Keith Lance

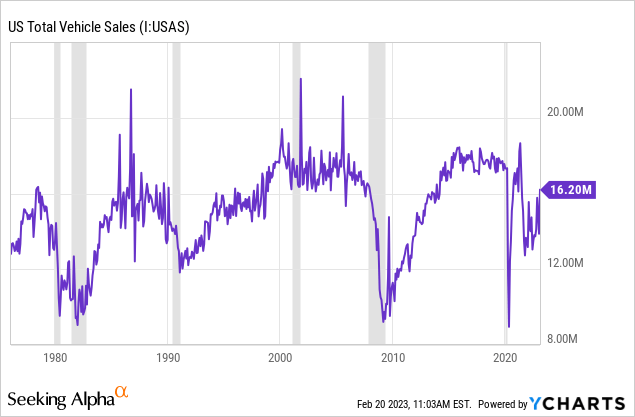

Houston, now we have an issue! The speed of core inflation had pulled again off of summer time 2022 highs, helped largely by an unwinding within the huge pandemic used automobile bubble. However now, fed-up customers are racing to purchase used automobiles, so costs are again on a fast ascent. This calls into query the complete disinflation narrative.

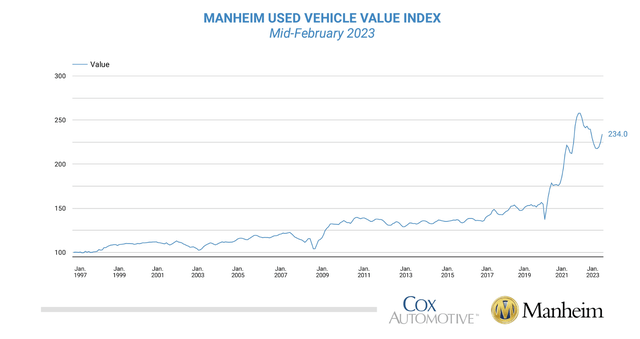

The dumpster-fire marketplace for used automobiles was maybe one of many clearest indicators of an unhealthy, unsustainable financial system throughout COVID. In some methods, it was an ideal storm. Congress flooded the system with stimulus cash on the similar time that semiconductor shortages punished auto producers. By the summer time of 2022, issues had began to normalize. By Fall, bulls had rightly taken the popping of the used automobile bubble as a marker of a sluggish return to a traditional financial system. Wholesale used automobile costs (standardized for make, mannequin, and age/mileage) peaked in January 2022 at about 258 index factors and fell to 218 by November 2022. However now, they’re again as much as 234. Earlier than the pandemic, costs had been about 156, or 33% decrease than they’re proper now. Used automobile costs are going up once more, they usually’re going up at a traditionally quick price not seen since 2009, in response to Manheim’s information.

Mannheim Used Automotive Index (Mannheim)

This hasn’t proven up but within the CPI studies due to the lag in reporting, but it surely’s about to. AutoNation (AN) is America’s largest automobile supplier. Helpfully for us, AutoNation simply reported earnings, they usually mentioned their margins had been about flat at near-record highs. With this piece of information in our pocket, we will be fairly positive that rising wholesale costs aren’t being eaten by sellers by way of decrease revenue margins. As a substitute, inflation in items is probably going again, and again in an enormous manner.

Sluggish Actual Wages Are Being Loaded Down With Debt

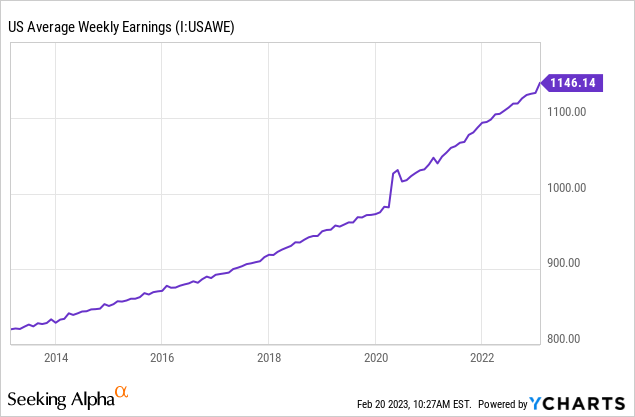

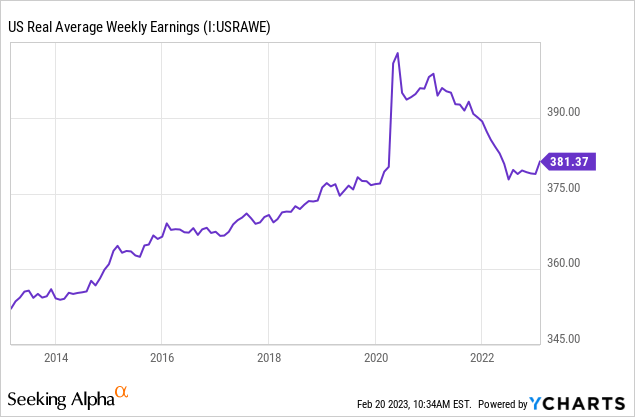

Right here we see median weekly earnings. In February 2020 the median was about $983, and now it is about $1146. That is roughly a 5.3% improve per yr. However while you regulate it for general inflation, you get this.

This is not a catastrophe, however we’re clearly under our earlier development. Bizarre stuff occurred in early COVID– the spike was from lower-wage service staff disproportionately getting laid off and from corporations providing greater pay for these prepared to danger COVID publicity.

So we all know that each typical wages and costs are up about 16% since pre-pandemic, however what concerning the worth of houses and automobiles? Effectively, automobiles are up 33% and rising because the pandemic, which is double the achieve in wages. Houses are up about 43%, almost triple the rise in wages.

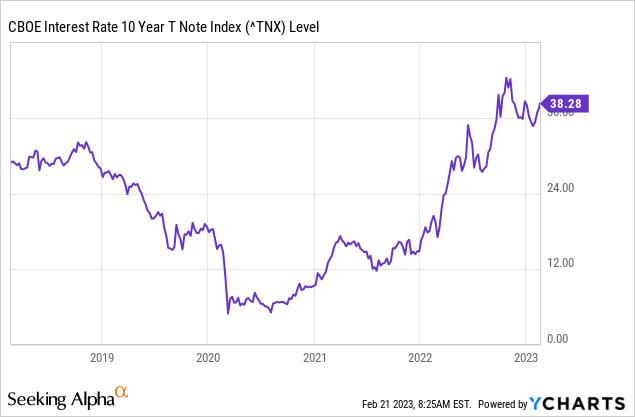

It will get worse– to cease inflation from spiraling uncontrolled, the Fed has been pressured to quickly hike rates of interest. So not solely are houses and automobiles 30-45% costlier, but it surely’ll now value you 5-6% for a automobile mortgage and about 7% for a mortgage– about double the going rate of interest earlier than. So a $30,000 used automobile which may have been financed @ 3% will now value you $40,000 @ 6%. Thus, the everyday automobile cost or mortgage is up much more than the uncooked rise in costs would suggest.

We should not ignore the impact of chip shortages on automobile manufacturing, however complete gross sales over the total interval of the pandemic had been about in step with the mid-2010s. Courtesy of huge stimulus and FOMO, this appears to be like a bit extra like a requirement difficulty and rather less of a provide difficulty than the mainstream media is giving it credit score for.

What is going on on now? Costs are charging greater once more in 2023. Largely, this is because of mass psychology. Concern of shortages and a scarcity of credibility in any respect ranges of presidency have basically modified customers’ considering. Furthermore, the collective expertise of going via a pandemic has shifted shopper psychology to emphasise the quick time period over the long term (YOLO) and to keep away from the worry of lacking out (FOMO).

If wages are up about 16% since pre-COVID, then how are these massive bubbles in housing and sturdy items occurring? Straightforward reply– first with stimulus and now on credit score. It is one factor to pay massive costs for eggs or milk out of pocket. It is a completely totally different factor to pay $799 a month for a used automobile for 72 months, as financing makes it simpler to overpay. That is the rationale that homes and automobiles are susceptible to cost bubbles in ways in which typical items and companies aren’t.

It is the accountability of the Fed right here to close down speculative borrowing by customers and companies until we need to invite the chance of one other 2008-style monetary disaster. Used automobiles are an issue for the Fed as a result of they seem to be a symptom of an out-of-control speculative financial system the place costs soar, wages keep stagnant, and the distinction is borrowed. Financial savings charges are near-record lows, whereas credit score balances are hovering. Market-based expectations for inflation are rising once more as properly.

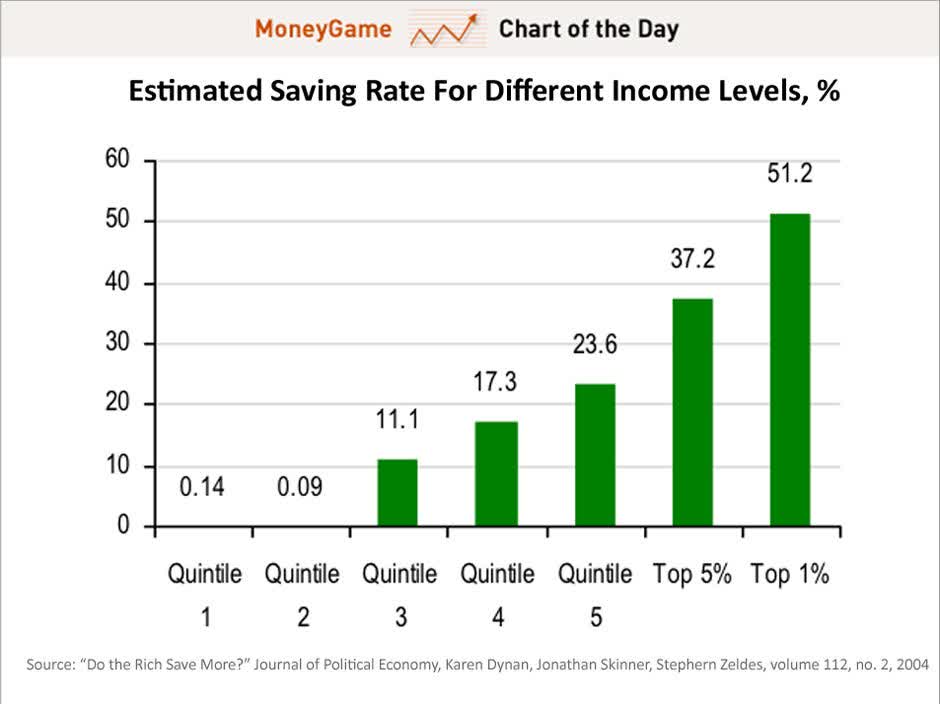

There is a 100% probability of this inflicting issues sooner or later sooner or later. It may be sooner or it may be later, however this can come house to roost. It is one factor to say that the nationwide financial savings price is about 3% (with nobody paying scholar loans), but it surely’s one other to know how financial savings charges differ by stage of earnings.

This can be a chart from a well known economics paper from about 25 years in the past referred to as “Do The Wealthy Save Extra?). These numbers had been from a typical financial system (late Nineteen Nineties) the place customers save a mean of 7-10% of their earnings.

Financial savings Fee By Earnings Degree (Enterprise Insider)

The important thing perception right here is that the common financial savings price does not imply a lot in a vacuum, however low financial savings charges inform you a large number concerning the vulnerability of the general financial system. In a typical financial system, these below about $40,000 in family earnings are likely to spend a bit greater than they earn, those that make below $100,000 have a tendency to save lots of modestly (~10% of after-tax earnings), and by the point you recover from $500,000, financial savings charges are likely to rise considerably, particularly if the excessive incomes are being pushed by annual bonuses or capital features.

Nevertheless, the loopy financial system we’re in has shifted issues to the purpose the place maybe the underside 80% of earnings earners are spending greater than they’re making, and the highest 20% aren’t saving a lot both. In consequence, costs maintain surging whereas wages keep comparatively regular. The distinction is solely placed on credit score. Inflation is consuming America’s financial savings alive and shifting shopper considering from the long-term to the short-term. And the longer financial savings charges stay close to document lows, the extra dominoes will fall in the course of the eventual recession. The seeds for future financial harm are already sown, and thus the principle problem for the Fed at this level is minimizing it.

What Does This Imply For The Fed?

January CPI confirmed a 1.9% lower within the worth of used automobiles, which we are able to infer is the stale used automobile costs nonetheless coming via. As measured by CPI, retail used automobile costs are as a result of rise within the coming months, presumably by so much. As a ballpark determine, used automobiles are about 4% of core CPI, so a 2% improve in used automobile costs would swing core CPI by about 16 bps for the month. Core CPI got here in at 0.4% for January (4.9% annualized), which was already fairly scorching, so this might crank it as much as 0.6% (7.4% annualized). A number of months of 0.6% month-to-month core CPI prints would inform the Fed that they are once more behind the curve, and drive them to lift charges even greater than thought.

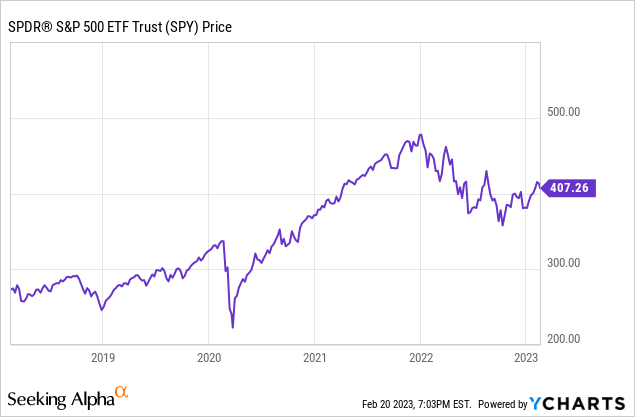

Solely three weeks in the past, the market went all-in betting on a Fed pivot, and Powell folded his playing cards on the river. Shares printed their 2023 highs shortly after. Now, with the inventory market establishing one other showdown with the Fed, the chances are rising that they will get caught bluffing. The market has kind of repeatedly misplaced to the Fed because the first hike in March 2021, with every low being decrease than the final. This time round, nevertheless, the bond market is unwilling to problem the Fed, with 10-year Treasury charges up about 50 bps because the earlier assembly, and the greenback stronger. The inventory market goes this one alone.

A latest Searching for Alpha piece by Mott Capital exhibits that the Fed funds market can be beginning to worth in actuality (“beginning” being the important thing phrase right here). And naturally, there may be actually the potential for Fed minutes this week to inform a extra hawkish story than bulls want to hear. With shares buying and selling close to peak multiples and nonetheless priced for a rosy return to low charges and low inflation, one other February CPI upside shock may set the stage for a number of 50 bps hikes within the Fed funds price–on the best way to charges of 6% or greater briefly order. Retail inventory merchants don’t get the message, and are pouring document quantities of cash into meme shares. But when the Fed desires to crack down and cease customers from spending cash they do not have, they’re properly geared up to take action. Which may imply the chance of taking money charges to close 7% and mortgages to close 9% to close down customers who insist on spending at unsustainable ranges. If this involves fruition, traders will rue the day they paid almost 20x peak earnings for the S&P 500 (SPY).

Ultimately, like a fall from a excessive place, the longer there may be “no touchdown,” the more durable the eventual touchdown will likely be for top a number of shares and pivot-hungry bulls.