Olivier Le Moal

On this month-to-month article, we attempt to establish 5 closed-end funds (“CEFs”) which have a stable previous historical past, pay high-enough distributions, and provide affordable valuations on the present time.

Writer’s Be aware: This text is a part of our month-to-month collection that tries to find the 5 finest buys within the CEF enviornment at that cut-off date. Sure elements of the introduction, definitions, and sections describing choice standards/course of might have some commonality and repetitiveness with our different articles on this collection. That is unavoidable in addition to intentional to maintain the complete collection constant and straightforward to comply with for brand spanking new readers. Common readers who comply with the collection from month to month might skip the overall introduction and sections describing the choice course of. Additional, a model of this text is made accessible a number of days early to the subscribers of the HIDIY Market service.

Why Make investments In CEFs?

For income-focused traders, closed-end funds stay a sexy funding class that gives excessive earnings (typically within the vary of 6%-10%, usually 8% plus), broad diversification (when it comes to the variety of holdings and number of asset lessons), and market-matching complete returns in the long run, if chosen fastidiously and purchased at affordable value factors. A $500K CEF portfolio can generate practically $40,000 a 12 months, in comparison with a paltry $7,500 from the S&P 500. Now, for those who had been a retiree and wanted to make use of all of that earnings, the portfolio most likely may not develop a lot in any respect, however it could nonetheless develop simply sufficient to match the speed of inflation. That definitely beats funding autos like annuities with out a few of their downsides. Nonetheless, if you’re ready to withdraw 5% or underneath, the remainder of the yield could be reinvested within the authentic fund or a brand new fund to make sure affordable development of the capital. In our view, if managed with some due diligence and care, a CEF portfolio might ship 10% (or higher) long-term complete returns. In case your purpose just isn’t high-income or your wants are comfortably met with lower than 3% earnings yields, you could be higher served with a well-diversified conventional DGI (dividend development investing) portfolio. We additionally write a month-to-month collection to establish “5 Secure and Low-cost DGI” shares. You’ll be able to learn our most up-to-date article right here.

All that mentioned, it is necessary to pay attention to the dangers and challenges that include investing in CEFs. We listing numerous threat components on the finish of this text. These investments are usually not appropriate for everybody, so please take into account your targets, earnings wants, and threat tolerance fastidiously earlier than you put money into CEFs.

With that in view, one can purchase selectively and in small and a number of heaps. Nobody can predict the long run path of the market with any diploma of certainty. So, we proceed to be looking out for good funding candidates which have a stable observe document, provide good yields, and when they’re providing nice reductions.

Methods to Construction a Excessive-High quality CEF Portfolio?

It is extremely necessary that we should always put money into funds which have a confirmed historical past of excellent efficiency and purchase them when they’re supplied at affordable reductions (low cost to NAV). As well as, it’s of utmost significance that we make our CEF portfolio a diversified one when it comes to underlying asset lessons. That is the explanation we suggest having a minimum of ten positions in a CEF portfolio. Apart from, earnings traders must measure the attractiveness of a closed-end fund when it comes to the earnings yield and its reliability and sustainability.

Market uncertainties will at all times stay with us, however that ought to not forestall us from performing on our long-term investing targets. It is best to maintain the deal with our long-term targets and methods which have confirmed to work in good occasions and dangerous. If you’re a brand new investor and/or beginning a model new CEF portfolio, our suggestion can be to start out small and construct the positions over time. We consider, for many traders, a 20%-25% allocation to closed-end and high-income funds ought to be sufficient.

Final 12 months, most funds misplaced worth in sync with the broader market. Nonetheless, not all funds are created equal, and a few have fared higher than others. For reference and full disclosure, from Jan. 2022 till 02/10/2023, our “8%-CEF-Revenue” portfolio misplaced roughly -5.3%, in comparison with -12.8% of the S&P 500.

Our 5 Greatest CEFs To Think about Each Month

This collection of articles makes an attempt to separate the wheat from the chaff by making use of a broad-based screening course of to 500 CEF funds adopted by an eight-criteria weighting system. Ultimately, we’re offered with about 30-40 of essentially the most enticing funds as a way to choose the most effective 5. Nonetheless, please observe that we don’t take into account funds which have a historical past of fewer than 5 years. We use our multi-step filtering course of to pick simply 5 CEFs from round 500 accessible funds. For readers who’re in search of a wider choice and diversification, we additionally embody a listing of the highest 10 funds.

That is our common collection on CEFs, the place we spotlight 5 CEFs which are comparatively low-cost, provide “extra” reductions to their NAVs, pay moderately excessive distributions, and have a stable observe document.

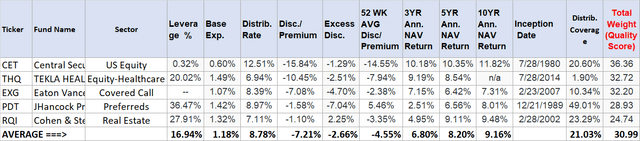

The chosen 5 CEFs this month, as a gaggle, are providing a median distribution charge of 8.78% (as of 02/10/2023). Apart from, these 5 funds have a confirmed previous document and collectively returned 6.80%, 8.20%, and 9.16% within the final three, 5, and ten years. Please take into account that these returns are a lot decrease than what they had been final 12 months and ought to be measured compared to the broader market. The common leverage for the group is low at about 17%, with a median low cost of -7.2%. Since it is a month-to-month collection, there could also be some picks that might overlap from month to month.

Please observe that these are usually not suggestions to purchase however ought to be thought-about as a place to begin for additional analysis.

Objectives For the Choice Course of

Our targets are easy and are aligned with most conservative earnings traders, together with retirees who want to dabble in CEFs. We need to shortlist 5 closed-end funds which are comparatively low-cost, provide good reductions to their NAVs, pay comparatively excessive distributions, and have a stable and substantial previous observe document in sustaining and rising their NAVs. Please observe that we’re not essentially going for the most cost effective funds (when it comes to reductions or highest yields), however we additionally require our funds to face out qualitatively. We undertake a scientific method to filter down the 500-plus funds right into a small subset.

This is a abstract of our main targets:

Excessive earnings/distributions. Affordable long-term efficiency when it comes to complete return on NAV: We additionally attempt to measure if there was an extra NAV return over and above the distribution charge. Cheaper valuation on the time of shopping for, decided by absolutely the low cost to NAV and the “extra” low cost supplied in comparison with their historical past. Protection ratio: We attempt to measure to what extent the earnings generated by the fund covers the distribution. Not all CEFs absolutely cowl the distribution, particularly the fairness, and specialty funds, as they rely on capital positive factors to cowl their distributions. We alter this weight in keeping with the sort and nature of the fund.

We consider {that a} well-diversified CEF portfolio ought to include a minimum of 10 CEFs, ideally from completely different asset lessons. It is also advisable to construct the portfolio over a interval somewhat than put money into one lump sum. When you had been to put money into one CEF each month for a 12 months, you’d have a well-diversified CEF portfolio by the 12 months’s finish. What we offer right here each month is a listing of 5 possible candidates for additional analysis. We predict a CEF portfolio could be an necessary element within the general portfolio technique. One ought to ideally have a DGI portfolio as the muse, and the CEF portfolio might be used to spice up the earnings degree to the specified degree. How a lot ought to one allocate to CEFs? Every investor must reply this query himself/herself primarily based on his/her private scenario and components like the dimensions of the portfolio, earnings wants, threat urge for food, or threat tolerance.

Choice Course of

We’ve greater than 500 CEF funds to select from, which come from completely different asset lessons like fairness, most popular shares, mortgage bonds, authorities and company bonds, vitality MLPs, utilities, infrastructure, and municipal earnings. Identical to in different life conditions, although the broader selection at all times is nice, it does make it tougher to make a closing choice. The very first thing we need to do is to shorten this listing of 500 CEFs to a extra manageable subset of round 75-100 funds. We are able to apply some standards to shorten our listing, however the standards must be broad and free sufficient at this stage to maintain all the possibly good candidates. Additionally, the factors that we construct ought to revolve round our authentic targets. We additionally demand a minimum of a five-year historical past for the funds that we take into account. Nonetheless, we do consider the 10-year historical past, if accessible.

Standards to Shortlist:

Standards

Brings down the variety of funds to…

Motive for the Standards

Baseline expense < 2.5% and Avg. Each day Quantity > 10,000

Approx. 435 Funds

We don’t want funds that cost extreme charges. Additionally, we would like funds which have truthful liquidity.

Market capitalization> 100 Million

Approx. 400 Funds

We don’t want funds which are too small.

Monitor document/ Historical past longer than 5 years (inception date 2016 or earlier)

Approx. 375 Funds

We would like funds which have a fairly lengthy observe document.

Low cost/Premium < +7%

Approx. 350 Funds

We don’t need to pay too excessive a premium; in actual fact, we would like greater reductions.

Distribution (dividend) Fee > 5%

Approx. 260-290 Funds

The present distribution (earnings) to be moderately excessive.

5-12 months Annualized Return on NAV > 0% AND

3-12 months Annualized Return on NAV >0%

Approx. 220-250 Funds

We would like funds which have a fairly good previous observe document in sustaining their NAVs.

Click on to enlarge

After we utilized the above standards this month, we had been left with roughly 220 funds on our listing. Nevertheless it’s too lengthy a listing to current right here or meaningfully choose 5 funds.

Be aware: All tables on this article have been created by the creator (until explicitly specified). Many of the knowledge on this article are sourced from Cefconnect.com, Cefa.com, and Morningstar.com.

Narrowing Down To 50 Funds

To convey down the variety of funds to a extra manageable depend, we’ll shortlist ten funds primarily based on every of the next standards. After that, we’ll apply sure qualitative standards to every fund and rank them to pick the highest 5.

At this stage, we additionally get rid of sure funds which have had substantial destructive NAV returns for each three-year and five-year intervals.

Seven Broad Standards:

Extra low cost/premium (defined under). Distribution charge. Return on NAV, final three years (medium-term). Return on NAV, final 5 years (long run). Protection ratio. Extra return over distributions. The full weight (calculated up thus far).

Extra Low cost/Premium:

We definitely like funds which are providing massive reductions (not premiums) to their NAVs. However generally, we might take into account paying close to zero or a small premium if the fund is in any other case nice. So, what’s necessary is to have a look at the “extra low cost/premium” and never on the absolute worth. We need to see the low cost (or premium) on a relative foundation to their document, say 52-week common.

Subtracting the 52-week common low cost/premium from the present low cost/premium will give us the surplus low cost/premium. For instance, if the fund has the present low cost of -5%, however the 52-week common was +1.5% (premium), the surplus low cost/premium can be -6.5%.

Extra Low cost/Premium = Present Low cost/Premium (Minus) 52-Wk Avg. Low cost/ Premium.

So, what is the distinction between the 12-month Z-score and this measurement of Extra Low cost/Premium? The 2 measurements are fairly related, perhaps with a delicate distinction. The 12-month Z-score would point out how costly (or low-cost) the CEF is compared to the 12 months. Z-score additionally takes under consideration the usual deviation of the low cost/premium. Our measurement (extra low cost/premium) compares the present valuation with the final 12-month common.

We kind our listing (of 210 funds) on the “extra low cost/premium” in descending order. For this criterion, the decrease the worth, the higher it’s. So, we choose the highest 10 funds (most destructive values) from this sorted listing.

(All knowledge as of 02/10/2023.)

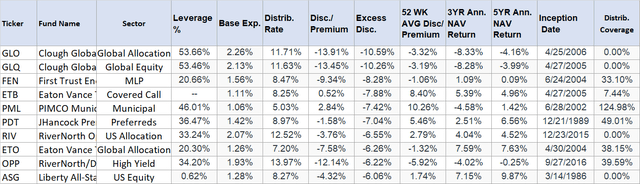

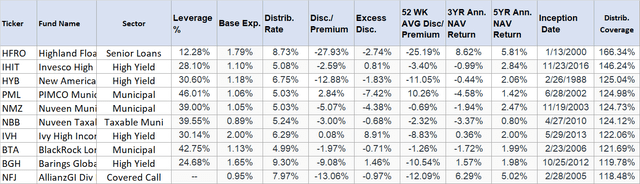

Desk 1:

Writer

Excessive Present Distribution Fee:

In spite of everything, most traders put money into CEF funds for his or her juicy distributions. We kind our listing on the present distribution charge (descending order, highest on the prime) and choose the highest 10 funds from this sorted listing.

Desk 2:

Writer

Medium-Time period Return on NAV (final three years):

We then kind our listing on a three-year return on NAV (in descending order, highest on the prime) and choose the highest 10 funds.

Desk 3:

Writer

5-12 months Annualized Return on NAV:

We then kind our listing on the five-year return on NAV (in descending order, highest on the prime) and choose the highest 10 funds.

Desk 4:

Writer

Protection Ratio (Distributions Vs. Earnings):

We then kind our listing on the protection ratio and choose the highest 10 funds. The protection ratio is derived by dividing the earnings per share by the distribution quantity for a particular interval. Please observe that in some instances, the protection ratio might not be very correct because the “earnings per share” perhaps three to 6 months previous. However generally, it is pretty correct.

Desk 5:

Writer

Extra Return Over Distribution:

That is the “extra return” offered by the fund over the distribution charge. It is calculated by subtracting the distribution charge from the three-year NAV return.

Desk 6:

Writer

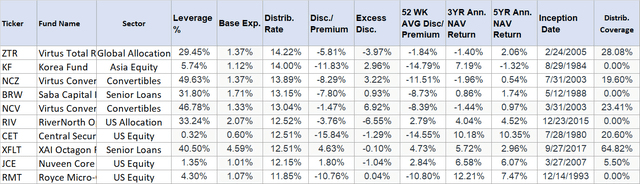

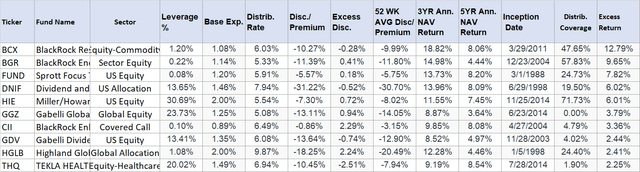

Whole Weight (High quality Rating) Calculated As much as This Level:

Be aware: The Whole Weight calculation just isn’t absolutely accomplished at this level since we have now not taken under consideration the 10-year NAV return. Additionally, we’d alter the burden for the protection ratio at a later stage. Nonetheless, we choose the highest 15 names on this foundation.

Desk 7:

Writer

Now we have now 75 funds in complete from the above picks.

We are going to see if there are any duplicates. In our present listing of 75 funds, there have been 25 duplicates, that means there are funds that appeared greater than as soon as. The next names seem twice (or extra):

Appeared two occasions: CII, ETO, GGN, HFRO, HGLB, PML, RIV, RMT (8 duplicates)

Appeared thrice: ASG, BCX, BGR, DNIF, FUND, HIE, THQ (14 duplicates)

Appeared 4 occasions: CET (3 duplicates)

So, as soon as we take away 25 duplicate rows, we’re left with 50 (75 – 25) funds.

Be aware: It might be worthwhile to say right here that simply because a fund has appeared a number of occasions doesn’t essentially make it a sexy candidate. Generally, a fund might seem a number of occasions merely for the incorrect causes, like a excessive present low cost, excessive extra low cost, or a really excessive distribution charge that might not be sustainable. However in the course of the second stage of filtering, it could not rating properly on the general high quality rating on account of different components like poor observe document. That mentioned, if a fund has appeared 4 occasions or extra, it could be price a re-assessment.

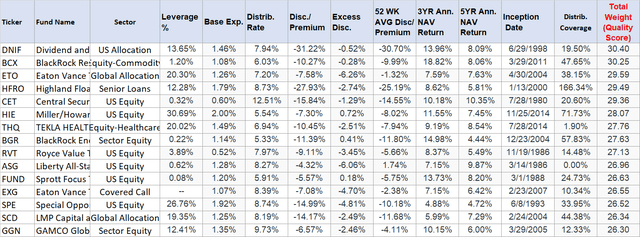

Narrowing Down To Simply 10 Funds

In our listing of funds, we already might have among the finest possible candidates. Nonetheless, thus far, they’ve been chosen primarily based on one single criterion that every of them could also be good at. That is not practically sufficient. So, we’ll apply a mix of standards by making use of weights to eight components to calculate the overall high quality rating and filter out the most effective ones.

We are going to apply weights to every of the eight standards:

Baseline expense (Max weight 5) Present distribution charge (Max weight 7.5) Extra low cost/premium (Max weight 5) 3-YR NAV return (Max weight 5) 5-YR NAV return (Max weight 5) 10-YR NAV return (Max weight 5, if lower than ten years historical past, a median of three-year and five-year) Extra NAV return over distribution charge (Max weight 5) Adjusted Protection Ratio (Max weight 7.5): This weight is adjusted primarily based on the kind of fund to supply truthful remedy to sure sorts like fairness and sector funds. We assign some bonus factors to sure sorts of funds, which by their make-up, rely on capital positive factors to fund their distributions, to convey them at par with fixed-income funds. These fund sorts embody Fairness/ Sector fairness (two bonus factors), actual property (two factors), coated name (two factors), and MLP funds (variable). Nonetheless, please observe that this is only one of 9 standards which are getting used to calculate the overall high quality rating.

As soon as we have now calculated the weights, we mix them to calculate the “Whole Mixed Weight,” additionally known as the “High quality Rating.”

The sorted listing (spreadsheet) of fifty funds on the “mixed complete weight” is hooked up right here:

File-for-export_-_5_Best_CEFs_for_Feb_2023.xlsx

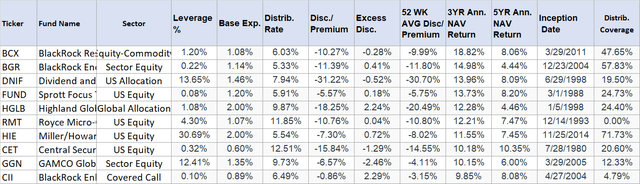

10-Positions Portfolio of The Month

When you had been to pick ten picks, we might merely decide the highest one from every of the asset lessons. That mentioned, due diligence on every title continues to be extremely advisable. Additionally, in our closing picks, we have a tendency to provide precedence to funds that pay common and constant distributions on a month-to-month or quarterly foundation. Funds which will have inconsistent dividends (even when they’re excessive) typically don’t make it to our prime listing. Additionally, remember that many occasions, single-country funds rating excessive in our rankings. Lots of them pay variable dividends. As well as, being single-country funds, they are often inherently riskier since their future returns are tied to only one nation, be it financial, regulatory, or geopolitical components.

This is the listing of the highest 10 picks (from completely different asset lessons):

(CET), (ETO), (OTCPK:DNIF), (THQ), (EXG), (HFRO), (MCI), (PDT), (RQI), (BST).

Desk 8:

Writer

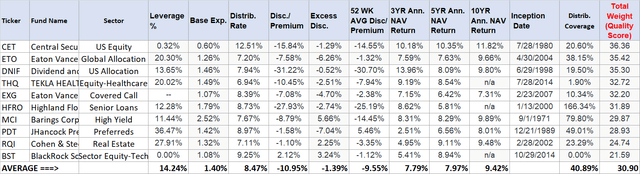

Remaining Choice: Our Checklist Of Remaining High 5

5-Positions Portfolio of the Month:

Now, if we had solely 5 slots for funding and wanted to pick simply 5 funds, we would wish to make some subjective selections. We predict our listing of 10 picks above is kind of compelling, and there are definitely greater than 5 names that we like. Whereas we slim down this listing, we ought to be cautious to maintain the listing as diversified as doable when it comes to asset lessons. Since this step is generally subjective, the selection would differ from individual to individual. Nonetheless, listed here are the picks for this month, primarily based on our perspective:

Desk: The Remaining 5 Funds:

Desk 9:

Writer

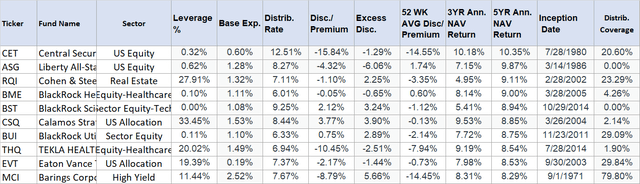

Some details about the picks:

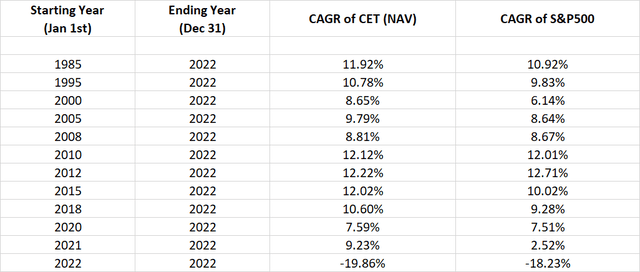

We suggest that readers take a look at each the highest 10 and prime 5 lists. The highest-10 listing affords rather more of a diversified lot (in comparison with the highest 5) for the present market surroundings. The distribution quantity per share for each teams may be very respectable at 8% plus. CET is our U.S. fairness fund choice for this month. It additionally made it to our listing final month. This fund just isn’t the everyday earnings fund because the distributions are semiannual and uneven. Actually, many of the distribution comes on the year-end, which features a particular distribution from capital positive factors. So, anticipate the distribution to be variable from 12 months to 12 months. In that sense, people who’re in search of constant month-to-month (or quarterly) earnings must keep away from this fund. That mentioned, CET has a really lengthy historical past, makes use of virtually no leverage, and usually trades at a big low cost to NAV. Nonetheless, its historical past is fairly spectacular. It could beat (or practically match) the efficiency of the S&P 500, whichever 12 months you started the funding. We checked with beginning years of 1985, 1995, 2000, 2005, 2008, 2010, 2012, 2015, 2018, 2020, 2021, and 2022.

Annualized positive factors for CET vs. S&P 500:

Desk-10

Writer

Be aware: At occasions, CET can commerce with bigger than the traditional bid/ask unfold (on account of low quantity), so it is suggested to make use of restrict orders.

THQ (Tekla Healthcare Fund) is our decide for this month from the Healthcare sector (additionally our decide the earlier month). The healthcare sector is more likely to do properly within the medium to long run. To prime it, we’re getting practically a ten.5% low cost and a 2.5% extra low cost proper now (in comparison with the 52-week common). The yield just isn’t very excessive however affordable at 6.9%. EXG (Eaton Vance Tax-Mgd World Fairness Inc fund) is a covered-call play from the Eaton Group. It invests over 50% of its portfolio in home blue-chip US dividend shares and the remainder within the worldwide market. It generates and enhances the dividend earnings of its portfolio by writing (promoting) name choices on the a part of its portfolio. At present, it’s providing a sexy low cost of over -7% (52-week common being -2.40%) and a yield of roughly 8.40%. The previous efficiency over 3 to 10 years is round 8%, which is respectable, protecting in thoughts the present state of the market. PDT (JHancock Premium Dividend Fund) is a hybrid fund that invests each in most popular securities and equities of frequent shares. Lots of its holdings are within the vitality sector. The fund is providing a sexy extra low cost over the 52-week common low cost (-1.90% vs. +5.40%) and a yield of practically 9%. The fund comes from the John Hancock fund household. The fund has an honest long-term observe document of sustaining its NAV. RQI (Cohen & Steers Qual Inc Realty fund) is among the finest closed-end funds from the Actual-Property sector. The true-estate funds have been down lots within the final 12 months, however they appear to be on a path to restoration. The fund just isn’t low-cost, although, when it comes to the low cost/premium, and it’s providing lower than a 1% low cost. However we have now included it for the explanations of diversification, the fund’s long-term observe document, and the restoration that’s underway within the realty funds.

CEF-Particular Funding Dangers

It goes with out saying that CEFs, basically, have some further dangers. This part is particularly related for traders who’re new to CEF investing, however basically, all CEF traders ought to pay attention to it.

They often use some quantity of leverage, which provides to the danger. The leverage could be vastly useful in good occasions however could be detrimental throughout powerful occasions. The leverage additionally causes larger charges due to the curiosity expense along with the baseline expense. Within the tables above, we have now used the baseline expense solely. If a fund is utilizing important leverage, we need to guarantee that the leverage is used successfully by the administration workforce – one of the simplest ways to know that is to have a look at the long-term returns on the NAV. NAV is the “internet asset worth” of the fund after counting all bills and after paying the distributions. So, if a fund is paying excessive distributions and sustaining or rising its NAV over time, it ought to bode properly for its traders.

Attributable to leverage, the market costs of CEFs could be extra risky as they’ll go from premium pricing to low cost pricing (and vice versa) in a comparatively brief interval. Particularly throughout corrections, the market costs can drop a lot quicker than the NAV (the underlying property). Buyers who shouldn’t have an urge for food for larger volatility ought to typically steer clear of CEFs or a minimum of keep away from the leveraged CEFs.

CEFs have market costs which are completely different from their NAVs (internet asset values). They will commerce both at reductions or at premiums to their NAVs. Usually, we should always steer clear of paying any important premiums over the NAV costs until there are some very compelling causes.

One other threat issue might come from asset focus threat. Many funds might maintain related underlying property. Nonetheless, that is simple to mitigate by diversifying into several types of CEFs starting from fairness, equity-covered calls, most popular shares, mortgage bonds, authorities and company bonds, vitality MLPs, utilities, and municipal earnings.

Concluding Ideas

We use our screening course of to spotlight 5 seemingly finest closed-end funds for funding every month. We additionally present a bigger listing of ten CEFs, with among the prime candidates from every of the asset lessons. As at all times, our filtering course of calls for that our picks have a wonderful long-term document, preserve respectable earnings to cowl the distributions (in sure classes), provide a median of seven%-8% distributions, and are cheaper on a relative foundation with an inexpensive low cost. Additionally, we make sure that the chosen 5 funds are from a various group when it comes to the sorts of property. Please observe that these picks are primarily based on our proprietary score system and are dynamic in nature. So, they’ll change from month to month (and even week to week). On the similar time, among the funds can repeat from month to month if they continue to be enticing over an prolonged interval. Additionally, observe that not each good fund would make it to this listing as a result of they might not be attractively priced or buying and selling at a major premium on the time of operating our filtering course of.

The chosen 5 CEFs this month, as a gaggle, are providing a median distribution charge of 8.78% (as of 02/10/2023). Apart from, these 5 funds have a confirmed previous document and collectively returned 6.80%, 8.20%, and 9.16% within the final three, 5, and ten years. Please take into account that these returns are a lot decrease than what they had been final 12 months and ought to be measured compared to the broader market. The common leverage for the group is low at about 17%, with a median low cost of -7.2%. Since it is a month-to-month collection, there could also be some picks that might overlap from month to month.

On the subject of CEF investing, we at all times suggest that it is best to be a bit conservative and construct your positions by including in small and a number of heaps to benefit from dollar-cost averaging. We consider that the above group of CEFs makes an ideal watchlist for additional analysis.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.