John Sommer

The Thesis

A giant dump has resulted from lower than spectacular earnings to shut out 2022 for Devon Power (NYSE:DVN). Now beginning 2023, decreased pure fuel costs and a compressor fireplace have the potential to take down this oil big and set Q1 up for one more disappointment. I undertaking $0.65 to $0.75 per share dividend payout for Q1. Regardless of these headwinds, Devon stays a extremely investible firm. If something, 2022 reveals what sort of gold mine the corporate might be when power costs get rolling. I’ll present how Q1 financials can probably play out so traders might be ready for any repeat drops in share value in addition to develop a value degree for enticing returns for the long run investor. Embrace close to time period ache for long run achieve.

The Headlines

Let’s look into why such a dramatic drop has occurred within the first place. The dividend got here in at a surprisingly low $0.89/share for a 34% discount from the earlier quarter. It was nonetheless, tied to an 11% improve within the base dividend (now a quarterly $0.20/share). Reviewing the supplemental tables paperwork helps to see the corporate’s inside workings.

Gross sales Are Down

It should not come as a shock that revenues, free money move, and general earnings are down since commodity costs had dropped over the total length of This autumn. I outlined that thought course of in my earlier article. The overall influence to web revenue was higher than I might have suspected, decreasing FCF $193 million or about 9% from Q3. This accounts for a $0.15 discount to the variable dividend ($193 million/653 million shares).

CAPEX is Up

Devon rang the register on this one in This autumn. A further $247 Million was diverted again into the corporate belongings for a whopping 36% improve from Q3 and 80% from This autumn of 2021. Within the close to time period, this decreased the variable dividend by $0.19. Wanting on the greater image, this is not misplaced cash. It has been reinvested into the enterprise to fund elevated manufacturing. Over the long run, traders ought to count on a return on funding attributable to elevated quantity/effectivity.

Q1 Appears to be like Challenged

We’ve three completely different head winds for Q1. First, the corporate put out ahead steering for Q1 quantity impacts attributable to a compressor fireplace at a facility within the Delaware Basin. This can minimize manufacturing by 10,000 BOE/day and end in volumes in Q1 being flat in comparison with This autumn. Second, commodity costs are decrease to this point within the first half of Q1. Until that modifications materially, free money move will face pressures. I am going to dig into the impacts of commodity costs later. Third, CAPEX might be within the ballpark of $920 million for Q1 and Q2, thus sustaining the spending price seen in This autumn.

Within the absence of hedging, utilizing a median value $3.00/MCF and $78/barrel WTI, I undertaking a dividend of $0.65 to $0.75 per share. If pure fuel costs rebound, we could also be having a unique dialog totally, however because it stands, I really feel there’s important threat to share value following Q1 earnings. Will this stay ceaselessly? No. There are a number of components that might result in a pure fuel rebound. I am going to dive into that in only a bit.

Hitting Rock Backside

I’ve painted a reasonably grim image so far for the close to time period. Remember Mr. Market is taking a look at this efficiency within the backdrop of some stellar money era in Q2 and Q3. Fortunately, these issues are close to time period in nature. I’ve little or no motive to consider power costs will decrease considerably from right here. Let’s look over some positives.

Money Reserves Grew

Even with the decreased money move, the corporate saved up $144 million in its money reserves. Those that recognize the bolt-on acquisitions of Validus and Rim Rock needs to be in favor of this transfer. To proceed within the path of capital environment friendly bolt-ons requires considered one of two issues, both money or issuance of extra shares (oil peer (FANG) has issued over 10 million shares for acquisitions). I a lot desire utilizing straight money, versus diluting shareholder fairness AND the variable dividend. Money reserves additionally offers flexibility for the corporate to capitalize on the reward that the market has given….buybacks.

Buybacks

Devon has $700 million in buyback authorization remaining. They’ve said that their common repurchase worth is about $51/share. Now that Rim Rock and Validus are within the fold, it’s logical that the worth at which the corporate finds a compelling return is now at a better share value. For instance, the Validus buy offers the corporate much more publicity to the Eagle Ford foundation which constantly has prime degree margins within the Devon portfolio. This was a finest at school add on for money era. With Devon’s present share value, and nearly $1.5 Billion within the financial institution, I consider Devon might be aggressive to seize on the present disconnect in enterprise worth and share value.

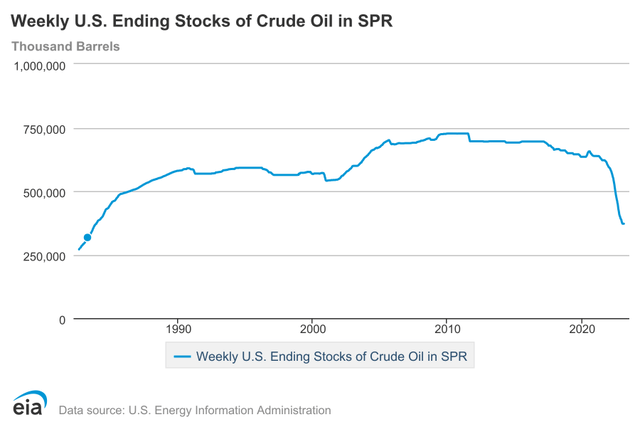

Crude Worth Flooring

The US Strategic Petroleum Reserve is at its lowest degree since 1984. Not too long ago, a 3 million barrel refill bid was rejected by the DOE as a result of the required specs on the market (i.e. value) weren’t met. On the similar time, the SPR is slated to obtain bids to promote 26 million barrels of crude oil from the reserve on February twenty eighth. Whereas this can create a close to time period provide increase, the SPR shouldn’t be an infinite reserve and finally will have to be refilled. The DOE has established standards to refill the reserve at $70/barrel. This can set up, at a minimal, a value ground for crude. If the administration is tough pressed to fill these reserves sooner moderately than later, this ground could should be revised upward as I don’t consider we’ll problem these ranges within the close to time period.

Offering additional help to a value ground within the mid to low $70/barrel is coming from exterior the USA. Russia has said that it’s going to minimize manufacturing by 5%. These two strikes could serve to counter-balance one another within the close to time period.

EIA

Pure Gasoline Restoration

The drop in pure fuel costs has been nothing in need of extreme, however provide and demand could also be coming again into stability. The elevated demand from the Freeport terminal coming again on-line is usually a sport changer. At full capability this terminal can course of 2 BCF/day, or twice the quantity of Devon’s total portfolio. This may very well be opportune timing to coincide with decreased provide attributable to manufacturing cutbacks.

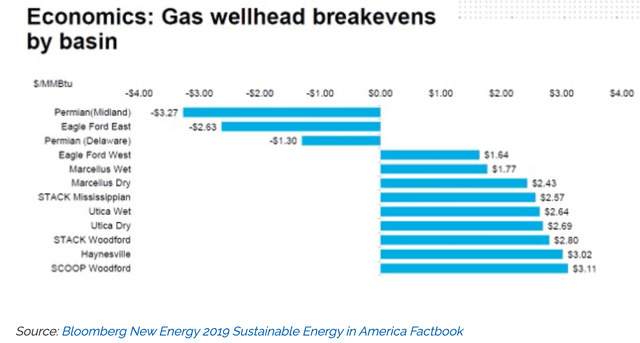

For almost all of producers, the present value is now under breakeven pricing. You may see from the chart under, even Haynesville, one of many largest pure fuel reserves, is $0.50 underwater at at the moment’s costs. This can finally end in a lower in manufacturing in these areas. And sure, you will observe that Devon’s Delaware and Eagle Ford basins have break even costs which are damaging. It is because these basins have been drilled for crude. Producers in these areas promote the NGLs and Pure Gasoline as a “aspect enterprise” for lack of a greater time period. The shale within the Marcellus and Haynesville areas are pure pure fuel performs.

I believe we’ll see a slight restoration from right here, in the end recovering into the $3 to $4 vary. Devon’s common value throughout its total portfolio was $4.01 for This autumn so it’s attainable Q1 would be the solely sufferer. If the free fall continues, brace for extra close to time period ache. I might additionally reference this glorious article on the path of pure fuel.

Bloomberg New Power 2019 Factbook

Historical past Lesson

If you’re skeptical that pure fuel can meaningfully have an effect on the underside line of this oil big, allow us to take a look at 2021 (not all that way back proper?). From Q1 to Q2 of 2021, pure fuel costs fell 18% whereas crude costs rose 9% in that very same quarter. The common value per BOE that the corporate bought rose a measly 2%. Successfully, pure fuel losses worn out all of crude’s positive aspects.

If pure fuel costs common $3.00 for Q1, we’re taking a look at a 25% lower from This autumn coupled with roughly a 5% drop in crude costs. Due to this fact, it’s affordable to conclude we’ll see a significant decline in value/BOE within the upcoming quarter. I mannequin a median value level of roughly $48.50/barrel vs $53.66/barrel from This autumn (a 9.6% decline). This was generated utilizing $77 crude, $3.00 pure fuel, and modeling NGLs to comply with the value of pure fuel ($18.50/barrel).

Nonetheless, a pure fuel rebound can present important uplift and drive the dividend again to the $1.00 territory in subsequent quarters. Allow us to not neglect that This autumn of 2021 generated sufficient FCF for a $1.00 dividend at $4.68 common pure fuel and $75 per barrel crude (admittedly at a decrease CAPEX and quantity run price).

Hedging

One type of safety the corporate does have from the pure fuel ground falling out from below them is hedging. The corporate has roughly 20% of its 2023 pure fuel costs hedged at $3.78/MMBTU (see web page 68 to the 10-Q report within the hyperlink). This may serve to melt among the blow seen within the first two months of the 12 months. Being solely 20% hedge is considerably of a downside for my part however hind sight is all the time 20-20.

The Large Image

Most traders view Devon as an oil play, however neglect that roughly 50% of the revenues are generated from pure fuel and NGLs. For the reason that upcoming quarter is projected to be tough, allow us to do not forget that Devon lives and dies by commodity costs, and that one quarter is not the entire story. As we progress by the again finish of the 12 months, Devon will begin to present some momentum. Volumes will tick up (5% progress projected) and CAPEX might be decreased by about $90 million per quarter or a couple of $0.07 uplift within the variable dividend because of much less spending.

The advantage of extra volumes is a bit tougher to pin down. If we assume costs are roughly flatline from right here, a further increase to FCF within the ballpark of $90-$100 million is affordable (30 MBOE/D improve in manufacturing). Mixed, we’re searching for $0.14 of upside to the variable dividend in 2H2023 versus Q1 because of decrease CAPEX and elevated volumes.

The length of depressed pure fuel costs will decide the underside for DVN shares. That is the place the chance lies. I’m of the notion to purchase Devon shares on dangerous information below the lens of a 2-3 12 months minimal funding place. I consider long run these “hick ups” present alternatives to seize glorious worth at an affordable value.

The Dangers

The longer and decrease the value dives in pure fuel and NGLs, the more serious it will likely be for Devon (within the close to time period). Hedging could possibly present some aid within the type of cease losses (thus precise outcomes might be higher than I predict). Hedging can also solely be a short-term tactic as contracts will finally get restructured to be extra in keeping with market charges. If pure fuel costs stay low for the majority of 2023, the hedge costs the corporate is ready to negotiate over the long run won’t be as favorable.

Inflation might additionally preserve driving CAPEX up. If excessive charges of inflation persist, the CAPEX finances could should expanded. This can mute any potential uplift that’s projected for the second half of the 12 months and eat into FCF.

Abstract

I’ve mentioned the headwinds for the upcoming quarter, principally attributable to the free fall in pure fuel costs. Q1 will nearly actually be decrease by way of income, FCF, and dividend payouts. I additionally count on close to time period stress on share value to proceed all through the primary half of 2023. That is below the belief of no significant modifications in crude costs for the 12 months. Q1 outcomes could set off one other large dump like we simply noticed over after This autumn outcomes.

Nonetheless, a pure fuel restoration can drive FCF again to the degrees seen previous to the Russia-Ukraine battle. If we assume Devon might be returning to $1.00 dividend payouts by Q2, shopping for under $50/share will keep a 7% return with giant potential of upside ought to power costs spike once more. Shopping for at present costs (under $55) will nonetheless web roughly 6.5% for 2023. Let the close to time period ache be your long run achieve.