Though it could sound counter-intuitive, typical use of Foreign exchange indicators can truly trigger an inexperienced dealer to lose cash, moderately than make cash. Nevertheless, if you’ll use one, the most effective Foreign exchange indicator is the RSI (Relative Power Indicator) as a result of it displays momentum, and it’s properly established that following Foreign exchange momentum can provide you a profitable edge. The RSI is a Foreign exchange momentum indicator, and it’s the finest momentum indicator. If you’ll use the RSI, one of the simplest ways to make use of it’s to commerce lengthy when it’s displaying above 50 on all time frames, or quick if under 50 on all time frames. It’s best to all the time commerce with the development of the final 10 weeks or so.

What’s the RSI (Relative Power Index)?

The Relative Power Index components was developed within the Nineteen Seventies, like so many different technical evaluation ideas. The Relative Power Index calculation is made by calculating the ratio of upward modifications per unit of time to downward modifications per unit of time over the look-back interval. The precise indicator calculation is extra complicated than we have to fear about right here. What’s essential to know is that if the look again interval for instance is 10 items of time and each single a type of 10 candles closed up, the RSI will present a quantity very near 100. If each single a type of 10 candles closed down, the quantity can be very near 0. If the motion is totally balanced between ups and downs, the RSI indicator will present 50.

The Relative Power Index definition is as a momentum oscillator. It reveals whether or not the bulls or bears are profitable over the look-back interval, which could be adjusted by the consumer.

Relative Power Index Technical Evaluation

The RSI indicator is usually utilized in forecasting and buying and selling methods within the following methods:

When the RSI is over 70, it needs to be anticipated to fall. A fall under 70 from above 70 is taken as affirmation that the worth is starting a transfer down. When the RSI is beneath 30, it needs to be anticipated to rise. An increase above 30 from under 30 is taken as affirmation that the worth is starting a transfer up. When the RSI crosses above 50 from under 50, it’s taken as a sign that the worth is starting a transfer up. When the RSI crosses under 50 from above 50, it’s taken as a sign that the worth is starting a transfer down.

What’s the Greatest Option to Use the RSI?

The third and fourth strategies described above relating to the cross of the 50 degree, are usually superior to the primary and second strategies regarding 30 and 70. That’s as a result of higher long-term income could be made in Foreign exchange by following tendencies than by anticipating costs to all the time bounce again to the place they have been: simply watch out to not transfer cease losses to interrupt even too rapidly.

This can be a level value increasing – whether or not to observe tendencies, or “fade” them by buying and selling in opposition to them. There may be a number of old style buying and selling recommendation on the topic, most of which was developed within the pre-1971 period when foreign money trade charges weren’t floating, however fastened by pegs to gold or different currencies. On this period, buying and selling was performed principally in shares or, to a lesser extent, in commodities. It’s a proven fact that shares and commodities have a tendency to indicate a markedly totally different worth habits from the trade charges of Foreign exchange foreign money pairs – shares and commodities development extra typically, are extra unstable, and have longer and stronger tendencies than Foreign exchange foreign money pairs, which have a stronger tendency to revert to a imply. Because of this when buying and selling Foreign exchange, more often than not, utilizing the RSI to commerce in opposition to directional strikes through the use of the strategies 1. and a pair of. described above, will work extra typically however will make much less revenue general than utilizing strategies 3. and 4. to observe tendencies by buying and selling within the path of the prevailing robust development, when such a development exists. Though it may appear engaging to attempt to win smaller quantities extra typically and use cash administration to compound winnings rapidly, it’s a lot tougher to construct a worthwhile imply reversion mannequin than it’s to construct a worthwhile trend-following mannequin, even when buying and selling Foreign exchange foreign money pairs.

One of the best ways to commerce crosses of the 50 degree is through the use of the indicator on a number of time frames of the identical foreign money pair.

A number of Time Body Cross of the 50 Degree

Open a number of charts of the identical foreign money pair on a number of time frames: weekly, each day, H4, all the best way down. Open the RSI indicator on all of the charts and ensure the 50 degree is marked. Virtually all charting packages or software program contains the RSI so it shouldn’t be troublesome. An excellent look again interval to make use of on this indicator is 10. Additionally it is essential that the look again interval is similar on all of the totally different time-frame charts.

If you could find a foreign money pair the place all the upper time frames are both above or under 50, and the decrease time-frame is the opposite facet of fifty, then you’ll be able to await the decrease time-frame to cross again over the 50 and open a commerce within the path of the long-term development.

The upper or decrease the RSI worth is, the higher the commerce is more likely to be. It’s an iron legislation of the markets that robust tendencies are extra possible than to not maintain going, and {that a} retracement that then turns again round tends to maneuver properly within the path of the development. This methodology is an clever manner to make use of an indicator: it identifies retracements inside robust tendencies, and tells you when the retracement is more likely to be ending.

Brief Commerce Instance

An instance is proven under utilizing the AUD/USD foreign money pair in a number of time frames, with the RSI indicator set to a glance again interval of 10. It’s under 50 on the weekly, each day, and 4-hour time frames, and is simply crossing from above 50 to under 50 on the 5 minute time-frame. This might be interpreted as a sign for a brief commerce.

There isn’t any cause why this can’t be mixed with different methods similar to help and resistance, shifting common crossovers, time of day and so forth.

It can be used as a day buying and selling technique if you find yourself ready to drop right down to low sufficient time frames.

Weekly:

Every day:

4 Hours:

5 Minutes:

Be aware: this isn’t an ideal instance, as it might have been higher if the Hourly time-frame additionally confirmed the RSI under 50. Greatest outcomes are obtained when there isn’t a large hole between the time frames which are used.

Three New Methods to Use RSI in Foreign exchange

J. Welles Wilder’s Relative Power Index (RSI) measures the power of the foreign money pair in opposition to its historical past of worth change by evaluating the variety of days the pair is up in worth to the variety of days it’s down. Values vary from 0 to 100. A typical use is as a warning of market tops and bottoms, based mostly on Wilder’s concept that overbought and oversold circumstances happen after disproportionate strikes. If it’s over 70, one would possibly quick; if it’s under 30, one would possibly purchase. In an earlier article, I described how you need to use RSI for divergence trades.

Listed here are three different methods to make use of RSI:First is what Wilder known as a failure swing. This occurs when RSI exceeds a earlier excessive (overbought above 70 or oversold under 20), corrects, after which heads for that excessive however fails to realize it. You’d place a commerce on the shut of the candle that corresponds to the second peak or dip.

Right here’s an instance from the hourly EURJPY chart. Value and RSI are rising in tandem. RSI turns into overbought, above 70. Each right. They once more rise however the second peak of RSI is decrease than the primary. You’d promote on the shut of the candle that accompanied the decrease peak.

If worth and RSI have been falling the scenario is reversed. When the indicator turns into oversold under 30, corrects, after which fails to succeed in the prior low, you’d purchase on the candle shut. Confirming the commerce with different proof—for instance, help or resistance or candlesticks—is advisable.

A second use of RSI includes help and resistance, not with worth, however on the indicator itself. It may possibly enable you to gauge if a development is altering.

Right here you’d watch the indicator to determine that it by no means rises above (in a down development) or falls under (in an up development) key ranges. Finding out previous RSI habits helps you discover these ranges.

The 15-minute chart of GBP/USD gives an instance. Value and RSI are rising. Value then turns into congested and RSI begins to drop. Is that this a easy correction or is the development altering? Analyzing RSI gives a clue. RSI by no means drops under 43. That is above the final dip in RSI and much above an oversold studying of 30. On the second dip in worth, with the RSI holding above 43, the dealer can really feel assured it is a correction and purchase on the candle shut of the second dip. A safer commerce would contain ready till worth broke and closed above the congestion high. As all the time, it’s finest to search out different proof to help the commerce determination similar to worth help and resistance ranges, candlesticks, or a comparability with different indicators.

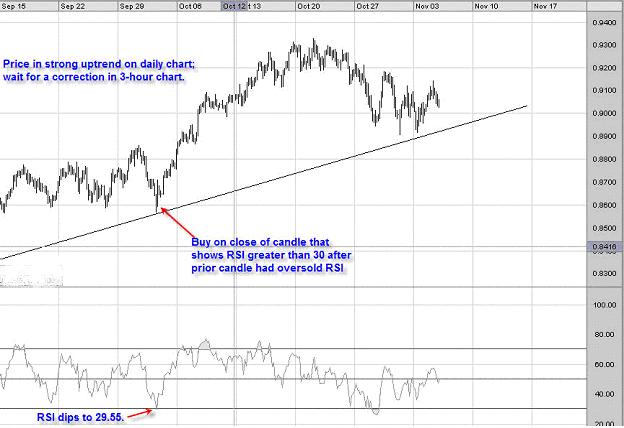

A 3rd manner to make use of RSI is when each worth and indicator are in an general development in a bigger time-frame, for instance, each day. You then watch the 3-hour or 1-hour chart to search out an overbought or oversold studying in RSI accompanying a worth rally or response. When the RSI overbought or oversold situation corrects, you’d place a commerce.

Right here’s an instance with the AUD/USD three-hour chart. Its uptrend started March, 2009. The place’s an excellent entry level if you wish to go lengthy? Within the chart under you see a worth correction to .8569. RSI drops to 29.55, oversold. On the following candle shut of .8655, RSI is 40.56. That is the purchase sign. Had to procure you’d have made a whole lot of pips as costs climbed to .9328 in late October.

The important thing to this method is discovering a robust development on a bigger time-frame after which buying and selling corrections on the smaller time-frame. Greatest outcomes appear to be while you use each day and one-or –three hour charts. As all the time, search for different proof to help your determination—staying above a development line or candle habits.

A collection of materials from the Every day Foreks info supply

Automate your buying and selling with our Robots and Utilities

Scalper ICE CUBE MT4 – https://www.mql5.com/en/market/product/77108Scalper ICE CUBE MT5 – https://www.mql5.com/en/market/product/77697

EA Lengthy Time period MT4 https://www.mql5.com/en/market/product/92865EA Lengthy Time period Mt5 https://www.mql5.com/en/market/product/92877

Utility ⚒

EasyTradePad MT4 – https://www.mql5.com/en/market/product/72256EasyTradePad MT5 – https://www.mql5.com/en/market/product/72454

Danger supervisor MT4 – https://www.mql5.com/en/market/product/72214Danger supervisor MT5 – https://www.mql5.com/en/market/product/72414

Indicators 📈

3 in 1 Indicator iPump MT4 – https://www.mql5.com/en/market/product/722573 in 1 Indicator iPump MT5 – https://www.mql5.com/en/market/product/72442

Energy Reserve MT4- https://www.mql5.com/en/market/product/72392Energy Reserve MT5 – https://www.mql5.com/en/market/product/72410