JHVEPhoto/iStock Editorial by way of Getty Pictures

Thesis

Tenet Healthcare Company (NYSE:THC), a big healthcare facility operator and the proprietor of the biggest ambulatory community within the US, is a darling of each hedge funds and Wall Avenue. In keeping with Whalewisdom.com, greater than 40% of excellent inventory is owned by hedge funds. This conviction is shared by Wall Avenue analysts, who overwhelmingly give it a Purchase ranking (and no Promote scores). Healthcare is recession-proof and will carry out effectively in case of a downturn in markets. And Tenet’s buying and selling a number of seems engaging. This was the preliminary impulse to take a look on the inventory.

Nonetheless, we’ve got sturdy reservations round a number of points: in the beginning, our DCF yields a justifiable share value of $62, so there may be restricted upside to at this time’s share value of round $60 and no margin of error; moreover we dislike the low profitability of the Hospital Operations phase, low historic income progress charges, a powerful reliance on M&A as progress driver, the construction of its M&A offers, margin stress from excessive employees prices and final however not least the excessive share of internet earnings attributable to noncontrolling pursuits, which represents massive leakage of worth.

We aren’t comfy with the sum of those points and due to this fact charge it a Maintain.

About Tenet

Tenet Healthcare is a Dallas-based diversified healthcare companies firm working 3 segments: Hospital Operations, Ambulatory Care and Conifer.

Hospital Operations. Tenet operates greater than 15 thousand licensed beds in 61 hospitals serving primarily city and suburban communities in 9 states. 44% of its beds are situated in California and Texas and one other 44% in Alabama, Arizona Florida and Michigan. We like significantly the presence in Texas, Arizona and Florida, with constructive demographic improvement and a inhabitants CAGR of 1.1% to 1.4% over the previous 10 years.

Its normal hospitals supply acute care companies, working and restoration rooms, radiology and respiratory remedy companies, medical laboratories, and pharmacies in addition to intensive and important care, coronary care items and a spread of different customary companies.

A lot of the hospitals are owned, and never leased, by Tenet. Two hospitals are leased and 6 hospitals are operated as JVs and both owned or leased.

The Hospital Operations additionally embrace 110 outpatient facilities, sometimes situated complementary to its hospitals, together with 67 imaging facilities in addition to different amenities.

The Hospital operations phase generated $15 billion in revenues in 2022 and had a mediocre working revenue margin of 6% ($0.9 billion).

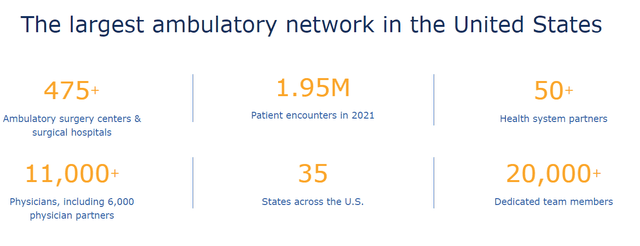

Ambulatory Care. Tenet’s ambulatory community is the biggest within the US and consists of greater than 475 ambulatory surgical procedure facilities & surgical hospitals. The enterprise is operated by USPI (United Surgical Companions Worldwide), an entirely owned subsidiary of Tenet. USPI’s community spans throughout 35 states and supplies companies by 11 thousand physicians and doctor companions. USPI’s purpose is to develop its community by greater than 100 facilities by the tip of 2025. It desires to realize this primarily via M&A and JVs with physicians and well being methods. Tenet’s M&A technique is one side of the enterprise we’re not actually fond off.

Ambulatory care generated solely $3.2 billion in revenues, however its working margin is a gorgeous 37% ($1.2 billion).

USPI

Conifer. Conifer is a JV with CHI (Catholic Well being Initiatives). Tenet owns 76% of the enterprise. The JV supplies finish‑to‑finish enterprise course of companies, together with hospital and doctor income cycle administration, affected person communications and engagement assist, and worth‑primarily based care options. Its prospects are hospitals, well being methods in addition to physicians. Conifer generated $1.3 in income in 2022 at a 22% working margin ($0.3 billion).

Broad Dispersion in Section Profitability

The group is worthwhile, producing what look like first rate margins of round 15% and 12% in 2021 and 2022, respectively. Nonetheless, upon nearer look, we discover that the Hospital Operations phase is working with an working margin of round 5-6% (excluding authorities grants). On condition that Tenet owns 85% of its beds and doesn’t pay hire on most of its hospitals, we’d wish to see a better profitability. If it leased its hospitals from third events, we concern it will be on the verge of chapter. One other low-light is the labor depth of the Hospital phase: Salaries, wages and advantages eat up 50% of revenues. Given the wage pressures within the US economic system and within the healthcare sector specifically, Tenet’s profitability on this phase could deteriorate.

Ambulatory care, however, generated engaging margins of 40% and 37% in 2021 and 2022, respectively. Though its revenues are round 1/5 of the dimensions of the Hospital Operations, it contributes 40% extra in absolute working earnings. The important thing distinction are the employees prices, which devour solely 25% of revenues. A key lowlight is the excessive share of internet earnings attributable to noncontrolling pursuits, round 50%, which is a results of Tenet’s M&A ‘machine’.

$ tens of millions 2020 2021 2022 Hospital Operations Revenues 14,262 15,982 15,061 Working earnings 971 1,480 853 Margin 6.8% 9.5% 5.8% Ambulatory Care Revenues 2,072 2,718 3,248 Working earnings 739 1,095 1,191 Margin 35.7% 40.3% 36.7% Conifer Revenues 1,306 1,267 1,306 Working earnings 279 296 289 Margin 21.4% 23.4% 22.0% Click on to enlarge

Weak Historic Income Progress

Group revenues have been technically flat since 2017, staying at $19.2 billion. Nonetheless, the corporate invested in mixture $3.8 billion in capex and acquisitions (internet of divestments) between 2017 and 2022, however we do not see the leads to a much-improved top-line. Hospital revenues have bounced up-and-down for the previous 3 years, pushed primarily by Covid. Ambulatory care revenues hit $3.2 billion in 2022, additionally impacted by Covid as individuals hunt down extra ambulatory companies but in addition as a result of a powerful This autumn 2022 and a respiratory virus epidemic.

We additionally assume that some portion of the declared progress within the Ambulatory enterprise is all the way down to M&A and the complete consolidation of entities, each new in addition to these beforehand held accounting-wise as an funding. If Tenet’s share in an entity, which was consolidated at-equity, will increase and surpasses a sure level, Tenet can consolidate it totally in its monetary statements. An instance: say, Tenet owns 36% in a enterprise consolidated utilizing the at-equity methodology (i.e. Tenet solely acknowledges the funding in its steadiness sheet and earnings are gathered within the funding account). Let’s assume additional that Tenet acquires an extra 15%. Its share will increase to 51% and as per accounting guidelines, Tenet has to completely consolidate it in its monetary experiences. It will now report the complete income in its earnings assertion (as a substitute of beforehand 0 coming from the entity), however financial possession would nonetheless quantity to solely 51%. In different phrases, “true” income progress economically attributable to Tenet shareholders can be overstated. Nonetheless, that is purely speculative on our aspect and we’ve got no knowledge to assist this speculation.

A Bizarre Steadiness Sheet

We are saying it upfront – we don’t like Tenet’s steadiness sheet. There are a number of weak factors, which we want to spotlight: debt, noncontrolling pursuits but in addition low returns on its property and investments.

Debt and noncontrolling curiosity distributions ate up round $1.4 billion in 2022 or 60% of working earnings. Complete monetary debt quantities to $15 billion, and we estimate the ratio of internet debt to Tenet-attributable adjusted EBITDA ratio (i.e. excluding noncontrolling curiosity’s share on EBITDA and excluding it from internet debt) at a really excessive 5.7x (see evaluation in Valuation part).

On a constructive be aware, nevertheless, the corporate would not have any re-financing wants till a minimum of 2026. The entire long-term debt is fixed-rate, implied rate of interest is round 6%, and maturities are staggered from 2024 to 2031. The corporate must re-finance solely $1.3 billion over the following two years with the complete quantity falling into Q3 2024 and nothing in 2025.

The second problem is expounded to worth leakage to Tenet’s noncontrolling pursuits which end result from Tenet’s “M&A Machine”. The corporate is making an attempt to develop via acquisitions of recent amenities, however sometimes doesn’t purchase 100% stakes. It takes over a majority and a mutual put/name settlement is put in place. This leads to two kinds of noncontrolling curiosity: redeemable and non-redeemable noncontrolling pursuits.

The non-redeemable noncontrolling curiosity has a e book worth of $1.3 billion. Internet earnings attributable to non-redeemables amounted to $242 million in 2022 and precise distributions amounted to $229 million, a big chunk of working earnings. The bulk ($221 million) is attributable to the Ambulatory enterprise. We think about this a severe leakage of worth. We estimate that the precise market value of those fairness stakes is far larger than the $1.3 billion carried within the books. We put the tag at a conservative $3 billion and regulate for it within the Internet debt changes. $3 billion interprets to 13x implied earnings, or a price-book ratio of two.3x – each multiples are under Tenet’s implied multiples, which is honest because it presumes a minority low cost.

Secondly, the redeemable noncontrolling pursuits. These are carried at a e book worth of $2.2 billion. These redeemable noncontrolling pursuits are tied to the put/name choices on minority stakes in Tenet’s totally consolidated entities we talked about earlier. Over the previous couple of years, Tenet’s administration has been coming into in a majority of these contracts to accumulate new operators. We, personally, dislike these offers as a result of they appear nontransparent to us. We do not know the mechanics behind the long run buy value willpower of the person minority stakes and likewise no particulars are supplied on the phasing of those put/name preparations. Moreover, these actions could distort the earnings assertion, as described earlier. The online earnings attributable to those minority pursuits amounted to $348 million in 2022 alone, which once more, is important, however a minimum of it’s non permanent till the put/name choices are exercised.

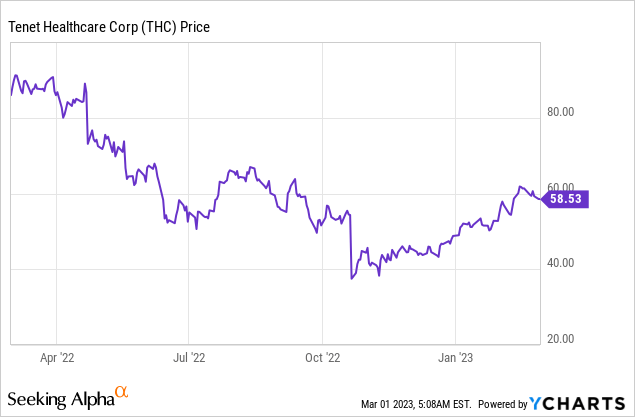

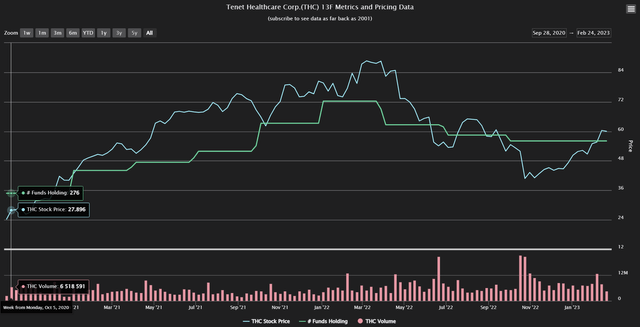

Share value with sturdy momentum since October

THC inventory at present trades round $58, down 38% since from its 52-week excessive. The inventory greater than tripled between the midst of the pandemic and the start of 2022 and was then a sucker guess for a lot of the yr. Nonetheless, it’s displaying sturdy short-term momentum and is up round 60% since its low in October 2022.

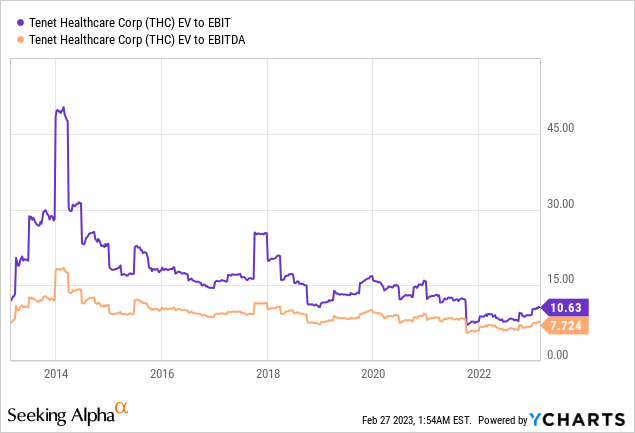

Relative Valuation

Historic buying and selling multiples. Tenet is at present buying and selling at traditionally favorable multiples. Its TTM EV/EBITDA a number of at present stands at 7.7x and the EBIT a number of stands at 10.6x. The multiples saved compressing for the previous 10 years till they hit a low in mid-2021 at 6x EBITDA and 8x EBIT, however recovered since then.

Tenet-attributable EBITDA. Whereas an EBITDA a number of of seven.7x seems engaging, buyers must be cautious due to the noncontrolling curiosity’s excessive share on internet earnings. Traders want to tell apart between the EBITDA of the underlying companies and the portion of EBITDA that’s truly attributable to Tenet. Both buyers think about solely the related portion; or alternatively take into consideration the noncontrolling curiosity’s of their internet debt adjustment, however at market costs.

Our evaluation means that Tenet-attributable adjusted EBITDA quantities to c. $2.7 billion as a substitute of the $3.5 billion consolidated determine.

A majority of the distinction is pushed by the Ambulatory phase. It generates $1.2 billion in working earnings however is accountable for $469 million in internet earnings attributable to noncontrolling pursuits. Assuming a tax-rate of 25%, roughly 1/2 of NOPAT is leaked to minorities. Related logic may be utilized to Conifer, the place Tenet owns solely 76%, which decreases the Tenet-attributable EBITDA by one other c. $90 million in line with our estimates.

All this brings the Adjusted EBITDA a number of to round 8x (we excluded minority pursuits from internet debt), which is analogous to the consolidated determine and nonetheless doesn’t really feel overly aggressive. Nonetheless, the implication for internet debt (excluding minority pursuits) is a leverage of round 5.7x adjusted EBITDA, which is sort of aggressive.

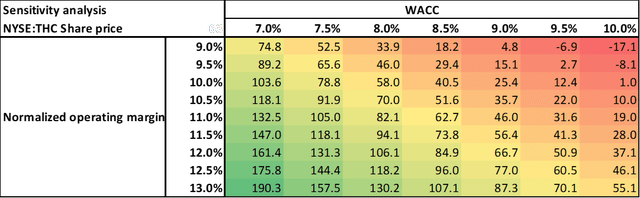

DCF Evaluation Yields a Honest Share Value of $63.00

We’ve additionally run a DCF evaluation and derived a good worth of round $63 per share. Our key assumptions are: 4.6% income progress in 2023 as per analyst estimates, 11% normalized working margin in step with 2021 and 2022 figures, a 25% marginal tax charge, CAPEX of round 4.4% of revenues, a WACC of 8.5% and a terminal progress charge of two%.

NYSE:THC Fair proportion value primarily based on DCF evaluation (Tenet Healthcare Company monetary statements, creator’s evaluation)

Our DCF base case leads to an enterprise worth of $24 billion. We’re working with internet debt and different changes of $18.2 billion: $14.7 billion monetary debt, redeemable minorities at e book worth of $2.1 billion, $3 billion in different minorities (not at e book worth, however at estimated market value, as described beforehand), much less $0.8 billion in money and $1.6 billion of Tenet’s fairness investments in minority shares of different companies. This interprets to an fairness worth of round $6.4 billion or $62 per share, that means the corporate is pretty valued at this time.

Because of the firm’s excessive leverage, Tenet’s justifiable share value is extra delicate in direction of WACC and progress charges than regular. An enchancment of 1 share level in normalized working margin yields a rise of $20-30 per share. As such, we want to see an effectivity program within the Hospital operations, the place profitability is a matter, as a substitute of placing a lot emphasis and concentrate on sophisticated deal buildings within the Ambulatory enterprise.

Love-Relationship with Hedge Funds

Surprisingly, Tenet is a hedge fund darling. In keeping with Whalewisdom, 43% of the corporate’s inventory is held by hedge funds, rating it as one of many most-beloved healthcare shares held by this proprietor kind. This pronounced curiosity was truly the important thing impulse that made us do a deep dive on Tenet.

The variety of holders elevated all through 2021 because the inventory was rising. We assume a number of the buyers have been betting on the shares momentum. Whereas THC inventory largely includes a low share on the funds’ portfolios, a handful of those buyers maintain a big chunk of as much as 10% of its portfolio in Tenet inventory. Many are long-term holders with their first inventory purchases being 5-10 years in the past, in line with Whalewisdom.

Hedge fund exercise in Tenet Healthcare Company Inventory (Whalewisdom.com)

Brief curiosity is simply 4% of widespread inventory in line with Marketbeat, which doesn’t fall out of line in a detrimental method.

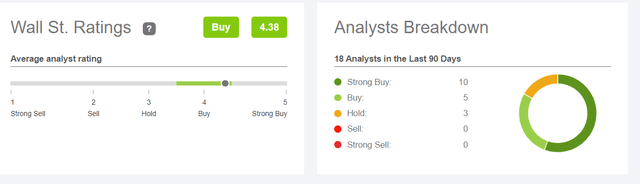

Wall Avenue Charges is a Purchase

Wall Avenue is optimistic concerning the inventory and charges it a transparent ‘Purchase’. The inventory is roofed by 18 analysts, a majority of which (10) considers it a ‘Robust Purchase’.

Common Wall Avenue Analyst scores (Looking for Alpha)

There’s a seen pattern in re-rating beginning in H2 2020, when round 2/3 of analysts thought-about it a Maintain and just one/3 a (Robust) Purchase. The sentiment has been considerably shifting all through 2021.

Looking for Alpha

The common value goal is at present $73.59, representing a 24% upside potential. The targets vary from a low of $60 to a excessive of $95.

Abstract

Tenet purely quantitatively, the story appears so as to add up: a gorgeous buying and selling a number of, some upside primarily based on analyst estimates with apparently affordable margin of error, overwhelmingly constructive analyst scores, conviction {of professional} cash managers, common short-interest and a constructive momentum – all this could warrant a buy-rating.

Nonetheless, we’re uncomfortable with a number of issues: in the beginning, our DCF yielded a justifiable share value of round $60, near at this time’s ranges. Moreover, we dislike the low profitability of the Hospital Operations phase, low progress charges of the previous years and powerful reliance on M&A as progress driver, the construction of the M&A actions, margin stress from excessive employees prices and final however not least the web earnings attributable to noncontrolling curiosity, which represents massive leakage of worth.

We, due to this fact, charge it a Maintain.