Justin Sullivan

Normal Electrical (NYSE:GE) has confronted some powerful instances over the past 20 years. This business chief was pressured to fully reshape the corporate after the financial disaster in 2008, and GE once more confronted adversity after Covid hit in late 2019. Normal Electrical has additionally had 2 CEOs within the simply the final 5 years, with John Flannery working the corporate for simply over a 12 months earlier than present chief Larry Culp took over in October of 2018. Culp has lastly been capable of refocus GE on their two most profitable companies within the aerospace and well being care industries.

As we speak, Normal Electrical is purchase. This firm an undervalued inventory with a robust stability sheet that may be very properly positioned to benefit from the a long time of robust progress that the corporate ought to see within the Aerospace and well being care industries.

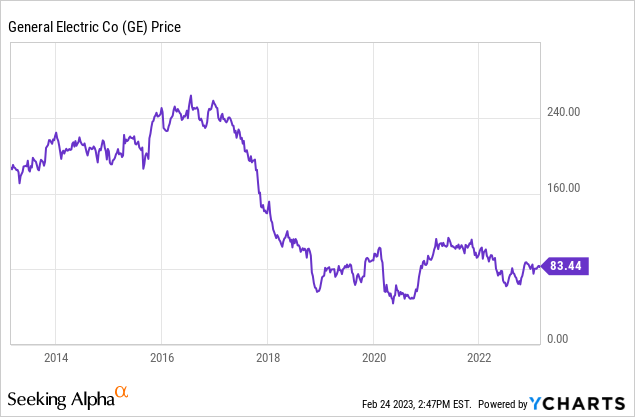

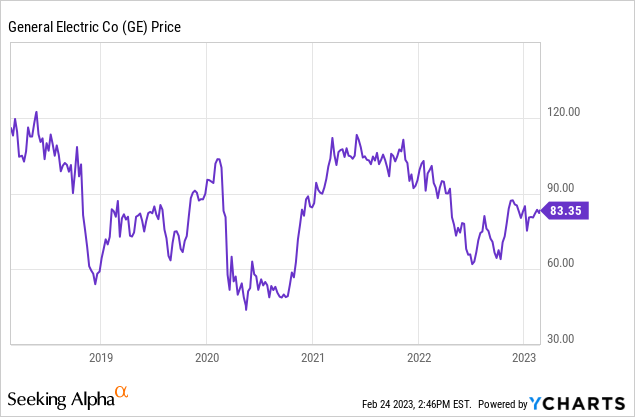

GE has carried out badly over the past 15 years. This firm bought off onerous after 2008, and the inventory has additionally gone nowhere over the past 5 years.

As we speak Normal Electrical’s future is obvious, administration has refocused the enterprise on the Aerospace and well being care divisions. The corporate can be now properly positioned to benefit from numerous constructive long-term catalysts.

GE’s latest earnings report confirmed how robust the corporate’s core companies are proper now.

Normal Electrical just lately reported fourth quarter revenues of $21.79 billion and natural income progress of 11%. The corporate’s adjusted revenues grew GE reported 7% year-over-year, with foreign money strikes hurting the corporate’s backside line. Administration additionally disclosed that yearlong orders of $83 billion have been up 6% organically, adjusted revenues of $73.6 billion have been up 6% organically, and three% on an adjusted foundation. The corporate additionally reported that adjusted revenue margins got here have been 7.9%. GE’s web margins are actually on the highest ranges the corporate has seen in 5 years. Normal Electrical additionally now has a really robust stability sheet, with $21.77 billion in money, and $34.74 billion in manageable long-term debt. The corporate reported free money circulation for the quarter was up $2.1 billion to $4.8 billion for the total 12 months.

GE additionally issued bullish steering for 2023. Administration expects the Aerospace division to proceed to develop within the mid to excessive teenagers, and GE Healthcare additionally just lately raised steering for subsequent 12 months as properly. Normal Electrical plans to spin-off the corporate’s power companies in early 2024 beneath the title GE Vernova. GE just lately spun-off their well being care enterprise, which has almost $19 billion in annual income. The newly spun off firm known as GE Healthcare (GEHC), and Normal Electrical has retained 20% fairness place on this inventory. Culp’s long-term plan is to separate GE into three corporations, and he expects to finish this objective by early 2024 after GE Vernova is spun off.

GE’s two foremost energy divisions additionally carried out properly final quarter. GE Energy noticed full 12 months orders of $17.8 billion, which was a rise of 9% and 17% in natural progress, pushed primarily by fuel tools. GE Renewable Vitality noticed orders fall 19% year-over-year primarily due to weak spot within the wind energy market, however orders on this division have been up within the final quarter by 4%. GE guided to the low to mid-single digit vary for income progress in GE Vernova in 2023.

The important thing to GE’s future would be the aerospace and well being care enterprise, and the long-term outlook for Normal Electrical’s cores industries is robust. GE just lately reported full-year revenues within the Aerospace division of $26 billion, with orders of $31.1 billion. Income on this division was up 22% on an adjusted foundation, and 23% organically. Administration additionally issued bullish steering, saying that GE expects their Aerospace division to develop within the mid to excessive teenagers in 2023.

Air site visitors ranges are purported to return to prepandemic ranges in 2023, and firms resembling United Airways (UAL) proceed to order huge quantities of latest planes to interchange and construct out their fleet. United Airways just lately introduced the most important buy of wider physique aircrafts in business historical past in December of final 12 months, and this business chief has not made any cancellations to their huge orders for brand spanking new planes. Air Journey was almost .5% of GDP prior the pandemic, and with governments and firms more and more requiring folks to return to work subsequent 12 months and journey restrictions in Asia and different area are regularly being eased. China just lately eliminated key journey restrictions to folks coming to and from Hong Kong and Macau earlier this month, a big latest coverage change by the Chinese language Authorities. Asia continues to open up. Analysts are additionally anticipating the airline business to do properly in 2023. Delta (DAL), United, and American (AAL), have all issued bullish steering for subsequent 12 months.

GE Well being Care additionally just lately reported robust outcomes and issued bullish steering. GE Healthcare reported fourth quarter earnings per share of $1.31, working earnings of $844 million, and gross sales of $4.9 billion. Administration issued bullish steering for 2023, discussing how they anticipate 5-7% gross sales progress, working revenue margins of 15-15.5%, gross sales of $19.4 billion, and working revenue of $3 billion. The corporate additionally raised earnings per share estimates for 2023 to $3.60-$3.75 a share from earlier expectations of $3.38 in earnings per share.

Despite the fact that GE trades at almost 41x ahead earnings estimate, this firm seems to be low-cost utilizing numerous completely different metrics. Normal Electrical trades at 1.37x enterprise worth to gross sales, and 1.19x gross sales. The sector common is 1.75x Enterprise worth to gross sales, and 1.4x value to gross sales. GE just lately issued bullish steering for subsequent 12 months, the corporate expects general natural earnings progress throughout all division to be within the excessive single digits subsequent 12 months. The corporate the corporate can be recentering their enterprise across the Aerospace division, which administration expects to develop within the mid to excessive teenagers subsequent 12 months. GE is anticipated develop their earnings per share from $1.92 in 2023 to $3.45 in 2024, and analysts additionally anticipate the corporate to have the ability to develop earnings per share by 44% per 12 months over the following 5 years.

GE additionally now has a really robust stability sheet with $21.77 billion in money and working annual free money circulation of $5.92 billion. Normal Electrical has massively lowered the corporate’s debt stage over the past 3 years, and the corporate presently has almost $30 billion in long-term debt, which is a traditionally low stage for GE. Administration additionally initiated a $3 billion share buyback plan in March of 2022, and the corporate’s robust stability sheet offers this firm numerous versatile choices for future use of capital.

Normal Electrical is a purchase. GE is now properly run and strongly positioned for the long-term. The corporate’s core Aerospace and well being care companies are very properly setup to benefit from robust multi-year traits. GE’s resolution to divest from GE capital has additionally created important flexibility and by releasing the corporate up from harder monetary laws. Whereas Normal Electrical has struggled for years with failing companies and unhealthy administration groups, this firm now has an efficient management staff that has refocused GE’s enterprise mannequin on the corporate’s core divisions which are setup properly for many years of robust progress.