Basic Evaluation of Prince Pipes and Fittings: Pipes kind an integral a part of infrastructure improvement. I imply, think about houses and cities with out pipes! We must go to rivers and ponds to fetch water. And picture doing that when it’s a must to attain the workplace by 10 AM after finishing day by day chores. That might be time-consuming. Perhaps, work timings must be totally completely different.

In brief, pipes are essential. Vital sufficient to construct ₹ 6,800 crore corporations! On this article, we will do a basic evaluation of Prince Pipes and Fittings, an organization that has been round for greater than three a long time. We’ll check out its enterprise, the trade that it capabilities in, its aggressive strengths, financials, and extra. Let’s start.

Concerning the Firm

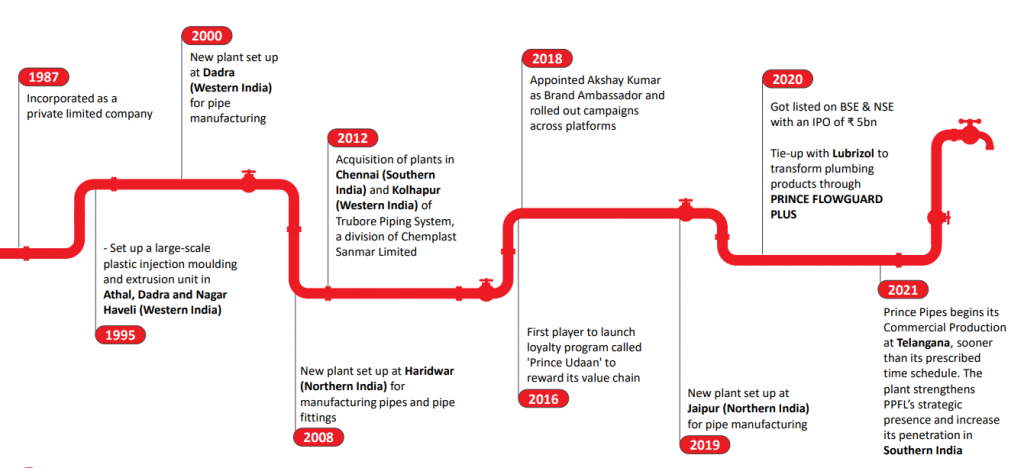

Prince Pipes & Fittings Restricted (PPFL) is one among India’s largest built-in piping options and multi-polymer producers. It has a historical past of greater than 30 years and is a Fortune 500 firm. It’s promoted by the Chedda household and is acknowledged for its in depth vary of merchandise and pristine high quality. The corporate manufactures polymer pipes and fittings for plumbing, irrigation, and sewage disposal.

PPFL has been thought of the Business’s Most Trusted Model and has the Largest Vary of SKUs. The corporate ranks amongst the highest 5 corporations within the piping trade. Because of its large manufacturing capability and huge distribution community. Having operated for greater than three a long time, the corporate has quite a few manufacturing items positioned strategically throughout the nation.

It markets its merchandise beneath two famend manufacturers – Prince Piping Techniques and Trubore Piping Techniques. It has greater than 1500 distributors and seven state-of-the-art amenities throughout India.

These are positioned at Haridwar (Uttarakhand), Athal (Dadra and Nagar Haveli), Dadra (Dadra and Nagar Haveli), Kolhapur (Maharashtra), and Chennai (Tamil Nadu). Moreover, two contract manufacturing items are positioned at Hajipur (Bihar), Aurangabad (Maharashtra), Jobner (Rajasthan), and Sangareddy (Telangana).

Business Overview

Plastic pipes and fittings are utilized in irrigation, actual property, and for the event of water provide and sanitation. India has a low per capita consumption of pipes of 11 kg as in comparison with the world common of 30 kg. The market is estimated to develop at a CAGR of 12-14% yearly until FY24. The expansion outlook stays robust, pushed by the Authorities’s deal with increasing areas beneath irrigation and growing city infrastructure spending.

As well as, the rising penetration of branded plumbing pipes within the reasonably priced housing mission section would additional result in demand within the pipe section. Nevertheless, the latest correction throughout polymers costs may result in decrease trade development in worth phrases, as a lower in uncooked materials costs would impression realizations.

About 600 million Indians face high-to-extreme stress over water. The Swachh Bharat Mission goals to realize larger sanitation protection with a funds of ₹ 12,294 crores. The Atal Mission For Rejuvenation And City Transformation goals to offer fundamental civic facilities like water provide, sewerage, city transport, and perks to enhance the standard of life with a funds of ₹ 77640 crores.

Branded pipes and fittings corporations continued to realize robust trade leads and market share from unorganized producers over the previous few years. The expansion of the organized section has additional been aided by a better lateral deal with value-added merchandise and fittings and product portfolio growth supplied to channel companions. Consequently, organized gamers have turn out to be one-stop resolution suppliers for plumbing purposes.

Aggressive Strengths

Sturdy model presence within the pipes and fittings section

Area information and understanding of the pipes and fittings trade have helped the corporate to construct a powerful distribution community.

Multi-location manufacturing items in India

A pan-India community of distributors

Technical collaboration with worldwide gamers to keep up the standard of merchandise

IPO

The corporate raised ₹ 500 crores, comprising 50% as a suggestion on the market and 50% recent problem. It had a value financial institution of ₹ 177 to ₹ 178 per share. Nevertheless, it had a muted debut. It acquired listed at ₹ 160 per share, i.e. at a reduction. Its shares closed at ₹ 627.90 per share on December 08, 2022. Which means it gave multibagger returns of 292.43% since its itemizing.

Prince Pipes and Fittings – Financials

Income & Profitability

The corporate’s income, in addition to income, present an growing development. Its gross sales grew at a 3-year CAGR of 19.12%, whereas its income grew at a 3-year CAGR of 44.81%. As well as, its web revenue margin has been displaying an growing development. It grew from 5.53% within the monetary yr 2017-18 to 9.39% within the monetary yr 2021-22. Equally, its EBITDA margin grew from 12.3% in FY18 to fifteen.6% in FY22.

Prince Pipes and Fittings- Key Metrics

Prince Pipes and Fittings is a small-cap firm with a market capitalization of ₹ 6834.00 crores as of December 08, 2022. It has earnings per share of ₹ 13.34, indicating that ₹ 13.34 is allotted to each particular person share of the inventory. A excessive EPS signifies good profitability. Its shares had been buying and selling at a price-to-equity ratio (P/E) of 46.34 which is decrease than the trade P/E of 61.71. This might imply that the corporate’s inventory is undervalued.

Return Ratios

The corporate has a great return on fairness of 21.63%. This means that the corporate generates a great quantity of revenue on the fairness that’s employed in it. Additional, it has a return on capital employed of 27.58%, indicating that it generates ₹ 27.58 for each ₹ 100 that’s deployed in its enterprise.

Debt & Liquidity Ratios

Prince Pipes and Fittings has a excessive debt-to-equity ratio of 1.15. This means that it’s dangerous for lenders and buyers. It means that the corporate is financing a big quantity of its potential development by borrowing. This ratio varies from trade to trade, nonetheless, its friends have a debt-to-equity ratio ranging between 0 and 0.28.

Additional, it has a present ratio of two.19. This means that its present property are virtually twice its present liabilities. It has a dividend yield of 0.58. Prince Pipes and Fittings has a credit standing of A+ from CRISIL, indicating a steady outlook.

Shareholding

The corporate’s promoters maintain a 62.94% stake in it. Retail buyers maintain an 18.50% stake, FIIs maintain 4.41% and DIIs maintain 15.45%. Additional, there is no such thing as a pledge in opposition to the promoters’ holding and their holding has decreased from 63.25% a yr in the past to 62.94% this yr.

It has 11,05,61,079 excellent shares. A few of the high institutional holders invested within the firm embody Mirae Asset (8.41%), Oman India Joint Funding Fund (2.54%), Kuwait Funding Authority (1.64%) New Mark Advisors LLP (1.13%), and Aditya Birla Solar Life Trustee Personal Restricted (1.05%).

Future Outlook of Prince Pipes And Fittings

Prince Pipes and Fittings goals to

broaden its distribution community throughout goal markets.

Introduce value-added merchandise to make sure price effectivity.

scale back prices to make sure comfy EBITDA margins.

enhance RoCE and RoE ratios by monitoring quantity and value development.

In Closing

On this article on the elemental evaluation of Prince Pipes and Fittings, we took a have a look at the corporate’s enterprise, the trade by which it capabilities in, and its aggressive benefit. Later we took a have a look at monetary metrics like income, profitability, ratios and shareholding. That’s all for this text people. We hope to see you round and completely satisfied investing till subsequent time!

Now you can get the newest updates within the inventory market on Commerce Brains Information and you too can use our Commerce Brains Inventory Screener to seek out one of the best shares.

Begin Your Monetary Studying Journey

Need to study Inventory Market and different Monetary Merchandise? Make sure that to take a look at, FinGrad, the educational initiative by Commerce Brains. Click on right here to begin your monetary studying journey with us. And don’t miss out on the Introductory Provide!!