bump QoQ.

Revenues on an annual foundation ought to come to $1.3 bn, and EBITDA needs to be within the vary of $280-300 mm on a full 12 months run price foundation. EV/EBITDA presently is 4.3X, in a reasonably comfy vary. Rivals Aris Water Options, (ARIS), and TETRA Applied sciences, (TTI) are buying and selling at 9.8X and 11.3X this metric, respectively. (Observe-TETRA isn’t a pure play water firm as is WTTR and ARIS.)

Analysts are calling for progress in Choose Power Companies, Inc. inventory value to $11.8 per share on a median foundation, with a low of $8.50 and a excessive of $15.00. How will we get to that $15 determine?

I feel Choose Power Companies, Inc. may shock to the upside when earnings are launched, and count on a bullish tone within the name that would result in estimate revisions-higher. It would not take a lot to get to that $15 determine, really. A a number of of 5X on the consolidated EBITDA I’ve projected, will get you to that $15.00 share value and does not appear outlandish given the power of the enterprise and supportive macro surroundings.