I’m thrilled to introduce you to Deer Ma, an Professional Advisor that I developed as a pc engineer and a passionate dealer. Buying and selling has been a long-standing curiosity of mine, and I’ve spent numerous hours analyzing charts, studying buying and selling books, and making an attempt out completely different buying and selling methods. Over time, I’ve come to understand the ability of automation and the way it may also help merchants enhance their buying and selling efficiency.

With my technical background, I’ve all the time been drawn to the thought of making an automatic buying and selling system. I wished to design a system that would assist me commerce extra effectively and successfully, with much less effort and time on my half. I began engaged on Deer Ma as a private venture, and after weeks of onerous work and testing, I created an Professional Advisor that I’m happy with.

Deer Ma is the results of my ardour for buying and selling and programming, and it’s designed to assist merchants reap the benefits of market alternatives whereas minimizing their danger. The content material of this text will cowl the technique behind the Deer Ma professional advisor, the outcomes I achieved, the method I used to optimize these outcomes and the library that convey Deer Ma to life. Whether or not you’re an skilled dealer/programmer or simply beginning out, my hope is that the data and insights I present will likely be useful in your individual buying and selling journey.

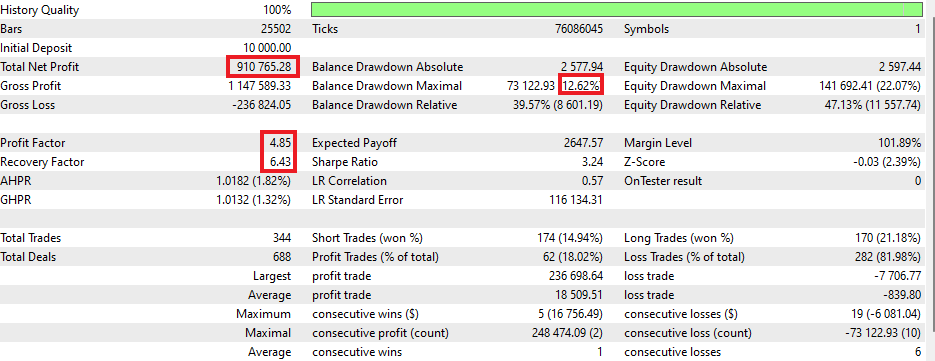

Outcomes :

As soon as the Deer Ma robotic is correctly arrange for the specified market, the outcomes are very fascinating. As proven within the graph under, which covers the interval from January 2019 to February 2023, an preliminary funding of $10,000 grew to $910,000. It is vital to notice that the fundamental parameters are optimized for USDJPY on a 1-hour chart, and due to this fact the identical outcomes will not be seen in different markets or charts with out adjusting the parameters accordingly. A paragraph under will clarify methods to discover the optimum settings for different markets.

The efficiency of the Deer Ma robotic from January 2019 to January 2022 would possibly seem stagnant at first look, however that could not be farther from the reality. The robotic’s cash administration algorithm steadily and exponentially will increase the positive factors over time, which might create the impression of a gradual begin. However as soon as the momentum picks up, the outcomes are staggering. Right here, the time sequence :

I extremely encourage everybody to strive the free demo of Deer Ma and see the outcomes for themselves. By testing the technique on their very own most well-liked market and chart, they’ll optimize the parameters for his or her desired efficiency.

Let’s check out the outcomes :

It is typically thought that top earnings include the value of excessive danger and drawdowns, however that is not all the time the case. Within the case of Deer Ma, the technique and danger administration permit for vital positive factors whereas preserving drawdowns low. As may be seen on the efficiency chart, the place there’s a internet revenue of $900,000, there’s solely a 13% drawdown. This can be a testomony to the effectiveness of the technique and the significance of correct danger administration. With Deer Ma, merchants can expertise excessive earnings with out exposing themselves to extreme danger.

Deer Ma’s buying and selling technique shouldn’t be about successful each commerce, however reasonably about managing dangers and maximizing earnings. As you’ll be able to see from the buying and selling outcomes, there are much more shedding trades than successful trades, which may be difficult for some merchants to deal with emotionally. Nevertheless, the important thing to Deer Ma’s success lies in its superior danger administration system and the power to generate bigger earnings on successful trades than the losses on shedding trades. This permits the general internet revenue to extend regardless of a better share of shedding trades.

Technique :

The Deer Ma professional advisor is constructed on a robust buying and selling technique that has confirmed to be extremely efficient with the nice settings. The technique relies on a mix of two shifting averages and a position-taking algorithm that ensures the EA enters the market with the absolute best commerce alternatives.

The primary shifting common used within the technique is a fast-moving common with a comparatively brief interval. This MA is used to determine short-term tendencies out there, permitting the EA to capitalize on market actions which will final only some minutes or hours.

The second shifting common used within the technique is a slow-moving common with an extended interval. This MA is used to determine long-term tendencies out there, permitting the EA to carry positions for longer durations and seize bigger market actions. The mixture of those two MAs ensures the EA is positioned to reap the benefits of each brief and long-term market tendencies.

To find out one of the best entry and exit factors for every commerce, the position-taking algorithm analyzes a variety of market elements, together with value and quantity knowledge, the variety of candles which have shaped, and the place of the shifting averages relative to the present value. This evaluation is used to find out the optimum entry and exit factors for every commerce, guaranteeing the EA is all the time positioned to reap the benefits of one of the best buying and selling alternatives out there.

Trailing stops :

Trailing stops are an integral part of the Deer Ma buying and selling technique. They permit for automated place administration by setting a stop-loss order that strikes with the market, defending earnings whereas minimizing losses. In Deer Ma, we use quite a lot of trailing cease varieties to optimize our positions and handle danger.

First, there’s the mounted trailing cease, which is the only kind of trailing cease. It units a hard and fast distance from the present market value at which the stop-loss order is positioned. If the market strikes in opposition to the place, the stop-loss order will set off when the mounted distance is reached, closing the place and limiting the loss.

The MA1_FOLLOWING trailing cease kind makes use of the primary shifting common as a reference level to path the cease loss. If the market strikes within the desired path, the cease loss follows the MA1 line. If the market strikes in opposition to the place, the cease loss is triggered when the value crosses the cease loss.

The MA2_FOLLOWING trailing cease kind works in the identical means because the MA1_FOLLOWING trailing cease however makes use of the second shifting common as a reference level. If the market strikes within the desired path, the cease loss follows the MA2 line. If the market strikes in opposition to the place, the cease loss is triggered when the value crosses the cease loss.

The QUICK_SECURITY trailing cease is designed to shortly safe a place as quickly as the value reaches a sure stage, minimizing potential losses. This kind of trailing cease is especially helpful in risky markets the place value actions may be sudden and sharp.

The MEAN_MOVING cease loss, then again, is taken into account to be essentially the most essential component of the Deer Ma technique. Its distance is decided by the quantity of the value, which signifies that the cease loss will likely be bigger for greater volumes and smaller for decrease volumes. Because of this, this cease loss adapts to the market situations, guaranteeing that the place is protected adequately.

Lastly, the INCREASING trailing cease kind is a posh mixture of value and time-based trailing stops. It permits the cease loss to regulate the space of the cease loss over time.

By providing a variety of trailing cease choices, Deer Ma permits merchants to customise their strategy based mostly on their most well-liked buying and selling model. Those that are extra inclined in direction of scalping methods would possibly go for the short safety cease or the growing cease, whereas those that favor trend-based methods may select the imply shifting or ma2_following stops. The flexibleness of Deer Ma’s trailing stops provides merchants the liberty to decide on the strategy that most closely fits their private preferences, which finally can result in a extra profitable buying and selling expertise.

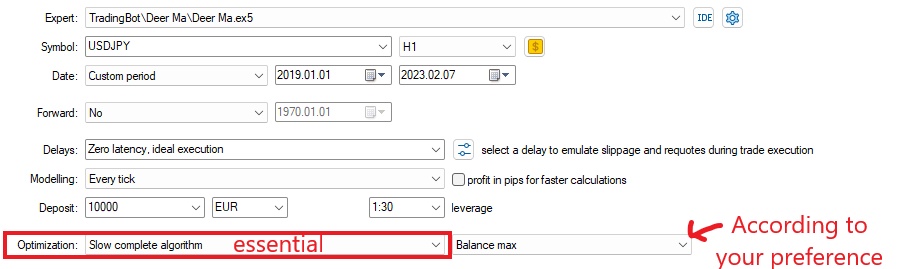

Optimization of parameters :

Deer Ma’s efficiency is essentially attributed to its particular optimization for the USDJPY on a 1-hour chart. It is important to notice that the parameters will must be re-optimized to go well with different markets and timeframes. Merchants ought to, due to this fact, conduct intensive backtesting earlier than deploying Deer Ma on any new chart to optimize its parameters for max effectivity.

To do that successfully, listed below are my ideas:

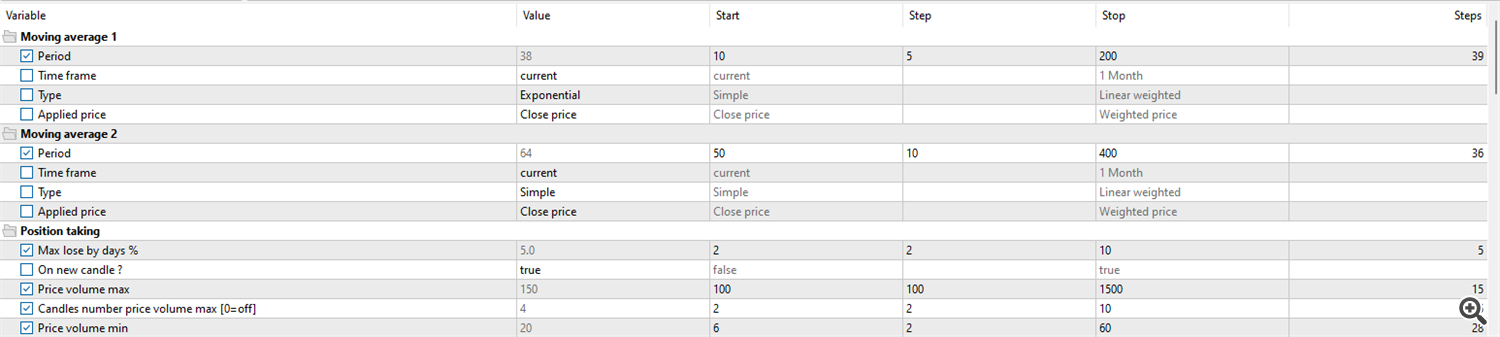

Choose the parameters you need to optimize, a beginning worth, the worth so as to add to every take a look at to attain.

I counsel you to check one trailing cease at a time and never all on the identical time as a result of in any other case many exams will likely be ineffective and can make you lose loads of time.

The primary parameters to optimise are :

M1 interval M2 interval Max loss by days % Worth quantity max Candles quantity value quantity max Worth quantity min Candles quantity value quantity min MA above for purchase, bellow for promote Chikun ? Take revenue (relying of the Trailing cease) Cease loss Trailing cease kind The completely different parameters of the trailing cease relying on the one chosen.

This half is principally for professional advisor builders however if you’re curious concerning the world of programming, I invite you to learn it ^^

Deer Ma’s growth relied closely on the EA Toolkit library, which is a sturdy set of instruments for creating professional advisors. The library gives an in depth assortment of sources and options, enabling builders to create environment friendly and efficient buying and selling robots. One of the crucial vital advantages of the library is that it’s continuously evolving, with new options being added based mostly on buyer suggestions. The flexibleness and energy of this library helped within the creation of Deer Ma, and it continues to function a useful useful resource for professional advisor growth.

In the event you’re keen on utilizing the Deer Ma professional advisor to your personal buying and selling technique, you should buy it right here :

Thanks for taking the time to learn this text on Deer Ma. I hope that you simply discovered the data offered right here to be helpful and informative. If in case you have any questions or want to study extra about this professional advisor, please do not hesitate to ship me a non-public message. I will be comfortable to give you extra data or reply any questions you might have. As soon as once more, thanks for studying, and I want you one of the best of luck in your buying and selling.