Phillip Faraone/Getty Photographs Leisure

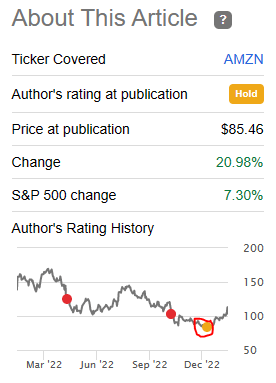

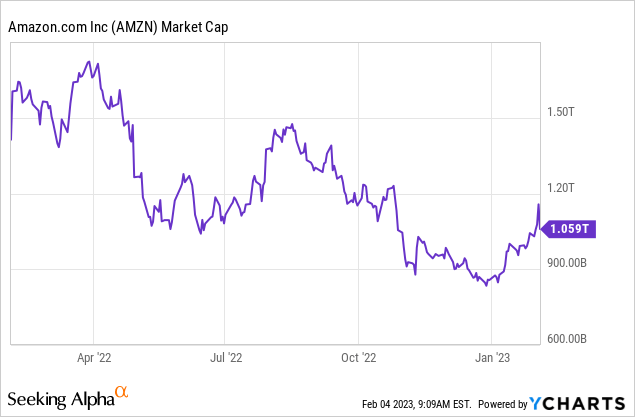

After we final coated Amazon (NASDAQ:AMZN) we gave it an improve to a “Maintain” ranking after pushing the “Robust Promote” thesis in Might and October. The rationale was that the inventory was a brilliant bubble within the technique of deflating, however deflating will take time and there’s by no means a straight line to truthful worth. Particularly we mentioned,

A bounce to the 200-day transferring common can be fairly painful for the quick facet. Therefore we’re upgrading this to a “maintain”, from a “Robust Promote”. Whereas we might not need to buy AMZN even 50% decrease than this, we expect the case for shorting the inventory is not compelling and we’re therefore transferring to the sidelines.

Supply: Pretty Valued For Extraordinarily Poor Returns

That was a well timed improve as AMZN bottomed inside a day of our name and has rallied 21% since then.

Searching for Alpha

We dissect the This autumn-2022 outcomes and inform you why it’s time to flip bearish once more.

This autumn-2022

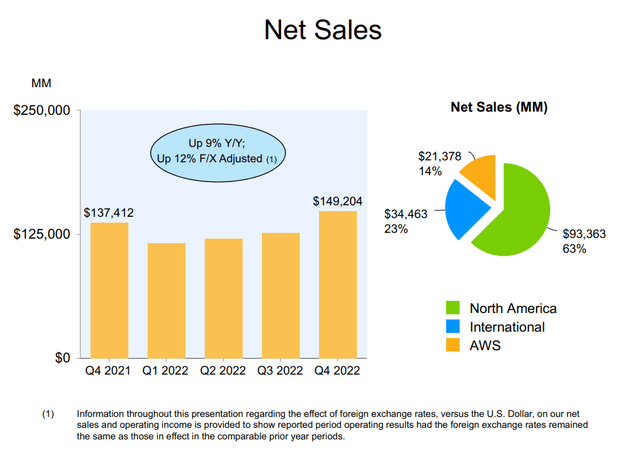

One weird facet impact of the 2009-2021 bull market has been that buyers have been completely conditioned to have a look at gross sales first fairly than earnings. By that commonplace, AMZN actually provides the group a point of happiness as the highest line quantity as soon as once more beat estimates by $3.4 billion. Gross sales got here in at $149.2 billion, a complete 9% yr over yr.

AMZN This autumn-2022 Presentation

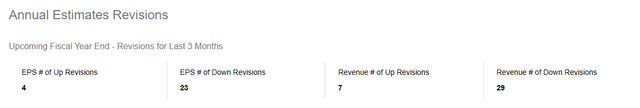

These searching for even a brighter spot may level to the forex headwinds with out which gross sales may need been up 12%. Whereas the quantity beat estimates, spare a thought for the analysts who labored day and evening to decrease the bar for AMZN.

Searching for Alpha

At a extra necessary degree, AMZN’s 9% income development is about consistent with nominal GDP.

Present-dollar GDP elevated 9.2 %, or $2.15 trillion, in 2022 to a degree of $25.46 trillion, in contrast with a rise of 10.7 %, or $2.25 trillion, in 2021 (tables 1 and three).

Supply: BEA

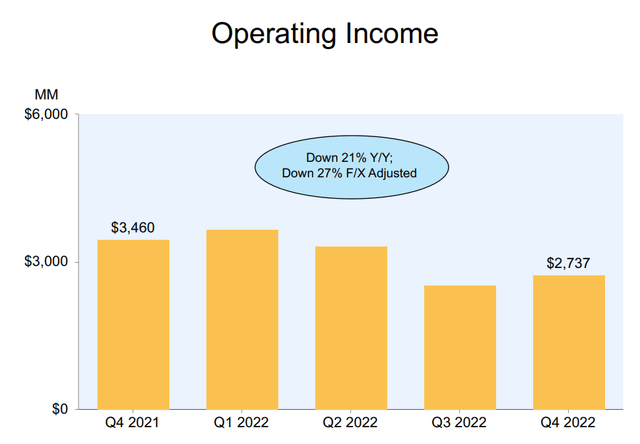

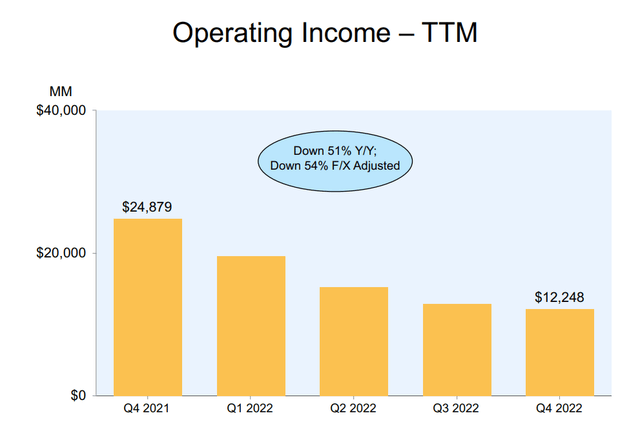

That is the primary and most necessary takeaway. AMZN’s development is useless. We instructed you this in Might and once more in October and we’re telling you now so you do not neglect that the expansion is gone. AMZN’s revenues are monitoring nominal GDP and a majority of firms accomplish that with out forcing buyers to pay ridiculously demanding multiples. Talking of demanding multiples, AMZN as soon as once more didn’t make one other yr of income development translate into rising earnings. Working earnings was down 21% yr over yr.

AMZN This autumn-2022 Presentation

It’s attainable that buyers do ask themselves a very powerful query. Precisely when will AMZN begin rising the underside line?

AMZN This autumn-2022 Presentation

For the longest time buyers have dodged that query by singing candy lullabies of how Amazon Internet Providers, or AWS, was price trillions of {dollars}.

Amazon.com Inc.’s cloud-storage enterprise is on a transparent path towards a $3 trillion worth, virtually triple what the entire firm is price now within the inventory market, in response to a Redburn Ltd. analyst.

The unit, Amazon Internet Providers, is so highly effective that the corporate could determine in some unspecified time in the future to separate it off from the huge, slower-growing on-line retail operation, analyst Alex Haissl wrote in a 128-page report initiating protection of the cloud-computing trade. He didn’t say when the $3 trillion worth could also be achieved.

Supply: Bloomberg

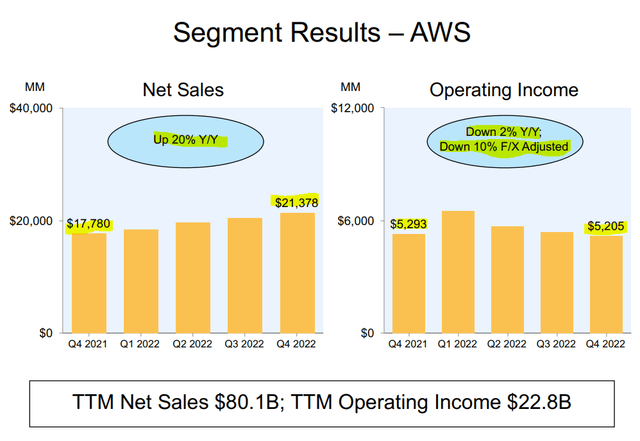

Whereas he didn’t say when that $3 trillion will probably be achieved, we imagine will probably be shut so far. Getting again to actuality, AWS shattered the final remaining leg of hope for the bulls. After we wrote about AMZN in October we had reiterated that AWS margins have been going to break down quickly.

We see cloud and net companies develop into a commodity service inside 2-3 years and count on margins to drop by 40% from these ranges (sub 15% working margin).

Supply: Ama-Gone, Why The Fed Is Nonetheless Not Bailing Your Poor Investments, Together with Amazon

As traditional, we have been too optimistic with our timeline. Gross sales grew 20% and working earnings dropped 10% when adjusted for foreign exchange.

AMZN This autumn-2022 Presentation

Working margin is now 24.3% down from a peak of over 30%. We’re dropping about 1.5% 1 / 4 in working margin and that’s with revenues nonetheless rising at a brisk tempo. Our outlook right here is that AWS will proceed its robust income development for a while earlier than even it joins the nominal GDP development fee of the remainder of the corporate. For 2023, 2024 and 2025, we see AWS income development decelerating to 18%, 14% and 10% respectively. Over the identical timeframe, working margins ought to contract to 14%-17%. That may hold AWS working earnings about flat from these ranges over the subsequent 3 years. One factor to remember is that working earnings will not be pre-tax earnings. There are a variety of extra prices earlier than you get to your pre-tax earnings quantity. So whenever you boil down this $21 billion working earnings to an after tax quantity, you’ll doubtless get far beneath $15 billion. As to what you must worth this at, our greatest quantity is about 15X after-tax earnings. So our truthful worth for AWS is about $225 billion. That leaves $800 billion plus for the retail facet which by itself has by no means made a revenue.

Verdict

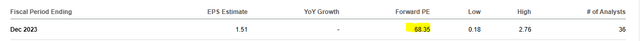

Certain, it’s possible you’ll get some “inexperienced shoots” on the tender touchdown entrance. Traditionally the Federal Reserve has achieved an excellent tender touchdown solely as soon as and positively has by no means experimented with mountain climbing proper right into a contracting ISM studying. If the January job numbers have been certainly correct, then it is advisable value in a terminal fee variety of over 5%, presumably nearer to six%. What may presumably go incorrect with AMZN if a recession or the next terminal Fed Funds Price materializes? In any case, it is just buying and selling at a P/E of 68.

Searching for Alpha

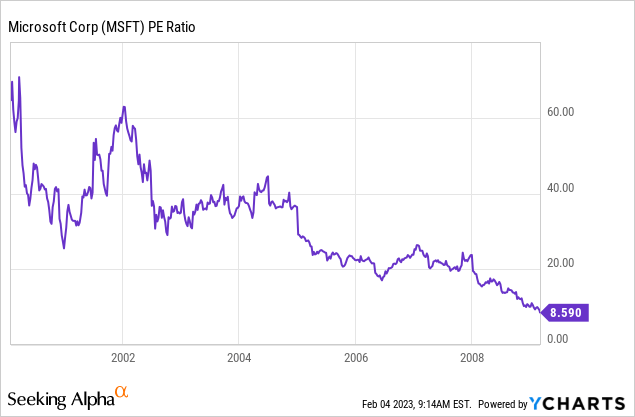

Consider the legendary firm referred to as Microsoft (MSFT), which didn’t cease making boatloads of cash even within the world monetary disaster, traded at a P/E ratio of 8.59 at one level.

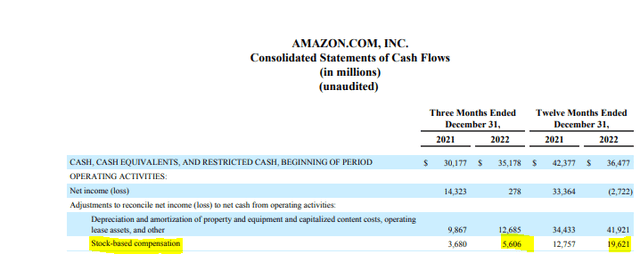

You’ll be able to run the maths at what the P/E ratio was after you subtract out the money available for MSFT on the time. So whenever you bizarrely settle for this 68X a number of on AMZN, bear in mind that you’re playing, not investing. Keep in mind that this a number of additionally doesn’t depend the inventory primarily based compensation. AMZN’s inventory primarily based compensation was funnily virtually the identical as its AWS working earnings.

AMZN This autumn-2022 Earnings Launch

We’d add that it’s rising far quicker. Possibly some analyst can slap a damaging $3 trillion valuation on this stand-alone and uncounted entity. We’re downgrading AMZN to a “Robust Promote” and stay up for the a number of normalization course of.

Please word that this isn’t monetary recommendation. It could seem to be it, sound prefer it, however surprisingly, it isn’t. Buyers are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their goals and constraints.