Owsigor/iStock by way of Getty Pictures

Mid-sized dwelling builder Century Communities, Inc. (NYSE:CCS) reported robust This autumn and full-year 2022 earnings. The corporate achieved spectacular outcomes throughout its steadiness sheet, gross margins, income, and prices. But with a housing recession nonetheless underway, 2023 will ship a special yr for Century Communities. Appropriately, Century Communities is cautiously optimistic because it builds out communities with barely smaller properties made extra reasonably priced by decrease enter prices. The corporate’s steering is the important thing start line for understanding the present enterprise.

Steerage

Going ahead, Century Communities will rely closely on key tailwinds. The corporate expects gross margins in Q1 2023 to be much like the earlier quarter after which improve in subsequent quarters thanks to those tailwinds.

Gross margin ought to enhance by 400 foundation factors in 2023 as the corporate reaches a brand new norm within the low 20s vary (in percentages). The advance will begin in Q2 of 2023 as the corporate sells out increased value stock and begins promoting stock made with cheaper supplies and improved cycle occasions. Falling lumber costs will drive about two-thirds of value reductions. A median 57-day enchancment in cycle occasions (in comparison with 6 months in the past when pricing hit its peak) will considerably scale back provide chain prices. The business’s discount in housing begins frees up sources. This discount of stress within the provide chain is a constructive side of the Federal Reserve’s speedy tightening of financial coverage. Century Communities will drive additional affordability by constructing barely smaller properties.

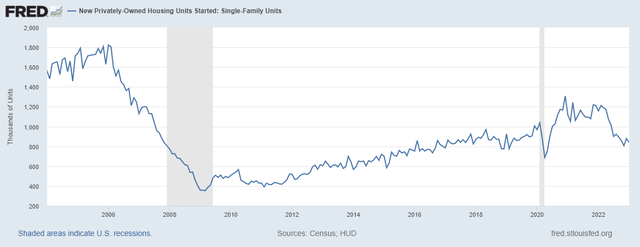

Excluding the pandemic lows, single-family housing begins are again to ranges final seen through the market’s final pre-pandemic downturn. (U.S. Census Bureau and U.S. Division of Housing and City Growth, New Privately-Owned Housing Models Began: Single-Household Models [HOUST1F], retrieved from FRED, Federal Reserve Financial institution of St. Louis, February 25, 2023.)

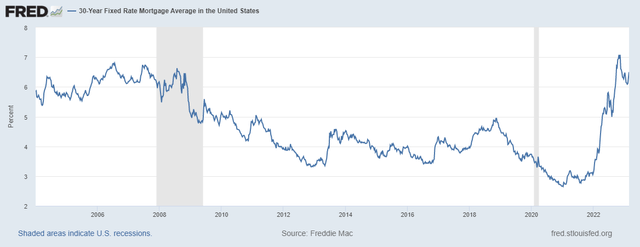

A stabilization in mortgage charges takes the strain off the corporate to supply incentives to encourage gross sales. As mortgage charges reached a peak in This autumn, CCS elevated incentives to 900 foundation factors on closed properties. Going ahead, the corporate expects to cut back the typical degree of incentives towards the historic norm of 300 foundation factors.

The 30-year fastened mortgage charge might have stopped happening for now however a peak might also be in place. (Freddie Mac, 30-Yr Fastened Charge Mortgage Common in the US [MORTGAGE30US], retrieved from FRED, Federal Reserve Financial institution of St. Louis, February 25, 2023.)

For the complete yr 2023, Century Communities expects to ship 7,000 to eight,000 properties. This quantity is a whopping 24% to 34% beneath 2022’s 10,594 delivered properties, the corporate’s second highest degree in its historical past. Century Communities guided to 2023 dwelling gross sales revenues starting from $2.6B to $3.1B, a considerable discount from 2022’s report $4.4B (a 30% to 41% plunge).

The corporate anticipates Q1 2023 will probably be its lowest closing quarter of the yr with progress resuming by means of the remainder of the yr. For the primary and second quarters of 2023, Century Communities expects its deliveries to drop year-over-year. The corporate blamed delayed neighborhood openings, fewer properties began within the second half of 2022, and prioritizing gross sales of near-term deliveries in This autumn. Deliveries will improve after Q2 2023.

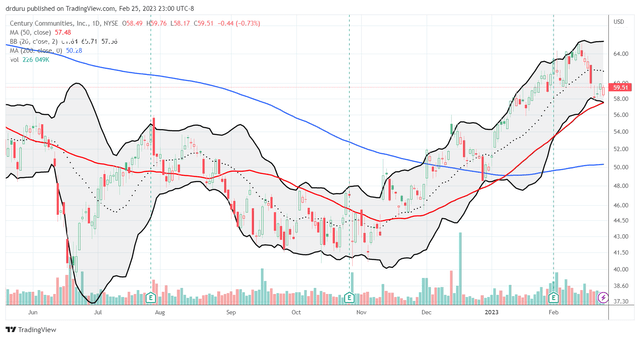

Usually, this type of steering can clobber an organization’s inventory value, particularly a builder. Nevertheless, traders appear happy with pricing within the worst of the housing recession again on the June and October lows. CCS fell 2.4% the day after reporting earnings. The inventory has misplaced an extra 3.6% since then. CCS continues to be considerably out-performing the S&P 500 (SPY) year-to-date 19.0% versus 3.4%. CCS can be nonetheless holding an uptrend for the yr. Nevertheless, I believe this uptrend is fragile, I don’t anticipate it to carry if the market perceives a rise in hawkishness from the Fed and/or an economy-wide recession turns into imminent. The latest rebound in demand and gross sales can be offering a raise to CCS and different dwelling builders.

CCS is clinging to an uptrend outlined by its 50-day shifting common (the crimson line above) (TradingView.com)

Gross sales and Demand

The inventory value is supported by the corporate’s profitable navigation of the present housing recession and quickly altering market situations. Century Communities executed the playbook frequent throughout dwelling builders. The corporate elevated its money place by concentrating its gross sales efforts and incentives on properties with near-term deliveries. This technique paved the best way to begin properties with decrease prices. The two,903 properties delivered in This autumn was the corporate’s second-highest degree ever. Century Communities hit its highest ever quarterly revenues with $1.2B in This autumn.

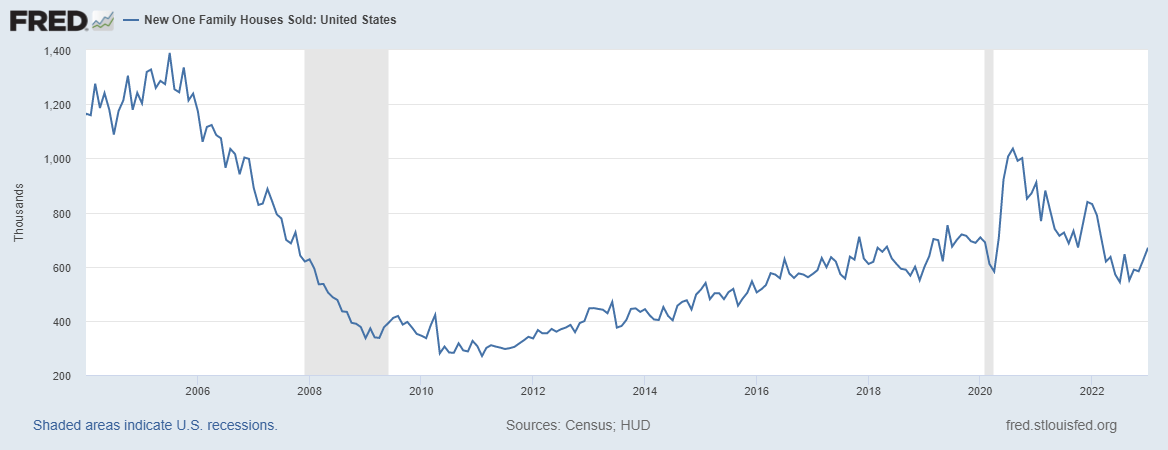

Century Communities landed what it thinks is a plateau in cancellations at 37% in This autumn. December cancellations fell to twenty-eight% in December and dropped extra in January. Internet new contracts of 1,258 dropped out of two,008 gross contracts. The corporate blamed “an elevated cancellation charge, mortgage charge volatility and general financial uncertainty protecting many potential homebuyers on the sidelines.” Gross sales improved from November by means of January. That restoration is mirrored within the business numbers: new single-family dwelling gross sales have skilled a small rebound since final yr’s lows.

New dwelling gross sales hit a trough throughout lows in July and September, 2022. (U.S. Census Bureau and U.S. Division of Housing and City Growth, New One Household Homes Bought: United States [HSN1F], retrieved from FRED, Federal Reserve Financial institution of St. Louis, February 24, 2023.)

Century Communities is well-positioned on this housing slowdown with roughly 81% of This autumn deliveries in properties priced beneath FHA (Federal Housing Administration) limits. This value vary permits the corporate to “goal the widest vary of potential patrons in any given market.”

Stability Sheet

A robust steadiness sheet gives a component of confidence in Century Communities. The corporate achieved $382M in working money circulate. This money circulate in flip helped scale back the web debt to web capital ratio to its lowest ever year-end degree at 23.5%.

Century Communities “continued to step away from land offers all through the second half of 2022 that not met our funding requirements and that have been usually increased in value than our owned tons.” The land pipeline fell by nearly 27,000 tons and minimize $650M in land acquisition commitments with a minimal $12M value for abandonment.

After spending $120.6M repurchasing 2.3M shares (common share value of $52.32), Century Communities didn’t buy any inventory in This autumn. The corporate nonetheless has authorization to repurchase 1.5M shares, however it didn’t present steering on any plans for drawing down on that allowance. I’d be shocked if the corporate bought extra shares at present ranges. Nevertheless, this sizable authorization signifies that CCS must be a superb purchase in future sell-offs.

The Commerce

Century Communities continues to navigate business challenges whereas sustaining a powerful monetary place. Its strategic gross sales choices, value reductions, enhancements in cycle occasions, and robust steadiness sheet ship constructive indicators for the near-term future. Whereas CCS has loved sizable good points this yr and since final yr’s lows, the inventory continues to be priced for a recession buying and selling beneath 1.0 value/e book.

CCS has traded beneath recession pricing of 1.0 value/e book for nearly a yr. (In search of Alpha)

If not for the looming prospects for a recession, I’d provoke a place at present ranges.

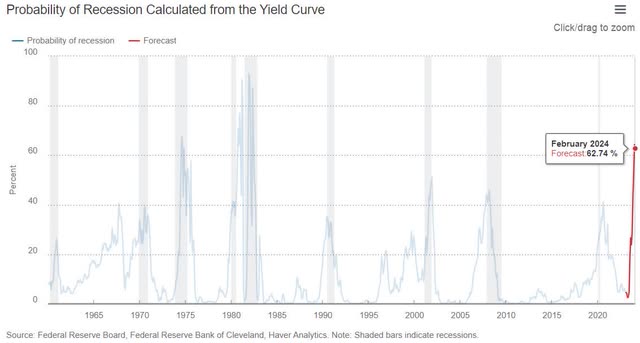

The Fed estimates the chances of a recession to launch above 50% beginning in December, 2023. (Federal Reserve Financial institution of Cleveland)

Furthermore, the seasonal commerce on dwelling builders will finish quickly (if it has not already ended). Thus, I’m protecting CCS inventory on my watchlist, however holding off shopping for for now.

Watch out on the market!