Picture credit: Techleap.nl

The Netherlands accommodates probably the most profitable ecosystem within the EU, however is falling behind its opponents within the US and Asia. And to stay aggressive, concrete efforts have to be made on particular features, says Techleap in its annual State of Dutch Tech 2023 report.

Listed here are the important thing takeaways from the report.

Scaleup to startup ratio

In keeping with the report, the scaleup-to-startup ratio within the Netherlands is decrease than friends as a result of an absence of capital.

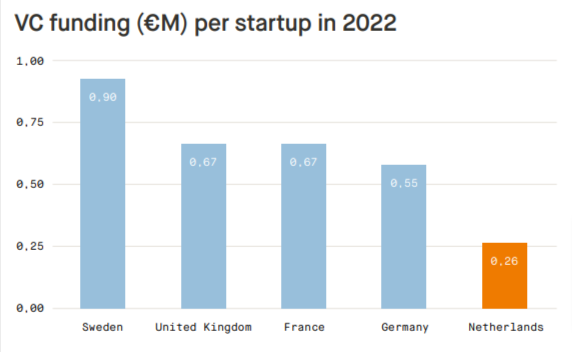

In 2022, whole VC funding within the Netherlands was €2.6B and the common funding of all startups was €0.26M per startup.

It was considerably decrease than different main EU startup ecosystems, together with the UK (€0.67M), France (€0.67M), and Germany (€0.55M).

![]()

In the meantime, Sweden stands out with €0.9M in VC funding per startup.

Financing progress

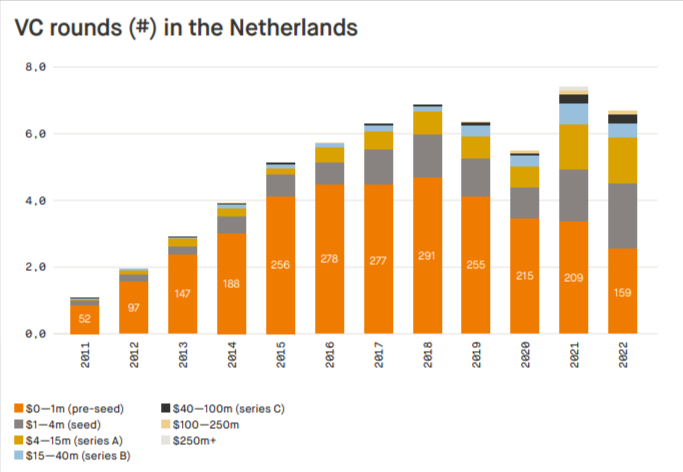

Investments: The report says that 2022 noticed a drop in funding ranges in any respect levels besides early-stage capital (pre-seed: €0-1M) in comparison with 2021.

Whereas the rise in pre-seed funding was constructive, fewer offers have been made, with 159 offers in 2022 (-24 per cent) in comparison with 209 in 2021.

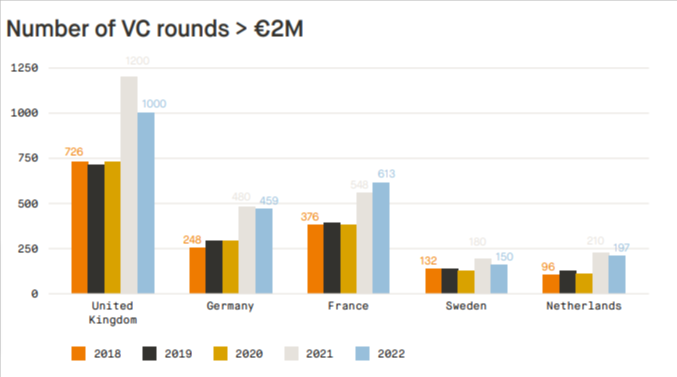

In keeping with the report, VC funding rounds above €2M dropped by 6 per cent for the Netherlands, however are nonetheless practically double 2020 ranges. France stands tall within the whole variety of VC funding rounds above €2M by 12 per cent progress in 2022 in comparison with 2021.

In the meantime, the UK and Sweden dropped 17 per cent, and Germany noticed a 4 per cent decline.

There was a giant drop in ‘massive funding rounds above €100M,’ setting the Netherlands again to 2020 ranges, exhibits the report. In 2022, there have been 6 rounds above €100M in comparison with 14 in 2021.

VC funding: €1.4B in funding got here from Dutch buyers in 2021 and 2022. Additionally, funding from US funds is down from 49 per cent to 23 per cent of all investments.

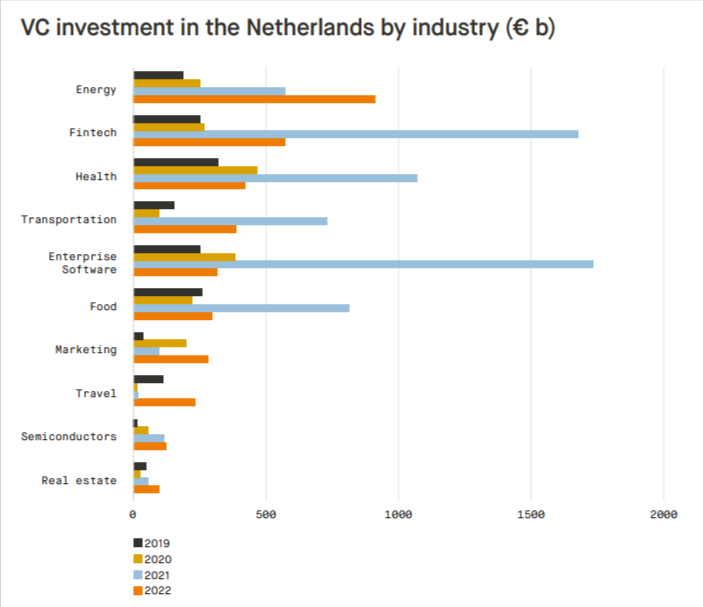

Sector: Most sectors have taken a success in comparison with 2021 however are nonetheless performing above 2020 ranges. Whereas the vitality sector soared in 2022, Fintech, enterprise software program, and the well being sector declined in comparison with 2021.

Regardless of a looming financial disaster, Affect investments are on the rise, as buyers are prepared to guess on sustainable firms. VC funds invested €1B in Dutch influence startups in 2022.

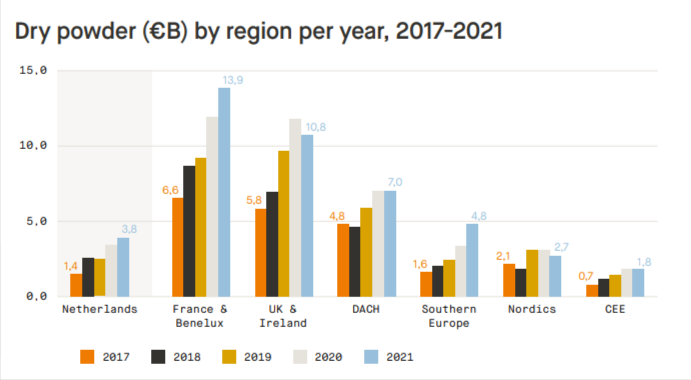

Dry powder: Dry powder ranges have reached €3.8B within the Netherlands, greater than doubling over the previous 5 years.

Expertise attraction and inclusion

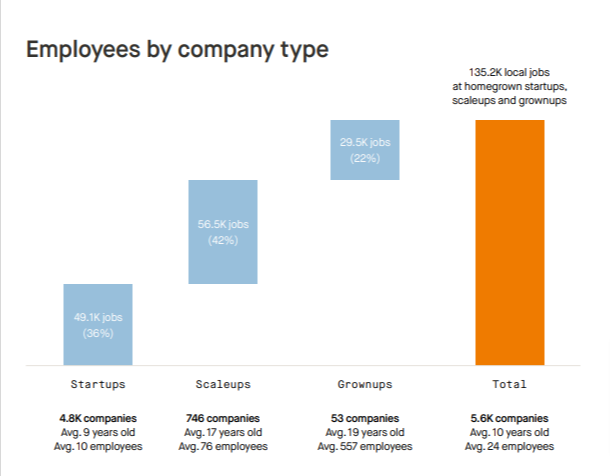

Employment: In keeping with the report, startups stay a driver of employment progress within the Netherlands with annual job progress within the tech sector in 2022 at 7.6 per cent.

The variety of staff at startups, scaleups, and grownups has been steadily rising over the previous few years from 109K jobs in 2020 to 130K in 2021 and 135K in 2022.

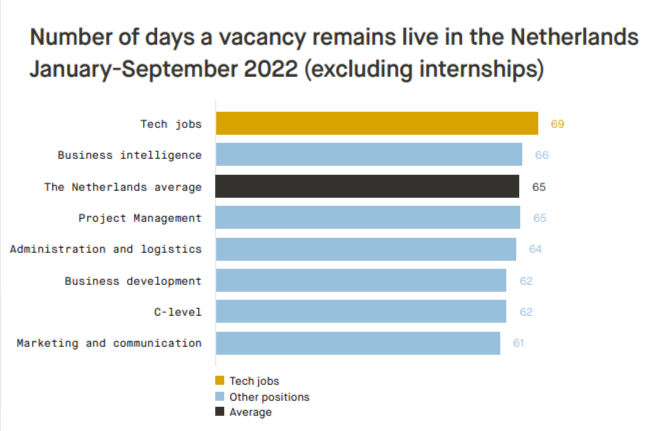

Expertise attraction: Attracting tech abilities within the Netherlands stays a priority for a number of startups.

In keeping with the report, Dutch tech job openings take greater than 60 days to fill and the share of hard-to-fill jobs in tech rose to 59 per cent in 2022 in comparison with 58 per cent in 2021.

In 2022, Belgium overtook the Netherlands with the very best proportion of hard-to-fill jobs.

Inclusion: 10% of tech founders within the Netherlands have a migrant background and the sector attracts extra overseas expertise than different sectors.

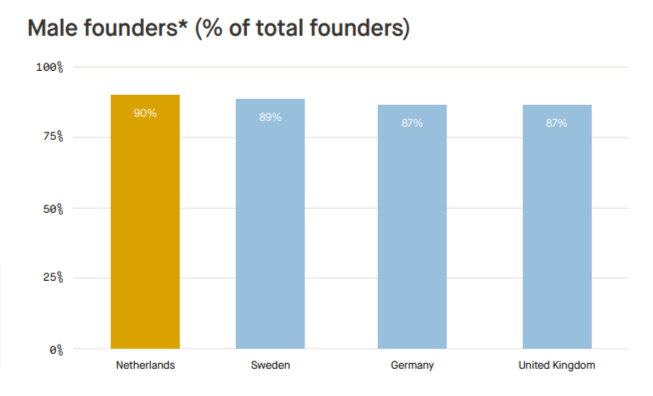

The Dutch tech sector continues to be dominated by male founders and staff, says the report.

Round 90 per cent of Dutch founders within the startup ecosystem are male, making it much less gender various than Germany (87%), Sweden (89%), and the UK (87%).

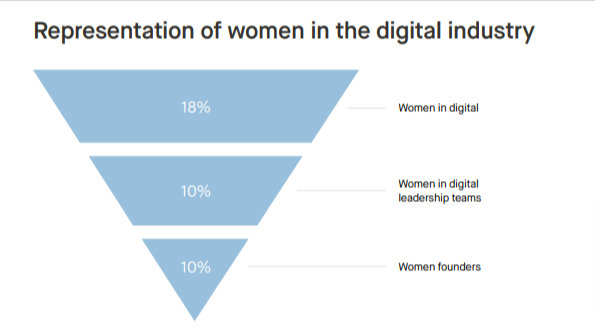

In the meantime, 10 per cent of all (co)founders within the Dutch startup ecosystem are feminine, whereas girls make up 18 per cent of the entire Dutch digital trade.

Feminine-only founder groups within the Netherlands account for five.2 per cent of all VC offers and 0.7 per cent of VC funding raised, beneath EU friends.

Techleap suggests creating a “people-first tradition that empowers progress with extra constant technique and accountability. Extra privacy-friendly knowledge is required to create efficient, people-first cultures.”

Deep tech ecosystem

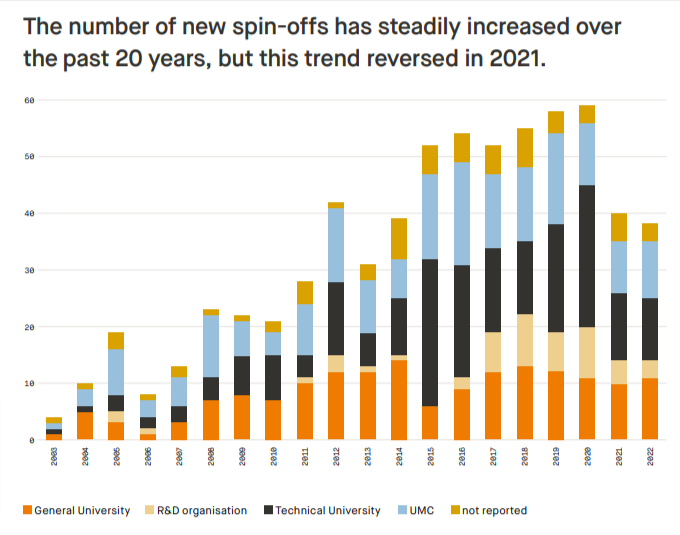

Spin-offs: The Netherlands is a high-performing analysis nation, affirms the report. In consequence, the variety of new spin-offs has steadily elevated over the previous 20 years, however this development reversed in 2021.

In keeping with the report, 674 spin-offs have been based over the previous 20 years. That is 90 per cent of the 745 confirmed spin-offs.

Of all 745 Dutch spin-offs, 80 per cent are nonetheless lively.

The scientific spin-offs from Dutch tutorial establishments develop and apply a broad vary of applied sciences to serve many various industries.

The report reveals that technical universities are the commonest supply of spin-offs, accounting for 30 per cent of all spin-offs, adopted by UMC’s (28 per cent), normal universities (25 per cent), and analysis organisations (7 per cent).

Spin-offs are principally funded by public funds, besides in life science.

Deep tech startups: “Dutch deeptech startups are resilient, however they take time to scale,” provides the report.

It’s because, normally, deeptech firms usually undergo prolonged analysis and improvement (R&D) trajectories with comparatively small groups.

Of firms nonetheless lively that have been based within the final 5 years, solely 28 per cent have greater than 10 staff. For firms based 5-10 years and 10+ years in the past, this quantity is 46 and 51 per cent, respectively.

Regional evaluation

The report cites that the Netherlands is specializing in constructing a nationwide ecosystem by way of public initiatives that drive connections between key startup hubs.

“The Netherlands is right here with many small, specialised ecosystem hubs throughout the nation,” reads the report.

North Holland: North Holland is house to over 3.4K startups and 51.6K startup jobs, representing 38 per cent of the startup workforce within the nation. Amsterdam stands on high for producing most of North Holland’s startup jobs.

In 2022, the vast majority of funding rounds have been centred in North and South Holland and pushed by overseas funding, exhibits the analysis.

Final yr, the North Holland area additionally raised €2B in VC funding.

South Holland: South Holland is a hub for impact-focused startups.

South Holland has over 2K startups supporting over 26.1K native jobs. The area has a mixed worth of practically €50B.

The area raised €419M in VC funding in 2022. The analysis additionally added that startup jobs grew within the province by 8 per cent in 2022.

North Brabant: North Brabant is house to almost 1.1K startups, making it the third-largest province within the variety of startups. It has 172 deeptech startups producing over 5K jobs, representing greater than 1 / 4 of the area’s startup workforce.

North Brabant raised €440M in VC funding in 2022.

Utrecht: Utrecht stands at 4th when it comes to the area by numerous startup jobs. This area has 900+ startups, creating over 16.4K jobs in 2022.

Utrecht raised €226M in VC funding in 2022.

Nevertheless, it ranks second in startup jobs per 1M inhabitants, states the report.

Groningen: Groningen is the engine of startup improvement within the North Netherlands.

The area is house to round 230 startups, creating 3.3K jobs.

Since 2018, the province has elevated startup jobs by 12 per cent — rising sooner than some other province within the nation.

Startups in Groningen raised €14.7M in VC funding in 2022.

Gelderland: Gelderland is a pacesetter in foodtech with massive startups driving progress, provides the report.

Between 2021 and 2022, foodtech startups accounted for practically one-fifth of latest jobs within the area.

The area raised €66M in VC funding in 2022.

Conclusion

In keeping with the report, the Netherlands is well-positioned to be a tech chief, nevertheless, it has to deal with some key challenges corresponding to:

Realign strategic tech coverage Join the communityIncrease capitalBoost regional developmentDevelop and appeal to extra talentSupport deeptechGrow the bottom