The case for elevating fairness allocations when rates of interest have been near zero was simple. After a 12 months of rate of interest hikes by the , the calculus is extra difficult.

By some accounts, a positive tailwind is now blowing for bonds, notably for a buy-and-hold technique with Treasuries. Jim Bianco of Bianco Analysis highlighted the thought this week by noting that purchasing Treasuries of late, and tapping into sharply larger present yields, provides a chance unseen in recent times till now.

“You’re going to get two-thirds of the long-term appreciation of the inventory market with no danger in any respect,” stated Bianco.

Truthful level, however deciding how or if to lift weights in bonds – Treasuries particularly – requires considerate evaluation. Granted, a at 3.88% (as of Feb. 23) is near the very best degree in additional than a decade and a world above the 2020 low of roughly 0.5%. What’s to not like?

However deciding how a lot to carry in Treasuries requires occupied with greater than yields. It’s additionally a process of factoring in your time horizon, danger tolerance, and different variables which are particular to you. It’s essential to additionally make some assumptions about how fairness returns will unfold over a related time horizon vs. the bond maturity you prefer. A superb place to begin is contemplating how the US inventory market () compares on a rolling 10-year foundation vs. shopping for and holding a 10-year Treasury notice, which is summarized within the chart beneath for outcomes for the reason that early Sixties.

Rolling 10-12 months Return: S&P 500 vs 10-12 months T-Notice

As an approximation of what you’ll have earned in a 10-year notice, I’m utilizing the present yield for a 10-year Treasury as a return estimate. For instance, assume you purchased a 10-year notice a decade in the past when the present yield was just under 2%. Shopping for and holding that notice implies a 2% return over the following decade, as proven by the final level within the crimson line within the chart above. By comparability, the S&P 500 earned an annualized 10.2% over the trailing decade (black line). The blue line marks the present 10-year Treasury yield: 3.88% (Feb. 23), which serves as a dependable forecast of anticipated return for a 10-year notice for the last decade forward.

The important thing takeaway: the S&P’s 10-year return varies broadly relative to the implied return for purchasing and holding a 10-year notice. No shock, nevertheless it’s a reminder that while you purchase a Treasury, and the way lengthy you maintain it, will forged a protracted shadow on how the funding fares.

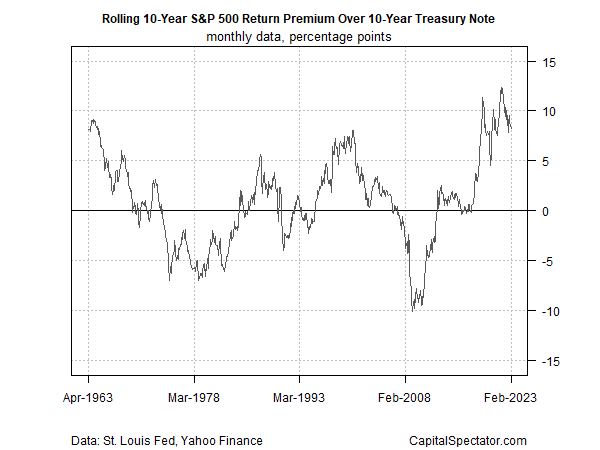

For a clearer comparability of how the S&P’s efficiency stacks up towards a buy-and-hold 10-year notice place, the subsequent chart tracks the inventory market’s premium over this Treasury safety. Clearly, current historical past has been unusually form to a heavy allocation in equities.

Rolling 10-12 months S&P 500 Return Premium Over 10-12 months T-Notice

Is it well timed to change to a heavy bond (Treasury) allocation? Possibly, however the reply requires greater than merely evaluating present yields within the bond market, though that’s a very good place to begin the evaluation.