400tmax

About two weeks in the past, Alphabet (NASDAQ:GOOG) reported annual outcomes for fiscal 2022 and the corporate missed on earnings per share in addition to income expectations. In fact, lacking by $440 million on income when reporting $76.05 billion shouldn’t be such a giant deal and GAAP EPS missed by $0.14.

Within the following article, we’re trying on the challenges Alphabet is already dealing with and take a look at the annual outcomes and speak slightly bit about share buybacks. And within the second a part of the article, we’re specializing in ChatGPT and if it could possibly be a contest or menace for Alphabet (particularly Google).

Full Yr and Quarterly Outcomes

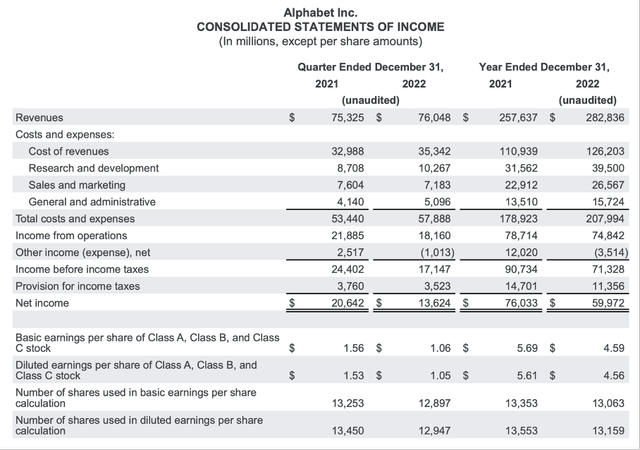

We begin by trying on the full-year outcomes for fiscal 2022. Income elevated 9.8% year-over-year from $257,637 million in fiscal 2021 to $282,836 million in fiscal 2022. In fixed foreign money, income elevated 14% year-over-year. And whereas the highest line nonetheless elevated, working revenue declined barely from $78,714 million in fiscal 2021 to $74,842 million in fiscal 2022 – leading to a decline of 4.9% YoY. And eventually, diluted earnings per share declined from $5.61 in fiscal 2021 to $4.56 in fiscal 2022 – a decline of 18.7% year-over-year.

Alphabet This fall/22 Earnings Launch

When trying on the outcomes for the fourth quarter of fiscal 2022, income nonetheless elevated barely from $75,325 million in the identical quarter final yr to $76,048 million this quarter – leading to 1.0% year-over-year high line progress. In fixed currencies, income elevated even 7% year-over-year. However working revenue declined 17.0% YoY from $21,885 million in the identical quarter final yr to $18,160 million and diluted earnings per share declined even 31.4% YoY from $1.53 in This fall/21 to $1.05 in This fall/22.

Segments and Development Potential

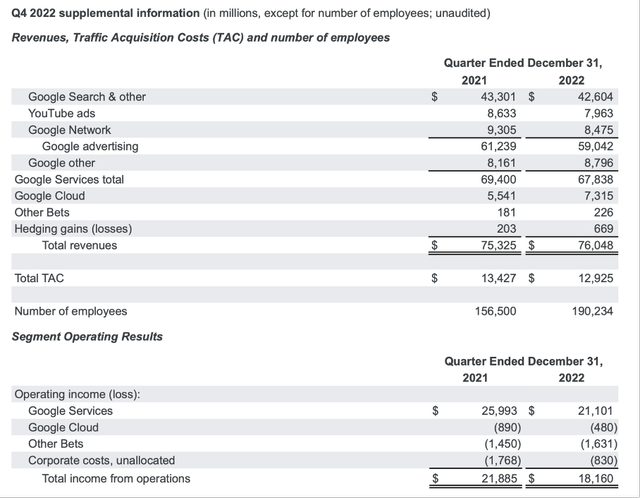

When trying on the totally different segments, we are able to begin by trying on the commercial phase. And when trying on the core enterprise – Google Search – we noticed income declining barely from $43,301 million in the identical quarter final yr to $42,604 million in This fall/22. Income was negatively impacted by advertisers pulling again spendings in “Search” within the fourth quarter (in comparison with the earlier quarter) and whereas retail and journey elevated, finance was declining.

YouTube

Income from YouTube adverts additionally declined from $8,633 million in This fall/21 to $7,963 million in This fall/22. And YouTube remains to be throughout its shift to YouTube Shorts – much like Meta Platforms (META) switching to Reels. YouTube Shorts at the moment are averaging over 50 billion day by day views (up from 30 billion in Q1/22) and monetization can be ramping up, however the firm remains to be early in its monetization efforts.

When speaking about YouTube, administration is targeted on 4 facets. Ramping up shorts, speed up engagement on a big display and investing in subscription providing. YouTube Music and Premium had been surpassing 80 million subscribers lately (however this quantity can be together with these customers simply being on trial). The fourth (and long-term) effort is to make YouTube extra shoppable. Folks ought to have the ability to store from the creators, the totally different manufacturers and content material they love.

Google Different

“Google Different”, which is together with income from Google Play (app purchases), {hardware} gross sales (just like the Fitbit merchandise) or YouTube non-advertising (like subscriptions) elevated income from $8,161 million in the identical quarter final yr to $8,796 million this quarter. And seven.8% year-over-year progress stemmed principally from {hardware} revenues and YouTube subscriptions.

Cloud

One of many greatest contributors to income progress remains to be Google Cloud with income growing from $5,541 million in This fall/21 to $7,315 million in This fall/22 – 32.0% year-over-year progress. And whereas the phase remains to be not worthwhile, it might cut back its working loss from $890 million in the identical quarter final yr to $480 million this quarter. Administration is seeing continued momentum and clients more and more selecting BigQuery because it unified information lakes, information warehouses and superior AI/ML into one system.

Alphabet This fall/22 Earnings Launch

And eventually, Google goes to focus extra on retail – a phase it doesn’t but have a robust standing in. Like I discussed above, administration is specializing in making YouTube extra shoppable. However administration is considering even broader. It’s on a multi-year mission to make Google a core a part of purchasing journeys. Google desires to enhance shopper experiences by a extra visible, immersive, and browsable search and it desires to persuade an increasing number of retailers to take part within the free listings. In 2022, Google already noticed an uptick in retailers – particularly smaller companies.

Share Buybacks

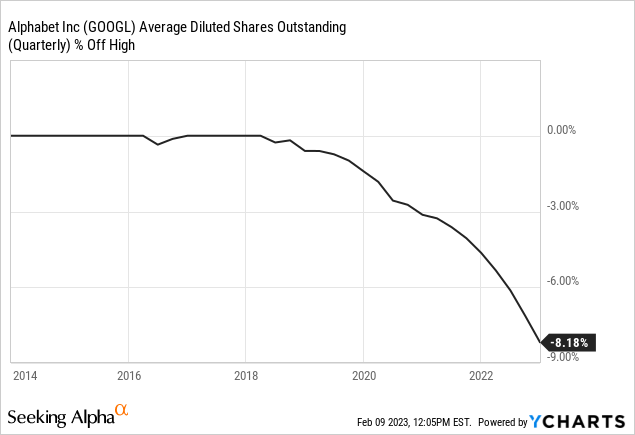

Just like different main expertise corporations, Alphabet can be shopping for again shares with an aggressive tempo. In fiscal 2022, the corporate spent $59,296 million on share buybacks – much more than within the earlier yr ($50,274 million spent on share buybacks in fiscal 2021). The variety of excellent shares peaked in 2018 (with 14.10 billion shares) and since then the quantity has been declining consistently and the quantity was diminished by 8%.

And in fiscal 2022, free money stream of $60,010 million was barely sufficient to finance the share buybacks, however as the corporate is paying no dividend and has little or no debt on its steadiness sheet, it could use its free money stream for share buybacks.

And so long as Alphabet doesn’t discover higher methods to make use of its money, it could additionally use $21,879 million in money and money equivalents in addition to $91,883 in short-term investments on the steadiness sheet for share buybacks. We’ll get again to the query if Alphabet is undervalued proper now, but when administration sees its personal inventory as a superb funding, it might use at the very least a part of these liquid property for share buybacks.

And when already trying on the steadiness sheet, we are able to additionally point out $14,701 million in long-term debt Alphabet has on its steadiness sheet, however this quantity is just a fraction of the annual working revenue (or free money stream) and will simply be paid again by the money on the steadiness sheet – subsequently we must always not fear.

Huge Moat vs. Challenges

And whereas there have been many alternative information tales in the previous couple of weeks, the dominating subject was synthetic intelligence and particularly ChatGPT. This already change into apparent when studying the earnings name transcripts of the main expertise corporations. Bloomberg acknowledged that mentioning “synthetic intelligence” throughout earnings calls spiked throughout this earnings season and Alphabet isn’t any exception: The time period “AI” was talked about 47 occasions throughout Alphabet’s final earnings name – in comparison with 10-15 occasions within the earlier two earnings calls.

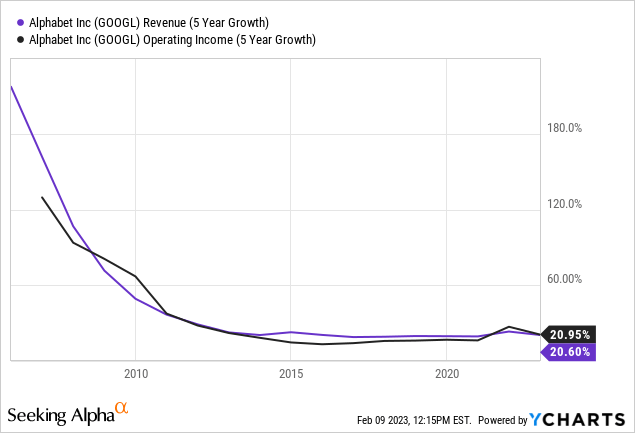

When attempting to reply the query if ChatGPT from OpenAI or Ernie from Baidu, Inc. (BIDU) could possibly be a contest for Alphabet we must always remind ourselves concerning the sturdy moat Alphabet has round its enterprise – particularly Google Search. And again in 2013 Stanley Druckenmiller known as Google the best enterprise mannequin he is aware of. The moat already change into seen when trying on the numbers. One of many traits of a large moat firm is stability and consistency in its outcomes. In fact, progress slowed down and Google shouldn’t be reporting the identical progress charges as within the first years, however progress charges are surprisingly secure round 20% within the latest previous.

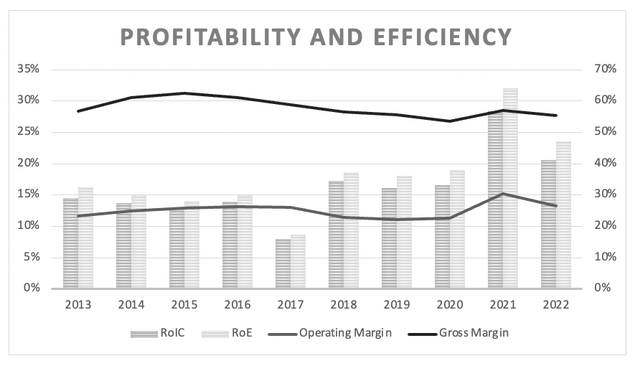

And when trying on the firm’s margins we additionally see consistency. Whereas the gross margin could possibly be described as barely declining within the final ten years, we must always see each as secure over time. Moreover, Alphabet is reporting an above-average return on invested capital – within the final ten years it was 16.22% and within the final 5 years RoIC was 19.81%.

Alphabet Working Metrics (Writer’s work)

These numbers clearly point out an financial moat across the enterprise. In my first article, I described the financial moat of Alphabet in additional element, which is predicated on a robust and recognizable model title, value benefits and particularly the community impact.

However now it out of the blue looks like Alphabet has a critical competitor with ChatGPT. In keeping with totally different numbers, ChatGPT is the quickest rising consumer-application in historical past, and it apparently has already greater than 100 million month-to-month lively customers in January 2023. I couldn’t discover a quantity on what number of day by day or month-to-month lively customers Google Search has however discovered estimates above 4 billion month-to-month lively customers. Proper now, there are about 4.9 billion folks utilizing the web all over the world and contemplating that nearly all people is utilizing a search engine and Google has a market share of 85% to 96% (relying on the system) we might assume about 4 billion month-to-month customers (we additionally should exclude nations like China or Russia).

Why it could possibly be an issue?

It appears proper now as if the AI struggle is heating up and competitors is growing. Baidu for instance introduced it can launch its ChatGPT-like bot known as “Ernie” within the coming weeks. And whereas Alphabet doesn’t have to fret a lot about Baidu (as the corporate is just working in China, a market to which Alphabet has no entry to), Microsoft (MSFT) partnering with OpenAI could possibly be the larger problem for Alphabet. Thus far, Google had a market share of 88% in america with competitor Bing being solely round 7%, however analysts estimate that Microsoft might acquire market shares by the transfer to incorporate ChatGPT in its Bing search. And first numbers are already indicating Bing is gaining traction. On February 9, 2023, the variety of App downloads for Bing spiked and the variety of day by day lively customers elevated from about 370k on February 2, 2023, to 570k on February 9, 2023.

Alphabet is already preventing again. Nevertheless, the introduction of Bard was overhasty and might need completed Alphabet extra hurt than good. The inventory value tanked that day and the corporate misplaced $100 billion in market capitalization. It appears a bit like Alphabet panicked because it was already reported that administration understand the problem (and perhaps the menace) a number of weeks in the past arising with the discharge of ChatGPT and issued a “Code Crimson”.

Why we shouldn’t be involved

Nevertheless, as a substitute of panicking, Alphabet ought to mirror on its strengths and when asking the query if ChatGPT could possibly be a menace for Google (and Alphabet) we additionally should needless to say ChatGPT can’t actually substitute Google. Whereas ChatGPT appears to be higher in producing concepts, longer texts or assemble arguments, Google is significantly better is discovering info. Particularly correct and present information can’t be discovered by ChatGPT. And Google is significantly better in presenting info in a extra interesting manner, whereas ChatGPT will provide solely textual content. And naturally, Google is providing many alternative providers – we are able to seek for photos, watch movies on YouTube or use Google Maps.

Apart from ChatGPT being no substitute for the totally different providers Google is providing, it could be an enormous mistake to underestimate Alphabet contemplating its “AI power”. Alphabet is specializing in synthetic intelligence for a very long time and CEO Sundar Pichai made this clear over the past earnings name:

AI is probably the most profound expertise we’re engaged on right this moment. Our gifted researchers, infrastructure and expertise make us extraordinarily effectively positioned, as AI reaches an inflection level.

Greater than six years in the past, I first spoke about Google being an AI-first firm. Since then, we now have been a frontrunner in creating AI. In truth, our Transformer’s analysis undertaking and our field-defining paper in 2017, in addition to our path-breaking work in diffusion fashions at the moment are the premise of most of the generative AI purposes you are beginning to see right this moment.

Google may also present new instruments and APIs for builders, creators and companions and the community of individuals that can contribute to Google is tough to match by any rivals – merely as a result of enormous variety of folks utilizing Google. It makes way more sense for builders and creators to construct on the work of Google as a substitute of a smaller competitor. Google can be engaged on bringing massive language fashions to Gmail and Docs.

And eventually, we must always not ignore that Alphabet is producing enormous quantities of free money stream it could use to both purchase rivals or spend enormous quantities on analysis and growth to remain aggressive on this “AI struggle”.

Intrinsic Worth Calculation

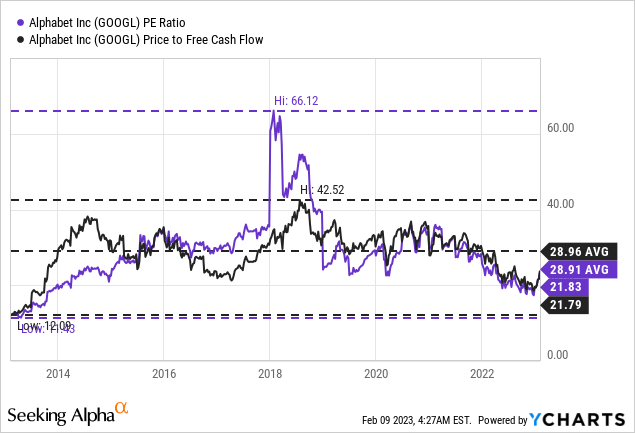

It additionally looks like Alphabet is buying and selling for cheap valuation multiples – regardless of the challenges Alphabet is dealing with. When simply trying on the price-earnings ratio or the price-free-cash-flow ratio, Alphabet is neither low cost nor costly. Proper now, it’s buying and selling for 21.8 occasions earnings in addition to 21.8 occasions free money stream. And whereas the inventory has been buying and selling for decrease multiples 10 years in the past, this is without doubt one of the lowest valuation multiples within the final ten years and clearly under the 10-year averages (28.96 for P/FCF and 28.91 for P/E).

When utilizing a reduction money stream calculation to find out an intrinsic worth, we are able to use the free money stream of the final 4 quarters as foundation ($60,010 million) in addition to 12,947 million excellent shares and a ten% low cost charge. When calculating with these assumptions, Alphabet should develop about 5.5% yearly from now until perpetuity to be pretty valued.

In my final article I wrote that Alphabet is already undervalued however may decline additional. Proper now, the inventory is buying and selling virtually for a similar value stage as on the finish of October. I might nonetheless argue that Alphabet is at the very least pretty valued and may already be undervalued. However I nonetheless assume Alphabet might decline additional within the quarters to return.

Conclusion

I’m not actually bearish about Google and definitely usually are not saying to quick it. Nevertheless, the mixture of a slowing down financial system and the corporate out of the blue dealing with an actual menace by way of ChatGPT (and let’s see what different corporations like Baidu provide you with) the inventory value might tumble within the coming months and generate an actual shopping for alternative.

I might subsequently charge Alphabet as a maintain proper now. The inventory shouldn’t be actually costly – nevertheless I see some challenges. And though the elemental enterprise of Alphabet is fairly resilient (in my view), we might see the inventory value decline.