jcamilobernal/iStock Editorial by way of Getty Photographs

A number of months in the past, I reviewed the Liberty All-Star Progress Fund (ASG) and concluded that for individuals who imagine in ‘progress investing’, ASG could also be a good selection because it pays a excessive distribution yield funded by means of largely capital positive factors.

This text examines the Liberty All-Star Fairness Fund (NYSE:USA), ASG’s sibling fund that’s managed in a similar way.

The USA fund provides traders curated entry to 5 ‘all-star’ fund managers, as chosen by ALPS Advisors. Though the USA fund’s historic efficiency has been respectable it has underperformed a passive market fund just like the SPDR S&P 500 Belief ETF (SPY) over the long-run.

Whereas the USA fund pays a horny 2.5% of NAV quarterly distribution, an investor might be able to outperform the USA fund in the event that they invested within the SPY ETF and withdraws 2.5% of the portfolio on a quarterly foundation.

Fund Overview

The Liberty All-Star Fairness Fund is a closed-end fund (“CEF”) managed by ALPS Advisors (“ALPS”) that makes use of a fund-of-funds (“FOF”) method to investing by allocating the funds’ portfolio to a number of unbiased asset managers which can be curated by ALPS. The USA fund is well-liked with traders with $1.6 billion in belongings and costs a 1.01% expense ratio.

Technique

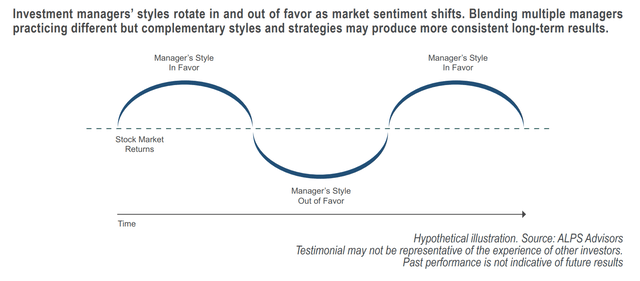

The principle thought behind a FOF method is that funding managers’ types rotate out and in of favour as markets evolve over time. What works in a low-interest charge ‘risk-on’ bull market might not work when rates of interest are normalized and traders are extra involved with ‘worth’ (Determine 1). Institutional traders have been efficiently training multi-managed portfolios for years, and ALPS Advisors brings the follow to retail traders.

Determine 1 – FOF method works by means of a cycle (USA advertising paperwork)

ALPS’ purpose is to assist traders type by means of the a whole bunch of funding managers and hundreds of funding funds obtainable within the market and make investments solely with the ‘all-stars’. ALPS researches and evaluates a broad universe of funding funds on behalf of traders to pick funds that not solely meet ALPS’ choice standards, but in addition complement one another in a portfolio setting.

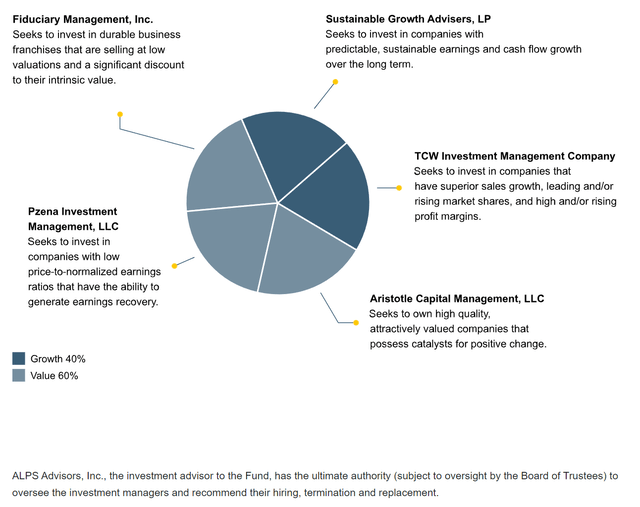

The USA fund blends collectively 5 totally different funding managers, every with a novel funding fashion that has persistently produced above common long-term returns (Determine 2). Broadly talking, three of the managers are thought-about ‘worth’ and two are thought-about ‘progress’.

Determine 2 – USA fund supervisor allocations (all-starfunds.com)

Portfolio Holdings

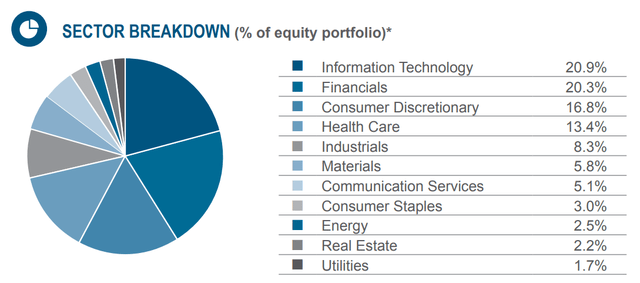

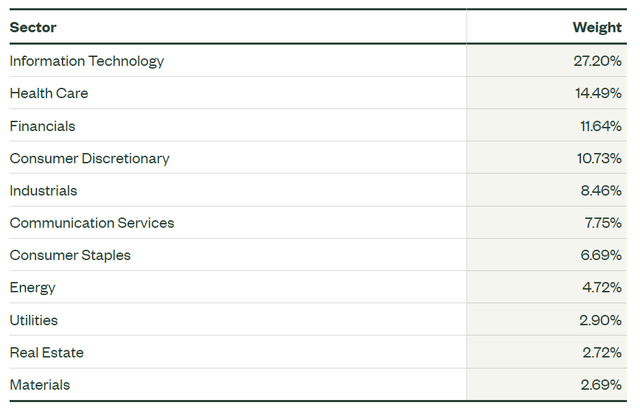

Determine 3 exhibits the USA fund’s sector allocation, as of January 31, 2023.

Determine 3 – USA fund sector allocation (USA January 2023 factsheet)

In comparison with the market, as measured by the weighting of the S&P 500 Index present in determine 4 under, the USA fund is underweight Info Know-how (20.9% vs. 27.2%), Communication Companies (5.1% vs. 7.8%), and Client Staples (3.0% vs. 6.7%). The USA fund is obese Financials (20.3% vs. 11.6%), Client Discretionary (16.8% vs. 10.7%), and Supplies (5.8% vs. 2.7%).

Determine 4 – S&P 500 sector weights (ssga.com)

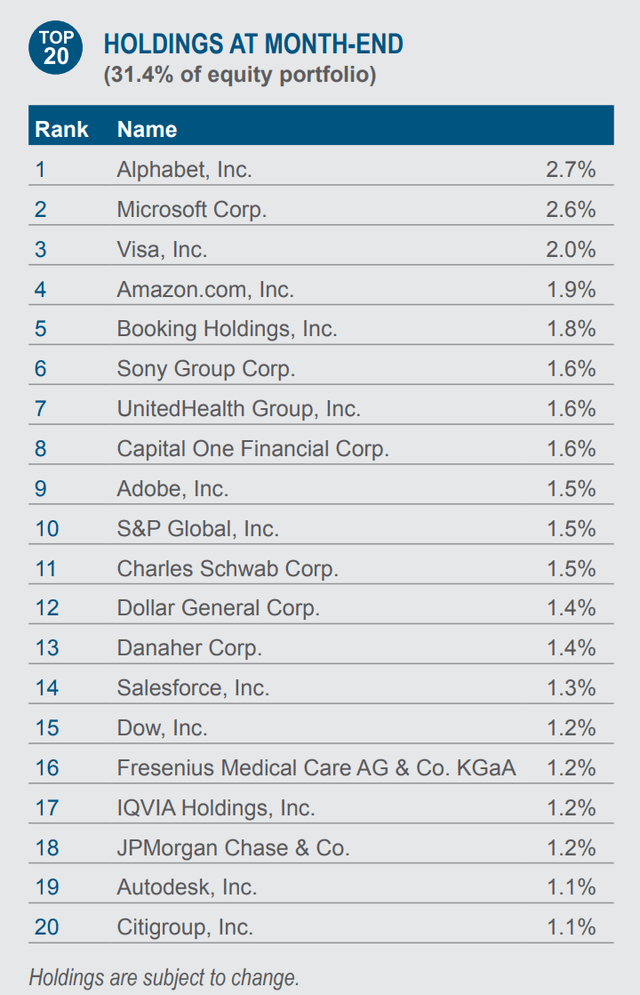

Determine 5 exhibits the fund’s prime 20 holdings as of January 31, 2023. Whereas many are family names similar to Alphabet and Microsoft, there are additionally notable much less well-known firms similar to Sony Group Corp. (SONY) and Fresenius Medical Care AG & Co. KGaA (FMS).

Determine 5 – USA fund prime 20 holdings (USA January 2023 factsheet)

Additional data on the fund’s holdings might be present in USA’s quarterly reviews.

Returns

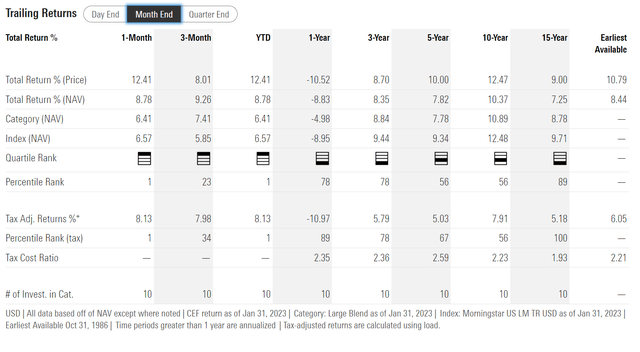

Determine 6 exhibits the USA fund’s historic returns. The USA fund has delivered stable long-term returns with 3/5/10/15Yr common annual complete returns of 8.4%/7.8%/10.4%/7.3% respectively to January 31, 2023.

Determine 6 – USA fund historic returns (morningstar.com)

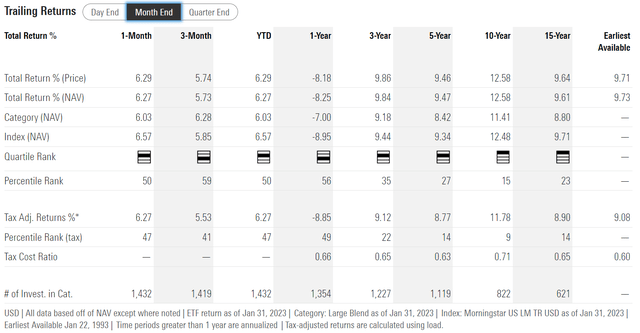

Nevertheless, one phrase of warning for traders is that whereas USA’s historic returns have been respectable, they’ve lagged behind a passive market index fund just like the SPDR S&P 500 ETF Belief (SPY) on all long-term time frames (Determine 7).

Determine 7 – SPY ETF historic returns (morningstar.com)

Distribution & Yield

The USA fund pays a quarterly distribution that’s 2.5% of the fund’s trailing NAV, or roughly historic fairness market annual returns of ~10%. In 2022, the USA fund paid $0.69 / share in distributions, though the present quarterly distribution is barely $0.15, or a ahead yield of 9.6%.

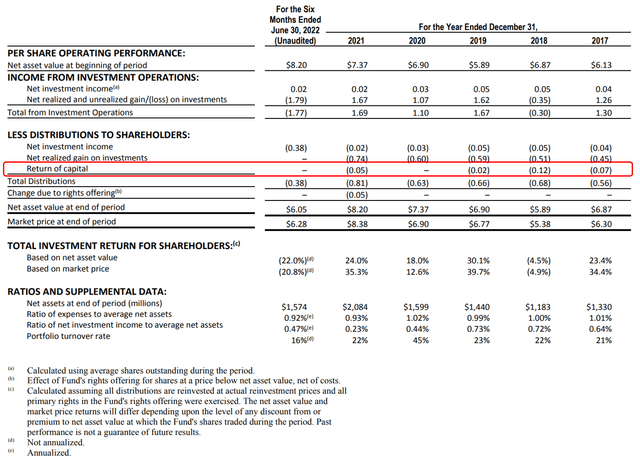

The USA fund has sometimes needed to depend on return of capital (“ROC”) to fund its distribution, however the issue is not extreme, because the fund has common returns of 8.4% since inception vs. its trailing 10% annualized payout charge (Determine 8).

Determine 8 – USA has sometimes used ROC to fund distributions (USA 2022 semi-annual report)

Do It Your self For Cheaper

Whereas the USA fund’s premise is alluring, investing with the ‘all-star’ managers, the USA fund’s precise returns have been a bit underwhelming. The issue is that long-term outperformance by funding managers could be very uncommon. Even the curated ‘all-stars’ of the USA fund have did not outperform the passive SPY ETF over the long term, as measured by 3/5/10/15Yr common annual returns.

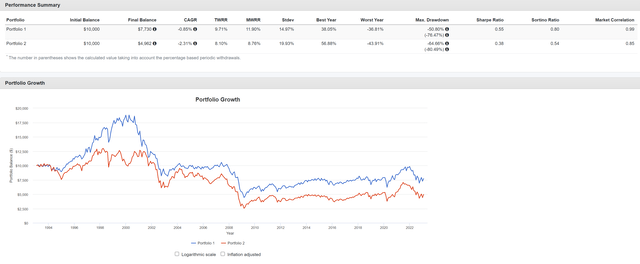

Some traders might argue that they maintain the USA fund as a result of it pays a 9%+ distribution yield vs. 1.6% for the SPY ETF, however that pondering could also be flawed. For instance, since SPY’s inception in 1993, an investor who invested an equal quantity of $10,000 into SPY and USA, reinvested all distributions and withdrawn 2.5% on a quarterly foundation would have extra money left over if they’d chosen SPY over USA (Determine 9, Portfolio 1 is SPY plus 2.5% quarterly withdrawal; Portfolio 2 is USA plus 2.5% quarterly withdrawal).

Determine 9 – SPY vs. USA, reinvested distributions and withdrawn 2.5% quarterly (Creator created with Portfolio Visualizer)

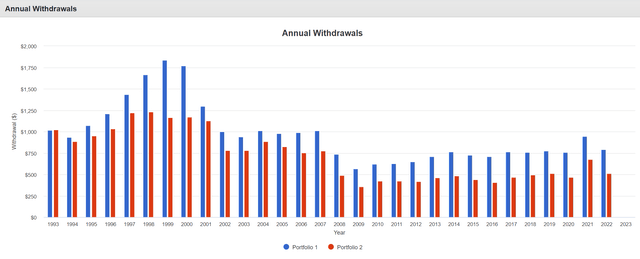

Moreover, with the next account stability (as a result of increased complete returns), the SPY portfolio really permits for increased withdrawals (Determine 10).

Determine 10 – SPY portfolio beats on each returns and distributions (Creator created with Portfolio Visualizer)

All-Stars Solely Play Offense

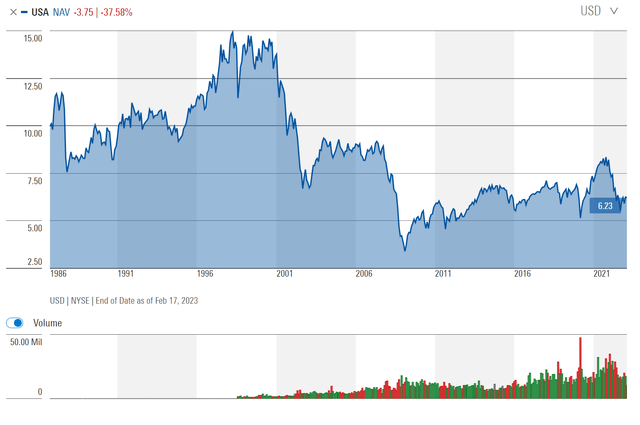

One other critique I’ve on the USA fund is that traditionally, its ‘all-star’ managers weren’t in a position to shield the fund from market drawdowns. For instance, trying on the fund’s historic NAV, we are able to see that the USA fund was halved in the course of the 2000/2001 Dot-com bubble; Then the fund was halved once more in the course of the 2008/2009 Nice Monetary Disaster (Determine 11).

Determine 11 – USA long-term NAV (morningstar.com)

Most just lately, the USA fund misplaced 20.4% in 2022, worse than the SPY’s 18.2% loss. So primarily, the USA fund is stuffed with ‘all-stars’ that solely know the right way to play offense. However borrowing from sport analogies, we all know that ‘protection wins championships’.

Conclusion

The USA fund provides traders curated entry to 5 ‘all-star’ fund managers, as chosen by ALPS Advisors. Every supervisor has a novel funding fashion that’s blended right into a portfolio with the purpose of outperforming over the long-run. Though the USA fund’s historic efficiency has been respectable, it underperforms a passive market fund just like the SPY.

Whereas the USA fund might enchantment to income-oriented traders who benefit from the 9%+ yield, I imagine an investor might be able to obtain higher outcomes in the event that they invested within the SPY ETF and withdraw 2.5% of the portfolio on a quarterly foundation.