JHVEPhoto

It has been a bit over 10 months since I wrote my bullish piece on Uncover Monetary Providers (NYSE:DFS), and in that point, the shares have returned about 7.8% in opposition to a lack of 8.7% for the S&P 500. A stronger, wiser man than me wouldn’t take this chance to brag, and bask within the heat glow of self congratulation. My regulars know of my odious tendency to brag, so I am going to bask in it. I am feeling good about this commerce, however I am left with the query of what to do now. The corporate has clearly reported earnings since, so I assumed I might evaluate the title to see if it is smart to purchase extra, maintain, or take my winnings and run. In any case, a inventory buying and selling at $118 is, by definition, a extra dangerous funding than that very same inventory when it is buying and selling at $111. I am going to evaluate the aforementioned earnings, and can examine these to the valuation. Moreover, the three January 2023 places with a strike of $80 that I offered once I final reviewed the title have simply expired, and I’m completely giddy to put in writing about how that commerce labored out. This firm has come again on my radar as a result of my places have simply expired. Moreover, although, I am rising anxious about bank card default charges. I could also be fretting needlessly, however I do not just like the look of this chart. I do not find out about you, however I see a really particular uptick in delinquencies just lately.

I am completely obsessive about making your studying expertise as nice as potential. One of many methods I attempt to make issues as good for you as potential is to supply up a “thesis assertion” paragraph initially of every of my articles, which provides you the “gist” of my pondering up entrance. On this means, you’ll be able to perceive my pondering comparatively rapidly, whereas insulating your self from my typically tiresome type. You are welcome. Anyway, I feel the monetary outcomes right here have been positive. My downside is that the shares are usually not objectively low cost, and that is sufficient to drive me away in the mean time. I’m anxious concerning the state of the financial system, and I feel the January 2023 rally has gotten forward of itself. For that motive, I will be taking income right here. Additionally, I’ve carried out very effectively on my deep out of the cash put choices right here, together with a batch that has simply expired some weeks in the past. My latest expertise with them signifies the potential deep out of the cash places has for producing nice threat adjusted returns. The issue is that the premia on supply aren’t ample to justify the train, so I am inclined to take a seat on the sidelines till the shares drop in worth from right here. Deep out of the cash places nonetheless include some threat, so it is troubling to me that they are yielding over 210 foundation factors lower than the U.S. Treasury Invoice.

Monetary Snapshot

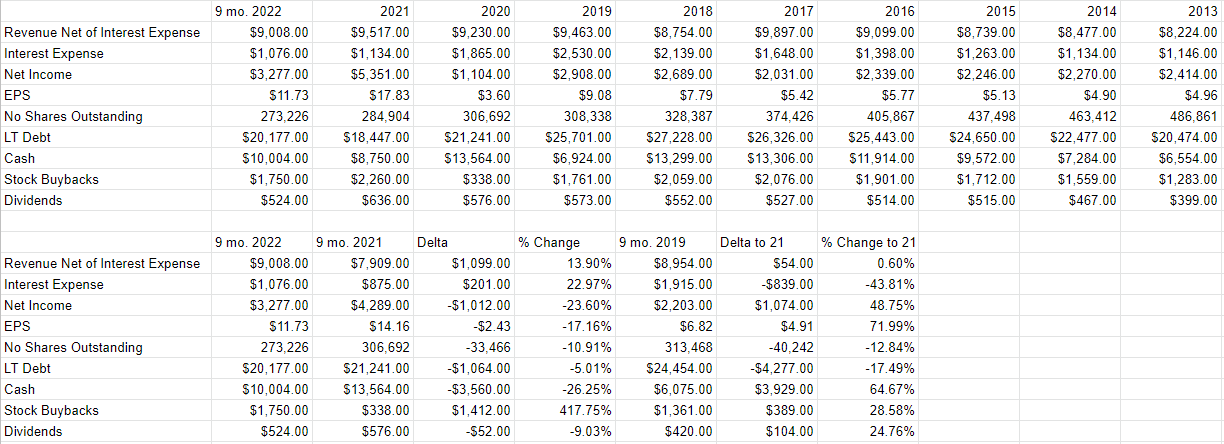

I feel the monetary historical past right here has been usually good over the previous yr. Particularly, income for the primary 9 months of 2022 was up absolutely 13% relative to 2021. Internet earnings was decrease by $1 billion, however that was largely a operate of unrealised positive aspects swinging from $562 million to the nice in 2021 to a lack of $394 million in 2022. I do not just like the drop in internet earnings, however I perceive it as being pushed by this dynamic. When in comparison with the pre-pandemic interval, the monetary outcomes are additionally fairly good. Though income is just marginally larger than it was in 2019, internet earnings is up by about $1.07 billion, or 49%.

Moreover, the capital construction has improved, with long run debt down by about $1 billion, and now money available represents absolutely 49.6% of excellent debt. Thus, I do not foresee a credit score or solvency disaster right here anytime quickly. Given the above, and despite my ongoing fears of rising credit score points within the financial system, I might be completely happy to purchase extra of this inventory on the proper worth.

Uncover Monetary Financials (Uncover Monetary investor relations)

The Inventory

As my common readers know, I’ve talked myself out of some worthwhile trades with phrases like “on the proper worth.” In response to this criticism, I might level out that I am of the view that it is higher to overlook out on some positive aspects than lose capital. My regulars additionally know that I contemplate the “enterprise” and the “inventory” to be fairly various things. Each enterprise buys a lot of inputs and turns them right into a remaining services or products. The inventory, alternatively, is an possession stake within the enterprise that will get traded round in a market that aggregates the group’s quickly altering views concerning the future well being of the enterprise, future rates of interest, the well being of the financial system, and so forth. The inventory additionally strikes round as a result of it will get taken alongside for the journey when the group adjustments its views about “the market” usually. An inexpensive sounding, if counterfactual, argument will be made to recommend that my Uncover Monetary funding would have carried out even higher had the market not dropped since I purchased final March. In any case, I am of the view that the inventory is affected by a bunch of variables that could be solely peripherally associated to the well being of the enterprise, and that may be irritating.

This inventory worth volatility pushed by all these components is troublesome, but it surely’s a possible supply of revenue as a result of these worth actions have the potential to create a disconnect between market expectations and subsequent actuality. I completely hate to sound like I am bragging about it, however that is precisely how I generated a really respectable return on my Uncover funding over the previous yr. The market was overly pessimistic, and I took benefit of that. I do not wish to be too repetitive, however in my opinion that is the one strategy to generate income buying and selling shares: by figuring out the group’s expectations a couple of given firm’s efficiency, recognizing discrepancies between these assumptions and inventory worth, and inserting a commerce accordingly. I’ve additionally discovered it is the case that traders do higher/much less badly once they purchase shares which are comparatively low cost, as a result of low cost shares correlate with low expectations. Low-cost shares are insulated from the buffeting that costlier shares are hit by.

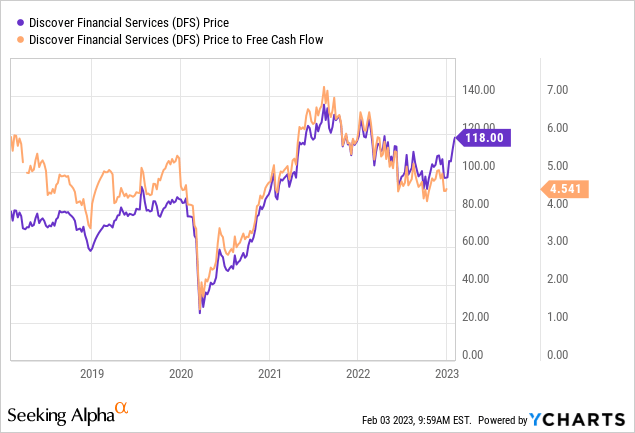

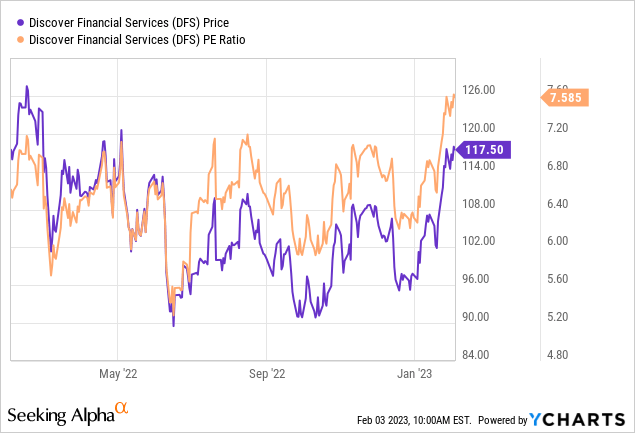

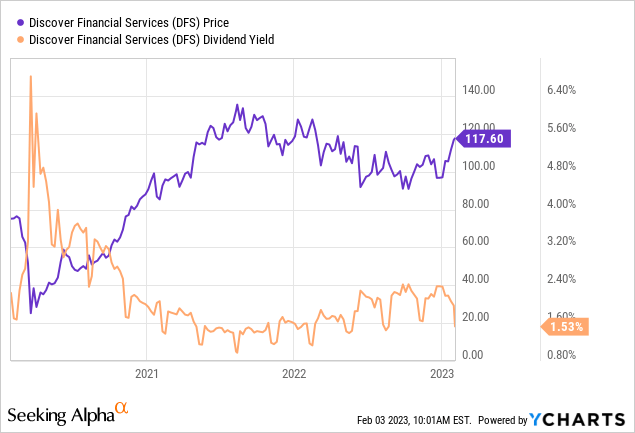

As my regulars know, I measure the relative cheapness of a inventory in a number of methods, starting from the straightforward to the extra complicated. For instance, I like to take a look at the ratio of worth to some measure of financial worth, like earnings, gross sales, free money, and the like. I prefer to see an organization buying and selling at a reduction to each the general market, and to its personal historical past. In case you do not have your copy of “Doyle’s Almanac of 2022 Trades” in entrance of you, I turned bullish on this inventory when it was buying and selling at a worth to free money move of 5.833. The issue is that there isn’t any extra free money move, so I must depend on different valuation measures. I word that the market is paying extra for $1 of earnings than it has at any time over the previous yr. That is troublesome in my opinion. It is also regarding to me that the dividend yield is on the low finish, and is presently yielding about 200 foundation factors lower than the 10-year Treasury Bond.

Yet another factor my regulars know is that I wish to attempt to perceive what the group is presently “assuming” about the way forward for a given firm, and so as to do that, I depend on the work of Professor Stephen Penman and his ebook “Accounting for Worth.” On this ebook, Penman walks traders by how they will apply the magic of grade 10 algebra to a typical finance formulation so as to work out what the market is “pondering” a couple of given firm’s future development. This includes isolating the “g” (development) variable on this formulation. In case you discover Penman’s writing a bit dense, you may wish to attempt “Expectations Investing” by Mauboussin and Rappaport. These two have additionally launched the thought of utilizing the inventory worth itself as a supply of data, after which infer what the market is presently “anticipating” concerning the future.

Anyway, making use of this strategy to Uncover Monetary Providers in the mean time suggests the market is assuming that this firm will develop income at a fee of about 1% from right here. In my opinion, that could be a fairly pessimistic forecast. This places me on the horns of a dilemma. An argument might be made to recommend that the shares are cheap, and one other might be made to recommend that they are costly, given that they are yielding a lot lower than the slightly much less dangerous 10-Yr Treasury. On condition that I am within the temper to protect capital, I’ll take my chips off the desk at this level. I could remorse this transfer, as there’s an opportunity that the market worth will rise from right here. In my expertise, although, what the market giveth, the market can in a short time taketh awayeth.

Choices Replace

My common readers know that I am additionally a giant fan of promoting deep out of the cash put choices. Manner again in late March of final yr, I offered three of the January 2023 Uncover Monetary places with a strike of $80 for $5 every. These have been 27% out of the cash on the time, and so they very just lately expired nugatory. Thus, my returns on this funding have been enhanced properly. Extra importantly, in my opinion, the danger on these returns was a lot decrease than it was on the inventory. Some may recommend that I “drone on” about this level, however I gotta be me. I wish to get throughout the concept investing is not only about maximizing funding returns. It is about maximizing threat adjusted funding returns. Deep out of the cash put choices are a good way to do that.

Though I like this technique very a lot, clearly, I feel, like with every part in investing, “there is a time and a spot.” Sadly, it isn’t the fitting time in the mean time, because the premia on supply are too skinny to justify the train. “The juice is not definitely worth the squeeze” as some may say. As an illustration, the January 2024 Uncover Monetary places with a strike of $80 are presently bid at solely $2.10. This represents a yield of about 2.6%, or about 210 foundation factors decrease than the 1-year Treasury Invoice. Though I like quick places an incredible deal, I’ll have to take a seat on the sidelines at this level, and watch for any weak point within the shares earlier than promoting extra of them.